Don't worry, cheer!The oil price is adjusted tonight, and it will spend more than 40 yuan in a box of over -full boxes.

Author:Shijiazhuang Daily client Time:2022.08.09

At 24:00 today (August 9), a new round of domestic oil -based price -adjustment windows will be opened. Institutions generally predict that domestic oil prices in this round are highly probably ushered in the "four consecutive declines", and it is also the fifth reduction in the year.

During this round of pricing cycle, the international oil prices are strong and weak. On August 5, local time, the lightweight crude oil futures delivered in September of the New York Commodity Exchange closed at $ 89.01 per barrel, down 9.74%from July 28; The barrel 94.92 US dollars fell 8.70%from July 29.

In terms of news, on August 3, local time, OPEC+announced that the daily oil production in September increased by 100,000 barrels. Reuters reports that this will be the minimum increase since the introduction of OPEC's introduction in 1982, which is equivalent to 86 seconds worldwide. In addition, OPEC+will hold the next meeting on September 5. In a statement, the organization said that limited idle capacity needs to be used cautiously when dealing with severe supply interruption.

In terms of inventory, on August 3, data released by the US Energy Information Administration (EIA) showed that as of July 29, EIA crude oil inventory increased by 4.467 million barrels and expected to reduce 629,000 barrels.

Regarding the changes in crude oil prices, Hu Xue analyzed by Zhongyu Information analyst said that international crude oil has remained strong under the influence of inventory fall and OPEC+negative production in the early stage, but after August, after entering August The impact of rising and the Asian epidemic counterattack, and international oil prices began to fluctuate.

Xu Na, an analyst of Zhuochuang Information, pointed out that since this round of pricing cycle, the bottom of the international oil price has continued to move down, the change rate of crude oil changes from positive and negative, and the price adjustment has been transformed from stranding downward. Zhuochuang Information Data Monitoring model shows that as of the close of August 5, the reference rate of reference to the reference of crude oil was -1.62%for the ninth working day in China, and it is expected that auto and diesel will be reduced by 80 yuan/ton. Calculated by liters is 0.06 yuan at 92 gasoline, and No. 95 gasoline and No. 0 diesel are reduced by 0.07 yuan, respectively.

According to Zhongyu Information Data, as of August 8th, the ninth working day of this round, Zhongyu crude oil was valued at $ 99.89/barrel, and the crude oil was changed by $ 1.34/barrel or -1.45%. /Ton.

According to the calculation of Jinlianchuang, as of the 9th working day of August 8th, the average price of reference to crude oil was $ 99.38/barrel, and the change rate was -1.64%, which corresponds to 110 yuan/ton corresponding to steam and diesel.

The minimum prediction value of the above three institutions and the capacity of the fuel tank capacity of 50L are calculated. The full box of 92 gasoline will be spent 3 yuan. Coupled with the previous three cumulative reduction of 38.5 yuan, it will spend less than 41.5 yuan for a box.

According to statistics, the price of domestic refined oil in 2022 has undergone 14 rounds of adjustments. The total amount of gasoline was raised by 1740 yuan/ton, and the total price of diesel was raised by 1,675 yuan/ton, showing the "ten rises and four declines and zero stranded" pattern. If the price is reduced in this price, the price adjustment of the refined oil oil in 2022 will show the "ten rises and five declines and zero stranded" pattern, and will also be the first "four consecutive declines" since 2019. Prior to this, the refined oil price adjustment was for the "five consecutive declines" in 2018.

According to the "ten working days" principle, the next round of price adjustment window is 24:00 on August 23.

The Ping An Futures Report pointed out that although OPEC+increased production is significantly less than expected, the global major economic manufacturing index has fallen, and the consumption of crude oil, and the decline in crude oil consumption will suppress oil prices. The US crude oil inventory rose last week. At the same time, the US gasoline inventory continued to rise since the inventory low point on June 10, showing that the terminal demand was weak. The current US gasoline fissure price difference has declined, driving the decline in the operating rate of American refineries, which is not good for crude oil consumption to consume crude oil consumption. Essence

Source: Zhong Xin Jingwei

- END -

"Prevention of epidemic, stabilize the economy, and safeguard safety" Visit large investigation | Create a better innovation environment, so that the automotive industry can achieve better development in Pudong!District leaders went to Jinqiao Economic and Technological Development Zone to

On the morning of August 8th, Zhu Zhisong, member of the Standing Committee of ...

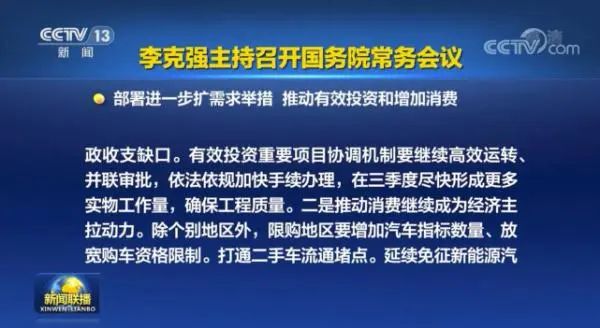

The policy exemption policy is determined that the purchase tax of new energy vehicles will continue to be "free"

On July 29, the executive meeting of the State Council deployed further expansion ...