Daily discussion of gold | US dollars strong upward, the price of gold has fallen sharply

Author:China Gold News Time:2022.07.18

Guest: Liu Zhongshan, a researcher at Beijing Golden Economic Development Research Center

The international gold price opened this week at $ 1742/ounce, up to $ 1745/ounce, and the lowest exploration to $ 1672/ounce.

In terms of news, in terms of US economic and monetary policy, US inflation data in June is 9.1%. It is difficult to change in the short term of US commodity supply patterns, and inflation will still run high. The market is expected to increase the Fed's interest rate hikes, and the pressure above the gold price is more obvious.

At the level of geography, in terms of Russian and Ukraine conflicts, the Russian -Ukraine conflict continues to continue, and the possibility of deteriorating sharply in the short term decreases. From the perspective of geopolitical situations, the support of gold can be obtained from the Russian -Ukraine conflict.

Crude oil price trend has a linkage effect on gold. The Seven Kingdoms Group (G7) tried to set the upper limit of oil prices and the world's major oil -producing countries Saudi Arabia increase oil production, which relieves the market's concerns about crude oil supply, and the price of crude oil is high. Falling to $ 100/barrel, the decline of crude oil prices weakened from the expected level of gold prices.

In terms of gold ETF positions, a total of 6.38 tons of positioning this week will be reduced. ETF continuously reduced the short -term pressure on the price of gold in the short term.

In summary, inflation is high, and the strength of the US dollar and the prospect of the Fed's interest rate hikes have continued to pressure the price. After the Fed's comprehensive inflation and the risk of economic recession, they still use inflation as the core policy goal. Therefore, the Federal Reserve ’s interest rate hikes will still cause long -term pressure on the price of gold. The geographical situation has a limited role in boosting gold. At present, the support factor support has weakened, and the factor factors are gradually enhanced. From the fundamental point of view, the pressure above the gold price is more obvious.

At the operational level, the fundamental gold price faces the Federal Reserve ’s interest rate hikes, and the technical trend is obvious. ETF continues to reduce positions in the price of gold, and the overall pressure is more obvious. From the perspective of the operation level, it is mainly based on the high -safety marginal empty order and alert the rebound after the reflection. It is expected that the gold price operating range next week is 1680 ~ 1740 US dollars/ounce. for reference.

- END -

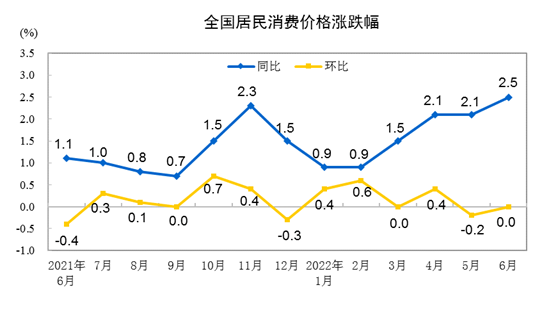

In June, the consumption prices of residents rose 2.5%year -on -year, and they were flat month -on -month.

In June 2022, consumer prices across the country rose 2.5%year -on -year.Among the...

"The first stock of prefabricated dishes" Tao Zhixiang claims to abandon the layout community, will this track still get angry?

The prefabricated vegetable market is hot. After the first annual report of the pr...