Takeaway is no longer a loss of money, but Meituan is still confused

Author:Red Star News Time:2022.06.17

It has been almost ten years since entering Meituan (03690.HK) to enter the takeaway industry. From the "hero hegemony" to the "burning money war", to determining the competitive pattern of "double oligarch" and the "double oligarch", and now it has become an exclusive 7 The leader of the market, Meituan is unsuccessful.

The business logic of the takeaway platform is that the platform needs to maintain the balance of the three -sided effect of merchants, users, and riders. But now, merchants have complained that the platform has become more and more, users complain that takeaway is getting more and more expensive, and riders complain to make less and less. The three parties seem to be dissatisfied with the takeaway platform, and some contradictions have even become a social issue that causes controversy.

The takeaway platform is also aggrieved. Meituan CEO Wang Xing once bluntly stated that the delivery income is not enough to cover the delivery expenditure. Each of the rider will lose one yuan for each order.

So, is the takeaway business really losing money?

The Red Star Capital Bureau will combine Meituan's financial report this year, and bring specific chats from the income end and cost. Who is the real beneficiary of the takeaway business.

(one)

The monetization rate of takeaway business continues to rise

More and more money

From the perspective of Meituan's revenue composition, the current company has three main businesses, namely Meituan takeaway, store hotels, tourism and innovation business.

For the Meituan business model, the takeaway business is the core of the Meituan business model, which is essential to the company.

First of all, the takeaway business is the core weapon of the platform "high frequency and low frequency". Because this high -frequency consumption can accumulate a large number of reused living service users, cultivate users to open the habit of using Meituan every day, and to drain it with a relatively low -frequency but high -gross profit margin product (such as store wine tour).

Secondly, after all, Meituan occupies nearly 70 % of the country's takeaway market. It has such a large user base and so much consumer demand. The takeaway business is also the "cash cow" business that Meituan lives.

Judging from the latest financial data, in the Q1 quarter of 2022, Meituan achieved a total of 46.269 billion yuan, an increase of 25.0%year -on -year; operating loss was 5.584 billion yuan, a year -on -year increase of 17.1%; Essence

Among them, catering takeaway revenue reached 24.157 billion yuan, an increase of 17.41%year -on -year, accounting for 52.21%of the total revenue ratio. It can be seen that the takeaway business is the main source of revenue of Meituan.

These are based on the necessity of taking takeaway. If you look at the "money" ability of this business, it can be found that the ability to make money by Meituan takeaway is becoming more and more advantageous.

Judging from the latest financial report data, the huge losses of Meituan in the first quarter are mainly from innovative business, while catering takeaway profit has increased significantly.

The financial report shows that Meituan's Q1 catering takeaway in 2022 achieved a profit of 1.577 billion yuan, an increase of 461 million yuan from 1.116 billion yuan in the same period last year, an increase of 41.31%year -on -year.

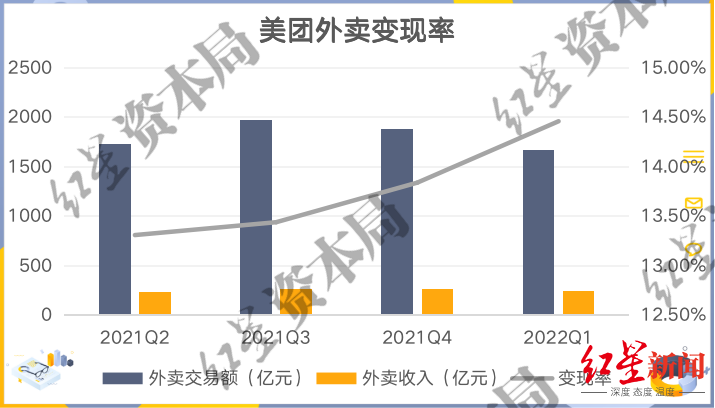

In addition, the realization of Meituan takeaway business is also increasing.

It is worth noting that starting in 2022, Meituan no longer discloses the transaction amount (GTV) of the catering shipping business. After the Meituan hidden GTV, it will be difficult for us to capture data such as changes in takeaway business and customer unit price.

However, because the unit unit price data is relatively fixed, we can still estimate the realization rate of monetization based on the total number of orders in the financial report with the total number of orders in the financial report.

Based on the average unit price of Meituan in 2021, because the number of takeaway transactions in Q1 in 2022 was 3.36 billion, the GTV was calculated that GTV was roughly 164.6 billion yuan, so the realization rate was about 14.7%.

Even if the higher unit price is calculated at 50 yuan, the realization rate is still about 14.4%, and the realization rate is still a record high.

Source: Company Financial Report, Red Star Capital Bureau

You must know that due to the impact of the epidemic, the number of menu and beverage takeaway transactions in Q1 in 2022 decreased by 14%, which led to a significant decline in turnover.

It can be seen that Meituan takeaway business is becoming more and more profitable today, which also proves that this is not a "bitter haha" business.

(two)

New regulations

Become a takeaway business helper

The secret of making money by takeaway business may be hidden under the new game rules formulated by Meituan last year.

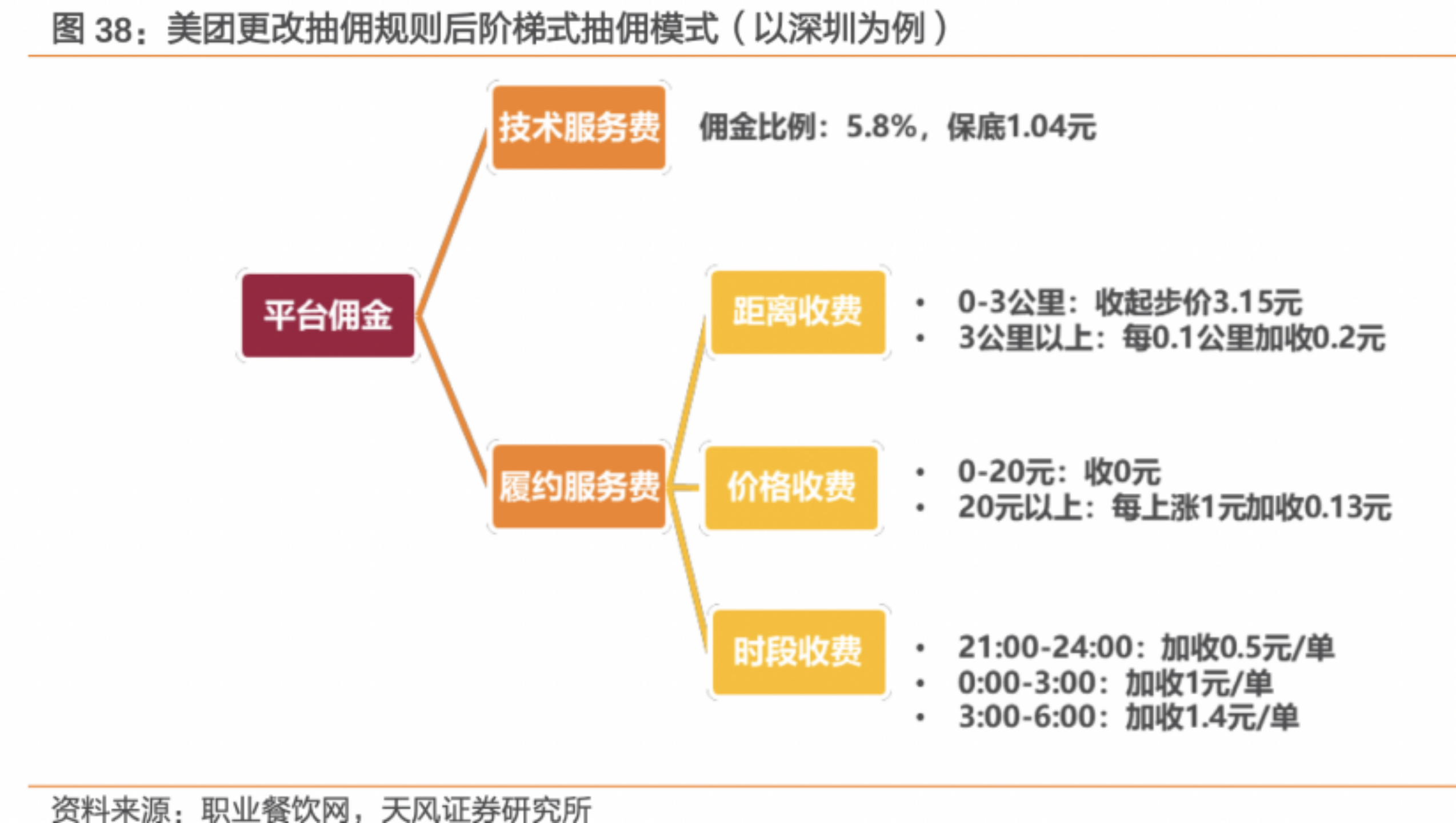

In May 2021, Meituan began to launch "transparent reform" in order to alleviate the pressure from regulatory agencies and merchants. The commission that was collected in proportion was split into two parts: technical service fee and performance service fee, and the performance service fee was agreed to the performance service fee through time sectional billing and distance binding.

The technical service fee is simple, that is, the platform service fee, as long as the takeaway merchants must pay this fee on the Meituan platform. The performance service fee is the delivery service fee paid by the Meituan rider when the takeaway merchants choose the Meituan rider.

In other words, the new version of the merchant commission = technical service fee+performance service fee (distance charging+price charging+time charging).

In different cities, technical service fees and performance service fees have corresponding charging standards. Taking Shenzhen as an example, according to Tianfeng Securities Research Report data, its technical service fee is 5.8%, and the performance service fee, such as at a distance of 3.15 yuan within 3 kilometers and 0.2 yuan per 100 meters per 100 meters.

In this "watch -type" step -up charging model, merchants have to pay attention to the price and distance of the order.

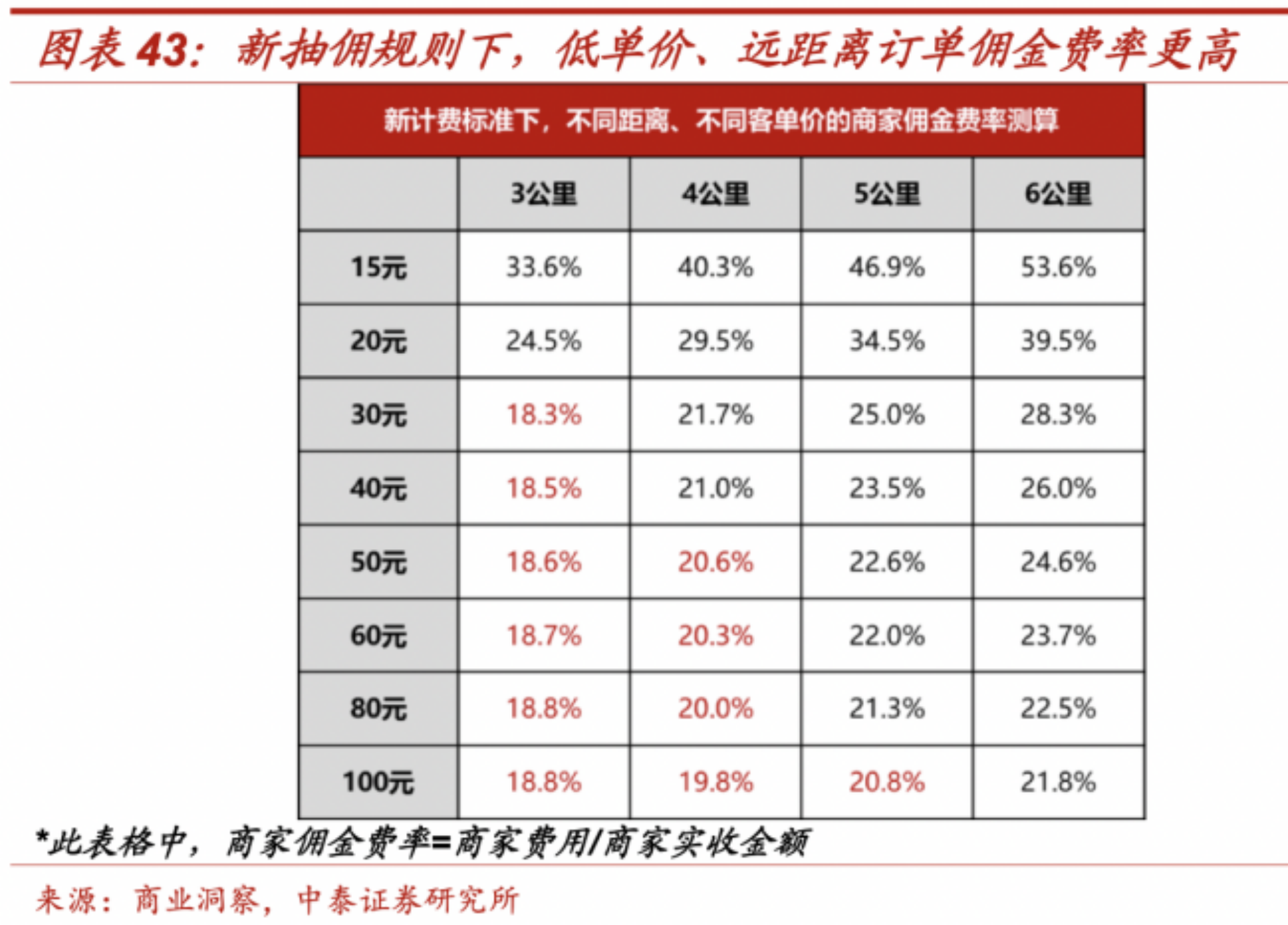

Taking the Shenzhen area as an example, a takeaway order with a normal period of 20 yuan, the delivery distance within 3 kilometers, its commission is drawn to 4.31 yuan (technical service fee 1.16 yuan plus a performance service fee 3.15 yuan), calculate its commission, The rate is 21.55%. The higher the order price, the lower the commission rate. In the same case, the order commission rate of 50 yuan will drop to 19.9%.

Compared with the price, the distribution distance is the key to the commission.

Earlier, Zhongtai Securities had made a quantitative form on the proportion of commissions under the new commission rules, and the table displayed:

For orders with a customer unit price of less than 20 yuan and the distribution distance of 4 kilometers, due to the significant increase in performance services, the proportion of commissioning has soared to more than 40%, and some of them even more than 50%.

It can be seen that for small and medium -sized merchants with a unit price of less than 20 yuan, the distance of delivery distance has become the core of its own profit. Late -night orders with a distribution distance of more than 3 kilometers may not even return.

Under the new rules, low unit prices and long -distance orders have increased. Merchants have to change their business strategies and focus on maintaining their "three -kilometer city pool" and increasing customer unit price.

In this way, it can be described as more in one way -the concentration of orders within 3 kilometers is conducive to the improvement of distribution efficiency, and the price of high order will also bring higher profits. These are the results that Meituan wants to see.

Earlier in April 2021, the General Administration of Market Supervision conducted a case investigation on the monopoly behavior of Meituan. By August, it officially issued a total of 3.442 billion yuan of fines from the Meituan monopoly behavior, and requested the improvement of its commission charging system.

Now that the commission system is changing, the transparent commission rules have made merchants have to try their best to seek preferred resolving a reduction in commission. This "thousands of single -sided" commission rules, at least for Meituan, are definitely not bad.

(three)

Takeaway for new business?

How can Meituan go and retreat in the future

In July 2020, Meituan launched Meituan's preferred and officially entered the field of community e -commerce retail, which is also the beginning of Meituan's huge losses.

From Q4 in 2020, Meituan has "burned money" crazy, showing his ambitions in the retail field of community e -commerce. According to the financial report, in Q4 in Q3 and 2021 in 2021, Meituan's new business losses reached 10.9 billion yuan and 10.2 billion yuan, respectively.

According to the financial report, in 2021, Meituan's catering takeaway and store and wine travel business contributed more than 70 % of revenue and operating profit of 20.268 billion yuan, while Meituan's new business (community e -commerce retail accounts for the main) revenue The proportion of less than 30 % caused a loss of 38.393 billion yuan.

Behind the road of crazy "burning money" is the high hopes of Meituan. In May 2021, Wang Xing stated at Meituan's performance meeting that Meituan preferably has strategic significance for the group, and the growth of Meituan user growth in the future is hoped to be in the new business.

As of December 31, 2021, the number of users of Meituan transactions was 690 million, an increase of 35.2%over the same period of the same period last year. Public information shows that Meituan has obtained more than 100 million new users in less than two years through community group purchase business.

The good news is that after nearly a year of crazy competition, the industry has gradually entered a calm period, including many group purchase companies such as the same city, orange heart preferences, and other group purchase companies. The market has only giants such as Meituan, JD.com, and Ali.

However, confusion also follows. When the "burning money" low -cost subsidy has been unable to continue to obtain new users at a high speed, all companies need to consider how to take the next step. In the first quarter of 2022, Meituan's user growth was less than 3 million. At the same time, the optimization of the operation of new businesses could also lead to the loss of some users.

Where should I go? "Treatment of cost reduction" is the answer given by Meituan.

Since the second half of last year, Meituan began to propose cost reduction and efficiency and increase strategy. The new business is the key goal of Meituan cost reduction and efficiency. Since the beginning of this year, Meituan has preferred the service of four provinces including Gansu, Qinghai, Ningxia, and Xinjiang. By April 26, Meituan preferably preferably suspend its self -service service. At the conference call in the first quarter of this year, Meituan also mentioned that it is improving operational efficiency and reducing costs, reducing user acquisition costs through a lower conversion rate.

But this does not mean that the road to burning money is over. According to "Late Latepost" previously reported, when the preferably preferably recovered from Meituan, the business difficulty was far exceeding expectations, and the profit was very thin. The state of losing money in the next 5-10 years will not change. huge.

In addition, Meituan is also implementing its "retail+technology" strategy. Meituan has continued to increase investment in scientific and technological research and development since the upgrading of the strategy in 2021. In the first quarter, Meituan's research and development costs increased by 40.3%year -on -year to 4.88 billion. During this year's epidemic, unmanned delivery vehicles can be described as frequently appeared. However, in order to truly increase efficiency through science and technology, it also takes a long period of development.

summary

Judging from the current situation of Meituan, the competitors are now layout of the same city business. Whether the advantages of Meituan can continue to be maintained, maybe it remains to be verified.

If Meituan intends to fill the big hole in the new business by taking out the takeaway business, and consider the results of the market feedback and industry competition, this is obviously not a long -term good strategy.

Red Star reporter Yu Yao Liu Yan Intern reporter Fan Di

Edit Yu Dongmei

- END -

The fake platform is free first, and it can be "really expensive" in the back: new online fraudulent surgery is staring at physical merchants

Establish a false e -commerce platform, a manufacturer settled in the illusion, an...

The 6th World Intelligent Conference "Binhai Zhongguancun Cooperation Innovation and Development Forum" was successfully held in Tianjin Binhai

On June 24, 2022, the 6th World Intelligent Conference Binhai Zhongguancun Coopera...