Feitian Yunyong's main business pulls the cross -haired rate, and the cost of obtaining traffic is high.

Author:Sutu.com Time:2022.07.13

Original

Author / Lu Bing

Cover Source: Feitian Yunyong

Recently, Beijing Feitian Yunmong Technology Co., Ltd. Flowing Cloud Technology LTD once again submitted a listing application materials to the Hong Kong Stock Exchange. It is worth noting that this is the application for listing again after the submission of the table.

According to the Schuduyuan Universe Research Institute, at the end of last year, Feitian Yunmong had submitted a prospectus to the Hong Kong Stock Exchange. The industry is called the "PPT Prospectus".

It can be seen from the prospectus that Feitian Yunyong updated the financial data and other information of 2021 and the first quarter of 2022. A total of 326 times mentioned the "Yuan Universe", and it is interesting that its main business is AR/VR. Serve. So, what did Feitian Yunyong reveal these new information?

Feitianyun excessively relies on marketing business, and the cost of obtaining traffic is high.

The Tianyancha APP shows that the establishment of Feitian Yunyong is less than a year, but its predecessor "Beijing Palm Zhong Feitian Technology Co., Ltd." was established in 2008. It is understood that Feitian in the palm is a game content marketing company that integrates "technology, content, IP, and business". Feitian Yunyong said in the prospectus that it turned from the game business to AR / VR content and service business in April 2017, and completed the transformation in May 2019.

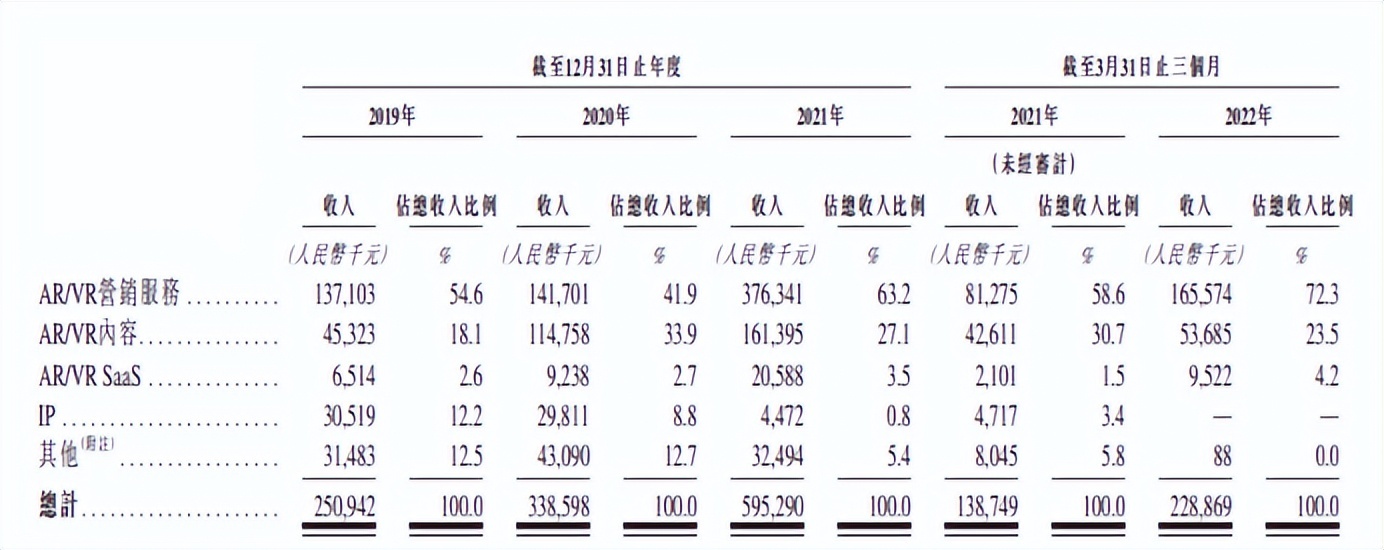

According to the prospectus data, the operating income from 2019-2021 was 251 million yuan, 339 million yuan, and 595 million yuan, respectively. In the first quarter of 2022, revenue reached 229 million yuan, of which AR/VR marketing service business The sector accounts for 72.3%of the total revenue, AR/VR content business accounts for 23.5%, and AR/VR SaaS accounts for 4.2%. It can be seen that Feitianyun's revenue rely on AR/VR marketing services.

Feitianyun also acknowledged in the prospectus that AR/VR marketing services are the main income of the company at present, and explained that it is based on AR/VR interactive content to provide advertising customers with the advantages of AR/VR marketing services and use technology and media resources. Provide customers with AR/VR marketing services including the formulation of AR/VR service plans, design AR/VR interactive content, and putting AR/VR interactive content, collection, monitoring and optimization data and feedback. Feitianyun also revealed that a total of more than 50 advertising customers provided AR/VR marketing services and promoted more than 250 advertising products, most of them were apps and websites.

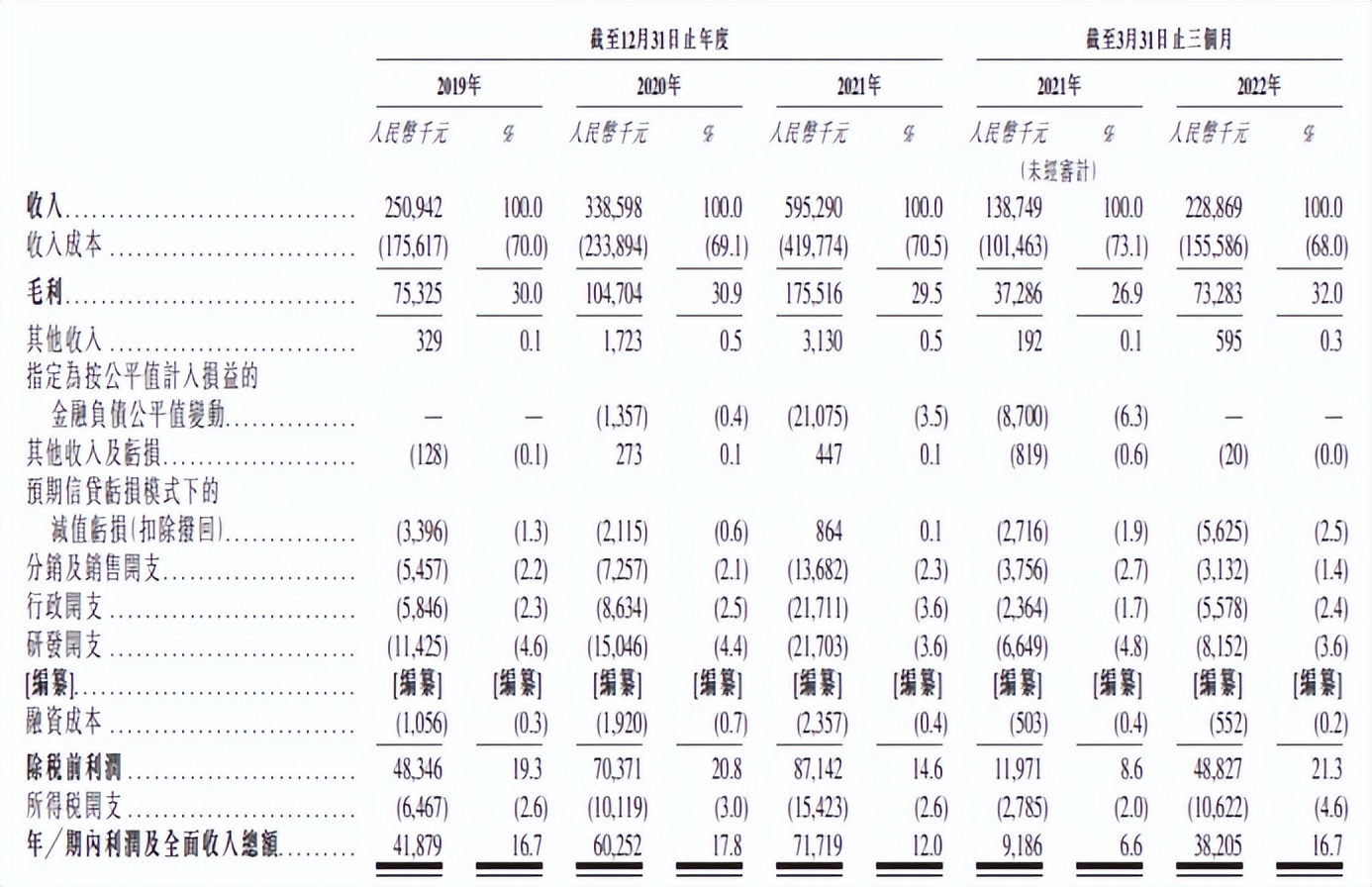

The Suluyuan Universe Research Institute also noticed that as of the first quarter of 2019, 2020, 2021, and 2022, Feitian Yunmong's income costs were 176 million yuan, 234 million yuan, 420 million yuan, 102 million yuan, and 102 million yuan, and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan and 102 million yuan. 156 million yuan, although the income cost floats large in the upper and lower, it accounts for about 70 % of the total income and remains stable.

At the same time, the prospectus also shows that Feitian Yunmong's main supplier is mainly to provide traffic platform agents and subcontracting and development services, or to provide content materials or IP companies. In the first quarter of 2019, 2020 and 2021 and 2022, the expenditures paid to the five major suppliers accounted for approximately 49.9%, 41.1%, 45.1%, and 54.2%of their income costs during their relevant periods.

It is worth mentioning that the income cost of Feitian Yunyong is mainly the cost of traffic acquisition, accounting for 65.6%, 59.2%, 74.2%, and 81.5%in the first quarter of 2019, 2020, 2021 and 2022. It can be seen that the cost of acquisition flow is high, from about 60 %, to more than 80 % in the first quarter of this year.

Feitianyun's main business pulls the gross profit margin, and the investment in investment is low

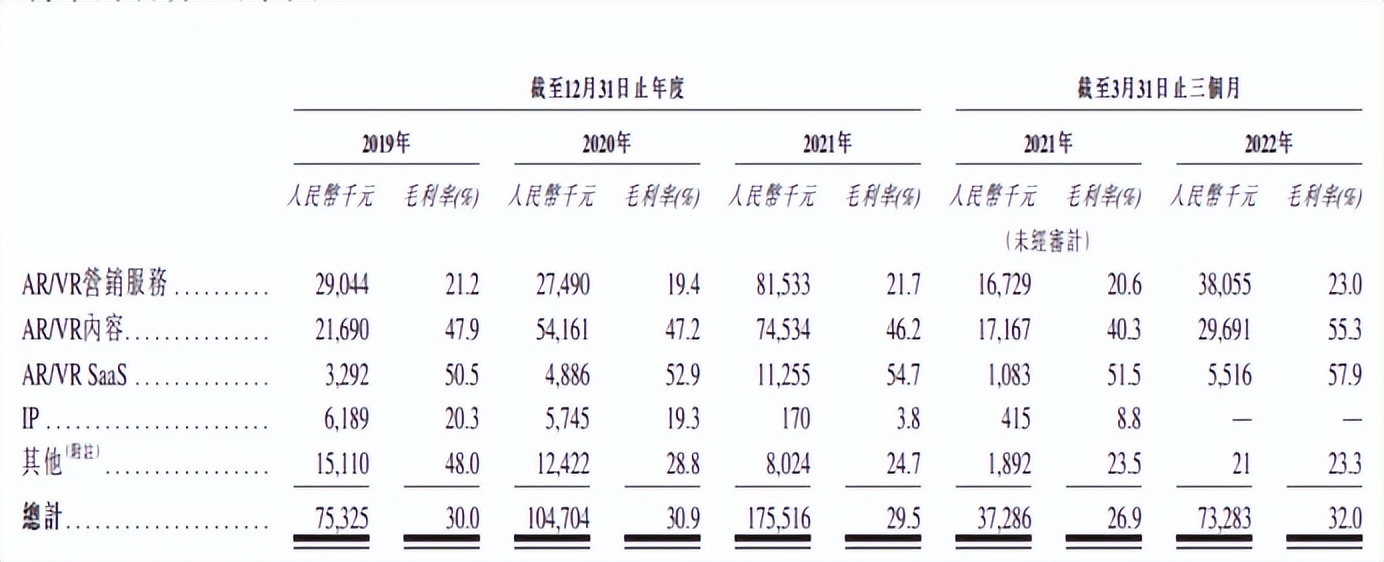

The SUOCD Cosmic Research Institute also noticed that in terms of gross profit margins, although the total revenue of AR/VR marketing services is increasing, the gross profit margins in the first quarter of 2019, 2020, 2021 and 2022 are 21.2, respectively. %, 19.4%, 21.7%, 20.6%, 23%, which is far below the gross profit margin of AR/VR content, AR/VR SaaaS related businesses.

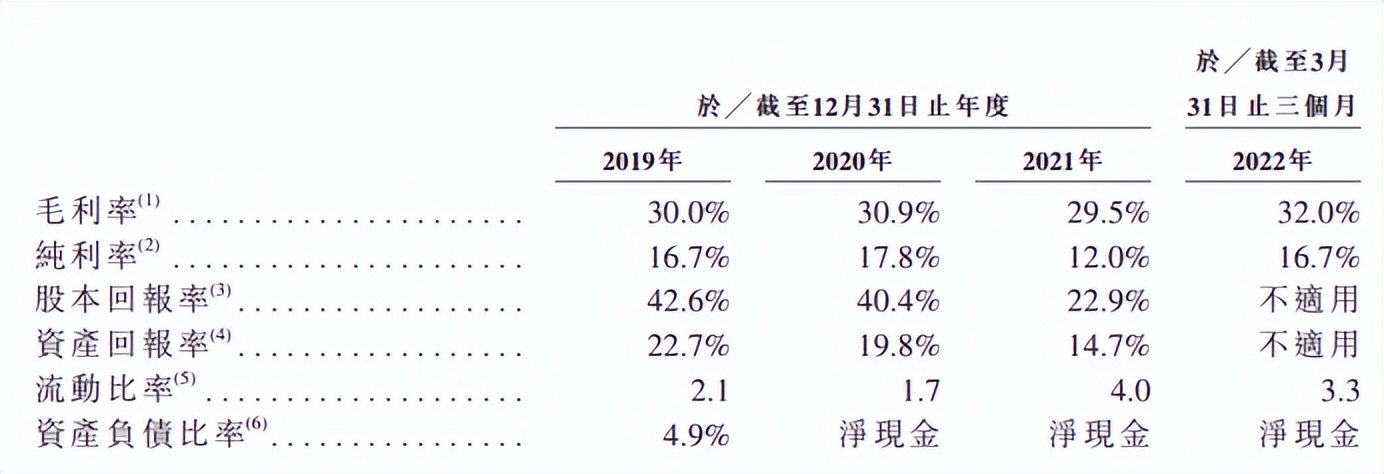

The overall gross profit margin of Feitian Yunyong in the first quarter of 2019, 2020, 2021 and 2022 was 30.0%, 30.9%, 29.5%, and 32%, respectively. It can be seen that although Feitian Yunyong's AR/VR marketing services have a large proportion of business, the proportion of the corresponding flow acquisition cost is increasing, and the overall gross profit margin is lowered.

Feitian Yunyong said in the prospectus that different products and service gross margin may also be different, so changes in product portfolios affect the overall gross profit margin. Feitian Yunmong said that its overall gross profit margin may change depending on the product and service portfolio. The gross profit margin of the AR / VR SaaS business is the highest, followed by AR / VR content and AR / VR marketing services. Low interest rates.

Of course, we also noticed that although Feitian Yunyong's acquisition of traffic has continued to rise, its gross profit margin is stable at about 30%, which is also due to its CPA, CPC or CPM pricing model. Get the cost for advertising. As the "Yuan Universe" company, Feitian Yunyong's research and development cost rate is low. In 2019, 2020 and 2021, Feitian Yunmong's R & D expenditure was 11.425 million yuan, 150.46 million yuan and 21.703 million yuan, respectively, accounting for 4.6 %, 4.4 %, and 3.6 %, respectively; the first quarter of 2022 R & D expenditure was to be the R & D expenditure was to be the first quarter of R & D expenditure to be as the R & D expenditure. 8.152 million yuan (accounting for 3.6 %), and the same period of 2021 was 6.649 million yuan (accounting for 4.8 %).

The flow ratio is reasonable, but the risk factors still exist

By calculating the rate of flow, the Sulu Yuan Universe Research Institute noticed that the development of Feitian Yunmong was relatively healthy. As of the first three months of 2019, 2020, 2021 and 2022, the mobile ratio was 2.08, 1.71, 4.05, and 3.28, respectively.

For Feitian Yunyong, it is not easy to make the first bucket of gold in the "Yuan Universe". If the advertising strategy does not meet the expected advertising goals, it may produce higher costs than forecast, affect gross profit. If these costs cannot be effectively managed, their profitability and financial performance will be adversely affected.

It is worth considering that in the prospectus, Feitian Yunmong also mentioned possible risk factors.

The first is because the AR/VR content and service industry (that is, the application layer of the Yuan universe scene) is relatively new and developing, which is affected by a variety of uncertain factors; secondly The operating history of the Yuan universe industry and the Feitian Yuan universe platform may be limited, and investors may have difficulty when evaluating business and growth; and concerns about business growth, it may not be possible to implement the business growth strategy or effectively manage its growth, it will be major disadvantages will be suffered from major disadvantages. Affairs and so on.

In addition, Feitian Yunmong also faces concentration risks and risks of opponents dependence on major customers and suppliers. The prospectus shows that a large part of Feitian Yunmong's income comes from the sales of major customers, and a large part of the total purchase amount of Feitian Yunong from major suppliers.

The prospectus shows that in the first quarter of 2019, 2020, 2021, and 2022, the five customers of Feitian Yunsong took about 46.1%, 38.5%, 39.2%, and 30.7%, respectively. During the same period, the largest customers accounted for about 12.0%, 14.2%, 10.2%, and 7.5%, respectively. During the same period, Feitian Yunmong's largest suppliers accounted for about 16.1%, 9.7%, 13.5%, and 14.8%, respectively. Therefore, Feitian Yunyong may be affected by concentrated risks from the main customers and suppliers.

The Sulu Yuan Universe Research Institute believes that in the emerging development industry of the Yuan universe, Feitian Yunmong enters the Yuan Cosmic Circle in advance and becomes an AR/VR marketing service provider. At present, the first prospectus has failed. After updating the prospectus data, it is unknown whether Feitian Yunmong can smoothly can be successfully IPO.

To be sure, the development of the industry requires capital attention. If Feitian Yunyong fails to become the "first share of the Yuan universe", it also brings more imagination to the Yuan universe industry; if it can smoothly IPO, it can also help the industry's Rapid development. The Yuan universe is the continuous integration of technology. We hope that more and more companies can focus on the development of technology and jointly build the base of the Yuan universe.

- END -

Curiously killed cats, this text message was deleted immediately!

Curiously killed catsWhen you receive the following text messagesWill you click on...

Use chemical methods to detect the universe?Yes, you didn't hear it wrong

[Illustration] Next to the earth is a sample model of the Asian Sea King Star with...