Digital cloud financial structure is initially determined, Beijing, Shenzhen, and Hangzhou ushered in three -legged standing?

Author:Liu Kuang Time:2022.08.25

The picture comes from Canva.

Under the promotion of various policies, the domestic digital economy has become tide, and the financial and tax enterprise service market is no exception. According to the "2022 China Digital Cloud Financial Development Research Report" provided by Ai Media Consultation, from 2017 to 2021, the scale of the service market of China's financial and tax enterprises has increased from the previous 181.66 billion yuan to the previous 181.66 billion yuan to 266.44 billion yuan, the annual compound growth rate reached 10%.

According to Ai Media Consultation, under the dual drive of the supply side and demand side, the scale of the financial and tax enterprise service market will continue to expand, and under multiple factors drive, the coverage of digital cloud finance in the future will be expected to further increase. In addition, with the further development of the industry, the industry pattern of cloud finance has also undergone new changes.

The Matthew effect is strengthened, and the three -legged head shows up

From the perspective of industry conditions, the current cloud financial industry has both external demand and industrial policies and the industrial ecology of digital industrialization. From the perspective of the market structure, at present, there is a clear trend of echelon differentiation within the cloud finance.

On the one hand, comprehensive cloud financial manufacturers represented by UFIDA, Kingdee, and every moment of technology have occupied the core market share with many advantages. According to the data released by Ai Media Consultation "TOP10 in 2022 China's Digital Cloud Financial Enterprise Development Competitiveness Rankings", in 2022, the Digital Cloud Financial Circuit, UFIDA, Kingdee International and each moment of technology, ranked among the top three, respectively, respectively. Firmly occupy the position of the first echelon.

In recent years, with the accelerated transformation of cloud finance, the two traditional financial and tax enterprises industry giants of UFIDA and Kingdee have begun to release the head influence in all aspects of the digital cloud financial track, occupying the first and second positions of the digital cloud financial track. Each moment in the era of cloud finance, every moment of technology, relying on the keen insight and their own innovative research and development capabilities, it took the lead in opening the situation on the cloud financial track, and created a number of industries "for the first time". The financial enterprise stood out and ranked among the top three in the industry, becoming a head player in front of the giants, which has initially formed a "three -point" pattern around the three regional urban centers of Beijing, Hangzhou, and Shenzhen. The head effect appears again.

On the other hand, vertical manufacturers represented by Huilianyi, Easy News, and the first year of technology are ranked second echelon. According to the data disclosed by the "TOP10 Ranking of the Development of Digital Cloud Financial Enterprises in China in 2022", three manufacturers such as the first year of the first year of technology, Yichao and Huilianyi, which are deeply cultivated in the fields, are also on the list. 7, 9 and 10, ranked in the second echelon of the industry. In addition, the remaining markets are divided by other manufacturers. The share of its share and market influence is far inferior to players in the first echelon and the second echelon. Generally speaking, the Matthew effect of the industry is very clear.

Horny upgrade

From the perspective of the entire cloud finance industry, the division of the echelon of cloud finance actually represents the maturity of the entire industry, and to a large extent, this maturity is reflected in the needs of cloud finance from a single in the past to diversified, and and also diversified, and it has changed, and it has changed from a single in the past to diversified. With the depth of sceneization into the industry, it has promoted the comprehensive upgrade of its own services, and differentiation is the deep result brought by this upgrade.

1. Scenario -driven service upgrade

Different from the expansion of cloud finance in the early days, with the maturity of the industry and the gradual clarity of users' needs, cloud finances are increasingly developing in the direction of scenes and professionalism, so their internal services have also accelerated and upgraded.

First, in order to meet the diversified needs of users, large cloud financial manufacturers have accelerated the pace of the entire scene and the layout of the entire scene, and gradually evolved towards a comprehensive platform. For example, every moment of technology starts from the earliest full process cost management platform to reimburse each moment, and gradually formed a full -time business process such as each moment of the file, the cloud ticket, the financial cloud sharing, and the business travel ecological platform. Comprehensive cloud financial platforms; use of Youyou Networks, Kingdee International and other manufacturers have also been involved in fees control cloud reimbursement, invoice cloud management, accounting files, cloud ERP, and ecological cloud associations. It can be seen that expansion to many fields is already a joint choice of cloud financial manufacturers.

The second is to meet the user's personalization and customization needs of a single scenario, and some cloud financial manufacturers have gradually strengthened the deepening of the industry, thereby promoting the cloud financial industry to extend in the direction of vertical and industry. For example, the decibels established in 2016, the initial focus of focusing costs and payment scenarios, now start to intervene in the field of reimbursement in expenses, hoping to form an expenditure management platform that integrates costs procurement, payment, and reimbursement. Positioning corporate reimbursement and expense management SaaS platform, now fully involved in the field of fees procurement, focusing on layout nail ecology, customers are mainly small and medium -sized enterprises; Beginning the field of involvement in fees; from the current point of view, the business direction of the three enterprises has gradually converged, hoping to cultivate it from corporate expense procurement to management vertical fields. In the field of expenses in each moment, it adheres to another path, refinement of cost control, creating expense procurement ecological platforms, opening the expense procurement ecological chain, open ecological standard interface to the market expense service provider, so that customer cost purchase has more. Suppliers choose opportunities.

Second, the evolution of digital intelligence accelerated

In addition, with the deepening of the industry's digitalization and the increase in cloud financial coverage, the digital intelligence and sharing capabilities of the cloud financial industry have continued to increase. On the data of the entire link, the cloud has created a larger and more complete closed -loop data link, laying a good foundation for the realization of data intelligence and automation; for example, compared with the traditional ERP platform, the new generation of financial sharing cloud platform can realize the realization The collaboration of internal and external functions has made traditional financial systems unable to connect public expenses, private costs, taxes, customers, suppliers and other external data chains to be fully connected, which has formed a good collaboration and symbiosis, which makes up for ERP's external collaboration. The shortcomings have become a powerful supplement to ERP. Secondly, with the gradual clouds of each link, the functional boundary between each module is clearer, and the intermediate processes are further standardized.

3. Ecologicalization continues to increase

With the opening and sharing of online financial data, cloud financial manufacturers have developed increasingly in the direction of platformization and ecologicalization.

On the one hand, after the data interconnection, the connection between various business links is increasingly close, and with the deepening of the digitalization of the enterprise, the various online integrated platforms gradually take shape. For example, Kingdee Cloud Xingkong realizes the integration of research and production of supply and marketing on the basis of a unified digital operation platform. It connects the traditional PLM system, ERP system, and MES system to form a integrated platform for the entire process of internal collaboration. On this integrated platform, after the client enters the system, other systems can be connected without switching the system.

On the other hand, as business, finance, and taxation are fully cloudy, and the ecology within the cloud financial manufacturer has gradually formed, they are related and influenced by each other to jointly promote the development of the cloud financial industry. Taking each moment of technology as an example, from the earliest passive access to the third -party service provider platform, to the later open procurement ecological platform, integrated interface ecology symbiosis, to today's data -driven, business and tax integration, and the ecological ecology of each moment of the technology platform, the ecological platform of each moment Increasing intelligence, deeper and deeper, the connection is getting closer, the value of its empowerment is becoming more and more significant, and its cloud financial platform has also become a large -scale sharing platform for collaborative symbiosis and co -creation.

In short, whether it is the upgrade of service or the ecological upgrade, it indicates the upgrade of cloud financial manufacturers.

KA prefers comprehensive manufacturers

In the context of the comprehensive upgrade competition in the financial and tax enterprise service market, an increasingly clear cognition is formed: that is, those who get medium and large customers will get the world. This is not only because the big customers (that is, KA customers) have a stronger paid awareness, a higher willingness to reduce costs, and more stable renewal rates. It is also because of higher paid prices, and it can also support the high -speed growth of the enterprise in the early stage. But from the perspective of KA customers, it often favors comprehensive cloud financial manufacturers such as Kingdee, UFIDA, and every moment of technology.

First, under the trend of comprehensive digital intelligence, the demand of large enterprises has shown a trend of geometric growth. Their demand for integrated solutions is becoming more and more clear, which is precisely the strength of comprehensive cloud financial manufacturers.

In the past, the informatization of a single process was not very different from small and medium -sized enterprises for service providers, both of which were single -line services. However, in the era of comprehensive digital intelligence, large enterprises often face group transformation and upgrades. At the same time, the group's internal internal issues are affected by issues such as centralized control, merger statements, and private deployment of various centers in various places, such as data islands and chimney phenomena.

In this context, the difficulty of demand for large -scale enterprises and medium -sized enterprises has increased more than one index level, and the ability of the former often requires higher dimensions. As far as Shangyun demand is concerned, big companies even hope to have the full business level of Shangyun. In this case, integration of financial and tax industries has become an inevitable choice. The strength of the platform.

Second, customers with large and large enterprises value the platform's qualifications, credibility and service capabilities more, so comprehensive cloud financial manufacturers with large customer service capabilities are easier to gain their favor.

Generally speaking, in addition to the service capabilities of cloud financial providers, medium and large enterprises, they also value the brand, qualifications, reputation, and cooperation's stability and long -term nature of Yun financial manufacturers themselves. Therefore, cloud financial manufacturers not only need their own service capabilities, but also need enterprises to have the recognition and endorsement of benchmark customers in various industries, but they have long been committed to serving comprehensive cloud financial manufacturers of large enterprises in the middle -aged enterprises. The recognition and trust are therefore more likely to endors the benchmark industry customers. Based on this, KA users often favor comprehensive cloud financial manufacturers.

Cloud Finance Entering a new stage of value reshaping

Throughout the development of financial informatization, from the earliest accounting electrification to the later ERP system, to the current cloud financial system, almost every information upgrade will drive financial informationization to a new step. The financial age is no exception. From the perspective of breadth and depth, Cloud Finance will lead the unprecedented change to the industry to enter a new stage of value reshaping.

First of all, the data of digital cloud finance shared and reshaped the boundaries of industry and wealth through the wider and wider field of data, becoming the core starting point for the digital transformation of enterprises. Data is the foundation of digitalization. Data drivers are the core of digital transformation. The financial system has a large number of core data from business operations to management decision -making. The unique advantage. Relying on the three pillars of data sharing, data standard sharing, and IT platform sharing. Digital cloud finance will break the most widely used data sharing of the "Data Island" formed by the traditional ERP system. The flow is extended from the two dimensions of two dimensions of horizontal and vertical, and promoted the enterprise to realize the cloud of the entire business and the whole scene, and truly turns the survival of the full digital cloud into reality. In this context, cloud financial manufacturers with multiple scene layout capabilities have gradually become the first choice for large and medium -sized enterprises, and the competitive advantage has increased significantly.

Secondly, based on data, cloud financial manufacturers have introduced a large number of core intelligent technologies such as RPA and OCR to promote digital cloud finance to further upgrade to smart cloud finance.

Compared with the traditional ERP system, the intelligent cloud financial system not only realizes the sharing, automation, automation, and the onlineization, visualization, and real -time (convenient business decision -making) of business data, but also through the access of hardware such as financial and tax robots It has greatly reduced the cost of the financial process itself of the enterprise, and has gradually become an indispensable rigid tool for enterprises to achieve financial system upgrades. It is not difficult to foresee that in the future, with the awakening of modern management awareness and the increase in cost reduction pressure, its demand for cloud finance will become more urgent.

Finally, with the widespread integration of cloud finances and industries, it has changed from the "tool" role in the past to the role of "empowerment". In the past, the application of traditional ERP systems promoted the "paperless" of financial information, but it has not yet got rid of the attributes of its "alternative tools". Now, as clouds are widely connected with business, organization, and ecological internal and external parts, it has become increasingly becoming. "Empowerment" of corporate value realization.

Under this new change, the financial personnel will be liberated from the tedious "accounting" work, so as to truly focus on the value creation activities of the core business of the enterprise, and do a good job of "staff" for enterprise operations. It is expected to be relieved from trivial business details, and takes more time to pay attention to important matters related to the long -term development of enterprises. At the same time, the huge innovative potential energy created by the digitalization of finance may guide the venture capital circle to participate in the innovative activities of cloud finance and promote the development of cloud finance in depth.

Looking at the future, with the further growth of the Chinese financial cloud market, some benchmark head companies of some digital cloud tracks may continue to expand market influence with their premier advantages, and they will stand up in the huge blue ocean market of "fiscal and taxation". Tide, continue to become a "tide" leading the industry's change.

- END -

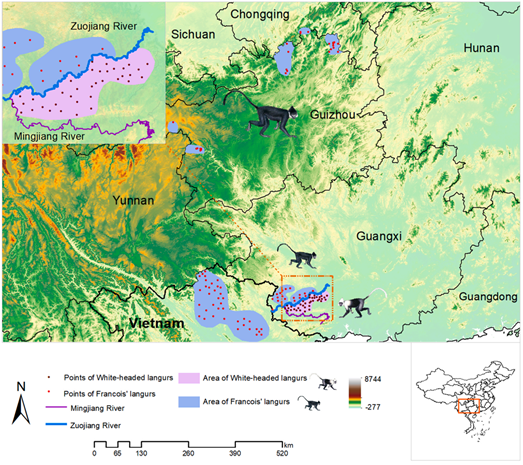

Monkey in the world: black and white monkeys' points together

Long -priests are close relatives of human beings. The most familiar princes that ...

The closest to Android 13 official version of the system Outa and vivo early adopter color Test COLOROS13 interface exposure

A few days ago, according to foreign media XDA reports, Google's Android 13 DP2 ve...