The strongest chip giant in the United States declines: "We are blame ourselves!"

Author:Positive Agreement Time:2022.08.08

The key to Intel's return to its peak depends on whether it can regain the dominance of the process.

Produced by the Zhengjie Bureau (ID: zhengjieclub)

Recently, a major event in the chip industry.

AMD's market value exceeds Intel again.

Intel CEO Pat Kissinger acknowledged that the decline in the stock price was to make a blame, and the stock price should indeed fall!

How did the strongest chip company once step by step?

Intel was the king of the chip industry, this should be unsuccessful.

From the perspective of technology pioneers, the law of Moore, which deeply affects the development of the industry today, is Gordon Moore, one of Intel founders.

From the perspective of leading the industry, the "Wintel" alliance formed by Intel and Microsoft has led and promoted the global PC market since the 1980s.

As early as 1992, Intel has become the world's largest semiconductor supplier.

At that time, Intel would not look at AMD.

Although like Intel, the founder of AMD also comes from Fairy Semiconductor.

However, since its establishment, AMD has been beaten by Intel.

In order to avoid British Tel's edge, AMD chose a low -cost and economical medium and low -end chipset to survive with "cost -effective".

Founder of Fairy Semiconductor

Many people in the chip industry believe that Intel is fully capable of killing AMD. The reason why it is not ruthless is to cultivate a non -powerful opponent and avoid the trouble of antitrust.

Even with Intel's mercy, in 2014, AMD almost went bankrupt.

Looking at these two opponents today, AMD is flourishing, but Intel has fallen into the throne.

One of the signs is the market value. In February this year, the history of AMD's market value surpassed Intel for the first time.

Just two days ago, the AMD market value exceeded Intel again.

Looking at it now, the AMD market value exceeds Intel more than $ 20 billion, and the gap between the two has begun to widen.

Market value comparison

It may be accidental one or twice, and the gap is inevitable.

Old opponents had only looked at their backs, but now they ran in front of themselves. No wonder Intel CEOs were deadly.

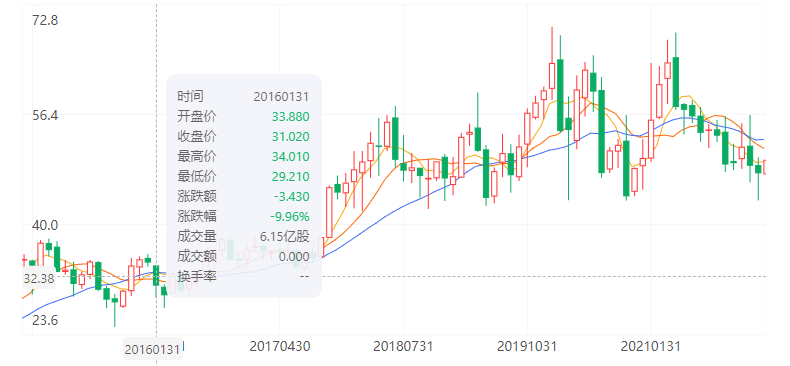

If today's stock price is compared with 2016, Intel's decline is even more similar.

In 2016, Intel's stock price was $ 31; it is now $ 36. Six years have passed, and the increase is only 16%.

In contrast, AMD, the stock price rose from $ 2.2 to $ 102, an increase of more than 40 times.

Stock price trend comparison

Investment investors who invest in Intel are cold.

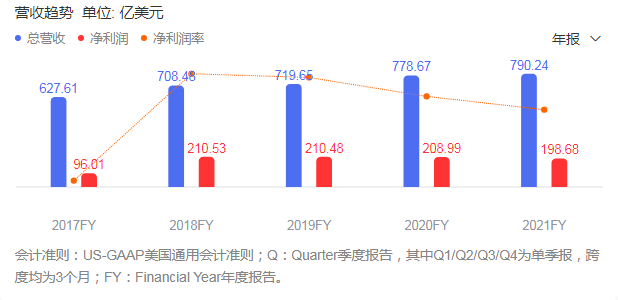

The stock price is "face", and "Lizi" is a problem with the income.

On July 29, Intel announced its financial report that in the second quarter of 2022, revenue was 15.3 billion US dollars, a year -on -year decrease of 22%. It also changed from profit to losses. In the quarter, a net loss was 500 million US dollars, and the profit was $ 5.1 billion in the same period last year.

In addition, Intel lowered its annual performance expectations, and it is expected to revenue in 2022 of US $ 65-68 billion.

You know, 4 years ago, Intel's revenue had exceeded $ 70 billion.

Intel revenue growth trend

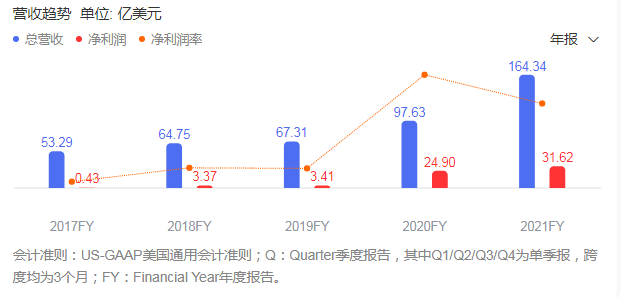

Looking at the competitor AMD, the second quarter revenue increased by 70%year -on -year, and net profit increased by 119%.

In 4 years, AMD's revenue has increased tripled.

AMD revenue growth trend

It is said that this is the same.

In a sense, Intel's "cake" was snatched by AMD.

Another viewing perspective is the PC market share. The proportion of AMD has continued to increase to 30%, reaching the highest point of history.

AMD and Intel's market share comparison

In the server chip market, Intel once controlled 99%of the market share.

Now, AMD has been taken away 15%of the market share.

Morgan Chase also predicts that in the future, AMD's market share will increase to 40%.

In recent years, global chips are in short supply.

The former king Intel did not increase the revenue, and even the soup did not drink it.

"We are our own prisoners."

Former Nokia Chairman and CEO Joma Olila once evaluated Nokia's performance in response to new opportunities.

This sentence is also very suitable for today's Intel.

The throne has been sitting for a long time, and often loses the sense of worry.

The so -called ship is difficult to turn around.

For a giant wheel like Intel, it is too difficult to change the direction and enter a strange field.

Especially, the times have changed.

Around 2010, the popularity of smartphones and tablets began to impact the PC market.

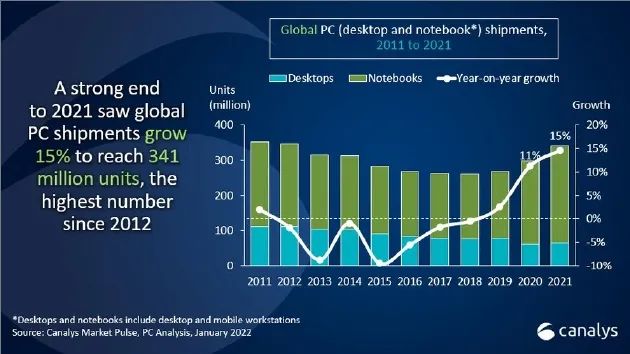

In 2021, the global PC shipped 340 million units.

It looks like a lot, but you know that 10 years ago, the global PC shipment had exceeded 350 million units.

Global PC shipments over the years

The PC business is Intel's main source of revenue. The market shrinks and naturally affects its revenue.

For example, in the second quarter of 2022, Intel's PC revenue fell by 25%, becoming the main factor to drag the overall performance.

In the face of the turbulent mobile Internet era, Intel swayed left and right, and did not resolutely transfer the production line to the mobile phone chip manufacturing.

After finally getting on Apple's express, Intel once ranked among the top three in the world in the market share, it was eliminated by Apple because of poor baseband signal and slow internet speed.

In July 2019, Intel announced that it would sell the 5G baseband business to Apple, which was equivalent to declared abandoning the mobile platform. External worry, the internal troubles gradually start: In the face of the more volume of chip industry, Intel's business model has also become outdated.

Intel's business model, referred to as "one dragon", is designed by itself, manufactured by yourself, packaged by yourself, and all jobs.

Ten years ago, there was no problem with this model.

Because Intel leads the development of the industry, technology, scientific research, funds, and equipment are all the top in the industry. Instead, "one dragon" can protect technology and build a moat.

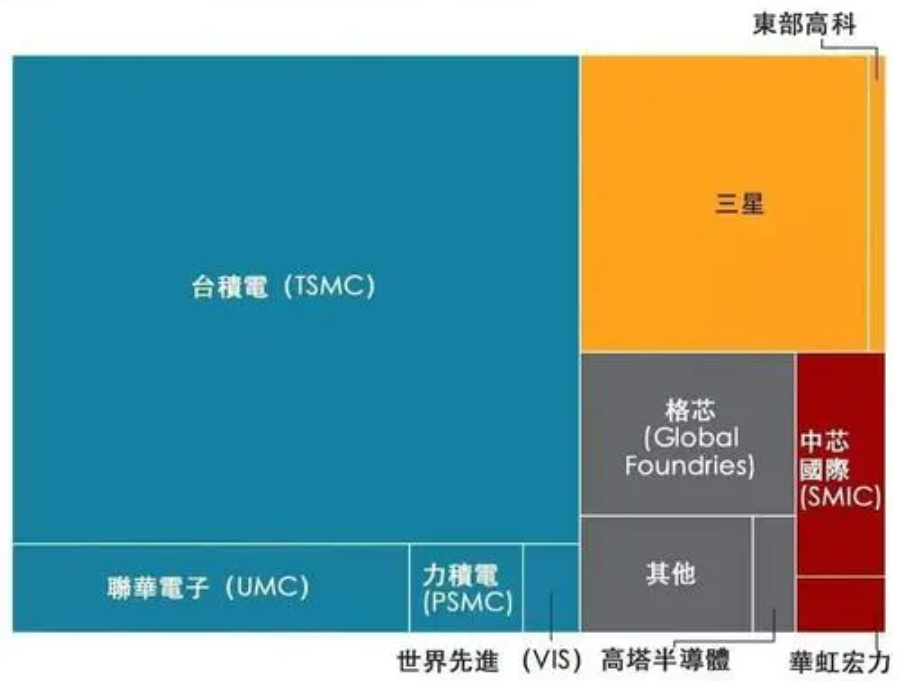

The rise of TSMC has changed the rules of the industry.

Focusing on the processing of TSMC, the foundry technology is the extreme, and the manufacturing process leads the lead.

Global chip foundry market share in 2021

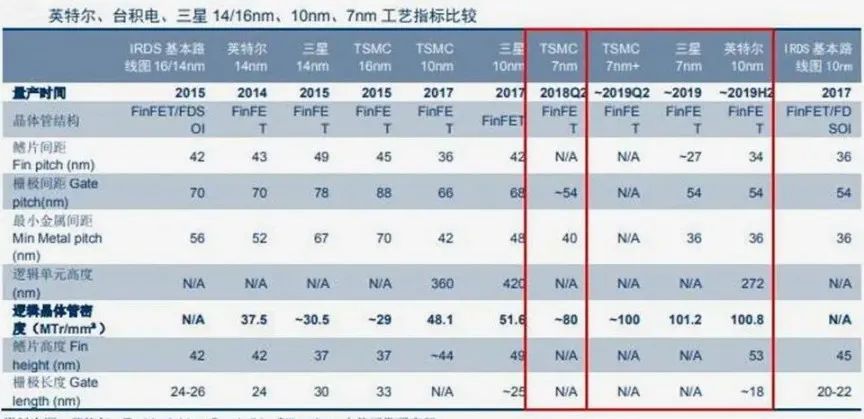

For example, TSMC and Samsung's 7nm technology have been mass -produced as early as 2018, and Samsung's 3nm has also been mass -produced this year.

In contrast, the release time of the 7nm process was postponed to the second half of 2022 or early 2023, and it was played as a "toothpaste factory" by the outside world.

It can be said that in the manufacturing process alone, Intel lags behind TSMC and Samsung.

The manufacturing process directly determines the performance of the chip, which ultimately affects sales.

AMD was unable to make it, and he simply turned it to TSMC, and he focused on designing.

As early as 2018, AMD released its desktop CPU based on TSMC 7nm process technology. The performance exceeds the Intel chip of the same level, and the pricing is also quite advantageous.

Four years have passed, and the 7nm CPU made by Intel himself was late and was nicknamed "squeeze toothpaste".

Intel, TSMC, Samsung process comparison

The division of labor in the chip industry is becoming more and more refined.

For example, TSMC invests tens of billions of dollars per year, just to die for the process.

Although Intel has money, it is too large to invest in the research and development process like TSMC.

Intel can fight the entire industry with his own power, can he be undefeated?

The product is not competitive, the technology has not made breakthroughs, and decline is inevitable.

Since its establishment in 1968, Intel has gone through the wind and waves several times.

This time, Intel is also adjusting his strategy:

The first is to launch the IDM2.0 mode.

In simple terms, it is to learn from TSMC and Samsung to undertake chip foundry business.

Prior to this, Intel also decided to spend $ 20 billion newly built two new chip factories, which has greatly expanded its capacity.

Intel factory

The second is to hold TSMC's thigh.

Intel's 14th generation CPU "Meteor Lake", manufactured using its own Intel 4 (7nm) process.

In order to avoid technical uncertainty and delay in production and release time, Intel has decided to make part of the TSMC 5nm process.

The former king, seeking helping others, is helpless.

The third is to adjust the product direction.

The Internet of Things and artificial intelligence are in the ascendant and have a strong demand for GPUs.

Intel decided to increase the research and development of GPU products to obtain new economic growth points.

So the question comes, can Intel go out of the valley and create glory again?

In my opinion, it is not so easy.

From the outside, whether it is a foundry or a GPU, Intel faces top opponents such as TSMC and Nvidia, the competition is very fierce.

From the inside, Intel has developed for decades, it has formed path dependence, transforms status, and adjusts the product.

Intel is increasingly declining, the core problem is to lose the dominance of Moore's law.

The key to Intel's return to its peak depends on whether it can regain the dominance of the process.

On June 30 this year, TSMC announced the "mass production of 3nm in the second half of the year", and Samsung also announced the 3nm process mass production.

The more advanced 2NM process chip, TSMC plans to mass production in 2024, Samsung plans to be 2025.

As the so -called, step by step.

TSMC and Samsung ran so fast. Intel after falling in people, it was not easy to catch up in a short time.

What's more realistic is that Intel will "jump tickets" next time?

Bleak

The end

Tip:

- END -

Precise service for enterprises!Texas to build a technology enterprise service cloud platform

On June 15, Texas held the fifth press conference of the First Camp Business Envir...

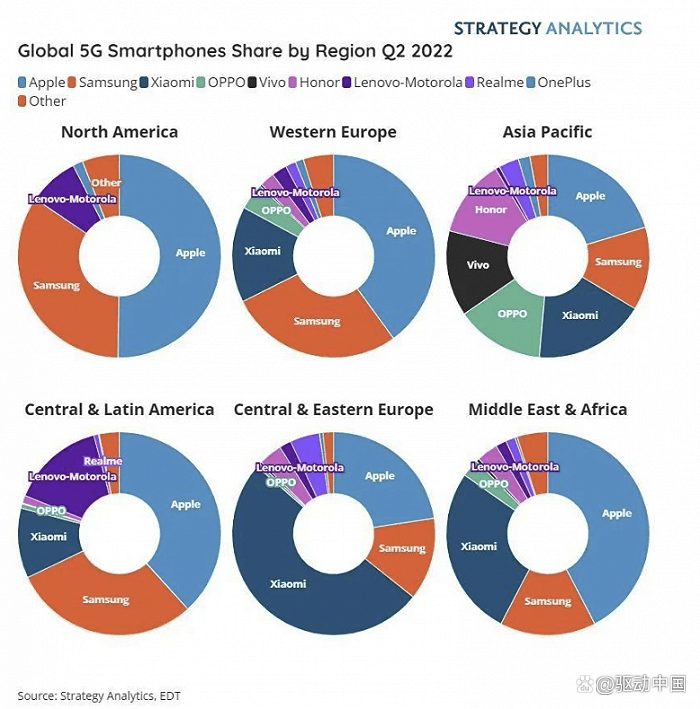

Institution: 2022 Q2 Apple continues to lead the global 5G smartphone market

Drive China August 10, 2022Recently, the market research institution Strategy Anal...