How to calculate the refund taxable tax?An article tells you

Author:State Administration of Taxati Time:2022.06.17

Since the beginning of this year, the large -scale value -added tax retaining policy has been fully implemented to help enterprises reduce burdens. Eligible companies can apply for tax refund in accordance with regulations. How to calculate the refund taxable tax? Learn together

The refund tax amount is calculated according to the following formulas:

The amount of incremental tax for refunding is allowed to reserve the tax = increase tax rate × inlet item composition ratio × 100%

Allowable to be refunded, reserved tax = stock retention tax × inlet item composition ratio × 100%

The proportion of entry composition is a special VAT invoice that has been deducted from April 2019 to a tax refund period (including the full digital electronic invoice with the word "VAT special invoice", the unified issuance of tax control motor vehicle sales ), Toll roads for general VAT electronic invoices, customs dedicated payment for value -added tax imports, and value -added taxes indicated by the tax payment certificate of tax payment accounted for the proportion of the amount of input taxes that have been deducted during the same period.

Related question and answer

Question: When the taxpayer calculates the proportion of the input entry, does it need to adjust the transfer of the input tax amount?

Answer: In accordance with the "Announcement of the State Administration of Taxation on Further Increasing the Implementation of Tax Returning Policy at the end of the VAT period" (No. 14, 2022), calculated the proportion of input composition involved in the amount involved in the refund taxable tax, which was 4, 2019. The deductive VAT invoices that have been deducted from the month to the tax refund (including the full digital electronic invoice with the word "VAT special invoice", the tax control motor vehicle sales unified invoices), the toll road traffic VAT VAT The value -added tax provided by the general invoices of electronic invoices, special value -added tax imports of customs, and the payment of tax payment certificates accounted for all the proportion of the amount of input taxes that have been deducted during the same period.

In order to alleviate the taxpayer's tax refund accounting burden, the taxpayer's input tax transfer part of the input tax period during the above calculation period does not need to be deducted without deduction.

For example: Among the input tax obtained from April 2019 to March 2022, a manufacturing taxpayer is 5 million yuan for VAT invoices, 1 million yuan for ordinary electronic invoices for roads, 200 special payment for the value -added tax import of customs For 10,000 yuan, the amount of input tax for the purchase invoice of agricultural products is 2 million yuan. In December 2021, the taxpayer had a non -normal loss due to a normal loss. Among the previously deducted VAT invoices, the amount of 500,000 yuan was transferred to the item tax in accordance with regulations. When the taxpayer applied for tax refund in April 2022 in accordance with the provisions of the 14th announcement, the calculation formula of the proportion of the input item was: the proportion of the entry items = (500+100+200) ÷ (500+100+200+200) × 100 %= 80%. The 500,000 yuan transferred from the entry items does not need to be deducted in the molecular and denominator of the above calculation formulas.

- END -

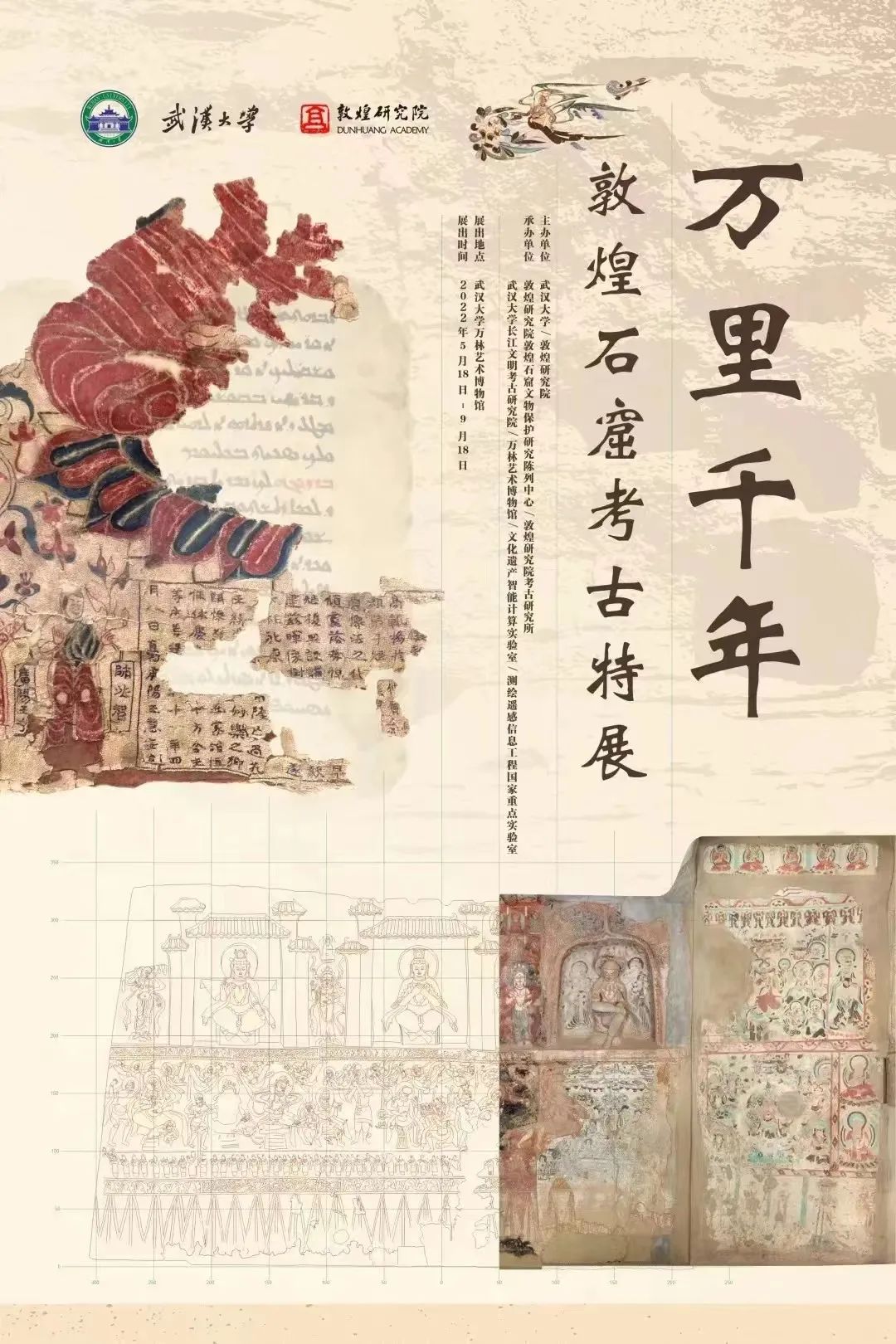

From today, the appointment channel is opened!

Personnel from outside Wuhan University to visitThousands of Miles Dunhuang Grotto...

Boshan District "Four Reinforcement" strengthens non -road mobile machinery supervision

Zibo, June 17, non -road mobile machinery is mostly leased, which has the characteristics of liquidity and concealment, and it is difficult to environmental supervision. In order to realize the reduct