Analysis of Wanzi Financial Report: See the business model of Ali, JD.com, Amazon, Meituan, Pinduoduo

Author:Changjiang Business School Time:2022.08.10

Use financial report data to interpret the business model of Internet companies, which is one of the most authoritative interpretations.

What are the business models of Internet companies? From the perspective of financial reports, what is the difference between Ali, JD.com, Pinduoduo, Meituan, and Amazon?

Dr. Xue Yunkui, a professor of accounting at the Yangtze River Business School and the founder of the four -dimensional analysis method, uses public financial reports as a case. The four -dimensional analysis method leads everyone to learn how to penetrate financial reports, analyzes the characteristics of the business model of the Internet company and its relationship with the core indicators of the financial report.

Regardless of whether you have a financial background, I believe that through today's article, you can interpret the information that breaks through the past cognition from the financial report.

Author | Xue Yunkui

Source | Friends of Accounting

Xue Yunkui

Professor of Accounting, Changjiang Business School

Four -dimensional analysis founders

The focus of the discussion in this article includes three parts:

(1) What is the financial report?

(2) What is a business model?

(3) How to use financial reports to analyze the business model of Internet companies?

Based on the integrity of case data, this article will focus on discussing the public financial reports of Amazon, Alibaba (hereinafter referred to as "Ali"), and JD.com, and the history of the financial reports traced on the analysis is more than 10 years. Finally, briefly evaluate Pinduoduo and Meituan's business model and its financial report characteristics.

1

What is the financial report?

Regarding financial reports, this article emphasizes two key points:

Where does the data from the financial report come from?

What is the question of the financial report?

(1) Where does the financial report data come from?

Simply put, financial report data is a summary of the company's transaction information. The transaction information is adopted from various transaction records called "original vouchers".

When each transaction occurs, the original voucher will record the time, place, target object, and the number, unit price and amount of the transaction.

For example, whether the transaction is in the warehouse or out of the warehouse? Do you save money or withdraw money? Is it receiving or payment?

When the transaction occurs, the relevant personnel will collect relevant transaction information. The record of the first time the transaction occurs in the transaction is called "original voucher".

Once the original voucher is formed, it will bring together the company's financial department in different ways, and the accounting professionals will classify and organize it. Then form a report in accordance with the requirements of corporate accounting standards or recognized accounting principles (GAAP).

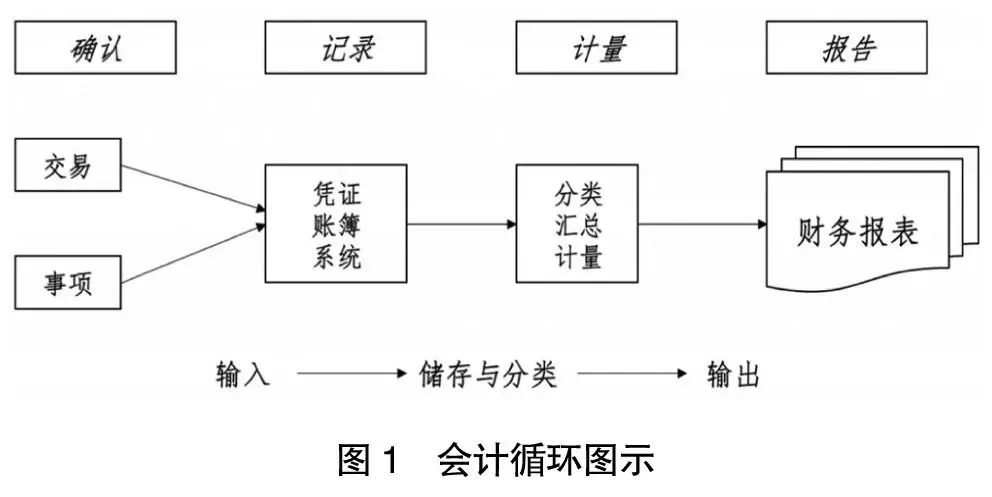

The processing process of the entire transaction information is shown in Figure 1.

Strictly speaking, all the positions and employees of the company are engaged in various different transactions. Some transactions serve external customers outside the enterprise, and some transactions only serve internal employees.

When most people perform transactions, they are both salesmen and recorders. He needs to enter the complete transaction into the system or obtain the original receipt or invoice.

For example, the invoice obtained when traveling on a business trip records the specific information of the ride.

What products do production workers produce in the production workshop and team, sometimes they need to record their own records, and sometimes special recorders or statisticians need to record or enter the corresponding information system.

In short, the transaction completed by any employee in any position needs to be collected in transaction information in an original voucher.

The process from the original voucher to the financial statements, including accounting records, measurement, and reports. It is the professional work of accounting personnel. They summarize and summarize the transactions occurred in various positions in the enterprise, and finally form financial statements.

It can be seen that the data of the financial statements covers all transactions that can be expressed by a company without any omissions and exceptions, otherwise it will affect the quality of financial statements information.

Of course, in reality, not the financial statements of each company can accurately and fully reflect all the transaction information of the company. In fact, the key is not the report itself, but whether the transaction is fictional.

If the transaction or submission to the accounting department to record the transaction is fictional, and the amount involves a large amount, it will cause the information distortion provided by the financial statements, or does not conform to "all major aspects, to express the company's finance fairly, Status and business performance ".

Is the information of the financial statements distorted?

Theoretically endorsement of accountants. If the accountant gives an audit report of "no reservation", it shows that these financial statements are trustworthy, it reflects all the transactions of a company, and is fairly expressed the result of these transaction records and measurement.

(2) What did the financial statements report?

Financial statements are usually the main part of the annual report of the enterprise. In the annual report of listed companies, about 70%of the space is financial report.

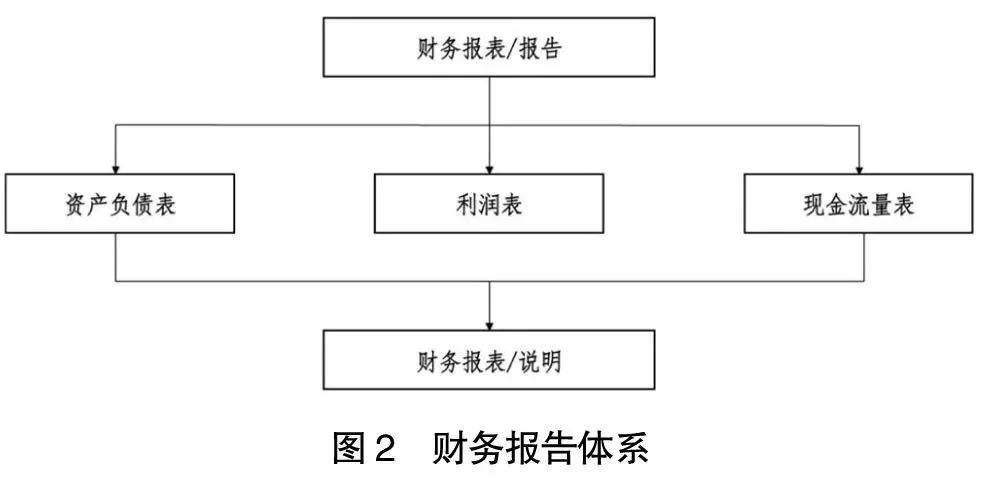

The financial report consists of two parts: main table and note.

The content provided by the main table is usually called mandatory disclosure content. In China, it was disclosed in accordance with the requirements of the Corporate Accounting Guidelines. The main tables of financial statements include the "balance sheet", "profit sheet" and "cash flow sheet".

First, the balance sheet mainly tells us how much money a company has, and who the money belongs to.

Including cash, stocks, investment, inventory, products, finished products, receivables, etc. These are the specific content of assets. If it is expressed in professional terms, it is the economic resources it owns or controlled.

Although these resources are controlled by the enterprise, they correspond to the corresponding ownership relationship, that is, who these resources belong to, that is, who has the right to claim these resources.

Usually include creditors and shareholders. If a company's debt is zero, then the shareholders' equity is 100%, that is, all the assets of the company are owned by shareholders, but it is almost impossible in reality. Therefore, a constant equation in accounting is "asset = liabilities+shareholders' equity".

Second, the center of the profit statement is about how much money it is made.

But how much money is made, you need to use "income-cost = profit" to measure.

The income element is the focus of discussion in this article, because analyzing the business model of a company is mainly to discuss the way of making money, limited to space, and other elements are lightened for the time being.

Third, the cash flow statement mainly reflects how much money the company has, which is how much cash.

How much cash is different from how much money, and how much money includes floating profits and floating losses, but how much cash only refers to the cash and deposits of real gold and silver.

The company's operation has both cash flow and cash flow. The cash inflow of operating activities minus the outflow of business activities, and it gets the net inflow of business activities.

Note is supplementary information and voluntary disclosure content except the table.

The so -called voluntary disclosure refers to disclosure to disclose information that is easier to understand their risks and performance for specific enterprises or specific industries in addition to the understanding of management.

Judging from the position of the regulatory agency, voluntary disclosure is an encouraged information disclosure. In the US securities market, it is usually called "Non-Gaap" information disclosure.

Therefore, the concept of financial reports is usually adopted, which mainly refers to two parts including financial statements and notes. The report part is the focus, which is the content of mandatory disclosure, with unified norms and formats. Note will have a certain degree of freedom.

The financial report system is shown in Figure 2.

The above is about where the financial statements come from and what it mainly reports. Understanding these two basic issues can we properly understand the meaning behind the financial report data.

But understanding the financial report does not mean to interpret these financial reports. There is a special method to interpret these financial reports. This method is to help everyone integrate financial report data with the company's strategy, management, management, and finance. Because this method contains four dimensions: business dimension, management dimension, financial dimension, and performance dimension, the author calls it the "four -dimensional analysis method".

Due to space, this article will focus on discussing a thin branch in the business dimension, which is the part of the business model of the enterprise. Although it is a small branch, it is the core of the core of the four -dimensional analysis method, which is very important and critical.

2

What is a business model?

The topics of business models, many discussions, and many literatures. But seeing the problem depends on the essence.

In essence, business model is a transaction matching model. The essence of business is transaction. The transaction is buying and selling, there are buyers, some sellers, production and consumption.

In this process, some intermediary service agencies, such as accountants, lawyers, wholesalers, retailers, and various information service platforms, market supervisors, etc. The matching mode can be simply called the business model.

In other words, leaving these basic elements to discuss business logic, I am afraid that it cannot be called a business model. Speak the business model as a small ceiling, and make the original clear concepts that everyone can't understand or not understand, and then it looks tall. This is wrong.

The traditional "store model" is to purchase goods and sell them in the store. This is the most traditional and classic business model. Simulating this model online is the "direct e -commerce model".

To some extent, JD.com is an online direct -operated model, but it is not as simple as simulation, not just simply put the offline store opening mode on the Internet.

Compared with the traditional store model, online direct -operated operations have a strong advanced nature, and further analysis will be analyzed below. But in the essence of business models, it is the "online" store model.

Is a company's business model online or offline?

Speak without. It is necessary to analyze its specific transaction composition through financial reports. Most of the transactions are from online, which is direct e -commerce. Most of the transactions originated from offline, which is traditional retail.

Another business model is called "platform model". In fact, the platform model is not online proprietary. Offline retail also has a platform model.

For example, Yiwu is the world's largest offline small commodity market platform.

Various building materials markets, medicinal materials markets, small commodity wholesale markets, automobile markets, etc., have the attributes of offline platforms to a certain extent.

Because they share many common market service functions. The establishment of the platform helps improve and improve market efficiency.

Online platforms such as Ali, Amazon, JD.com also have some platform functions. In addition, Meituan and Pinduoduo have platform attributes. The following will further discuss the difference between them.

Although they are both platforms, the platform and the platform are also different. For example, Meituan and Pinduoduo have been upgraded to a new version based on Ali. The difference between each version will be discussed below.

(1) Direct business mode

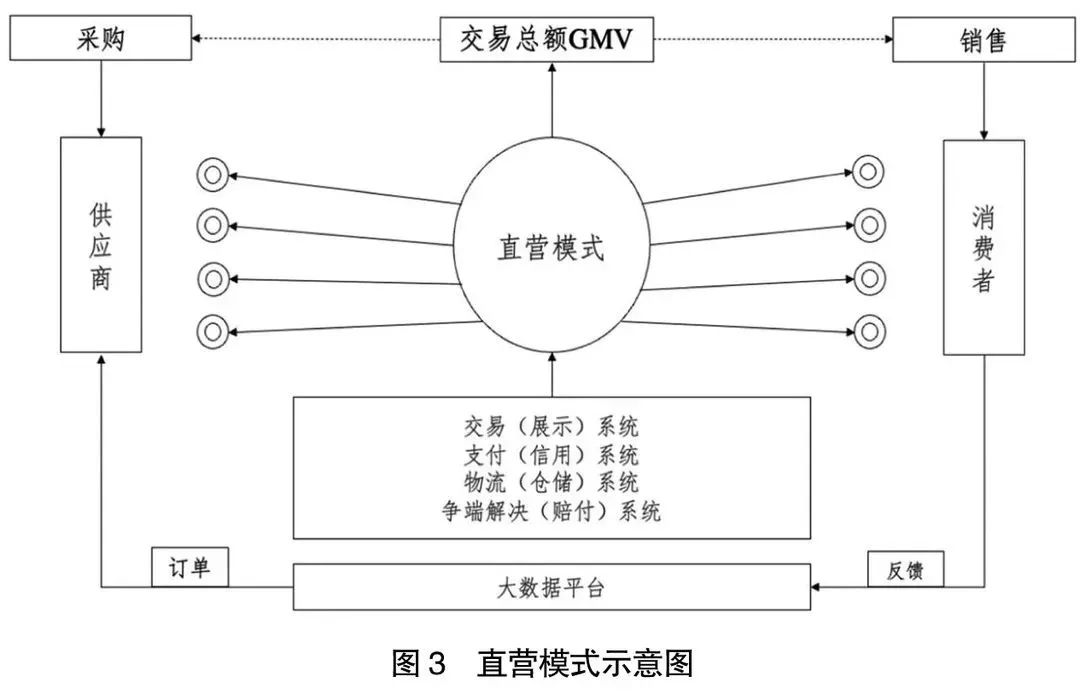

The direct -operated model is relatively simple. It is a business model that retailers purchase directly from suppliers, and then sell the purchased goods to consumers. Traditionally called "unified purchase of bags".

What are the characteristics of such a business model in accounting? E -commerce companies buy goods from suppliers, and they are usually called commodities.

For example, the entry price is 8 yuan, and then 10 yuan sells it. The price price is 2 yuan.

In terms of accounting, its sales income is 10 yuan, the sales gross profit is 2 yuan, and the sales gross profit margin is 20%.

Because the accounting is recorded at the price of the product, some people say that this accounting method is the "total method", or the total number of commodity transactions (GMV).

Because the gross profit margin of such companies is generally low. Some commodities have less than 1%of the gross profit margin. Therefore, the sales revenue is very large, which can be hundreds of billions of yuan, but the net profit may be hundreds of millions of yuan.

The profit of this business model is very thin, and the risk of business is very large. What are the reasons?

Because of these products to be sold, they have been purchased through suppliers beforehand. The ownership of these products has been transferred to the company, and the corresponding risks have also been transferred to the company.

If the goods cannot be sold, mildew, deterioration, damage or slow sales, price declines, etc., these risks will become risks of merchants, so it says that its operating risk is relatively large.

Figure 3 abstracts the JD business model to a certain extent. The left side of the figure is the supplier and the consumer on the right. Logically, the number of consumers expressed in this picture should be more than the number of suppliers. Because consumers are 100 million, suppliers are about tens of millions.

In order to support online transactions, e -commerce companies need to build some platforms, including trading systems (or product display systems), online payment systems, logistics storage systems, and dispute resolution and claims systems.

As online transactions involve massive consumers and suppliers, this requires a system to accurately match both parties in the transaction, or accurate delivery of information, which involves big data calculations.

In principle, there is no difference between online direct -operated models and store models. On the one hand, consumers and suppliers are on the other hand. So why is the traditional store model competing for e -commerce?

The core difference is the big data platform. As a business model, it can master the preferences and needs of massive customers, and feedback these needs information to the supplier will become the most valuable asset of the supplier. Feming customers 'needs to suppliers through calculations and orders, to some extent, they can guide suppliers' production.

From a social perspective, the efficiency of commodity production in the entire society has been greatly improved, which can at least reduce the backlog of inventory and reduce the waste and losses caused by production discomfort to road products.

Therefore, if the traditional store model is called commercial 1.0, then the direct business model of e -commerce can be called commercial 2.0. It is very helpful for the improvement of the entire society's efficiency. This is the first model shared with you in this article -the direct -operated model.

(2) Platform mode

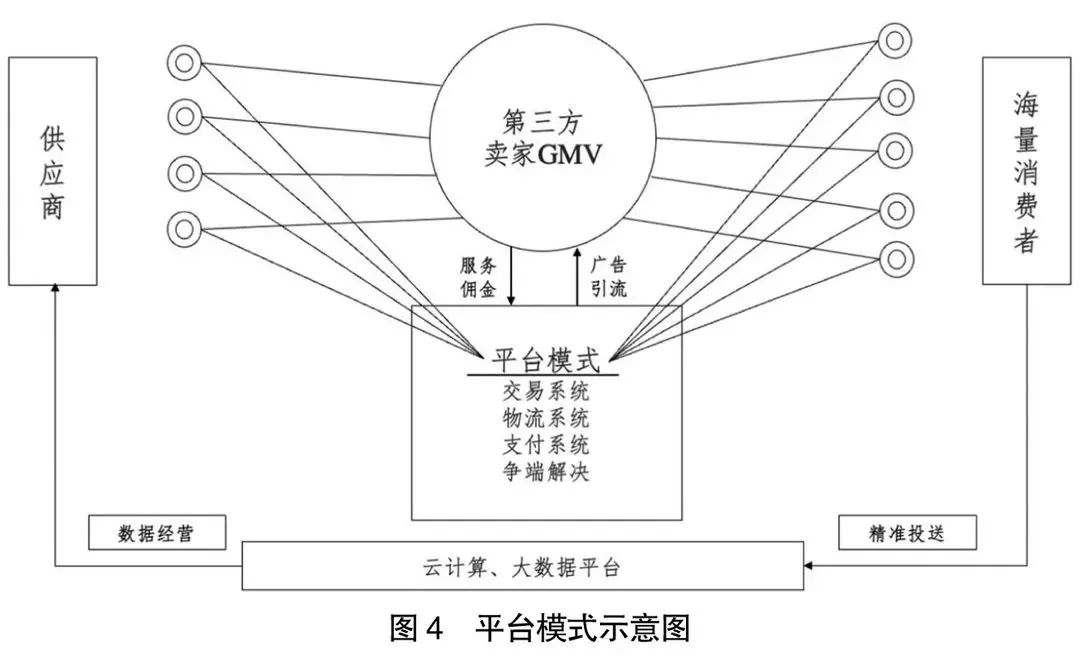

The so -called platform mode is an upgraded version of the direct -operated mode. If JD.com's business model is understood as a direct business, Ali can be called a platform model.

It is said that Jingdong is a direct -operated model. It is to say that it is based on the direct -operated model. It does not mean that 100%of its income comes from direct business. Regarding this topic, it will be discussed further.

What is the difference between the platform mode and the direct -operated mode?

In order to facilitate everyone's understanding, take Taobao and Tmall as an example to explain, to serve third -party merchants directly, encourage merchants to open stores, and the entry threshold is low. This is what Ali refers to "making the world that there is no difficult business". Whether you are a large capital or a small capital, big business or small business can open stores on the platform and provide various support and services.

As a result, two accounting concepts appeared on the platform income: platform transaction revenue and service revenue.

For Ali, because it helps merchants deliver product information accurately, match related consumers and promote transactions, it can obtain advertising drainage income or marketing planning income.

Merchants sell goods, it provides some related platform transactions support and obtains commissions and commission. Different commodity categories have different commission standards. Amazon's commission has a higher commission to some extent. But these income is not the total transaction transaction that occurs on the platform.

Therefore, Ali created the concept of the "net method". In other words, it earns advertising and commission income, which is a net income rather than the total commodity transaction.

Based on the recognized accounting principle, the sales revenue of Ali's fiscal year in 2021 was 717.3 billion yuan, but it seemed to prefer to adopt the indicator of total platform transaction (GMV).

Ali GMV was 81.9 trillion yuan in fiscal year in 2021, so it claims to be the world's largest e -commerce platform. In fact, GMV is a sales income completed by a third -party merchant, not Ali's own income.

Amazon does not emphasize the sales of third -party merchants, because this will be much larger than Amazon's own income, which also involves the commercial secrets of third -party merchants and have nothing to do with Amazon. Therefore, it only calculates its own accounting principle of accounting principle. Divided into part.

Compared with direct operating, the sales of gross profit have increased a lot, but the risk of operating risks has been reduced a lot. Why is the risk of business low?

Because platform companies do not need to buy or sell goods. Whether a third -party merchant makes money or a loss, the platform can obtain its own sharing income. This is why Ali's gross profit is 40%to 50%, while JD.com's gross profit is less than 20%. Everyone said that Ali's Maori Baya Moshan is much higher, indicating that Aribiama's profitability is stronger and is a good company. Of course, this simple understanding is not wrong, but this understanding is a bit biased.

To understand the accounting data properly, it is necessary to connect it with the business model, which is why the author has to create a four -dimensional analysis method. Because the author has to try to connect the two concepts of business models and financial reports, in order to explain the meaning of this financial report data.

Figure 4 is a platform model schematic, represented by Ali. So, what is the difference between the platform mode and the aforementioned direct -operated mode?

From the perspective of the figure, the platform model is the same as the direct -operated model. There are also trading systems, logistics systems, payment systems, and dispute resolution systems. But the point is that it provides sales services to third -party merchants and charges advertising fees and commissions instead of operating the goods directly.

As for how much the advertising fee and commission income accounts for the Ali platform, it can be called a platform business model. It is necessary to see the specific figures of the financial report to determine.

Can Ali be called a platform company?

It depends on how much it comes from the platform's income. If it accounts for more than half, it must be a platform company. Even less than half, the source of its main income can also be called a platform company. This is the true meaning of the business model through the financial report data.

As a platform company, Ali provides the platform transaction volume far more than JD.com. Therefore, its data calculation volume is obviously much larger than JD.com. In this scene, it has a cloud computing than JD.com.

In addition to supporting its own platform operation, Alibaba Cloud Computing also supports the data computing and storage needs of many other merchants. Therefore, this also makes Alibaba Cloud one of the fastest -growing new businesses in Ali's growth.

Of course, as a platform company, it is said that it is the most reflected part of the commercial value. In terms of massive consumer information and supplier information it collects, this information makes it a data management company.

Data operation involves multiple monetization methods of data. Direct subscription data is the simplest way to monetize. It is equivalent to selling data as raw materials. It can also be transformed into specific products and further processing.

If personal consumer credit is a successful example of data deep processing. It uses big data to design specific consumer credit and sells related products to consumers. This is the business model of "Ant Financial".

It may be just a small part of the data operation. Data operation has a lot of room for development in the future.

Of course, it also involves a controversy, which is the information it collected to consumers. Whether its property rights belong to public property or private property rights or corporate property rights. Can merchants operate and sell money with these data?

These issues belong to the legal category and are not among the discussions in this article. But it is related to the vital interests of each of us and have to think about it.

For example, can Ali sell the information of "I" to sell money? Of course, the so -called "me" information is definitely not specific personal privacy information, but an abstract, desensitized information.

If you blindly say that this information is public, it seems unfair to the merchant, and the merchant itself has a lot of investment and a lot of processing processing, thereby forming a data management model. This requires laws and regulations to guide.

Obviously, the establishment of the platform model has appeared in a new version in the innovation of business models. If the store model is commercial 1.0 and the direct -operated model is commercial 2.0, then the platform model can be called commercial 3.0.

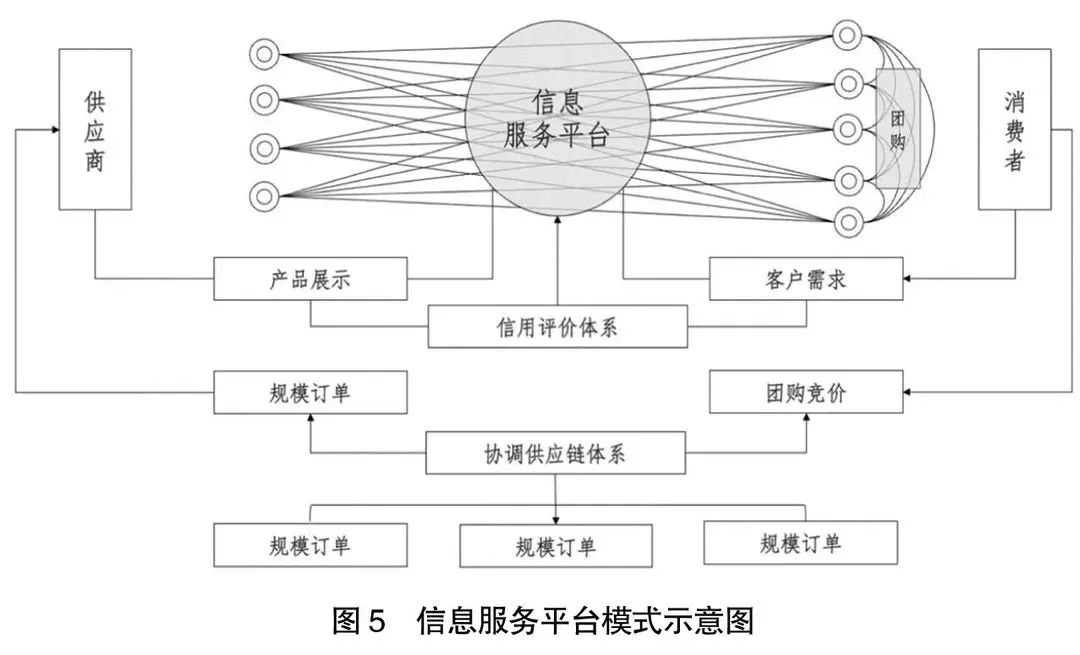

(3) Information Service (Intermediary) Platform Mode

Real business 4.0 must be more leading than 3.0. Previously, there was the definition of Industry 4.0, but there was no commercial 4.0. The definition of commercial 2.0 to commercial 4.0 in this article is an innovation.

The commercial 4.0 to be discussed here refers to the information intermediary mode or the information service platform model.

What is the difference between the information service platform and the e -commerce platform model represented by Ali? Why can the new generation of companies, such as Meituan, Pinduoduo, etc., can they live later?

Some people in the industry say that Pinduoduo is because of picking up Taobao's elimination business, but it is not. From the essence of business models, it is far ahead of Taobao models.

The first is to set the seller's information with the buyer's information as an information platform, which is no longer a business product, but a business information. This is the same, and so is the Meituan. Meituan's model is more life -like. Here is an example of Meituan as an example.

Meituan's public comments are related to eating. After everyone eats, publish the experience and feelings of dinner on the platform, and the platform will collect the customer's comment information to guide other consumers to consume and help stores improve product quality and services.

From a business perspective, it is obviously much more advanced than the platform model. Customers not only pay for meals, but also contribute "product experience" for the platform for free. The wisdom of thousands of consumers gathered to promote the development of new e -commerce companies.

Therefore, from the evolution of business models, it has subverted the e -commerce platform model and created a new era of interaction between consumers and suppliers, consumers and consumers. Of course, this massive customer interaction with suppliers is impossible without the support of Internet technology and mobile Internet. To a certain extent, the Internet has helped us realize this business model.

Of course, we need to thank those entrepreneurs who can conceive such business models. Any business model innovation requires wisdom. These innovative business models cleverly combine technology and consumer habits to form business strategic differences. Therefore, there is another saying in management of business model innovation. "Undverted innovation".

The emergence of any new business model will subvert the traditional business model and make the growth of enterprises under traditional models encounter a bottleneck, which is a sign of the progress of the times.

The so -called strategic differences can often achieve the effect of less than half the effort, which is much stronger than the difference between tactics. The difference between tactics is that you do a little better than others. Many years of hard work can lead the opponent half a step. But strategic differences are not the same, and you can do a thousand miles a day when you come up.

In fact, the business model is good or not, it can be understood how fast its growth is. Meituan and Pinduoduo have the characteristics of the information intermediary mode we discuss to a certain extent.

Compared with the previous discussion, the information service platform model (see Figure 5) can only be called a traditional e -commerce company. The reason why such a business model is the information service platform is because it earns information service commission and no longer through specific products or trading.

Why is this model welcomed by the market?

Because for consumers, the price of group purchase is better than the discount price of any other way in the market.

In general, consumers are weak in terms of bargaining ability, and merchants will be relatively strong. However, through a group buying platform like Pinduoduo, we organize everyone to gather sand to form a tower to form a scale, so as to have a strong bargaining ability. Therefore, this business model can save money for consumers.

So, is it not good for suppliers?

Not. Large -scale orders can help suppliers organize large -scale production. Moreover, precise order can guide production without waste, thereby forming a scale effect.

Therefore, commercial 4.0 means to some extent that it has improved the economic benefits and management benefits of the entire society. Compared with 3.0, it has a huge progress and has a disruptive effect. It is not just a new business model. the concept of.

The company's operating risk of the information service platform type is also very low, because it is also charged with commission, and it is generally commissioned by seller. As long as there is business in the world, it will have stable income, and the sales of such companies are also very high.

Why are most companies that sell gross profit so high and operating risks so low? At least it has not yet started to make money, which is likely to be related to its platform construction.

As an information service platform, it is difficult to generate nuclear fusion if you cannot gather a certain amount. Therefore, in order to generate nuclear fusion, the early investment will be very large. From this perspective, its investment risk is very high.

However, this risk is generally defined as a strategic risk, not a risk of business, because it is an active "burning money" from a strategic level, not a passive loss.

The e -commerce platform model is to provide services for third -party businesses, and the information service platform has surpassed the directly serving third -party merchants. It is just a pure information platform. Through this platform, it associates suppliers and customers. Customers and suppliers are directly related to the coordination of the information service platform.

Commercial 3.0 e -commerce platform model isolated suppliers and consumers, and the information platform model of Commercial 4.0 not only makes them associated between them, but also the design of "group purchase bidding" also makes consumers and consumers form formed Interactive relationships, massive consumers radiate through mobile terminals to make customers a salesman and profit center of merchants, so it is the most valuable business model under the current technical conditions.

Meituan made customers a free product experience, while Pinduoduo turned the customer directly into a salesperson. Can such a business model unsuccessful?

Of course, the success of the business model is only a necessary condition, not a sufficient condition. The formation of the entire supply chain system must have both technical support and the support of algorithms.

In any platform system, it includes both the merchant's own products and services, as well as products and services of third -party in society. The stronger the platform tolerance and integration ability, the greater the energy formed.

Therefore, in this sense, the platform has only established a supply chain coordination mechanism. There are also third -party suppliers of various related industries. In order to let everyone see this business logic clearly, the author did not include these derived third -party service companies in Figure 5.

Including Internet companies, logistics companies, financial companies, etc., which are vertical and horizontal services, are to make everyone understand the essence of this business model more clearly.

3

How to use financial reports to analyze the business model of Internet companies?

The first two parts discussed the financial report and business model. The third point to be discussed next is how to use financial report information to interpret the business model of Internet companies.

For example, what is the difference between Ali and JD?

What is the difference between Amazon and JD and Ali? Finally, the previous principles will be used to briefly analyze Pinduoduo and Meituan to see what is different.

How to use financial report information to interpret the business model? First of all, you need to determine whether it is an Internet company?

What is an Internet company?

Since the accounting of accounting is based on the composition of the financial report to analyze how many income comes from the Internet, and to determine whether it is an Internet company, it is more professional and authoritative through finance.

It is said that Amazon is an Internet company, but it also has a physical store. The physical store revenue in 2021 was 17.1 billion US dollars, accounting for 3.63%of Amazon's total revenue, which means that more than 96%of the income comes from online. Amazon is an Internet company.

However, this conclusion cannot be absolutely. Who stipulates that Amazon cannot open a physical store in online business?

The new retail and direct revenue of Ali's fiscal year was 167.6 billion yuan. Because Ali did not disclose the online Tmall store income alone, we could not remove it, and we could only speculate and analyze it based on its annual report.

As far as the author's understanding is concerned, the two big heads after the merger of the two -piece income are new retail, including Hema Xiansheng and the newly acquired Gaoxin Retail, Intime, Red Star Macalline, etc. This part of the income has grown rapidly, and the amount is not small. It accounts for 23.36%of the entire Ali total revenue.

Therefore, it can still be said that Ali is an Internet company, because at least 77%of the income is derived from online.

Of course, new retail is not a complete offline transaction. Since it is called new retail, it means that it is no longer a traditional store, but traditional stores in name have contributed more and more income to it. To the degree, it is an old bottled new wine.

JD's offline retail has not disclosed separately. As far as the author understands, its proportion of offline retail should be very small.

Jiangsu Wuxing Electric Co., Ltd., which was acquired in April 2019, has more than 300 offline stores, and has also made limited contributions to its offline income. Jingdong claims to be China's largest directly -operated retail company. This direct -operated retail includes both online and offline.

As for how much the offline is offline, because it does not disclose separately, the author cannot be made up, just to discuss the needs, it is estimated that the proportion of offline income will not exceed 10%.

It is clear that the above -mentioned sample companies have the identity of the Internet company, and then start to enter the topic.

(1) The meaning of growth: Is it it iterative business model?

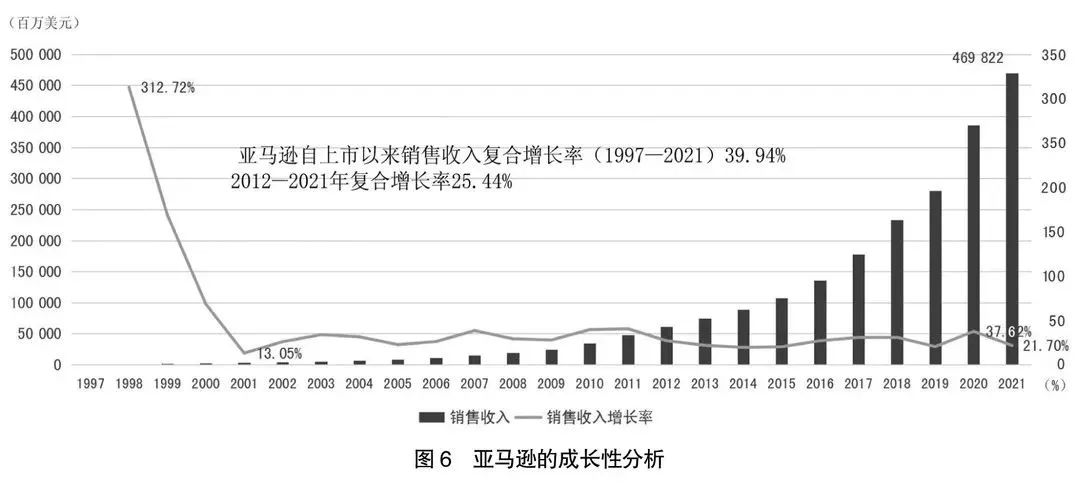

Amazon is a typical Internet company, and nearly 97%of the income comes from online. Figure 6 is the revenue growth of Amazon in 1997 to 2021, which is a model for continuous and stable growth.

Whether Amazon's business model is successful is particularly important, that is, Amazon's compound growth rate (that is, the average growth rate) since its listing in 1997 was 39.94%.

A company has been able to maintain a growth of nearly 40%for more than 20 years, and it is only first in the world, no second.

It can be seen from Figure 6 that the company grows rapidly when the size of the company is very small, with an increase of 200%to 300%, because it is small. Therefore, this growth rate has gradually declined as the scale expands, but it still maintains growth, which shows that its business model still has a good prospect.

When analyzing the company's growth, it is necessary to understand its entire process, but the focus is on the past 10 years. Of course, more valuable is the past year or two.

The growth of 21.7%in 2021, 37.62%in 2020, and 25.44%in the past 10 years, which is the current situation of Amazon's growth. Compared with the current innovation of e -commerce models, Amazon's business model represents tradition, with only 20%to 30%of growth.

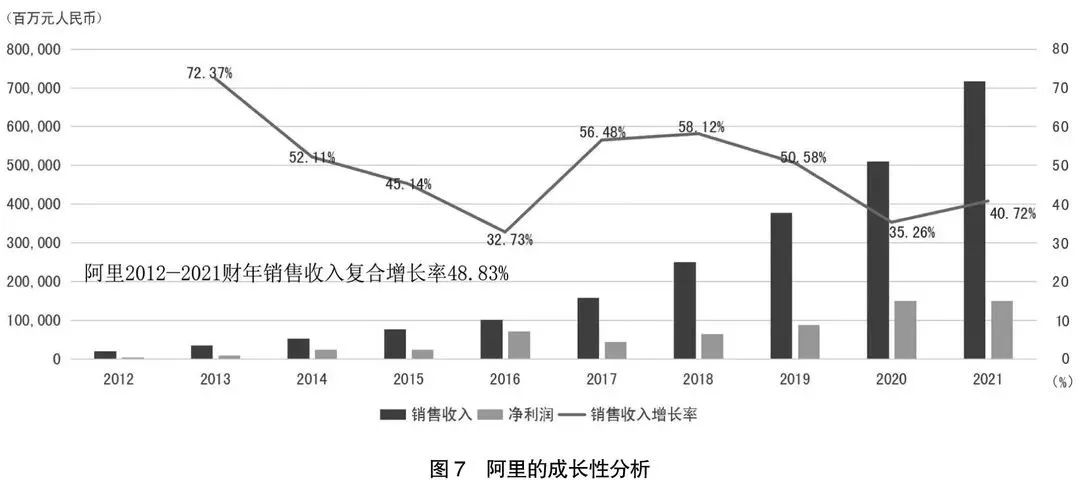

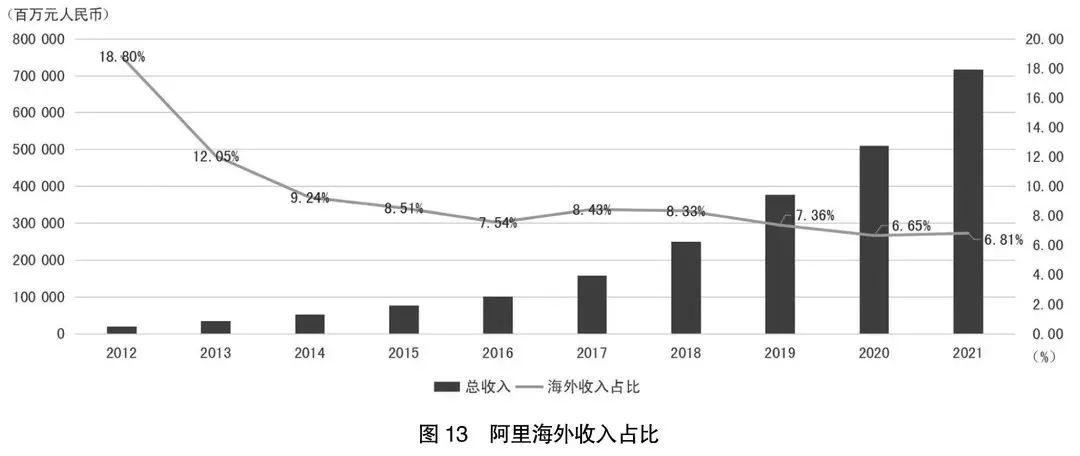

70%of Ali's business model belongs to the contribution of the Internet line. Because Ali ’s annual report is only 10 years, it has not been listed in 2014.

Ali has a compound growth rate of 48.83%in the past 10 years, far faster to Amazon. Therefore, Ali is a more successful company in operation (25.44%) in business. Ali's success has the reasons for the Chinese market. In the business model, Ali also has to lead Amazon.

Although affected by the epidemic in the past two years, it still maintained a 40.72%growth in 2021. It was 35.26%in 2020 (see Figure 7 for details). From the perspective of growth rate, Ali is the representative of Chinese Internet companies and e -commerce companies.

Jingdong's data is one year older than Ali, but it is still calculated in 10 years, which has a certain comparable foundation.

JD.com's growth rate in 2021 was 27.59%, 29.28%in 2020 (see Figure 8 for details), obviously not as fast as Ali.

From 2012 to 2021, its compound growth rate was 41.68%. Compared with Ali, Ali's growth was obviously faster. In this sense, Alibaba's operations were more successful than JD.com.

(2) The proportion of main business: Is it directly operated?

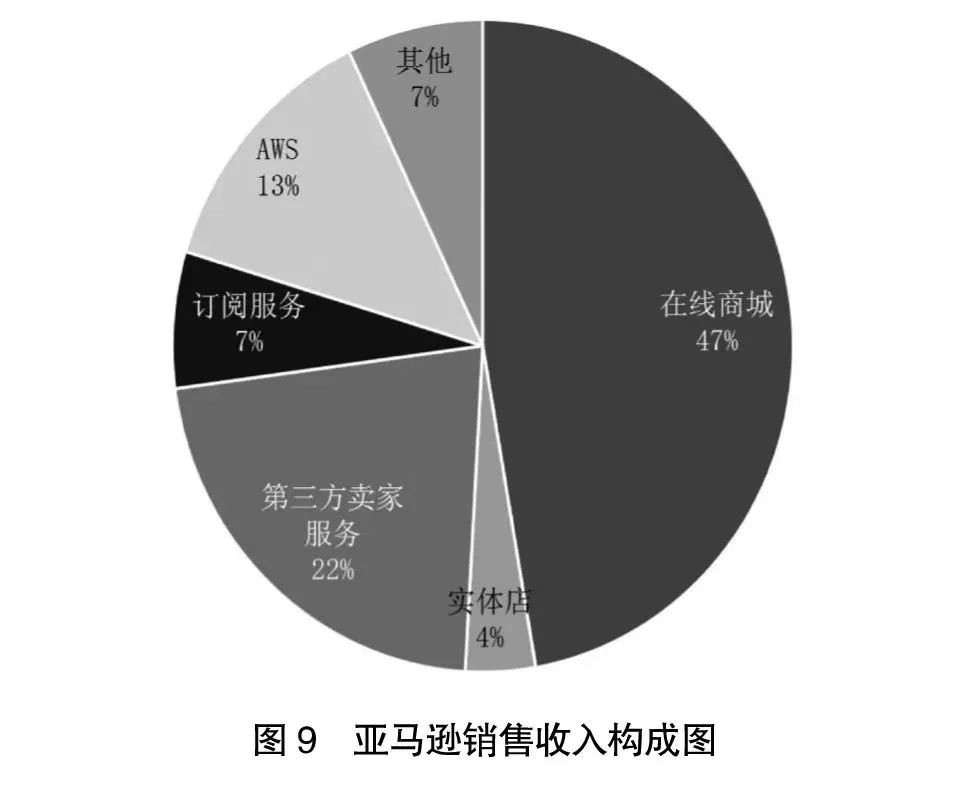

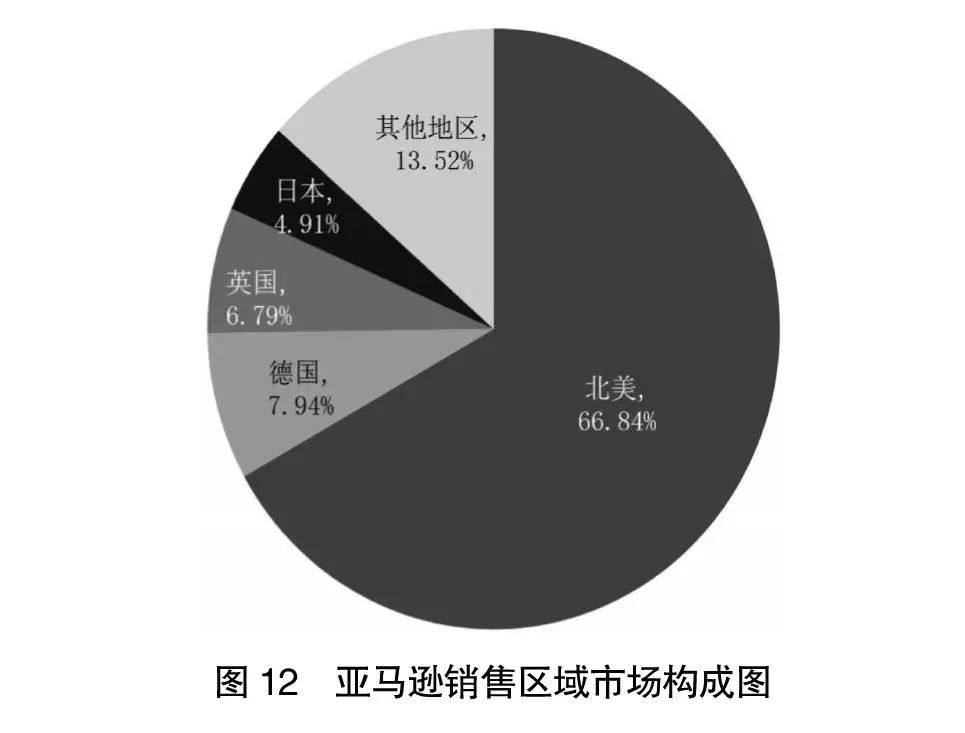

Amazon's main revenue is online mall. In 2021, its revenue was 222.1 billion US dollars, accounting for 47%of the total revenue, constituting Amazon's largest income, and its revenue constituted Figure 9.

So Amazon is a direct -operated company, which is a business 2.0. Of course, in addition to direct income, Amazon also has other sources of income, and then subdivided below. Ali's main business income is the core business. In fact, this statement is not accurate. What is the core business?

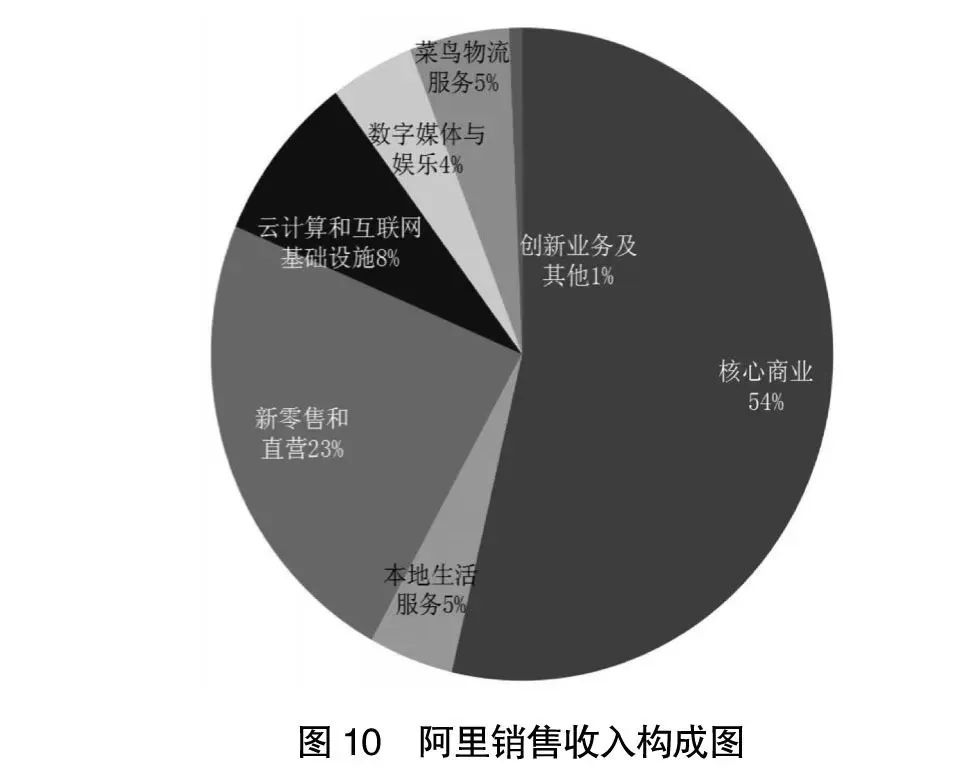

In essence, Ali serves ads and commissions for other third -party merchants. This part of revenue reached 384.7 billion yuan, accounting for 54%of Ali's total revenue, which determined that Ali is a platform -based e -commerce company and belongs to the commercial 3.0 model.

Ali sales revenue composition is shown in Figure 10.

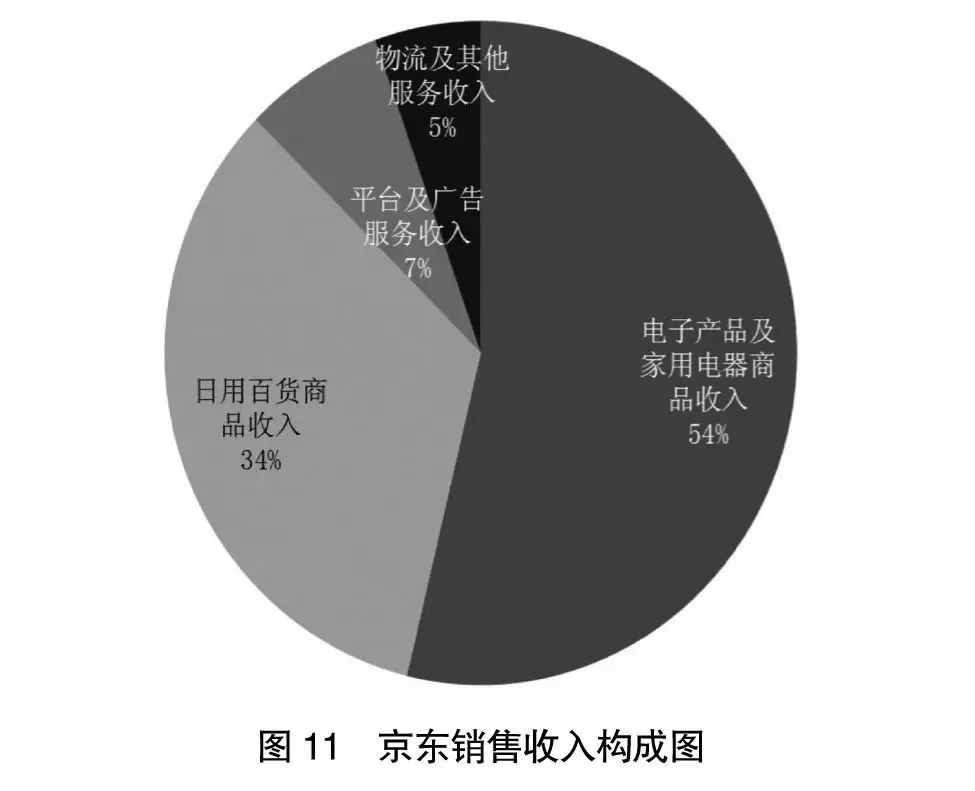

JD.com is basically a typical 2.0, because JD.com's self -operated retail accounts for 88%of total revenue (see Figure 11).

There are also many shops in JD, but the income of third -party stores accounted for a small proportion, which can be ignored (of course, there is a problem on the algorithm).

In terms of financial report data, Jingdong platform revenue is less than 10%, and self -employed income accounts for an absolute majority. Therefore, JD.com is a traditional e -commerce company in the typical sense, and it is a business model based on business 2.0.

In addition to the largest income, Amazon's third -party seller service revenue accounts for 22%, which is its second largest source of income. It is similar to Ali's main business income and is a contribution of third -party sellers, including many contributions to Chinese merchants opened on the Amazon platform.

The Amazon platform service revenue is not as large as the total proportion, but its transaction volume is far greater than its own direct revenue. Therefore, third -party seller services should contribute great profits to Amazon.

Moreover, its third business is cloud service revenue, and it is also the world's largest cloud service, which contributes 13%of total revenue. Amazon subscription service accounts for 7%, mainly refers to the sales of virtual products.

If it merged with the online mall, the proportion of the two after the merger is more than 50%, and other income accounts for only 7%. Therefore, from the overall weighing of sales, Amazon's business model should be between 2.5-3.0.

New retail and direct operations of Ali accounted for 23%of new retail and direct operations, and Alibaba Cloud and Internet infrastructure contributed 8%. At the same time, Ali also includes Youku video income and game revenue of about 4%. Rookie logistics services are 5%, local life services have contributed 5%, and innovation business is less than 1%.

Jingdong's direct retail revenue exceeds 87%. This is mainly contributed to the business 2.0 model. Its platform and advertising service revenue account for only 7%, and logistics service revenue accounts for 5%. Similarly, although the platform revenue does not contribute much to total income, it has a great impact on profits. This also shows that its business model is also above 2.0.

Through the analysis of sales composition, you can clearly understand the business models of these Internet companies. Because these data come from authoritative financial statements, understanding the business model through financial report data has become the sole authority path.

All other theories about business models can be ignored. Because the company's financial report data is a data collected by all the transactions of a company, and this data is endorsed by professional accountants.

If the data endorsed by the accountant and these data supervised by the regulatory agency are fake, then the other data sources are even more ingredients.

In comparison, accounting data is still the most trusted data. The reason why we hate accounting fraud is because they trust them too much, not that they are fake than other data sources.

(3) Overseas revenue proportion: Is it global?

In the compulsory information disclosure, in addition to the product sales revenue composition, there is also a regional distribution of sales revenue. Now let's explore the company's globalization issue.

By analyzing what regional market it is from, it is understood whether it is a global company or a local company.

Taking Amazon as an example, in its global revenue, the revenue of North America (the United States, Canada) accounts for 66.84%of the total revenue (see Figure 12), indicating that Amazon is a North American market.

In addition, it has also obtained a certain income ratio in Germany, Britain, Japan, and other regions.

Ali's main income is more than 93%of it originated from China, and overseas revenue accounts for only 6.81%. The proportion of Ali ’s overseas income has been in a downward trend since 2012, which shows that its globalization has been shrinking.

In 2012, Ali originated from overseas revenue, accounting for 18.8%, and now only 6.81%(see Figure 13). Therefore, the proportion of overseas income is a downward trend.

From the perspective of Figure 13, Ali has been in the past 10 years. Although the business has become bigger and bigger, the growth is fast, and the operation is very successful, but the income is basically from the Chinese local market. In this picture, its global ability not only has not enhanced, but has declined. This is a conclusion from its financial report data analysis.

JD's overseas income is not disclosed separately, it can only be 0. In other words, JD.com's income is 100%derived from China and is a pure Chinese local Internet company. The author speculates that from the layout of JD overseas assets, even if overseas income is not 0, it can be ignored.

In terms of financial report data, Amazon's globalization is not high. Because the North American market contributed two -thirds of the total income. It is just comparison, Amazon's global service capabilities are far above the Chinese Internet companies we discuss. Therefore, the global expansion and service capabilities of Chinese Internet companies need to be further enhanced and enhanced. The author has compiled the specific category of sales of Amazon, JD and Ali companies (see Table 1). Interested readers can be used for reference.

(4) Sales gross profit margin: Is it different?

Whether Internet companies are different, the key lies in gross profit. The height of the sales gross profit margin not only expresses the differences in strategy, but also the difference between the technical level.

Of course, most of the time simply only look at the gross profit margin of sales is incomplete, and it is impossible to distinguish whether it is technology or a strategic lead. Therefore, there is a need for mutual support for relevant evidence. This needs to look at the proportion between its sales gross profit margin and R & D investment.

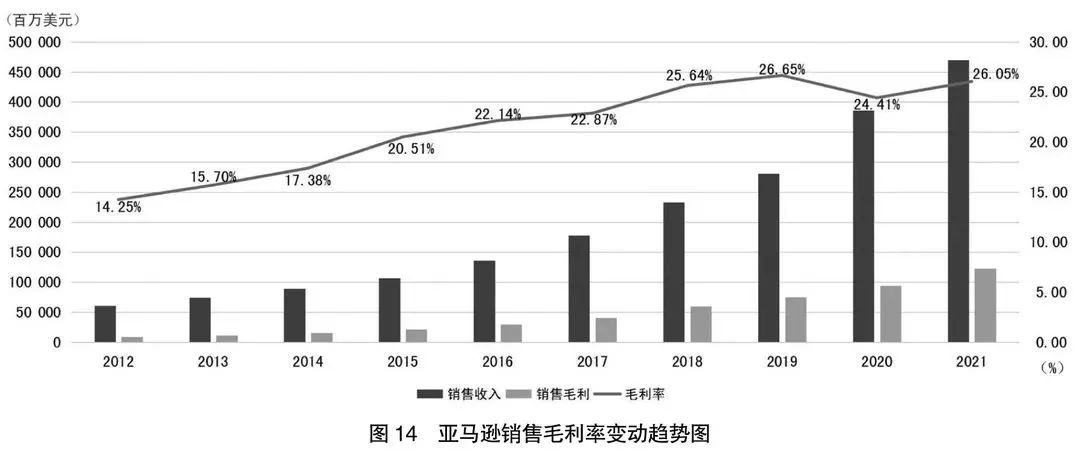

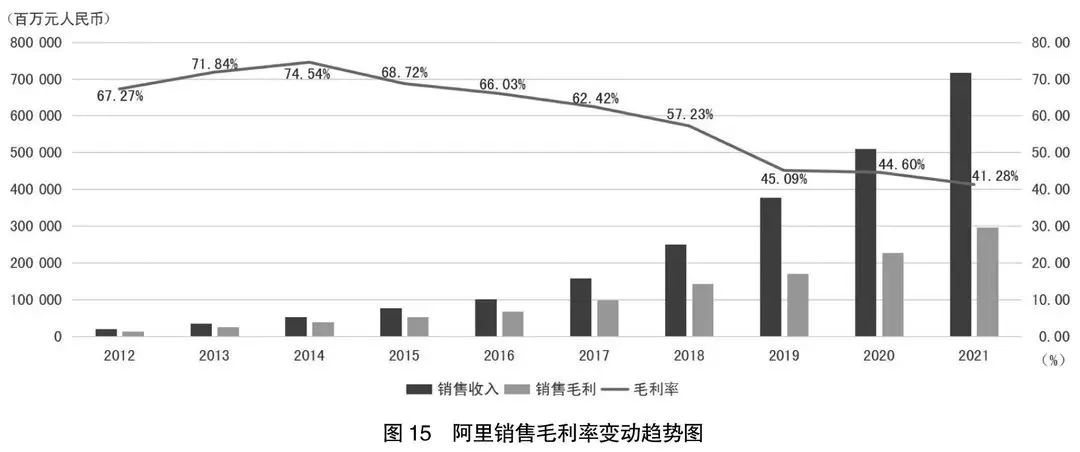

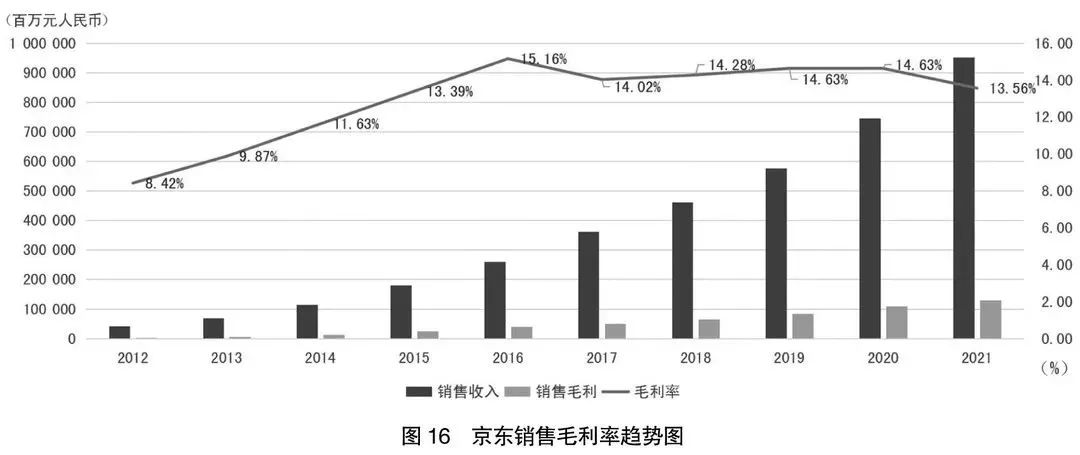

From the perspective of sales gross margin, Amazon showed a steady rise. In 2021, its gross profit margin was 26%, Ali was 41.28%, and Jingdong Mall was 13.56%. So in terms of sales gross profit margin, can everyone clearly see the differences between each other?

Most of the reasons for these differences are the huge differences in business models. Ali's business model belongs to commercial 3.0 and is higher than Amazon. According to the analysis of the aforementioned sales composition, Amazon found that it is between 2.5 and 3.0, and JD.com is basically a standard 2.0. It can understand the differences in the sales of the sales gross profit margin in the financial report. It can be said that it is clear at a glance.

Let's take a look at the trend of the evolution of the sales rate of sales. In fact, the core of the gross profit margin of sales is to look at this trend, and see how it evolves in a strategic level.

Because of the sales of gross profit margins, the author calls it a lifeline of the product. If this lifeline goes up, it indicates that the vitality is very strong, young and bloody. If this line is going down, it shows that its competitiveness is declining, and the differences in business models are decreasing.

From Figure 14, Amazon's line is very majestic. In 2012, its sales gross profit margin was only 14.25%. At that time, it was a pure commercial 2.0 version to some extent.

It is now gradually evolving to 3.0, or transforming in the direction of 3.0. Its e -commerce platform and cloud computing are standard 3.0, but it is still not the company's main business. Therefore, just see that its entire gross profit margin is going up.

Traditional e -commerce companies have evolved from 2.0 to 3.0, and they can succeed. Amazon may be the only case. Many of the company's growth is determined by genes, and it has merged into the company's blood. Therefore, it is difficult for ordinary companies to transform successfully. Due to space limitations, this article will not expand this topic.

From the perspective of the trend, Ali sells gross profit margins (see Figure 15), so Ali's transformation does not turn from 3.0 to 4.0, but from 3.0 to 2.0.

Where is this specific manifestation?

The specific manifestation is that it is expanding from the platform to new retail and direct operations, from online to offline. From a strategic perspective, Ali's acquisition and development of offline shopping malls may be a retreat rather than a progress, which is from 3.0 to 2.0.

Of course, Ali uses 3.0 technology to transform 2.0. From the perspective of social responsibility, or from the perspective of business, it is understandable. It meets market demand. It is understandable for business models.

It is just that from the financial report data, the fact that the decline in the sales gross profit margin reduces the company's core competitiveness to some extent. This is the fact that expressed from the trend, not the point of view, ideas, or prejudice of the author.

JD.com's prominentness is that its overall gross profit margin is the same as Amazon (see Figure 16), which indicates that its core competitiveness is progressing and developing.

Of course, JD.com is also working hard to transform from 2.0 to 3.0. They have a expectation that they are trying to expand the proportion of the total income of the platform. This is a direction for JD management to break through, that is, striving to walk on the road from 2.0 to 3.0. Very important factor.

The improvement of JD.com's gross profit margin indicates that its core capabilities are increasing. This core ability has both the transformation of the business model and the improvement of systematic efficiency. JD.com's efficiency ranks first among global e -commerce companies, limited to space, and cannot be discussed one by one.

(5) R & D investment: Is it high -tech?

The fifth aspect of Amazon, Ali and Jingdong's business model, are they high -tech companies? Or do they pay attention to high -tech investment? Are they pursuing technical leading or cost -leading?

Regarding the leading technology and cost -leading, the author itself is not biased, and both are business models.

Cost -leading is also needed for society, because cost leading to improve efficiency. To some extent, technology leaders are the improvement of product functions or the improvement of service experience. They are all needed by society, and the two themselves have not derogated.

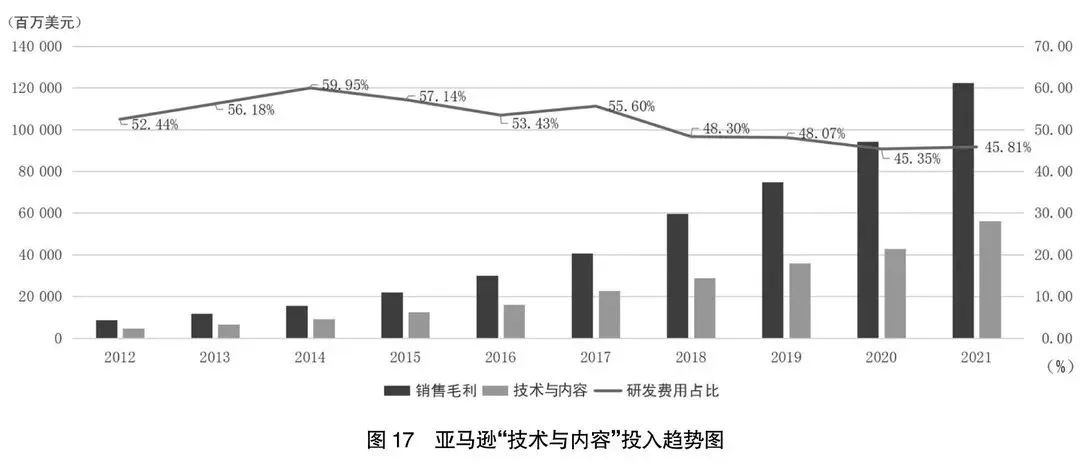

The "technical and content" investment disclosed in Amazon's financial report is $ 56.1 billion, ranking first in the world. "Technology and content" may be aware of the different ways of "research and development". Amazon used a very special terms "technical and content", which accounted for 45.81%of gross profit (see Figure 17). In other words, Amazon used the nearly half of the gross profit earned for technological innovation. Why is it not called research and development? What is the difference between it? Due to the development of e -commerce, especially the development of cloud technology, it has blurred the boundaries of R & D and operations, and blurred the boundaries of R & D and production. Or business?

Therefore, Amazon has included technology -related investment in "technology and content", which may be a bit different from other companies' data diameter. It needs to attract the attention of analysts.

But in any case, Amazon used nearly half of gross profit to technological innovation, indicating that it was a company pursuing technological innovation. This is also to a certain extent to support the underlying logic of its continuous steady increase in sales. Without the support of this underlying logic, its sales gross margin indicator cannot become like this. There is a cost at a business model 2.0 to 3.0 and requires effort.

Ali's business model itself is 3.0, which has technical content, especially in big data processing. In the past two years, Ali has established Luo Hansang and Ali Research Institute, expressing further attention to R & D and innovation.

So, how much is its R & D investment?

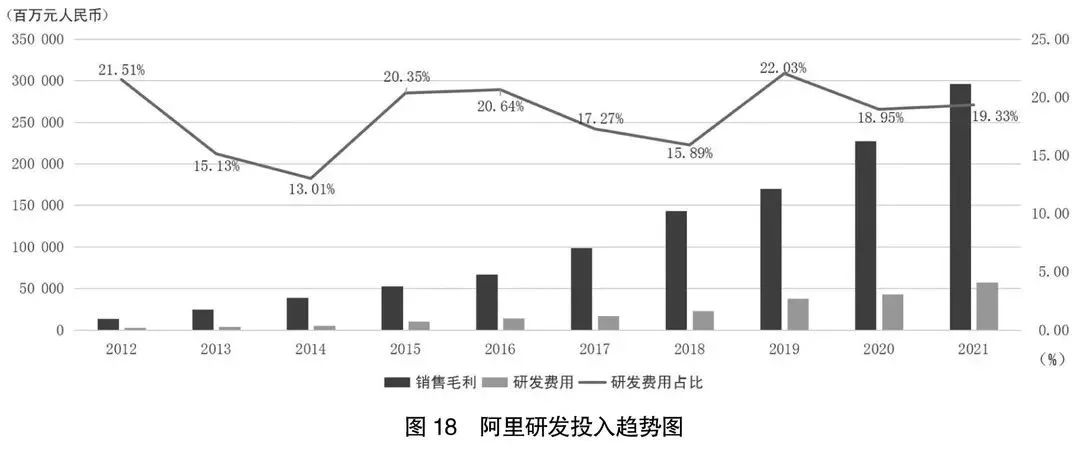

In 2021, it was RMB 57.2 billion, accounting for 19.33%of sales gross profit (see Figure 18). This is equivalent to the average level of R & D investment in the Fortune 500 companies. However, compared with Amazon's $ 56.1 billion in investment, it is still huge.

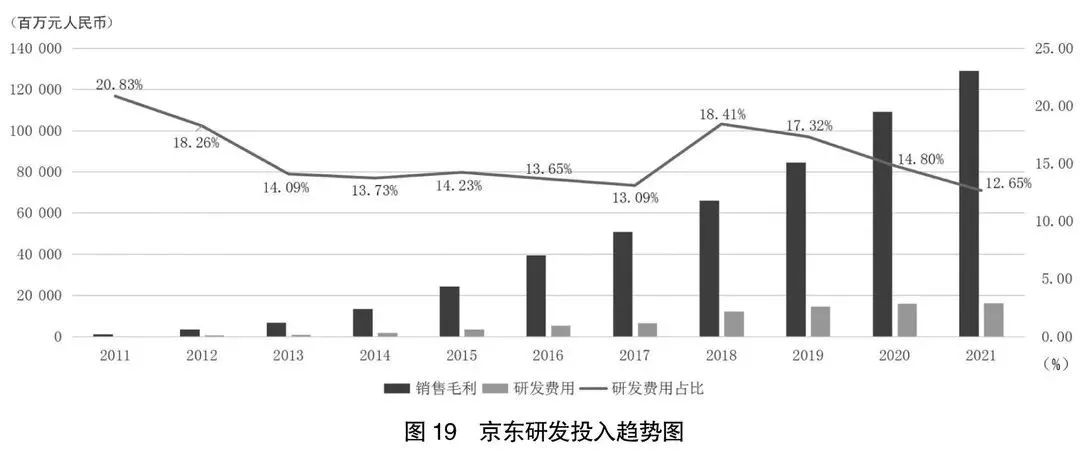

JD.com's R & D investment was 16.3 billion yuan, accounting for 12.65%of gross profit. Therefore, don't expect JD.com to become a high -tech company, understanding JD is a leading company to lead the company in pursuit of high -efficiency and low cost.

Is Ali a high -tech company?

Judging from this indicator, it is still difficult to say that it is a high -tech company. Judging from the changes in the proportion of R & D investment in the past ten years, basically the same level, that is, the intensity of the general R & D investment is insufficient.

It can be seen from Figure 19 that JD.com ’s investment in R & D is relatively low, and it also shows a downward trend. Although JD.com has insufficient investment in research and development, this does not affect JD's scientific and technological innovation.

Because of more than 100 billion yuan of R & D investment, many innovative achievements can also be achieved, including artificial intelligence and smart warehouses, JD.com has achieved a series of attention to the world.

The so -called insufficient research and development investment is only the difference in the perspective of financial report data. This is the only comparable place. As for the quantity and quality of technological innovation, comprehensive system evaluation will be extremely complicated.

(6) Sales expenses: Is marketing drive?

Related to the R & D investment is the investment of enterprises in marketing, which expresses the corporate culture and values. Does the company pay more attention to technological innovation, or do you pay more attention to doing business?

Because if the management understands the company as a business, it will see marketing more importantly and put more resources on marketing. If the management understands it as scientific and technological innovation, it will often make technology investment more important.

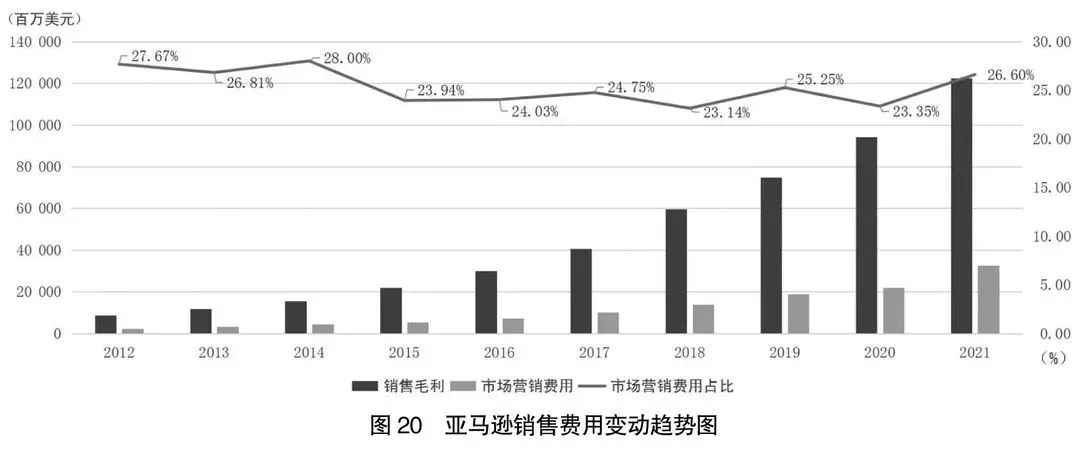

If you compare the data of Amazon, you know that 45%to 50%of Amazon's gross profit is used for research and development, and 26%and 27%of gross profit are used for marketing (see Figure 20).

This proportion expresses that Amazon is a technology -driven company, not a marketing -driven company. Because its technical investment is twice as much as its marketing investment.

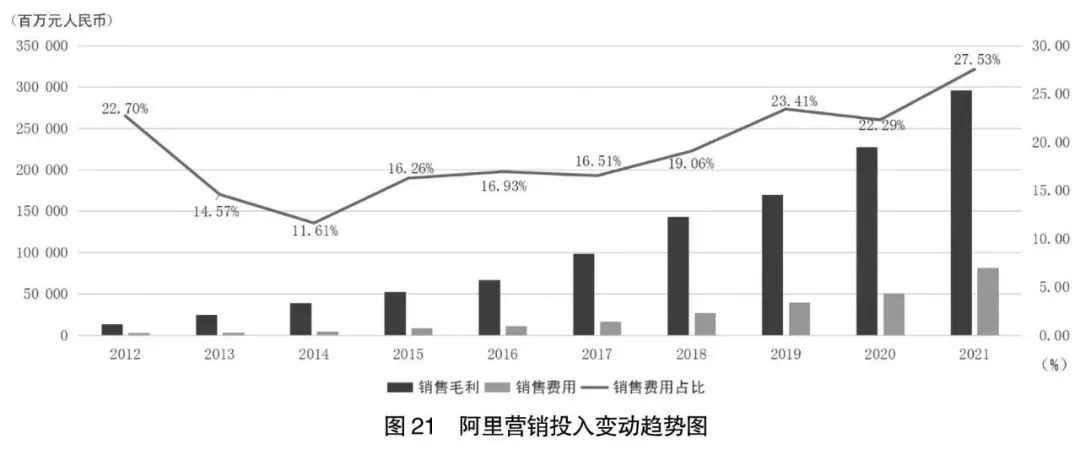

Ali's marketing investment is 27.53%(see Figure 21), and R & D investment is less than 20%. In this sense, Ali is still a marketing -driven company.

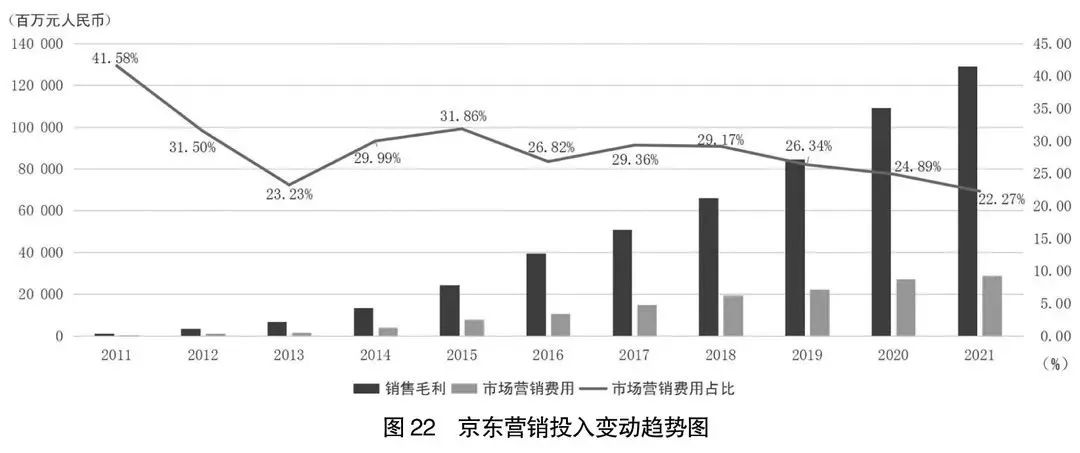

JD.com's marketing investment is 22.27%(see Figure 22), and R & D investment is 12%. It is a marketing -driven type.

As a result, preliminary conclusions can be concluded that the main players of Chinese e -commerce companies tend to do business, not innovative technology.

You can see the changes in Amazon's sales costs over the years, and compared to the changes in the proportion of Ali marketing expenses. In terms of trend, Ali's marketing has been significantly strengthened. Especially after returning from 3.0 to 2.0, it also needs to increase investment in marketing.

JD.com's overall marketing investment proportion declines, to a certain extent, it also means that with the increase of scale and brand, its scale efficiency is changing, but it does not reduce the absolute investment in marketing.

Based on the above, Amazon is an e -commerce company that is based on online malls, also operating cloud computing and third -party seller platform services, based on the North American market, leading the new trend of the global industry development. , Excluding the analysis conclusions of other dimensions of the four -dimensional analysis method.

Ali is a company that serves a third -party seller platform. It also operates cloud computing and new retail online and offline. It is a Chinese local Internet company or e -commerce company with strong profitability.

JD.com is a Chinese e -commerce company that is dominated by online self -employment and also operates a third -party seller platform with an efficient logistics system.

4

The "new gameplay" of Chinese e -commerce

The rapid rise of new players such as Pinduoduo, Meituan, and Douyin has brought new vitality to the Chinese e -commerce market. The younger generation of entrepreneurs founded a business model 4.0. From the innovative perspective of business models, it is at the forefront of the world. The West usually talks about Industry 4.0. This article provides you with the definition of commercial 4.0.

(1) Pinduoduo

Pinduoduo's business model is an information service platform. We define this information service platform model to 4.0.

Is this the case?

As long as you look at its compound growth rate, it can be seen.

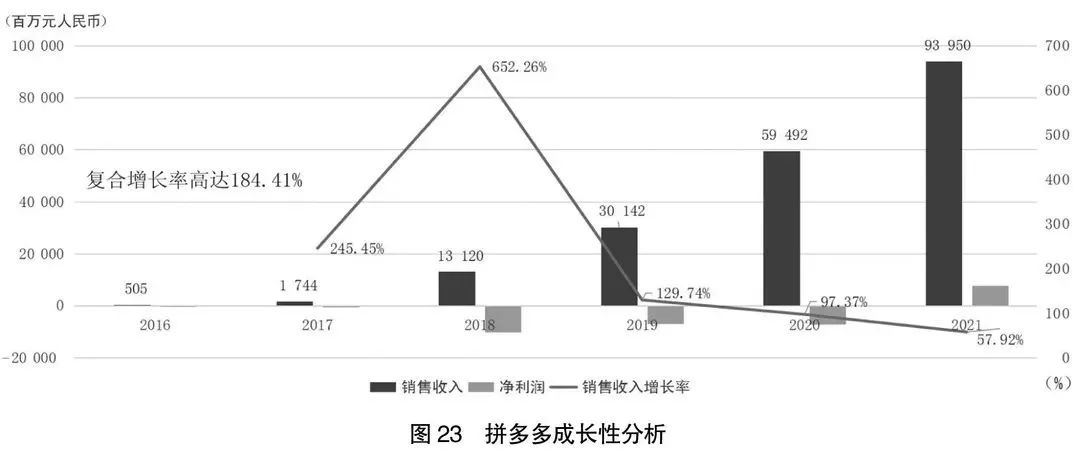

Since 2016, Pinduoduo's compound growth rate has reached 184.41%(see Figure 23), and there are no companies that have grown faster than it.

In 2016, its sales revenue was only 500 million yuan, and the sales revenue in 2021 has reached 93.9 billion yuan. The company is in a high -speed growth stage with a maximum growth rate of 600%.

In 2021, even if it fell to the average horizontal line, 57.92%increased, far faster than Ali, Amazon and JD.com.

This is the effect of strategic differences, which is the power of the business model. Of course, most years of Pinduoduo are still losing money. Losses belong to losses, we call it "strategic losses", and it has been profitable in 2021. This is a lot of greatness.

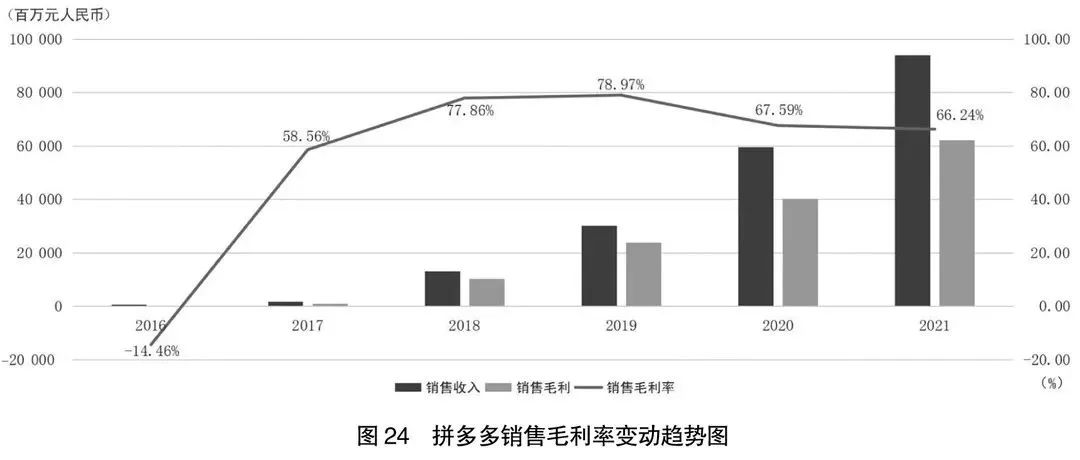

Secondly, its sales gross profit margin is as high as 66.24%(see Figure 24), and the sales gross profit margin of business model 4.0 is much higher than 3.0, which shows that the information service characteristics of its business and the particularity of the platform.

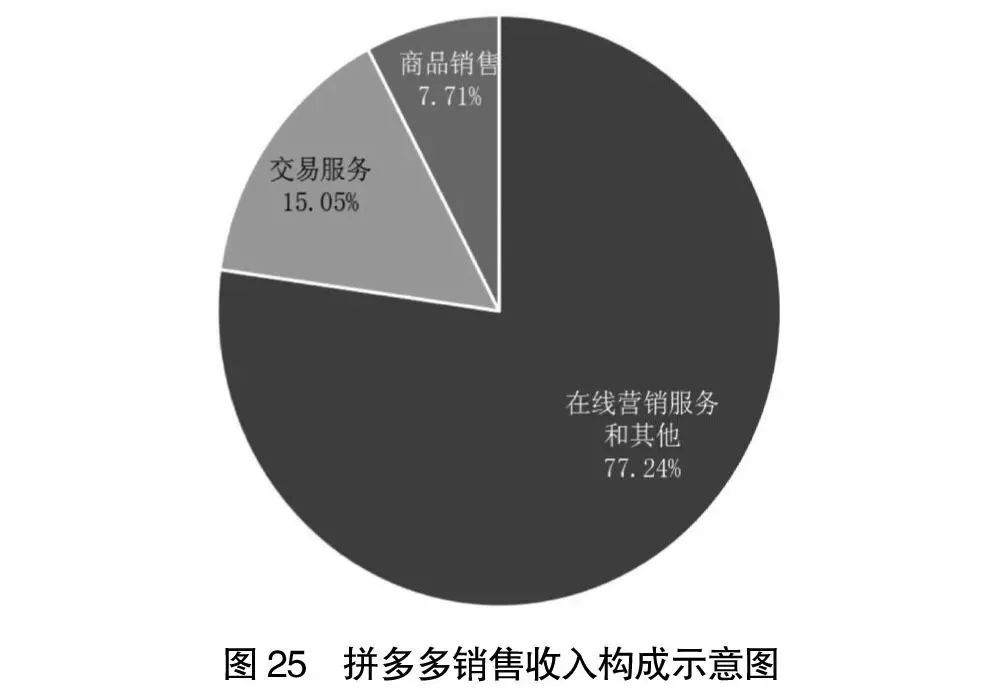

By fiscal 2021, 77.24%of the income originated from online marketing services (see Figure 25). If all 100%income comes from online marketing services, its sales gross profit margin may be higher, so its development in other business has diluted its sales gross profit margin to some extent.

The rise of the gross profit margin of Pinduoduo has been rising all the way, indicating that its core competitiveness has been increasing, and its business model is constantly improving.

The entire business composition of Pinduoduo, "online marketing services and other" accounting for 77.24%, trading services 15.05%, and 7.71%of commodity sales (see Figure 25). If you understand online marketing services as advertising, then Pinduoduo is essentially an Internet advertising company.

Why is the loss of Pinduoduo a strategic loss?

The reason is that its losses are mainly derived from huge marketing investment, that is, at the strategic level, to win companies that have taken the initiative to "burn money" in the market. Its high -speed development mainly depends on sales rather than technological innovation -driven. Of course, the innovation of business models is also innovative and is strategic innovation.

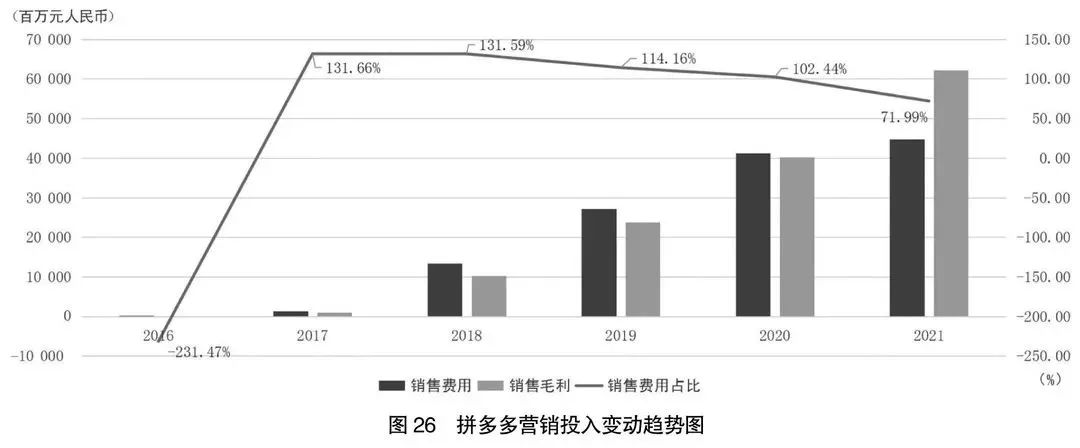

In fiscal 2021, its sales cost was 44.8 billion yuan, accounting for 71.99%of the sales gross profit (see Figure 26). The reason why it loses is because the sales cost of the previous year exceeds the company's overall gross profit.

(2) Meituan

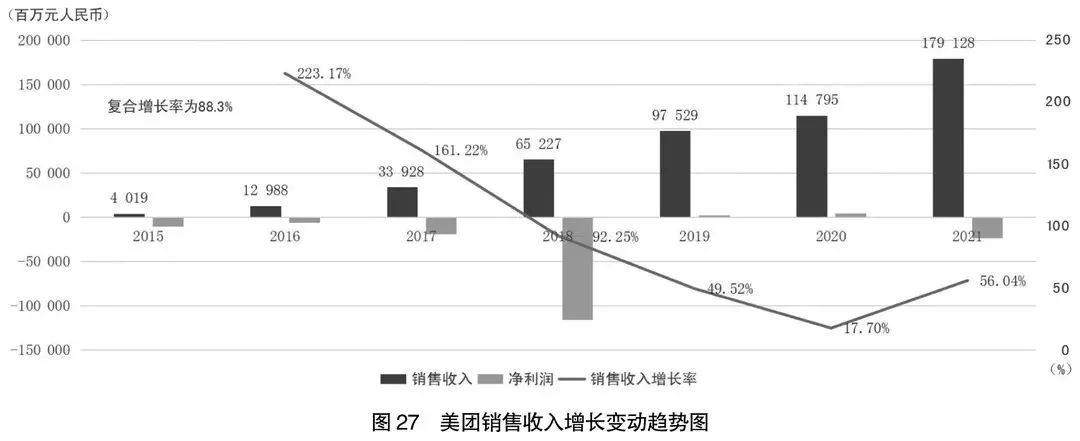

Meituan's sales revenue growth rate (that is, its growth rate) is as high as 88.3%(Figure 27). In this way, it is comparable to Meituan and Pinduoduo, who's business model is more clear at a glance.

From the compound growth rate, Pinduoduo is 184%, and the compound growth rate of Meituan is 88.3%. But if it is much faster than JD.com and Ali, this is the magic of business model innovation.

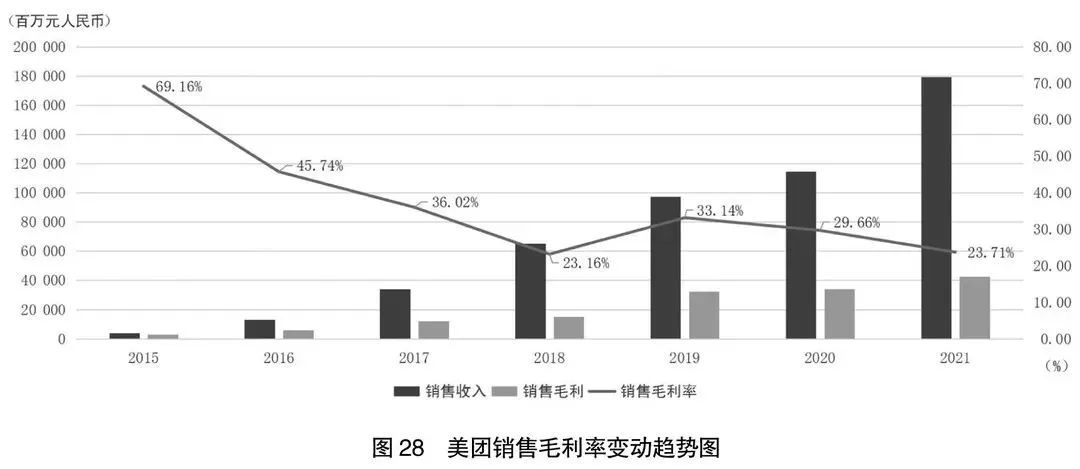

Meituan's sales gross profit margin is now only 23.71%. In this proportion, it should not be as pure as Pindu.

It can be seen from Figure 28 that the gross profit margin of Meituan was high at the beginning, reaching 69.16%, and continued to decline in the later period. This is likely to be related to its offline business such as logistics distribution.

At the beginning of listing, Meituan, as a pure information service platform, had a very high gross profit margin. In the later period, the low -gross business of new catering and takeaway distribution has diluted the gold content of its business model to some extent.

From the perspective of financial report indicators, this is not a good trend. This will lose the difference between a company and lose its competitive position and core competitiveness, thereby showing a trend of decline and decline until it changes the culture and values of a company's company Essence

Of course, Meituan is currently strengthening its R & D investment, at least from the financial report data. This makes Meituan's business model very contradictory. On the one hand, it is seeking innovation and scientific and technological investment; on the other hand, it also expands many low value -added and low -tech content. Therefore, in terms of strategic ideas, management, management The layer may need to clarify a clearer future development idea.

In 2021, Meituan's R & D investment was 16.7 billion yuan. Although the amount was not very large, it accounted for 39.26%of the entire sales gross profit. Among the Chinese Internet companies in the aforementioned analysis, it is one of the companies that pay attention to R & D investment. This indicator is higher than Huawei. Huawei R & D investment accounts for about 37%of the sales gross profit, while the R & D investment of Meituan is about 40%.

Professor Xue Yunkui's new work

"Passage Finance: Discover the Business Logic of the Internet" was published recently

5

Conclusion

Generally speaking, using financial report data to interpret the business model of Internet companies is one of the most authoritative interpretations.

The interpretation of financial report data must be combined with the business model to be practical. Usually, research and analysis on financial report data, especially the analysis of large samples and big data, will ignore the strategic positioning of different companies, the business model, management model and financial model of different companies, and simply interpret the data on the data. This makes the conclusion. There are great limitations. Therefore, the interpretation of financial report data must be combined with the business model. The success of the business model is the success of strategic differences. The use of Internet technology to create a business model is a disruptive innovation and the theme song of this era.

In particular, the Chinese Internet company has developed rapidly all the way in the past 10 years, especially the rapid development of the mobile Internet, so that the subversive innovation of business models has been at the world's leading level.

It took 10 years to develop directly from Business 2.0 to Commercial 4.0. Globally, from the perspective of business model innovation, walking at the forefront of the world makes the Chinese proud.

However, the success of commercial success does not represent the sustainable development of corporate competitiveness. This sentence is important. Although we are business successful, it does not mean the sustainable development of corporate competitiveness. Only by continuous technological innovation can we produce lasting competitiveness.

This reminds the author what an entrepreneur said:

"Application innovation without basic research, just like building high -rise buildings on the beach, the higher the more dangerous. Each inch of building an innovative building is built in an inch, and the foundation of basic research must be dug a foot deep."

Innovation is the first driving force for development. Enterprises continue to increase investment in R & D, cultivate and strengthen new momentum, and achieve high -quality development. It is necessary to continue to invest in hard technology. Innovate the development strategy and laid a solid foundation.

Note:

Most of the data and charts used in this article are compiled and produced by research assistant Liu Xueying, and thank you here; this article's financial report data is adopted from the Wind Financial database; the data of this article is notes from the annual reports of various companies; other major events information; Regular or temporary announcement.

The copyright of the chart in the article belongs to the author, and the reprint needs to be authorized

- END -

Yinjiang Technology: Use AI to help Hangzhou to create a city of "digital governance"

On January 13, 2022, Hangzhou Xixi Hospital had an emergency epidemic. In order to...

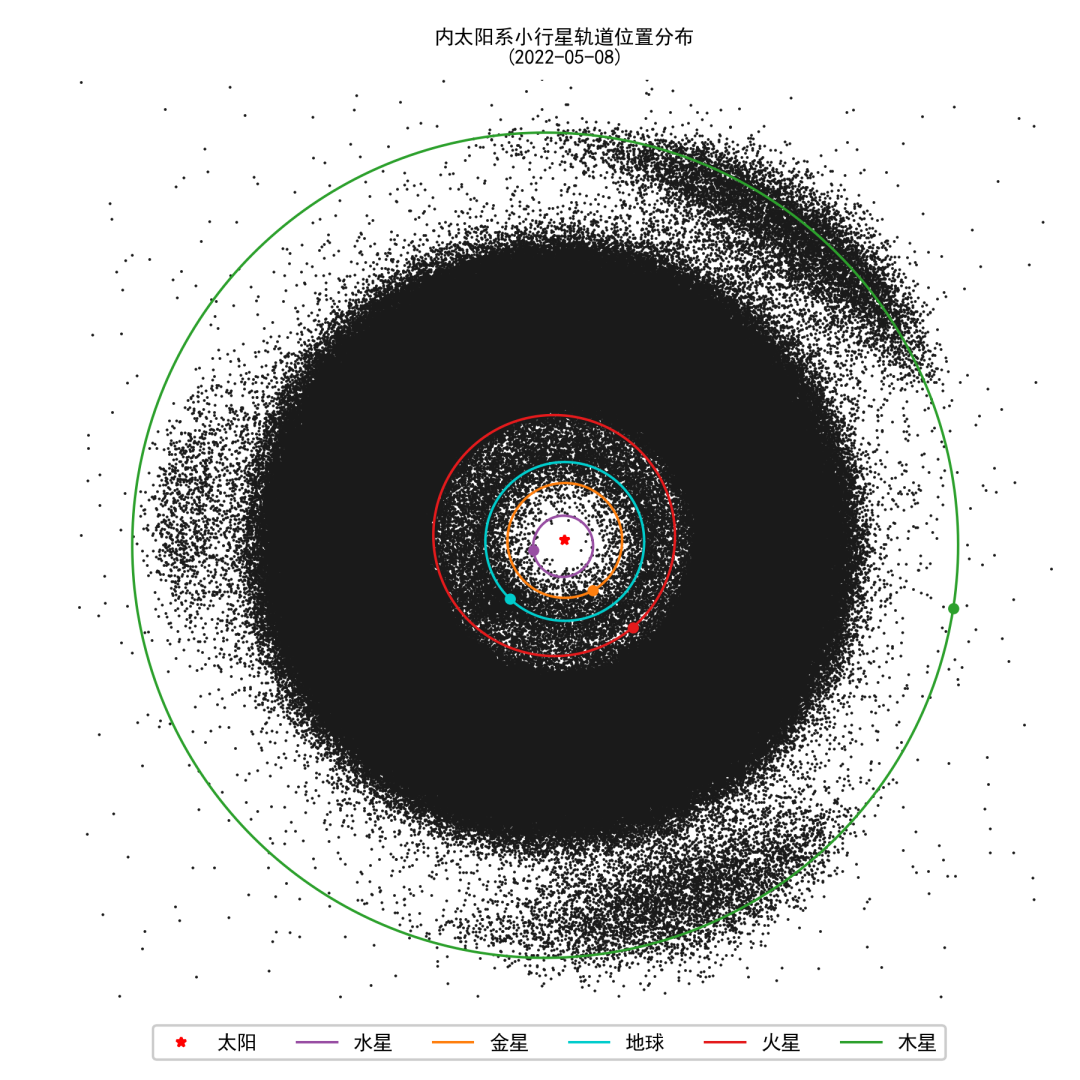

"Alien" in the near -ground asteroid track

We know that in addition to the eight major planets, we also wander a small astero...