The central bank responds to hot topics in the market!It is related to monetary policy, deposit loan, financial risks, digital RMB ...

Author:21st Century Economic report Time:2022.07.13

21st Century Business Herald reporter Bian Wanli Beijing reported on July 13, the National New Office held a press conference in the first half of the financial statistics status. Sun Tianqi, director of the Central Bank Financial Stability Bureau, attended the meeting and answered reporters on the recent hot topic of market market.

1. The cost of comprehensive financing of enterprises is steadily reduced

Ruan Jianhong said that in the first half of the year, the central bank continued to optimize the central bank's policy interest rate system, strengthened the supervision of deposit interest rates, and focused on stabilizing the cost of bank liabilities. In June, the interest rate of the newly absorbed regular deposit was 2.5%, which was 16 basis points lower than the same period last year. Give full play to the potential for the reform of the loan market quotation interest rate, and the 1 -year LPR and 5 -year LPR decreased by 10 basis points and 20 basis points, respectively to reduce the comprehensive financing cost of the enterprise. In June, the interest rate of new corporate loans was 4.16%, 34 basis points lower than the same period last year.

2. Progress of policy and open financial instruments

The central bank supports national development banks and Agricultural Development Bank to set up financial instruments, with a total scale of 300 billion yuan. Specific use of financial instruments: First, supplement the capital of major investment in projects, not more than 50%of all capital; second, for the short -term special bonds that cannot be in place as capital, they can bridge special bonds.

Policy and development financial instruments are invested in accordance with the principles of marketization, independent decision -making in accordance with laws, self -profit and loss, self -risk, and self -ownership, only financial investment exercise corresponding shareholders' rights, do not participate in the actual construction operation of the project, and follow the principle of marketization. Determine the exit method.

It is understood that at present, under the cooperation of various departments, localities and enterprises, some projects have been included in the project library or are fulfilling the process of entering the warehouse; some projects are improving project elements such as land use and energy; some projects are accelerating investment in investment. Preliminary work such as consulting and feasibility study provides favorable conditions for financial instrument investment.

Zou Lan said that policy and development financial instruments, as staged measures, through appropriate policy design, are conducive to adhering to the policies requirements of not to engage in large water irrigation and not excessive currency, guide financial requirements, guide financial finance, guide financial finance The institution issued a medium- and long -term low -cost supporting loans, unblocked the monetary policy transmission mechanism, enhanced the stability of credit growth, helped achieve the overall effect of expanding investment, employment, and promoting consumption, and stabilized the macroeconomic market.

In the next step, the central bank will follow the relevant departments to promote policy and development financial instruments in an orderly manner. There are three main aspects of work: one is to speed up the establishment of financial instruments; the other is to form a list of alternative projects; the third is to carry out solid project docking.

3. The increase in macro leverage is significantly lower than that of other major economies

Since the fourth quarter of 2020, my country's stable leverage has achieved significant results. The macro leverage rate has declined for five consecutive quarters, creating valuable policy space for subsequent complicated situations. From an international comparison, since the epidemic, the increase in macro leverage in my country has significantly lower than other major economies, and has supported the rapid recovery of economic recovery with relatively few new debt.

From the perspective of policy effects, China has supported the optimized combination of "higher growth and lower inflation" with a mild macro leverage increase, which shows that the macro policies are strong, more than effective.

Ruan Jianhong said that it should be seen that although the risk challenges facing my country's economic development since this year have increased significantly, the fundamental fundamentals of my country's economy have not changed. As the domestic epidemic prevention and control situation continues to improve, and the policy and measures of stability of the economy will accelerate the effectiveness of implementation, my country's economy has shown a significant recovery momentum. This also creates conditions for maintaining a reasonable macro leverage in the future.

4. The impact of the epidemic is mainly staged

In March and April this year, affected by the unexpected factors at home and abroad, the downward pressure on my country's economy increased, and the income and balance sheets of some enterprises and residents were damaged. In this context, government departments have increased their support for the real economy. The cumulative increase of 6.7%year -on -year in the first 5 months of infrastructure investment, 0.5 percentage points higher than the growth rate of all investment, which reflects the meaning of macro -control. It is also a necessary measure for the economy to pass the economy.

Zou Lan said that it should be seen that the impact of the epidemic is mainly staged. Since May, the domestic epidemic situation has improved, and the State Council has been accelerating the implementation of a policy of stabilizing the economy. The fiscal policy, monetary policy, and industrial policies have all increased their implementation. The main economic indicators have improved significantly, and the general economic operation has bottomed out.

From the perspective of financial data, credit investment has increased significantly. From January to June, corporate loans increased by 3 trillion yuan year-on-year, and corporate financing was generally better; residential loans were affected by the impact of the epidemic of residential loans, but since June Essence In the future, with the overall control of the epidemic situation, the macro economy is expected to maintain a steady recovery, the asset and liabilities of enterprises and residents are expected to gradually improve and improve, and credit support will maintain strong efforts.

Zou Lan said that the central bank will continue to do a good job of stable economy policies and measures in accordance with the decision -making and deployment of the Party Central Committee and the State Council, increase the implementation of stable monetary policies, create a good monetary financial environment, form a policy joint, and maintain economic operation in a reasonable range. Specifically: First, the total amount is reasonable and abundant; the other is the price to further promote financial institutions to reduce the actual loan interest rate.

5. Digital RMB pilot regions expand capacity. The cumulative transaction is about 83 billion yuan in the first half of this year. The new district and Chengdu have canceled the whitelist restrictions, absorbing Industrial Bank as a new designated operating institution.

As of May 31st this year, the total number of pilot areas of 15 provinces and cities passed the cumulative transaction pens through digital RMB was about 264 million, with a amount of about 83 billion yuan, and the number of merchant stores that supported digital RMB payment reached 4.567 million.

Zou Lan said that in the next step, the central bank will expand the scope of pilot scope in an orderly manner, strengthen scene construction and application innovation, carry out major issues of issues, and deepen international exchanges and cooperation.

6. The scale of residents and corporate deposits increases more

At the end of June, the scale of residents deposit was 11.28 trillion yuan, an increase of 10.3 trillion yuan from the beginning of the year, an increase of 2.9 trillion yuan year -on -year. Ruan Jianhong said that the marginal rise of residents 'willingness to save deposits, and the marginal decline of investment willingness is mainly due to the repeated in the second quarter of the new crown pneumonia in my country, and residents' preference for liquidity has increased. At the same time, the volatility of the capital market has increased, and the risk preferences of residents have decreased. It is expected that with the gradual alleviating of the epidemic, residents' willingness to invest will gradually recover, and the willingness to consume will steadily return.

The scale of corporate deposits was 74.9 trillion yuan, an increase of 5.3 trillion yuan from the beginning of the year, an increase of 3.1 trillion yuan year -on -year. Ruan Jianhong said that on the one hand, financial institutions have strengthened their support for the real economy through loans and bond investment, and corresponding derivative deposits have increased. On the other hand, in the first half of the year, my country implemented a large -scale VAT tax refund policy, increasing the deposit of the entity department.

Data show that in June, the interest rate of newly absorbed regular deposits decreased significantly at 2.5%, which was 16 basis points lower than the same period last year. The decline in deposit interest rates is conducive to enhancing the support of financial support for the real economy including consumer growth.

7. Structural monetary policy tool results

Since the beginning of this year, the central bank has introduced three new structural monetary policy tools, including scientific and technological innovation re -loans, pilot special loan pilots of inclusive pensions, special re -loans of transportation and logistics, and carbon emission reduction support tools in the fourth quarter of last year. Clean and efficient use of special re -loans.

"These are basically phased tools. The long -term are mainly agricultural support small re -loan and re -discounting tools. The structural monetary policy tool box has been rich and perfect." Zou Lan said that in general, structural monetary policy The tool "focuses on key points, reasonable and moderate, there is progress and retreat." At the same time, the working mechanism of "independent lending, lending management, the central bank's reimbursement and total amount afterwards, and the relevant departments clear Stimulate financial institutions to optimize the credit structure and achieve the effects of precisely tilted in the fields of inclusive finance, green development, and scientific and technological innovation.

Up to now, carbon emission reduction support tools have issued a total of 182.7 billion yuan, supporting banks to issue 304.5 billion yuan in loans in the field of carbon emission reduction, driving reducing carbon emissions by more than 60 million tons. Coal cleaning and efficient use of special re -loans has accumulated banks to issue 43.9 billion yuan in low -cost loans to enterprises. The three new tools created this year will be issued on a quarterly. It will apply for the first time in July this year. At present, the central bank is promoting related work in an orderly manner.

8. The effectiveness of the market -oriented adjustment mechanism of deposit interest rates

In April this year, the central bank guided the establishment of a market -oriented adjustment mechanism for deposit interest rates. The main purpose of this mechanism was to promote further marketization of deposit interest rates. Members of interest rate self -discipline mechanisms can independently determine the level of deposit interest rates in accordance with their own situation, referring to the bond market interest rate represented by the 10 -year Treasury bond yield and the loan market interest rate represented by the one -year LPR.

According to Zou Lan, since the establishment of this mechanism, various banks have actively adjusted the level of deposit interest rates based on the market interest rate change. Initial statistics from the central bank, in June of this year, the average interest rate of new deposits incurred in banks across the country was about 2.32%, which decreased by 0.12 percentage points compared with April before adjustment. The establishment of the market -oriented adjustment mechanism of deposit interest rates has significantly enhanced the market -oriented pricing capacity of deposit interest rates, which is conducive to maintaining a good competitive order in the deposit market, stabilizing the cost of bank liabilities, promoting reducing actual loan interest rates, and better supporting the development of the real economy.

9. 99%of the banking assets are within the security boundary

Sun Tianqi said that since the risk incident of Henan Village Bank, the central bank has actively cooperated with local governments and regulatory authorities to respond steadily, guiding branches to perform the responsibility of maintaining regional financial stability, and to monitor and emergency protection of liquidity risk. On the whole, my country's financial risks converge, and generally controllable. 99%of the banking assets are within the security boundary.

In the fourth quarter of 2021, the central bank rated results showed that of the 4398 banking institutions participating in the evaluation, there were 4082 level 1-7 financial institutions within the margin of security, and the number of institutions accounted for 93%of the bank industry participation institutions. 99%of the institution. Among them, 24 large banking rating has always maintained at level 1-5, which is an excellent rating. The size of the assets accounts for 70%of the entire banking industry's participation institutions. It is the cockpit stone of the entire financial industry.

In addition, a total of 316 high-risk institutions at the 8-D level. Sun Tianqi said, "The number of high -risk institutions accounts for 7%of the bank industry participation institutions, but the size of the assets accounts for only 1%of the banking industry's evaluation agencies. That is to say, most of the central bank rating of SMB , Monetary policy continues to adhere to me, taking into account the internal and external balance

Zou Lan said, "In recent years, we have always adhered to the implementation of normal monetary policies, leaving sufficient policy space and tool reserves for new challenges and new changes in cope. In the second half of the year, the central bank will continue to implement a stable monetary policy, Accelerate the implementation of the determined policies and measures. "

Specifically, including: implement the various structural monetary policy tools introduced in the early stage, guide financial institutions to enhance the ability of financial services in accordance with the principles of marketization and rule of law; guide policy development banks And the establishment of 300 billion yuan in financial instruments to support infrastructure construction; it also includes the early completion of the annual financial deposit profit to the central government, helping to stabilize the economic market and stabilize employment to protect people's livelihood.

Zou Lan said that we are highly concerned about the accelerated tightening of the monetary policy of major economies. In the early stage, measures have been adopted to adjust the foreign exchange deposit reserve rate and strengthened measures such as the macro -prudential management of cross -border capital flows. To a certain extent, the negative overflow shocks caused by changes in the external environment were reduced to a certain extent. The two -way fluctuation of the RMB exchange rate is at a reasonable level, and the flow of cross -border capital is generally stable. At the same time, as a super -large economy, the domestic currency and financial conditions are mainly determined by domestic factors. The monetary policy will continue to adhere to the orientation of me as the main internal and external balance.

- END -

Wentai Technology: In the second quarter of "Wentai Convertible Bonds", 2369 shares were converted, with a cumulative transfer of about 17,300 shares

Every time AI News, Wentai Technology (SH 600745, closing price: 82.1 yuan) issued an announcement on the evening of July 1 that Wentai Convertible Bond was transferred from April 1, 2022 to June 30

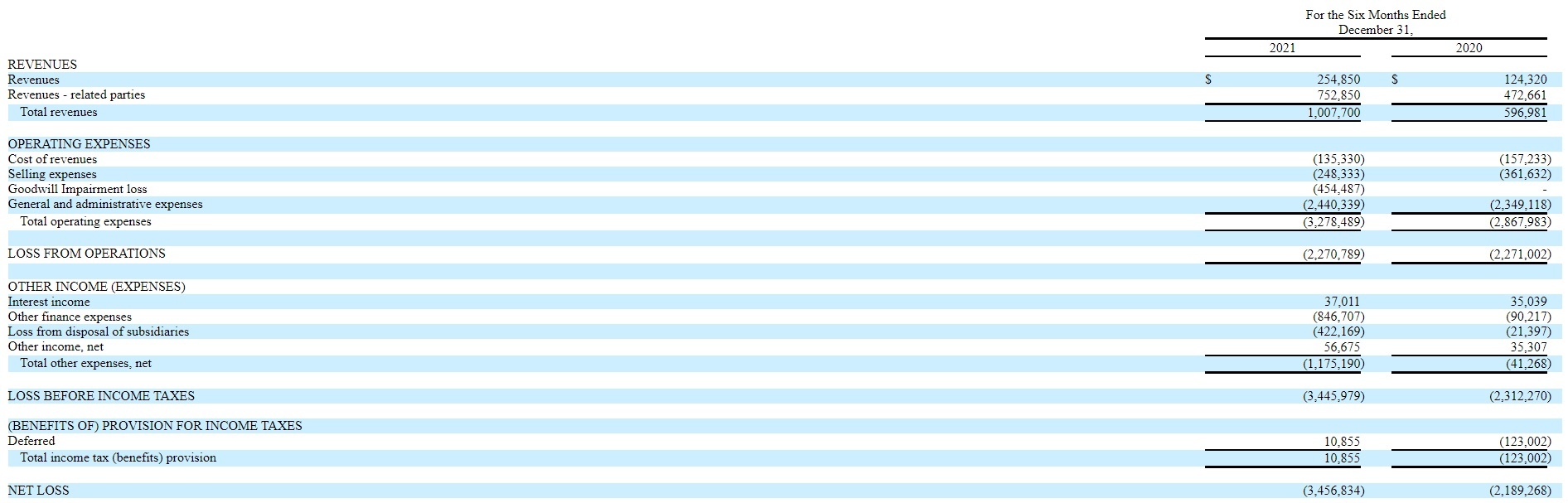

Inclusive Wealth in the second half of 2021 increased by 68.8% year -on -year

On July 4th, Capital State learned that the financial performance of the U.S. -lis...