Crack "difficult financing"!Weifang High -tech Zone poured "Financial Living Water&qu

Author:China High -tech Industrial He Time:2022.06.14

Provide "one -lease" financial services, focus on dredging the "blocking point" of financing; issued policies such as risk compensation and emergency loans of the high -tech zone government, improve the corporate financing guarantee system, and further reduce the risk of credit investment in bank institutions in the region ... Since this year, Weifang High -tech has since this year, Weifang High -tech The district adheres to the prevention and control of the epidemic and the main business of the main business, and continues to deepen the reform of the "decentralization of management", focusing on the development point and pain point of small and medium -sized enterprises, further optimizing the business environment, resolving financing problems, and inserting "golden wings wings to the development of the enterprise ", Allowing" financial living water "to flow to small and medium -sized enterprises that are truly marketable, prospects, technology, and competitive, help the high -quality development of the high -tech zone in the high -quality development of the high -tech zone.

Establish a "think tank" to provide professional financing services for enterprises

Shandong Junfu Non -Weaving Materials Co., Ltd., located in Weifang High -tech Zone, was established in 2007. It is a non -woven material (non -woven) enterprise focusing on R & D, production, and supply of high -tech content. "This year, affected by the epidemic, the price of raw materials required by Junfu non -weaving companies continued to rise, the pressure of corporate mobile funds continued to increase, and the development of enterprises was blocked." Said Sun Mingyuan, deputy general manager of Shandong Junfu Non -Weaving Materials Co., Ltd.

Zhang Xia, deputy director of the Financial Supervision Center of the Weifang High -tech Zone, said: "To help the production enterprise affected by the epidemic alleviating the pressure of funds, we prefer the" think tanks "of the backbone members of banks, insurance, securities, and professional service institutions to help companies help companies Solving funds in a timely manner. "Through visiting companies, I learned that Junfu and non -weaving companies have a large demand for corporate funds. The first time they prefer the suitable financial" think tanks "members, they have repeatedly went to the company to investigate and docking the combination solution. Combined with the actual situation of the company's overseas branches, the cross -border capital operation business of CITIC Bank was reported to the Shandong Foreign Exchange Administration to realize the use of the company's overseas funds in the company. At the same time, coordinated the Huijin Guarantee Company to optimize the loan mortgage guarantee measures, replace the land mortgage of the company's stock loan, enhance financing capabilities, and add 30 million yuan in financing for enterprises.

"Be able to accurately formulate financing plans in accordance with the actual situation of our enterprises to help us make suggestions. We feel that the service is very targeted." Facing the professional services of the high -tech zone, Sun Mingyuan said with emotion.

In recent years, the Weifang High -tech Zone seized the opportunities for the first batch of special operations of the Torch Center of the Ministry of Science and Technology of the Ministry of Science and Technology, integrating financial counseling, "financial steward" resources and professional teams, and setting up corporate financing services "think tanks". By sending policies and solving problems, it provides enterprises with "one -sided" financial services, and strives to unblock the "blocking point" of financing, so that enterprises can truly feel financial warmth services and financial wisdom. Since the beginning of this year, more than 50 companies have helped solve the demand for funds of 387 million yuan.

Make good use of the "financial strategy" to open a green channel for the enterprise

In the development of enterprises, the dilemma of funding is often faced, and enterprises lack smooth and diversified financing channels. Like many companies, Shandong Tianrui Heavy Industry Co., Ltd. is also facing financing difficulties.

Recently, in the workshop of Shandong Tianrui Heavy Industry Co., Ltd., the reporter saw that the worker master was assembling magnetic suspension power equipment products. These dozens of products were newly booked this year. After the assembly was completed, it will be shipped immediately. Tianrui Heavy Industry is a leading company in the core technology of magnetic suspension power equipment. The company has the demand for funding due to product development and production scale. "We are in a period of rapid development. According to the traditional loan model, lack of mortgage." Said Pan Zhongyi, financial manager of Shandong Tianrui Heavy Industry Co., Ltd..

"After fully understanding the situation of the enterprise, we combined with the risk compensation policy of the High -tech Zone Government, we formulated the" credit+equity+patent pledge "plan to coordinate the Shandong Branch of Industrial and Commercial Bank of China Shandong Branch through the" 10 million "special channels. Take the approval 'green channel' and successfully issue a loan of 20 million yuan to the enterprise, which has become the first order of the special operation of the "10 million". "Zhang Xia said.

SMEs are important pillars of economic development and social stability. However, financing difficulties have always been an important bottleneck for SMEs to continue to develop rapidly. In response to the characteristics of light assets and high growth in technology -based enterprises, the Weifang High -tech Zone has introduced policies such as risk compensation and emergency loans of the high -tech zone government to improve the corporate financing guarantee system and further reduce the risk of credit investment in bank institutions in the region. Since the beginning of this year, with the help of government risk compensation, United Huijin Guarantee Corporation has launched financial products such as "WeCang Aid Enterprise Loan" through innovation, and provides financing support for enterprises in 658 districts to support 677 million yuan.

Not only that, the Weifang High -tech Zone through policy guidance stimulates credit potential, focusing on the location advantage of financial aggregation and industrial agglomeration around the high -tech zone, to give full play to the policy guidance of the high -tech zone to support the development of the financial industry, establish a bank institutional credit investment incentive mechanism, and report on a monthly basis Related indicators such as total credit, increase, increase, etc., enhance the awareness and responsibility awareness of financial institutions, excavate the potential of credit investment, and give commendation and policy support to financial institutions with outstanding contributions. In 2021, the credit incremental amount of the banking institutions was rewarded 1.447 million yuan. Five financial institutions were awarded the contribution of the development of the high -tech zone, accounting for 41.7%of the reward for the reward.

Serving "personalized" and "loan" for enterprises to develop "timely rain"

Shandong Xinlan Environmental Protection Technology Co., Ltd. is a domestic car urea industry leading brand and industry standard formulation enterprise. It is currently the largest car urea production enterprise in the northern private scale and the Weichai Group supply chain. "In recent years, with the strategic deployment of the national carbon peak, carbon neutralization and other strategic deployments, we have ushered in the peak of new business growth. Essence The Weifang High -tech Zone immediately organized the company's "financial steward" team to fully investigate and study. New Blue Environmental Protection is a typical technology -based enterprise, light asset operation, no suitable mortgage, and traditional credit models do not work. According to the characteristics of the enterprise, the High -tech Zone Financial Supervision Center has organized a number of banking institutions and enterprises for face -to -face doxing, and eventually the Bank of China Weifang Development Zone Branch operates 8 million yuan in credit loans.

It is reported that from January to April this year, the balance of loans in the district increased by 8.74 billion yuan compared with the beginning of the year, and the new loan ranked first in the city.

"In the next step, we will continue to innovate from the aspects of market positioning, credit policies, and scientific and technological services on the basis of fully based on the needs of corporate needs. Xiong Futao, director of the Financial Supervision Center of Weifang High -tech Zone.

Since the beginning of this year, the Weifang High -tech Zone has adhered to the prevention and control of the epidemic and the development of economic and social development. For enterprises at different fields and different stages of development, tailor -made credit products, innovate service methods, gather financial forces, effectively increase credit investment, help the entity Economic take off, providing solid support for the high -quality development of high -tech zones.

Source: Weifang High -tech Zone

Author: Zhang Yuli

Edit: Chen Nan

- END -

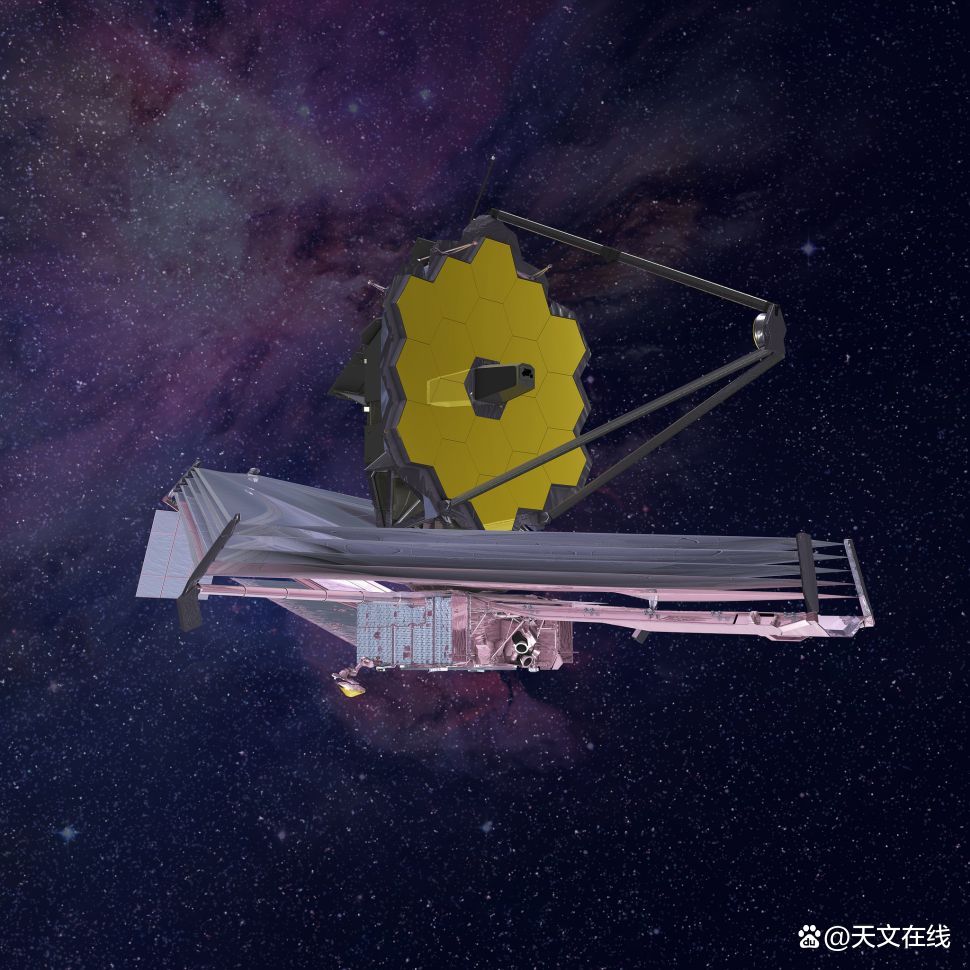

Demonstrate!After the launch of the JWST telescope, we may be able to understand the dark matter more

James Weber space telescope may help us solve the imminent mystery of dark matter....

Dialogue science-Do you really understand 5G networks?

Liu HaifeiProject Manager of China Mobile Group Shaanxi Co., Ltd.Ministry of Industry and Information Technology Wireless ExpertSenior engineerGlobal PMI memberNorthwestern University of Technology Ma