what's going on?ICBC's branches mistakenly collect fake coins, and relevant personnel have

Author:Broker China Time:2022.06.14

ICBC Anhui Branch was punished for two consecutive years for mistakes!

A few days ago, the administrative punishment information of the website of the Hefei Center Sub -branch of the People's Bank of China showed that the Anhui Branch was warned and fined 6.187 million yuan for 5 categories of illegal acts including fake currency.

Five types of illegal acts involved in fake currency collections

The ticket shows that the bank has not filed with the RMB settlement account management system on time at the unit's bank settlement account; the personal bank's settlement account is not filed or not in the account management system within the prescribed time; The actual settlement business of the sub -account has not been approved by the People's Bank of China; the actual settlement business in the "account butler" product (multi -layer account) of the "account butler" product (multi -layer account) is not recorded by the People's Bank of China; the unit merchants use personal bank accounts as the receipt settlement account.

At the same time, the bank also has insufficient professional capabilities of cash practitioners, failing to collect fake coins in accordance with regulations, and misrepresented counterfeit currency; the revenue budget income has not been paid in time in time to occupy the pressure; Failure to re -identify customers in accordance with regulations, and do not adopt intensive identification measures on high -risk customers in accordance with regulations; some ETC pre -boarding business handles illegal acts that have not expressed their consent and missed complaint data.

Article 44 of the "Regulations on the Management of the People's Republic of China" stipulates that the business institutions of financial institutions that handle the RMB access business and the State -owned commercial banks authorized by the People's Bank of China violate Article 34 and 3 of these Regulations Article 15 and Article 36 stipulates that the People's Bank of China will warn and impose a fine of 1,000 yuan to 50,000 yuan; the person in charge and other direct responsible persons shall be given disciplinary sanctions in accordance with the law.

Wang Yujin, the deputy general manager of the operation and management department of the ICBC Branch, was responsible for the misrepretion of fake currency of the bank, warned and fined RMB 2,000.

In addition, the ticket also shows that ICBC has four related responsibilities per capita for being punished by the central bank for being responsible for the bank's violation of the Anti -Money Lake. Zhang Rui Party, then the general manager of the Internal Control and Compliance Department of the ICBC Hefei Branch, and Zhang Rui, then the general manager of the ICBC Anhui Branch internal control and compliance department. Customers and failure to take strengthening identification measures on high -risk customers in accordance with regulations, both were fined RMB 35,000. Wang Jianmin, then the general manager of the settlement and cash management department of Anhui Branch of the ICBC, was fined 25,000 yuan for the bank's failure to re -identify the customer in accordance with regulations. At that time, the general manager of the personal financial business department of the ICBC Anhui Branch, the general manager of the personal financial business department of the ICBC province, was fined 35,000 yuan in accordance with regulations and re -identifying customers in accordance with regulations and re -identifying customers in accordance with regulations.

It is not the first mistake to collect fake coins

A reporter from securities firms noticed that this is not the first time that ICBC's Anhui Branch has been punished by administrative penalties for mistakes for fake currency. In June last year, the bank was not approved by the bank settlement account or not filed in accordance with regulations; fake currency was not collected in accordance with regulations; fake coins were collected by mistake; no obligation to perform customer identity in accordance with regulations; Seven illegal acts including information rights were fined 1.147 million yuan.

To curb the circulation of fake currency, banks should have played a key role, but some banks have falsely collected fake currency, or even fake coins, and are therefore administrative. So, how should banks collect fake coins in accordance with formal procedures?

Article 33, 34, and 36 of the "Regulations on the Management of the People's Republic of China" stipulates that counterfeit currency shall be confiscated by the business institutions of a wholly state -owned commercial bank authorized by the People's Bank of China or the People's Bank of China. Banks should unlock the collection of forged and altered renminbi of the Local People's Bank of China.

Regarding the collection and management of counterfeit currency, Article 6 of the "Measures for the Collection and Appraisal Management of the People's Bank of China" stipulates that financial institutions find counterfeit currency when applying for business, and two or more business personnel of the financial institution will be collected in person. For fake RMB banknotes, the word "fake currency" should be stamped; for counterfeit foreign currency banknotes and various fake coins, they should be sealing in a unified format in a unified format, stamped with the word "fake currency" in the seal, and in a special bag in a special bag It indicates the details such as currency, coupon, noodles, Zhang (plots), crown characters, collection, and reviewers.

If you find that you receive a counterfeit currency, you should pay the People's Bank of China and the public security organs in a timely manner. After the bank receives fake coins, if the number is large, the public security organs should be reported immediately. If the number is relatively small, the two or more staff of the bank will be collected in person, stamped with the word "fake currency", register for booking, and hold to hold to hold to hold. People issue a collection of collections uniformly printed by the People's Bank of China. The fake currency collected, the bank was terminated to the local branch of the People's Bank of China at the end of each quarter, and was destroyed by the People's Bank of China. No department shall deal with it by itself.

Editor -in -chief: Wang Lulu

- END -

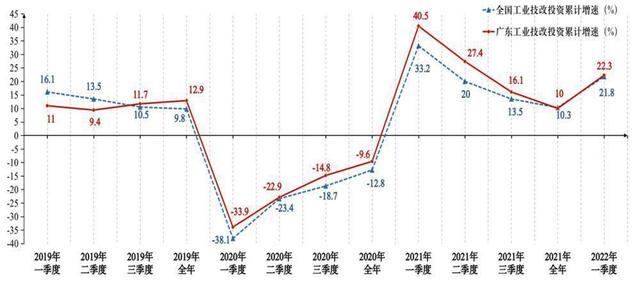

Guangdong: The cumulative growth rate of industrial technical reform in the first quarter reached 22.3%

Text, Figure/Yangcheng Evening News all -media reporter Xu Zhang Chao Sun JingSinc...

The 7th China Innovation Challenge Jiangsu Sai launched

Recently, the Ministry of Science and Technology launched the seventh China In...