"Controlled anonymous" "Privacy Protection" ... How much do you know about digital RMB?

Author:Sichuan Observation Time:2022.08.16

In the era of big data, consumers attach increasing importance to personal privacy protection, and they are no exception when using digital RMB. How to make payment more convenient and secure when ensuring the privacy of consumers? Digital RMB is exploring the solution by achieving "controllable anonymous".

The picture shows the audience on September 5, 2021. The audience passed by the Shougang Park of the Shougang Park of the Faculty Fair. Photo by Xinhua News Agency reporter Wu Wei

Small payment can be traced on a large amount of large amount according to law

Cash transactions are anonymous and can ensure the privacy of consumers. Naturally, the digital renminbi that is positioned in circulation must also meet the needs of people's anonymous transactions. The digital RMB wallet is opened without even binding a bank card.

Mu Changchun, director of the Institute of Digital Currency Research of the People's Bank of China, previously introduced that in accordance with relevant laws and regulations, telecommunications operators shall not disclose customer information corresponding to the mobile phone number to third parties including the People's Bank of China, so they use the mobile phone number to open the mobile phone number. The four types of wallets are actually anonymous.

At present, whether it is Internet payment or bank card payment, it is necessary to bind the bank account system to meet the real -name account opening requirements of the bank. However, the digital renminbi wallet is managed by layered management. Four types of digital RMB wallets are opened without binding a bank card, and the mobile phone number can be achieved. Of course, such wallets also have the corresponding balance limit and payment limit.

In accordance with the current management requirements of the digital RMB wallet, the trading limit of the four types of digital RMB wallets with the lowest permissions is: the balance of the balance of 10,000 yuan, the upper limit of the single payment limit of 2,000 yuan, the daily cumulative payment limit of 5,000 yuan, the annual cumulative payment limit of 5 10,000 yuan.

In addition, some digital RMB hard wallets can not be associated with user identity, as convenient as buying a "prepaid card".

As far as small payment is concerned, digital RMB can be completely anonymous, but if a large payment is required, you need to upgrade the "wallet" and provide information such as valid identity documents and your bank account as required. For example, after upgrading to the second -class wallet, the upper limit of the digital RMB wallet balance will be increased to 500,000 yuan, the upper limit of the single payment limit will be increased to 50,000 yuan, and the cumulative payment limit of the daily payment limit is 100,000 yuan.

However, Mu Changchun emphasized that only when the suspected illegal and suspicious transactions are triggered, the authority can inquire with the operating agency and use user personal information in accordance with the law. At the same time, the scope of use and use is strictly controlled within the authorization of laws and regulations, and safety protection measures are taken.

The picture shows a bank staff showing the digital RMB hard wallet. Xinhua News Agency reporter Chen Zhonghao

Open the "digital footprint" of the child wallet to protect the "digital footprint"

Some Internet platforms have tracked and collected "digital footprints", especially various financial information. How to avoid exposing "digital footprints" in online payment scenarios? Digital RMB -launched sub -wallet functions may solve this problem.

When the digital RMB is paid on the e -commerce platform, users can open a child wallet under the mother wallet, and the user's payment information will be packed and encrypted. E -commerce platforms will not be able to directly obtain information such as bank card number and bank card validity period, but only the mobile phone number used to associate the e -commerce platform account when opening the wallet. At present, the digital RMB wallet supports multiple sub -wallet applications such as JD.com, Didi Chuxing, Meituan cycling.

The reporter learned that digital RMB followed the "minimum and necessary" principle when collecting personal information, and the amount of information collected was less than existing electronic payment instruments.

Mu Changchun said that digital RMB only collects the necessary personal information directly related to the purpose of processing. For users who choose to refuse to provide permissions, the Digital RMB APP will be strictly implemented. In order to ensure the safety of user property, digital RMB only collects the information required for risk control to strengthen the risk identification of user digital RMB wallets, and prevent risks such as theft, malicious reporting, and cyber fraud.

On April 29, 2022, in Laoshan District, Chongqing, a passenger used a digital RMB to pay for a bus. Xinhua News Agency

Preventing telecommunications fraud to perform the "three anti" obligations

If you only pay attention to personal privacy protection and ignore the risks of facilitation, large -scale, and cross -regional risks in the digital age, the central bank's digital currency may be used by criminals.

In recent years, electronic payment has been stared at by criminals and has become a settlement channel for illegal crimes such as online gambling and telecommunications fraud. Experts point out that the user information of the central bank's digital currency collection is less than electronic payment. If the anonymous level is too high, it will provide new criminal soil for criminals, a large number of illegal transactions or flowing from electronic payment to the central bank digital currency. At the same time, the central bank's digital currency is more portable. If it provides the same anonymity as cash, it will be greatly facilitated to facilitate money laundering and other illegal transactions.

At present, the central banks and international organizations of various countries will take precautionary risks as an important prerequisite when exploring the anonymity of the central bank's digital currency. Designs that cannot meet the requirements of anti -money laundering, anti -terrorist financing and anti -tax evasion will be rejected by one vote.

Fan Yifei, deputy governor of the People's Bank of China, wrote that if there is no third party anonymous trading, personal information and privacy will be leaked; but if a complete third party anonymous is allowed, it will promote crimes. Therefore, in order to achieve a balance, controllable anonymous must be achieved.

In order to ensure the effective implementation of digital RMB controlled anonymous requirements, Mu Changchun revealed that in the next step, digital RMB will gradually establish an information isolation mechanism, clarify the legal conditions of digital wallet query, freezing, and deduction, establish a punishment mechanism, improve digital RMB anti -money laundering, Anti -terrorist financing and other regulations ... As the design of the top -level system continues to improve, it is expected that the "controllable anonymous" characteristics of digital RMB can bring a more convenient and safer payment experience to the public.

Sichuan Observation (Source: Xinhua News Agency)

- END -

Beijing Astronomical Museum's "Beauty of the Starry Sky" imaging platform work collection notice

The vast universe, stars flashed. The beautiful moment we captured, deep and intox...

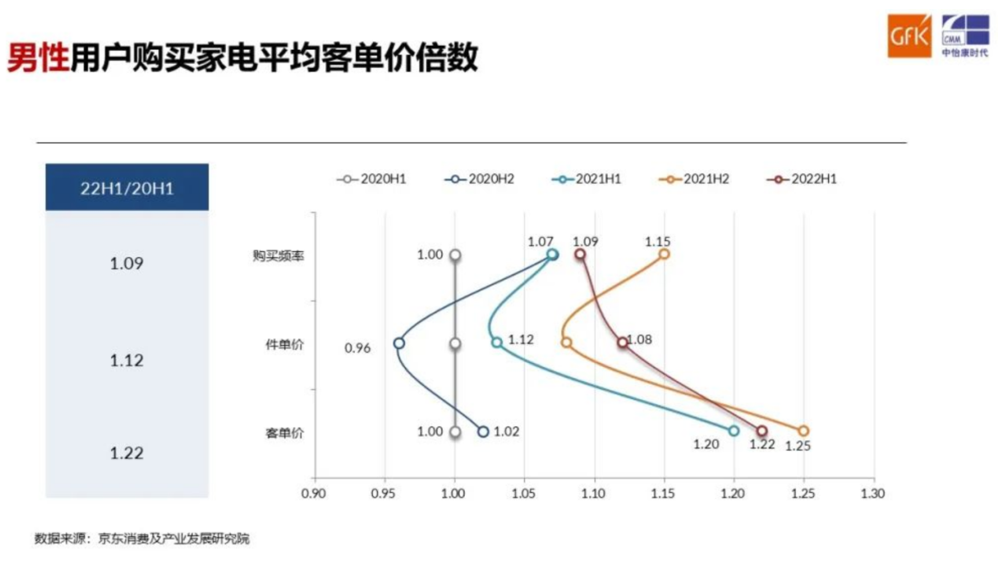

The main consumer consumer's main force from the home appliance consumption report to see the rise of "his economy"

The game and televisions that have erupted for two consecutive years have allowed ...