The credit business layout of the three major technology giants

Author:Zero One Finance Time:2022.08.19

Source | Zero One Finance

Author | Chenglin Pua

Credit business has always been the main source of profit for traditional banks. Since the Internet changes and the lifestyle of people around the world, large technology companies have gradually deployed credit -related businesses. At present, large -scale global technology companies that have deployed credit business include Amazon, Apple, and Google.

Amazon

Amazon provides credit to platform merchants and customers in various forms. Amazon has previously provided credit from its own balance sheet (and may still be done now). Now it mainly allows banks or cooperation with banks to provide merchants and customers on their platforms with credit and related services.

Amazon has been providing credit services to small and medium -sized companies on its e -commerce platform since 2011. Amazon's funds from their own balance sheets to provide loans to small and medium -sized companies. Since 2016, Amazon has cooperated with Bank of America to provide loans to merchants (especially small companies) sold on its platform. According to Amazon's 2016 annual report, Bank of America has provided a loan amount of $ 500 million in 2016. In 2019, the loan quota increased to $ 620 million, an increase of 740 million US dollars in 2020.

In 2018, Amazon cooperated with the United States Express to extend Amazon's credit products from loans to credit cards. The annual interest rate of credit cards is currently between 14.24% and 22.24%. There is no annual fee for credit cards launched with American Express. There are also some preferential rewards for the credit card, such as buying cash return rewards for some specific stores.

In 2020, Amazon also started cooperating with Marcus to provide merchants with credit products. According to media reports, merchants can apply for a credit limit of up to $ 1 million, with interest rates between 6.99% and 20.99%. This is the first time Amazon has shared customers' behavioral information with external institutions. The credit product is decided by Goldman Sachs.

Amazon cooperates with many financial institutions to provide credit cards to consumers who purchase goods on their platforms. The credit cards provided by Amazon are only open to Amazon and Amazon Prime users (Amazon encourages users to become their members, enjoy the benefits such as free postage and cashback offers).

Amazon Store Card and Amazon Prime Store Card are provided to Amazon and Amazon Prime users, respectively. The store card is the so -called "closed loop" card, that is, they can only be used on the Amazon platform. Amazon Store Card and Amazon Prime Store Card were issued by Amazon and Synchron Bank (a US bank). Synchrony Bank cooperates with many retailers to issue closed -loop credit cards (that is, the credit card can only be used in the retailer's platform or store). The Amazon Store has no annual fee, but its annual interest rate is 25.99%.

In addition, Amazon also offers Amazon Secured cards and Amazon Security Prime cards, which is also a closed card. The Amazon Secure card aims to help users establish, repair or accumulate their credit. Like the store card, the Amazon Secured card is issued by Synchrony Bank and can only be used on Amazon. The annual interest rate of the Amazon Secure Card is 10%, and its late fees are $ 5, which is significantly lower than the store card.

Amazon also launched Amazon Rewards and Amazon Prime Rewards credit cards with J.P. Morgan Chase and Visa. The annual interest rate of credit cards is currently between 14.24% and 22.24%. Amazon Rewards and Amazon Prime Rights credit cards can be used anywhere. The above credit card has related reward plans, which provides cash repayments from Amazon e -commerce platforms, Amazon related companies and other businesses.

In August 2021, Amazon cooperated with Financial Technology Corporation AFFIRM to provide users on the e -commerce platform to provide the shopping payment options for the first payment (BNPL). Buying first and then paying is a short -term financing method that allows consumers to buy future repayment. Unlike credit cards, it is usually interest -free. BNPL is also known as "sales point installment loan", and is now becoming an increasingly popular payment method, especially when shopping online. On the Amazon platform, the interest rates provided by Affirm are currently available from 10% to 30%, and the repayment period ranges from 3 months to 36 months.

Google has a relatively small layout in the field of credit. At present, there are mainly related layouts for users and merchants.

Google's borrowing activities for users are limited to Google's offline stores. Consumers can buy Google products from Google's offline stores. Google provides a Google Store Financing account. This is a credit card issued by Google and Synchrony Bank (a US bank). The card can only be used in Google's line Shopping in the store or Google Store. The card is a 0%interest rate for certain products and then paid for payment options. Google cooperates with SME digital lending platform Flexiloans to enable small merchants to get credit loans. Flexiloans was the first loan to launch on the Google Pay platform. Flexiloans once said that he hopes to issue loans to more than 50,000 small companies. Flexiloans said that Google Pay has always been at the forefront of merchant payment, Flexiloans hopes to provide a safe digital borrowing experience for each Google Pay merchant. Merchants can apply for loans from Flexiloans through Google Pay for Business. In addition to applying for loans, Google Pay for Business can also help merchants create online stores, manage customer balance classification accounts, and so on.

apple

Apple entered the consumer credit market with Apple Card in August 2019. Apple Card is a credit card launched by Apple and Goldman Sachs's consumer bank subsidiary Marcus. Goldman Sachs is responsible for issuing the card and performing all related credit guarantees. Although Apple Card can be stored in the Apple wallet virtual, it actually provides a physical card. Apple Card runs on the network of MasterCard. The annual interest rate provided by Apple Card is between 10.99% and 21.99%, and the specific annual interest rate depends on the credit status. As of the end of 2020, Apple Card's transaction volume exceeded $ 4 billion.

In addition, Apple also provides an option for US users to buy Apple iPhone with Citizens Bank (a US bank). After the customer uses this option to pay, it needs to be paid per month within 24 months, and the interest rate is 0%. In addition, Apple Card holders can also use Apple Card's monthly installment payment plan (ACMI) to purchase eligible Apple products without paying interest. After using this monthly installment payment plan, the details of its payment will be automatically updated in the Apple Card in Apple virtual wallets, allowing users to know the money they should pay.

Earlier, Apple's interest -free installment payment/buy first and then pay only applies to Apple products. However, Apple announced in June 2022 that Apple will launch Apple Pay Later, a customer -oriented interest -free and non -cost installment credit product. Apple Pay Later will allow customers to pay the purchase fee in four equal amounts within six weeks; payment will be managed through Apple's virtual wallet application. Although Bloomberg has previously reported that Apple and Goldman Sachs is jointly formulated a installment payment plan, the "Wall Street Journal" report said that Apple seems to be carrying out this business without bank cooperation. Underturn. The outside world regards this information as Apple will enter the field of buying first.

(Main source: Congressional Research Service, a report released by the US Congress Research Service on July 29, 2022 "Big Tech in Financial Services")

End.

Zero One Financial Digital Economic Decision Service Platform provides services such as media communication, digital internal reference, research consulting, conference activities, etc. At present, more than 400 institutions have been served; more exciting content, please log in to the website: 01Caijing.com. 2901 original content public account

↓↓ Su Daqiang, only third! ↓↓

Zero One Finance, Praise 7

- END -

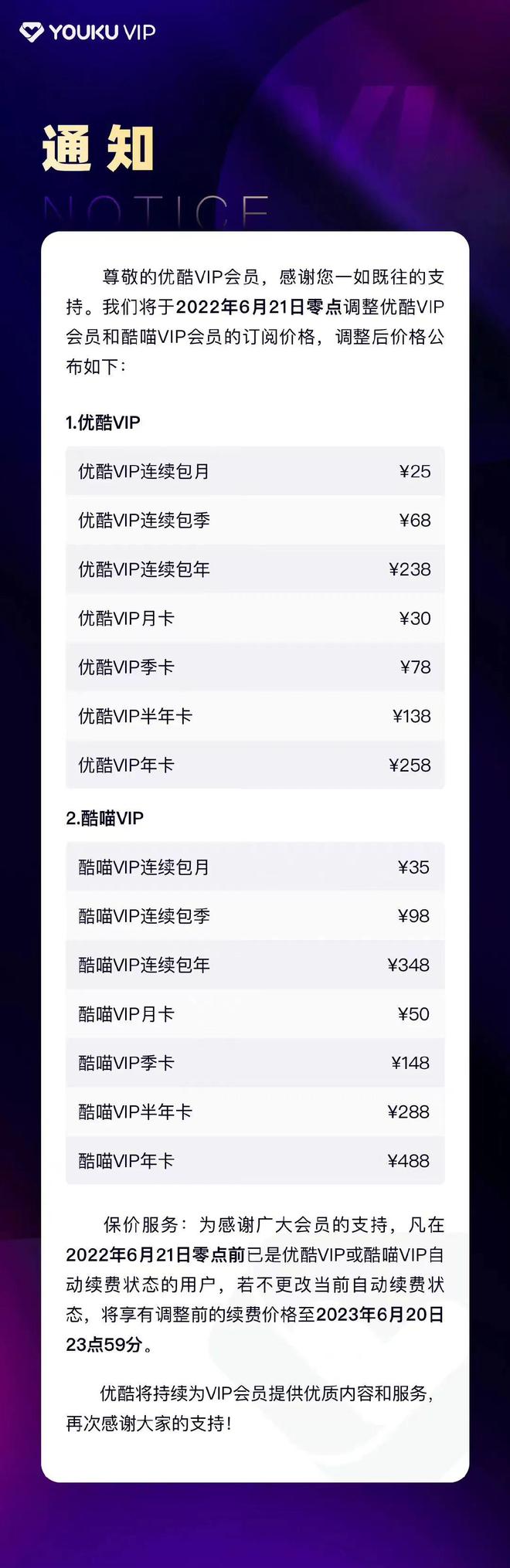

From the 21st, Youku members increase price increases

Wuhan Evening News, June 16th (Profile reporter Zhang Jinyu) On June 15, Youku ann...

Extinction and evolution: Is the disappearance of the reproduction of the disappeared species after self -repair on the earth?

Some netizens asked: Some species who have been extinct for 50 years are reproduce...