IQiyi, Tencent Fighting Southeast Asia | Special Topics of Go to the Sea

Author:Zero state LT Time:2022.07.13

From 2020 to 2021, affected by the geographical and epidemic black swan, Chinese entrepreneurs going to sea undoubtedly undergoing unprecedented new changes. The hour hand has been dumped into 2022. What is their current situation? What experience and lessons are worth sharing? Is there still a chance to go to the future?

Zero -state LT specially launched the Observation column "Viscers Mirror", which records the new journey of Chinese companies going overseas from multiple dimensions. This article is the 16th of the series. Focusing on Tencent and iQiyi's Southeast Asia to go out of the sea, explore China's long video platform, and how to get rid of overseas.

The overseas war of China's long video platform is intensifying.

According to data platform DataAI CN data, in April 2022, the Chinese non -game applications went out of iQiyi in the list of iQiyi ranked fifth, especially the Thai market growth was strong.

The cause originated from a Thai local drama "Master of the Gangsters in Love with Me" in the US IMDB score of 9.1, which made the Golden Lord iQiyi's reputation. Qiyi was broadcast. In the play, the characters outside the play have repeatedly rushed on the hot search in Thailand and the Mainland entertainment list.

In addition, in the first quarter of 2022, iQiyi announced its profit for the first time. At the same time, the international version of iQiyi made a circle that made long videos out of sea is no longer a state of "dullness". Looking back at China's long video giant, it actually deployed overseas markets before the epidemic. Especially the Southeast Asian market.

01

Aiteng positions Southeast Asia

Youku is far away from Europe, America and South Korea

Why is Southeast Asia?

The entertainment industry, the growth user market, and the high cost compared with the mainland, perhaps the answer. The total population of Southeast Asia is about 650 million, however, this hot land has always been one of the main battlefields of the mainland. According to data, Southeast Asia's online video market growth has increased from 2%in 2015 to 26%in 2020, and it is expected to reach 50%in the next five years.

In fact, the earliest Chinese video players who went to Southeast Asia in sea were LeTV.

LeTV registered the official account in YouTube in June 2013, publishing episodes such as "Zhen Huan Biography", "Prince Princess Promotion" and "Yueyue Biography". Subsequently, each family continued LeTV's approach, set up overseas accounts, and released video content that has been broadcast on the mainland.

Since 2014, overseas television stations represented by True and GMM have begun to purchase the copyright of Chinese TV dramas, once the peak period of mainland Taiwan broadcast dramas on Southeast Asian TV stations. However, this situation lasted shortly. When the purchase cost of the episode did not reach the expected income, the local production cost was lower, and the enthusiasm of overseas television stations to purchase mainland Taiwan dramas cooled down.

However, the enthusiasm of overseas audiences to mainland web dramas gives a signal to the mainland streaming media: must go to sea.

From the initial relying on the YouTube platform, the charging model was transferred to others, and the overseas version of the self -developed overseas version was transformed. Mainland streaming manufacturers gradually deepened their control over overseas markets.

Iqiyi launched the international version of the Iqiyi APP in June 2019, and the first stop for going to the sea positions Southeast Asia. Tencent launched video streaming service WETV in June 2019. Since then, iQiyi has connected with Tencent's short soldiers in Southeast Asia, each in different periods.

Tencent WETV adopts a member system, with a monthly meeting fee of 30 yuan. There is no advertising other than that. The use of this method is related to the environment of video websites in Southeast Asia at that time. It entered the market earlier. The higher share of US Netflix and Japan LINE TV adopted this model.

In the same year, Tencent's hit drama "Chen Qingling" swept Thailand and won more than 100 million playback volume, and Xiao Zhan became a Thai superstar. The other hot works include "The Legendary Chen Yan" and "Three Lives III Pillow Books" and so on. Wetv topped the list of Google Play Entertainment in Thailand in March, and also ranked among Indonesia, Malaysia and Singapore. In one year, WETV increased by 175%, the total length of viewing increased by 300%, and the user covered more than 110 countries and regions.

The spring of iQiyi arrived in 2020.

"Hidden Corner", "Fourteen Years of Chenghua" and "Beautiful scholars" and other dramas are widely released in Malaysia, Thailand, Singapore, Cambodia, Myanmar and other places. In the same year, the number of iQiyi members reached 101.7 billion, and the annual operating losses shrank to 20%compared to 32%in 2019.

Compared with the cost of the mainland drama production of the rising ship, overseas production teams and customized dramas show more price advantages. Taking Thailand as an example, according to 2021 Thai TV series actresses and quotations in the industry in the industry, the pyramid -level female artist Aumpatchrapa's TV drama episodes of Thai drama are stable at 200,000 yuan, which is far from the mainland actresses.

High cost performance brings investment attractiveness, making iQiyi and Tencent began to enter local dramas.

IQiyi released six original contents of Asian original content in 2020, especially "Saying Goodbye" and "Hello, Heart". Tencent continued the Dan American drama track, entered the game with "The Mystery of the Dead" and "Cheng Xin Cheng Yi", and intends to directly launch dramas such as "Zhang Gong's Case" and "Hao Yi Xing". Trial.

Overseas investment episodes have spawned new entertainment idols, which is another revenue of streaming companies behind the episode. The recent popularity of iQiyi's "Master of the Gangsters in Love with Me" has driven the binding of CP interactive live broadcast with goods, cover magazine distribution, meeting meeting, etc., and has long been commonplace. After all, a generation of idols and one -generation powder can only stand on the platform.

Youku encountered iQiyi and Tencent in the mainland market, showing fatigue. In the overseas market, it chose to bypass Southeast Asia and enter the European and American markets.

In 2017, Youku's self -made drama "White Night Chase" was purchased by Netflix to the copyright of overseas, and it was broadcast in more than 190 countries and regions around the world. It became the first domestic drama to officially broadcast overseas. In 2019, "Twelve hours of Chang'an" was launched in North America in VIKI, Amazon and YouTube in North America in the form of "paid content".

The variety show is brighter than the episode in Youku's overall content. According to the "Status of Pan Entertainment Application: Mobile Report in 2022", Youku ranks first in the popular OTT application (possibilities MAU) Australia and British millennials, ranking third in Canada and South Korea. The main contribution comes from the variety show "This!" It is Hip -hop ", of which the total number of playbacks on Youku YouTube's official channel in the fourth quarter exceeded 100 million, and the interactive volume exceeded 12 million, and it was transmitted in the final of the overseas market in the finals.

In contrast, the foundation of Tencent and iQiyi in the Southeast Asian market is gradually stable, and the content production has its own advantages. Youku has become weak in the Southeast Asian market, and the future in the European and American and Korean markets is unknown. It is only waiting for it to invest in the operation of the APP overseas version.

At present, in the financial report, the three families of Aiyouteng did not disclose their overseas revenue parts alone, but as the business increased, I believe this day will not be too far.

02

Nai Fei is still a trendy

There are no winners in iQiyi and Tencent

Long video business growth is positively related to the development of Internet users.

In 2021, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam added 40 million new netizens, and the total number of users accounted for 75%of the total population of the six countries. Among them, 80%of netizens have online payment habits, mobile video users reach 72%, and Internet people over 30 years old account for more than 60%of the total population. In the same year, Southeast Asia's digital economy market size reached US $ 174 billion, and it is expected to continue to break through to $ 360 billion in 2025.

Increasing the base of netizens, the formation of online payment habits, and younger users are the main factor of becoming the blue ocean. However, this blue ocean is not only open to iQiyi and Tencent, but the main opponent in front of them is Netflix.

When Nafei entered the Southeast Asian market, it first adopted a price reduction strategy to cater to local consumption. In Thailand, the Philippines, Indonesia and other places, it was sold at a subscribing price of less than $ 5. When the low -cost strategy encountered the epidemic day, Nai Fei's global payment users reached 222 million in 2022.

In 2021, the global hottest Korean drama "Squid Game" was invested by Nafei, representing Naiti's long -term layout of the growth of the Korean entertainment industry. In this way, Nafei's investment in Korean dramas has trained a fixed customer group in the streaming market in Southeast Asia.

In terms of total volume, Naifei ’s operating income in 2021 was US $ 29.698 billion (including net profit attributable to shareholders was US $ 5.116 billion), and the total revenue was about 6 times that of iQiyi revenue in the same year. Twice of Tencent. In addition, it is the leader who rely on membership to achieve profitability in the long video track.

At present, independent data is found to explore the revenue of Tencent WETV and iQiyi International in Southeast Asia, but through comparison with VIUTV, it may be able to get a glimpse. The WETV and iQiyi International Edition have a long -term growth trend in the Southeast Asian market, but compared with the decline in the number of subscribers, Nai Fei still does not pose a threat.

In addition, Disney+HOTSTAR (Disney's streaming media), VIUTV (a Cantonese free TV channel opened by Hong Kong Television Entertainment Co., Ltd.), Apple TV+(Apple Subscribe), Hooq (Singapore Streaming Media) , IFLIX (formerly Malaysian Streaming Media), etc., were once the enemy of iQiyi and Tencent Wetv in the Southeast Asian market.

Tencent and iQiyi admitted late in Southeast Asia. As a later person, the pressure not only comes from competing with the streaming media that has established a foothold, but also that they continue the war from the mainland to overseas.

The acquisition of IFLIX with Tencent in June 2020 shows its determination to expand the Southeast Asian market. The acquisition will be included in 19 countries and regions, including IFLIX, which covers Southeast Asia, and 17 million subscribers are included in the pocket.

Iqiyi entered and laid out the market in the direction of refined regional operations, which is different from Tencent's large acquisition. In November 2019, iQiyi reached a cooperation with the Malaysian first media brand Astro to formulate a marketing strategy on the basis of localization. In 2020, iQiyi has set up offices or overseas teams in Thailand, Malaysia, the Philippines, Indonesia, Singapore and other places to handle local operating affairs.

IQiyi and Tencent are evenly matched in the Southeast Asian market.

The layout of Southeast Asia has not really presented the profitability of iQiyi and Tencent videos. Instead, it is inertia, making people worry about whether iQiyi and Tencent will bring their inertia in the mainland to overseas markets. High -turnover and high -consumption operation mode: invested a large number of manpower and material resources to push the production price of high dramas; cultivate some of the rising traffic stars; the user experience of excessive advertising implantation and sacrificed, and then improve the user in the name of experience Consumption prices have lost users.

Compared with Tencent, iQiyi can only be desperate.

Tencent does not rely on long videos as an entity growth, but for iQiyi, long videos as the core business are essential. Tencent Video is a sub -business under Tencent's social network, and other business segments such as network text (reading) and games can be transformed in content for long video business. At the same time, Tencent has the ability to maximize the star economy and push Xiao Zhan to the Thai people.

Iqiyi and Tencent encountered Naiti in the Southeast Asian market. They were passive choices and took the initiative to attack. Breakthrough, or surpass, everything needs time.

03

China Long Video Platform

How to win overseas war

According to the Southeast Asian online current market research report released by the consultant and consulting company Media Partners Asia (MPA) in 2022, the most popular content in the region is the most popular content types in the region in turn (30%), American dramas (30%), American dramas (30%) 23%), Chinese drama (14%).

Based on costume dramas, the ratings of domestic dramas in Southeast Asia have increased year by year.

From 2021 to 2022, the story of realism the subject of realism is becoming the main string law. 10 outstanding overseas communication works reviewed by the State Administration of Radio and Television were selected as "Shanhai Love", "Dajiang Dahe 2", and "Family".

The online playback channels of real -themed theme dramas such as "Shan Haiqing" and "Dajiang Dahe 2" are iQiyi (unique broadcast, Youku participation), so that iQiyi's quality performance in the main theme episode is better than Tencent than Tencent Strong. In 2022, there is a probability that the hit drama "The World" has more support in the next round of going to sea.

Tencent Video took the market in the second quarter of this year with "Menghua Record", and was launched on July 1st on the Naifei platform to show the recognition of domestic dramas on overseas streaming media platforms. The journey of streaming media Southeast Asia and staying in the mainland in the mainland. There is a significant difference that it is a "volume" of commercial war -type internally. IQiyi and Tencent are "telling the level of Chinese stories" and challenged Naiti's status in Southeast Asia.

In addition, iQiyi and Tencent are incorporated into the homeland and broke through the language and culture. In August 2021, iQiyi International version launched the first Southeast Asian self -made drama "Soul Ferry · Nanyang Legend", which uses Dolby panoramic sound technology and 4K high -definition picture quality, which is an important step for the Southeast Asian market. In the second half of last year, iQiyi proposed to further reduce costs and increase efficiency through AI translation to ensure the viewing experience of local users.

Tencent videos tend to strengthen localized cooperation, including completing exclusive cooperation with the Malaysian Media Primary Media Group (Media Prima) to acquire TV series from three Thailand.

Is it based on making dramas or "buying and buying" to obtain the market. Iqiyi and Tencent Video continued their business inertia in Southeast Asia.

Iqiyi is met as "China Naifei", and it is actually that it can target Naifei in terms of operation model and main business. In the first quarter of 2022, Nafei announced the data, showing that subscribers plummeted, while iQiyi achieved its first profit at the same time. This reversal enhanced the confidence of the mainland streaming media industry.

We hope to see in the future that what Iqiyi and Tencent presented in the Southeast Asian market are not internal rolls, but each occupying the track to continuously improve the quality of the episode (industrialization) in the form of the overseas media industry. Globalized cakes are bigger.

For global audiences, good dramas and good stories are everything.

Author | Ma Sixun

Edit | Hu Zhanjia

Operation | Chen Jiahui

Produced | Zero -state LT (ID: lingtai_lt)

- END -

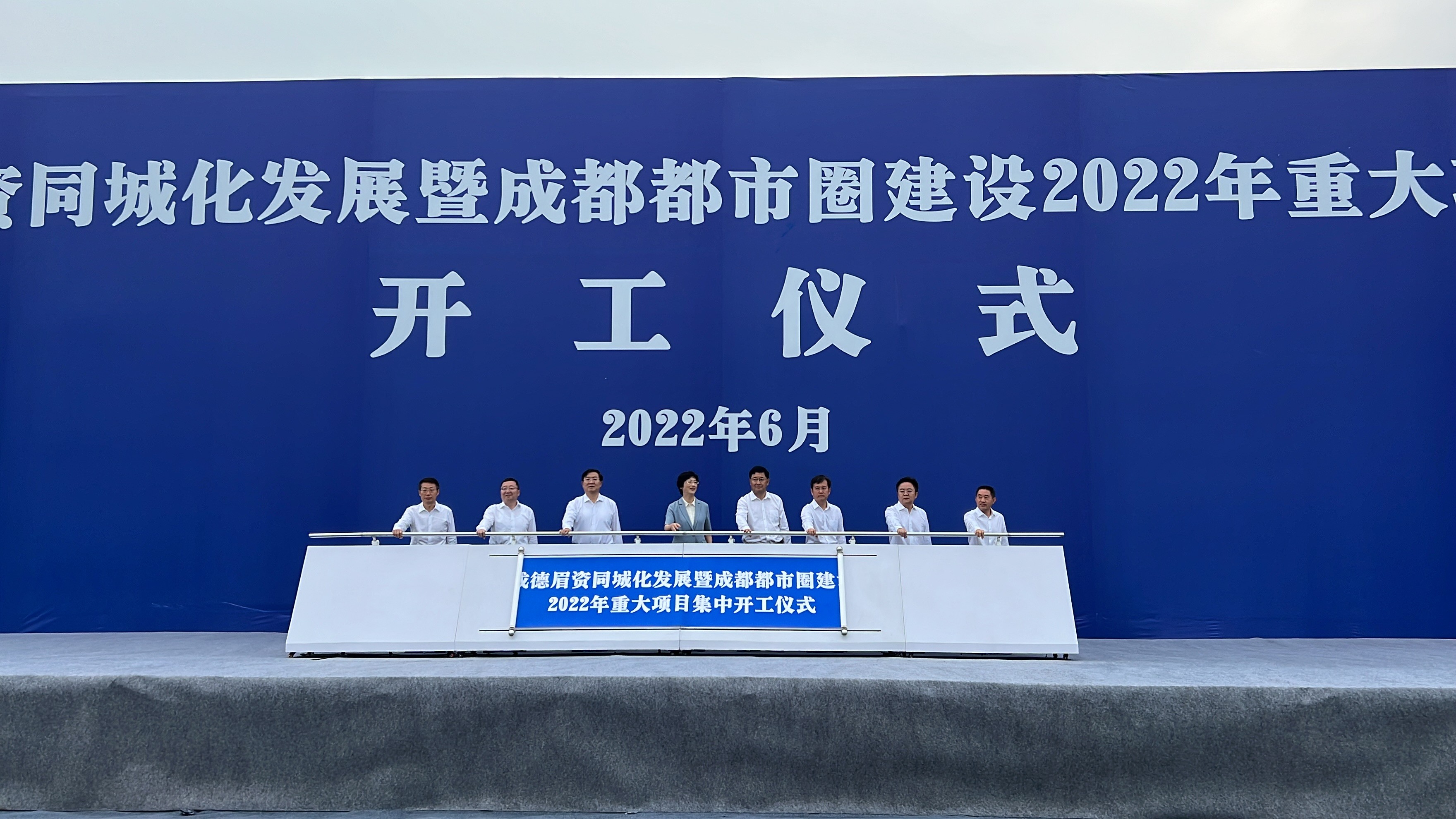

Total investment exceeds 100 billion Chengdu Metropolis Circle 22 major projects concentrated on construction

On the morning of June 18th, Chengde Meimei's same urbanization development and th...

China -EU trains (Yangtze River) Yellowstone starting

Jimu Journalist Pan XizhengCorrespondent Xu ChenIntern Yang RuoxiOn the morning of...