Yatong Seiko's new and old two version of the prospectus purchasing data changing investment project or exaggerated environmental investment amount

Author:Jin Ziyan Time:2022.07.04

"Golden Syllabus" northern capital center Nanfeng/Author courts/risk control

Laizhou is located in the northwest of the Jiaodong Peninsula. It is located at the junction of Yantai, Qingdao, and Weifang. Yantai Yatong Precision Machinery Co., Ltd. (hereinafter referred to as "Yatong Seiko"), which is located in this seaside city, may face many tests.

Among them, the other side of Yatong Seiko's downstream automobile industry has "encountered cold" in recent years. Behind its performance growth in 2020, it is difficult to eliminate dependence on sales. In addition, the two versions of Yatong Seiko's prospectus about the purchasing data of steel are "not right". In addition, the environmental protection issues involved in the fundraising project and the amount of environmental protection investment are inconsistent with the official environmental assessment documents announced, and the quality of the letter or hidden worry.

1. The growth of the downstream automobile industry showed "fatigue", intensified sales or "pretending to be pretty" performance

You can't hold it, hold your body. The changes in the demand for downstream industry are one of the main factors affecting the income of the upstream industry.

In recent years, Yatong Seiko's downstream automobile industry or "cooling".

1.1 Automobile parts business, contribute to Yatong Seiko more than 70 % of the main business income

According to Yatong Precision Works, signed by the prospectus (hereinafter referred to as the "Prospectus") signed on November 1, 2021, according to the "Classification of the National Economic Industry", Yatong Precision Motor Automobile Parts Business, the industry is in the automotive manufacturing industry in the automotive manufacturing industry Manufacturing of car parts and accessories. Yatong Seiko is mainly engaged in the research and development, production, sales and services of automobile parts and mining assisted transportation equipment.

From January to June, 2018-2020 and 2021, the main business revenue of Yatong Seiko was 802 million yuan, 919 million yuan, 1.204 billion yuan, and 756 million yuan, respectively. %, 91.24%, 91.6%, 90.33%. During the same period, the operating income of Yatong Precision Motor Parts Business was 672 million yuan, 715 million yuan, 971 million yuan, and 581 million yuan, respectively, accounting for 83.81%, 77.8%, and 80.63, respectively. %, 76.88%.

In addition, from January to June 2020 and 2021, the export revenue of Yatong Precision Products accounted for less than 1%of its current main business income, and the export business amount was small Essence

In other words, more than 70 % of Yatong Seiko's sales revenue comes from automotive parts business, and its main market is the domestic market.

1.2 In recent years, the growth rate of domestic auto parts manufacturing revenue has declined as a whole

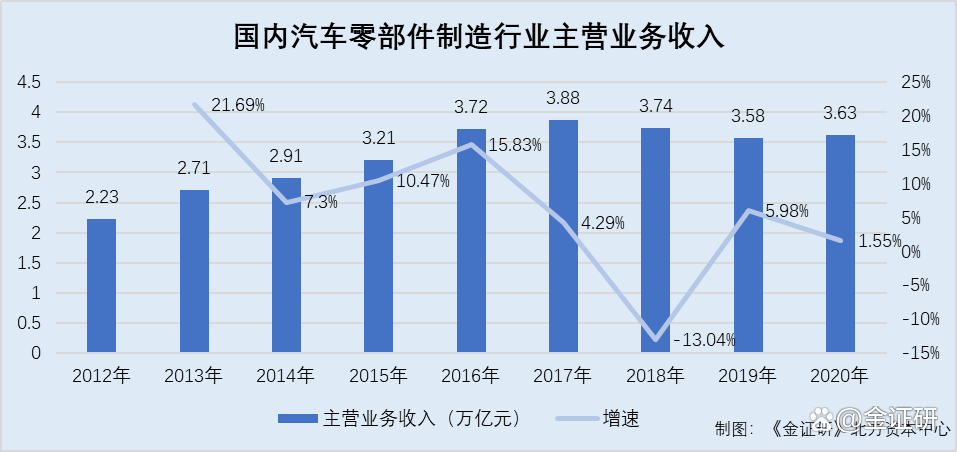

According to the prospectus signed by Mingke Salmonic Holdings Co., Ltd. on December 15, 2021 (hereinafter referred to as the "Mingke Smart Prospectus"), in 2012-2020, the main business income of the domestic automobile parts manufacturing industry respectively It was 2.23 trillion yuan, 2.71 trillion yuan, 2.91 trillion yuan, 3.21 trillion yuan, 3.72 trillion yuan, 3.88 trillion yuan, 3.37 trillion yuan, 3.58 trillion yuan, 3.63 trillion yuan. From 2013-2020, the year-on-year growth rate of the main business income of the domestic automobile parts manufacturing industry was 21.69%, 7.3%, 10.47%, 15.83%, 4.29%, -13.04%, 5.98%, 1.55%.

Since 2018, the largest business automobile parts of Yatong Seiko, the growth rate of the main business income of its ownership business in the industry has declined as a whole.

It is restless that the production and sales of the downstream automobile industry in Yatong also declined.

1.3 downstream automobile industry, domestic automobile production and sales have declined for many years in a row

According to the prospectus, the downstream of automobile parts is mainly automobile manufacturers.

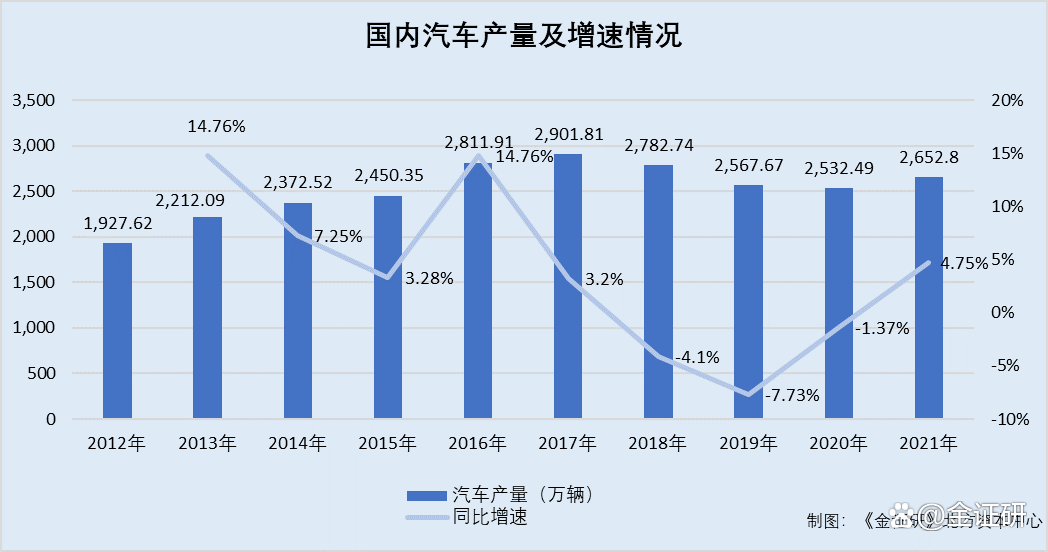

According to data from the National Bureau of Statistics, from 2012 to 2021, the production of domestic automobiles was 192.762 million, 22.129 million, 23.725 million, 24.5035 million, 28.191 million, 29.018 million, 27.827 million vehicles, 25.67 million vehicles, 25.324 million vehicles, 25.324 million 26.528 million vehicles.

According to the research of the Northern Capital Center of Golden Evulation, from 2013-2021, the year-on-year growth rate of domestic automobile production was 14.76%, 7.25%, 3.28%, 14.76%, 3.2%,-4.1%, -7.73%, -1.37% , 4.75%.

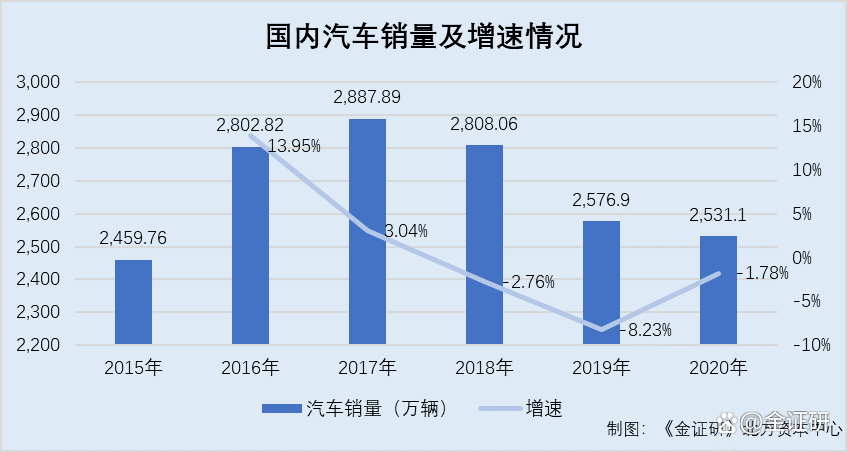

According to data from the Automobile Industry Association, from 2015 to 2020, domestic cars were sold for 24.5976 million vehicles, 28.028 million vehicles, 28.889 million vehicles, 2,808,600 vehicles, 25.769 million vehicles, and 25.31 million units.

According to the research of the Northern Capital Center of "Jin Securities", from 2016-2020, the year-on-year growth rate of domestic automobile sales was 13.95%, 3.04%,-2.76%, -8.23%, -1.78%.

It can be seen that from 2016-2020, domestic automobile production and sales are declining. At the same time, since 2018, the growth rate of domestic automobile sales has been in a negative growth trend. Although the output of domestic automobiles increased from 2020 in 2021, it has not reached the level of 2018.

It should be noted that Yatong Seiko's net profit declined in 2019.

1.4 The net profit declined in 2019, the net profit growth rate in 2020 exceeded 80%

According to the prospectus, from January to June 2020 and 2021, Yatong Jingong's operating income was 858 million yuan, 1.07 billion yuan, 1315 billion yuan, and 837 million yuan. During the same period, Yatong Seiko's net profit was 111 million yuan, 105 million yuan, 192 million yuan, and 103 million yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2019 to 2020, the operating income growth rate of Yatong Jingong was 17.35%and 30.6%, respectively, and the net profit growth rate was -5.14%and 82.46%, respectively.

However, behind Yatong Seiko's "beautiful" performance, it may be supported by sale.

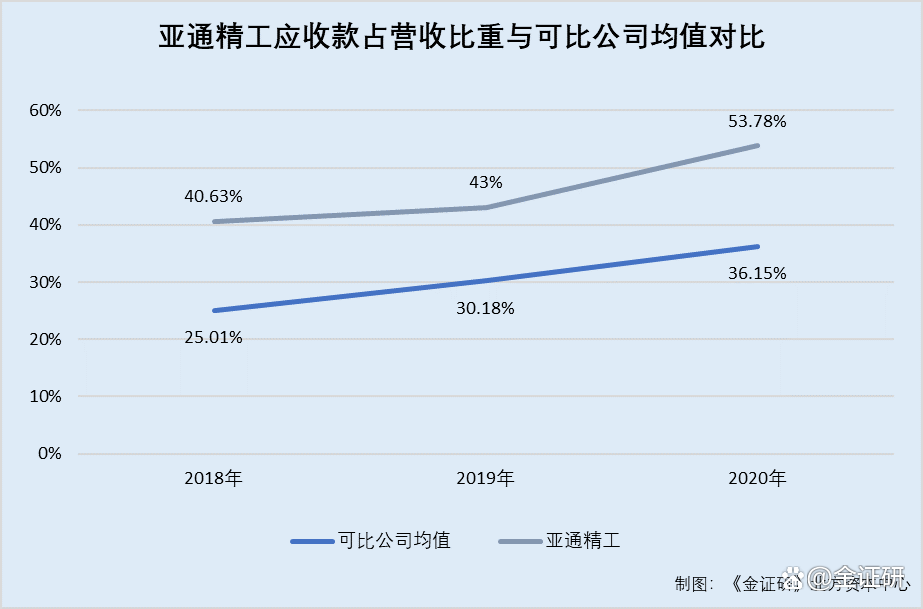

1.5 In 2020, the proportion of revenue receivables increased to more than 50 %, and higher than the average value of the peers

According to the prospectus, at the end of each period of 2018-2020 and January to June 2021, Yatong Seiko's receivables were 109 million yuan, 67 million yuan, 178 million yuan, and 206 million yuan. 100 million yuan, 355 million yuan, 477 million yuan, and 521 million yuan, receivable financing was 0 yuan, 11.223 million yuan, 52.949 million yuan, and 99,100.61 million yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2018-2020 and January to June 2021, Yatong Seiko's receivables, accounts receivables, and receivable financing (hereinafter referred to as "receivable" receivable "receivable ")) 349 million yuan, 433 million yuan, 707 million yuan, and 826 million yuan, respectively, accounted for 40.63%, 43%, 53.78%, and 98.74%of Yatong Jingye's current operating income.

In addition, Yatong Seiko's receivables accounted for its operating income higher than its comparable company in the same industry.

According to the prospectus, Yatong Seiko has a total of six comparison companies in the same industry, namely Hefei Changqing Machinery Co., Ltd. (hereinafter referred to as "Changqing Co., Ltd.") and Huada Automobile Technology Co., Ltd. (hereinafter referred to as "Huada Technology") Shanghai Lianming Machinery Co., Ltd. (hereinafter referred to as "Lianming Co., Ltd."), Suzhou Jinhongshun Automobile Parts Co., Ltd. (hereinafter referred to as "Jin Hongshun"), Zhejiang Changhua Automobile Parts Co., Ltd. (hereinafter referred to as "Changhua Co., Ltd." ), Wuxi Zhenhua Automobile Components Co., Ltd. (hereinafter referred to as "Wuxi Zhenhua").

According to the annual report of Changqing's 2019-2021, from 2018 to 2020, the receivables of Changqing shares were 85 million yuan, 144 million yuan, and 134 million yuan, respectively. The accounts receivables were 228 million yuan and 228 million yuan, respectively , 448 million yuan, the receivable financing was 0 yuan, 110 million yuan, and 60 million yuan, respectively. During the same period, Changqing's operating income was 1.874 billion yuan, 1.834 billion yuan, and 2.297 billion yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2018 to 2020, the receivables of Changqing shares were 313 million yuan, 482 million yuan, and 543 million yuan, respectively. %, 26.29%, 23.66%.

According to the annual report of Huada Technology's 2019-2021, from 2018 to 2020, the receivables receivables of Huada Technology were 122 million yuan, 188 million yuan, and 129 million yuan, respectively, and the receivables were 739 million yuan and 772 million yuan, respectively. , 899 million yuan, the receivable financing was 0 yuan, 0 yuan, and 64 million yuan, respectively. During the same period, Huada Technology's operating income was 4.052 billion yuan, 4.178 billion yuan, and 4.134 billion yuan, respectively.

According to the research of the Northern Capital Center of Golden Syllabus, from 2018-2020, Huada Technology's receivables were 861 million yuan, 960 million yuan, and 1.092 billion yuan, respectively, and their current operating income of Huada Technology was 21.25, respectively. %, 22.99%, 26.41%.

According to the annual report of Lianming's 2019-2021, from 2018 to 2020, Lianming's receivables were 9.69 million yuan, 0 yuan, and 0 yuan, respectively, and the accounts receivable were 328 million yuan, 234 million yuan, and 3.27 3.27, respectively. 100 million yuan, receivable financing was 0 yuan, 26.3077 million yuan, and 47.8803 million yuan, respectively. During the same period, Lianming's operating income was 1.098 billion yuan, 1.036 billion yuan, and 1.121 billion yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2018 to 2020, Lianming's receivables were 338 million yuan, 260 million yuan, and 375 million yuan, respectively, and their proportion of the current operating income of Lianming shares was 30.74, respectively. %, 25.14%, 33.45%.

According to the annual report of Jin Hongshun 2019-2021, from 2018 to 2020, Jin Hongshun's receivables were 819.603 million yuan, 26.909 million yuan, and 141.578 million yuan, and the receivables were 227 million yuan, 225 million yuan, and 154 million yuan. The financing of receivables is 0 yuan, 43.418 million yuan, and 55.3417 million yuan, respectively. During the same period, Jin Hongshun's operating income was 1.07 billion yuan, 768 million yuan, and 470 million yuan, respectively.

According to the research of the Northern Capital Center of "Jin Si Yan", from 2018 to 2020, Jin Hongshun's receivables were 309 million yuan, 295 million yuan, and 224 million yuan, respectively, and it accounted for 28.89%and 38.41%of Jin Hongshun's current operating income, respectively. , 47.65%. According to the prospectus signed on September 16, 2020 (hereinafter referred to as the "Changhua Shares") and its 2020-2021 annual report, from 2018-2020, the receivables of Changhua shares are 0.66, respectively. 100 million yuan, 112 million yuan, and 136 million yuan, accounts receivables of 250 million yuan, 212 million yuan, and 215 million yuan, respectively. During the same period, Changhua's operating income was 1.518 billion yuan, 1.431 billion yuan, and 1.454 billion yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2018 to 2020, the receivables of Changhua shares were 315 million yuan, 324 million yuan, and 352 million yuan, respectively. %, 22.66%, 24.2%.

According to the prospectus signed by Wuxi Zhenhua on May 25, 2021 (hereinafter referred to as the "Wuxi Zhenhua Prospectus") and its 2021 annual report, from 2018-2020, Wuxi Zhenhua's receivables are 21.5014 million yuan, respectively. 13.012 million yuan and 667,900 yuan, the receivables were 463 million yuan, 610 million yuan, and 755 million yuan, respectively. During the same period, Wuxi Zhenhua's operating income was 1.527 billion yuan, 1.569 billion yuan, and 1.417 billion yuan, respectively.

According to the research of the Northern Capital Center of "Golden Syllabus", from 2018 to 2020, Wuxi Zhenhua's receivables were 484 million yuan, 716 million yuan, and 871 million yuan, respectively. %, 45.6%, 61.51%.

According to the research of the Northern Capital Center of the "Syllarsians", from 2018-2020, the average value of the comparison company receivables of Yatong Precision Industry in the industry is 25.01%, 30.18%, and 36.15%, respectively.

In 2020, the net profit of Yatong Seiko increased by 82.46%year -on -year, while the proportion of receivables of that year rose to 53.78%, and the difference between this ratio with the peers was expanding. Behind the "gorgeous turn" of Yatong Jingye's net profit, it is supported by sales.

The data disclosed by the two versions of Yatong Seiko may also be worthy of attention.

Second, the two versions of the prospectus of the steel procurement data of the steel procurement data, the audit institution's alert letter or difficult to diligently duty

If you don't believe it, you can't do it. Information disclosure is an important "window" for investors to understand listed companies. However, the two editions of Yatong Seiko

The prospectus discloses its purchase data for steel, or contradictions.

2.1 The purchase amount of steel in 2020 disclosed in the first version of the prospectus is more than 174.46 million yuan than the prospectus

According to the prospectus, the automobile parts operated by Yatong Seiko are mainly stamping and welding parts, and its upstream industry is the steel industry. Among them, the production materials provided by the steel industry include cold -rolled steel, hot -rolled steel, galvanized plate and other steel. The proportion of steel procurement for the main raw materials of Yatong Seiko is about 50%.

According to Yutong Precision, the promotion of the prospectus signed on June 18, 2021 (hereinafter referred to as the "first edition of the prospectus"), from 2018 to 2020, the purchase amount of Yatong Precision Steel was 297 million yuan and 263 million yuan, respectively. , 460 million yuan, the purchases were 56,800 tons, 55,500 tons, and 98,200 tons, respectively.

According to the prospectus, from 2018 to 2020, the procurement of Yatong Jingye Steel was 297 million yuan, 263 million yuan, and 442 million yuan, respectively, and the purchases were 56,800 tons, 55,500 tons, and 96,900 tons.

According to the research of the Northern Capital Center of "Jin Securities", in 2020, the amount and procurement of the steel procurement and procurement disclosed by Yatong Seiko's prospectus were less than 1,746,600 yuan and 1,292 tons disclosed in the first version of the prospectus.

It is worth mentioning that the accounting policy changes, accounting errors, retrospective adjustments, etc. in the two versions of Yatong Seiko, or have not affected the purchasing data.

2.2 In the two versions of the prospectus, the scope of the merger and change, the change of accounting policy, and the error of accounting are more correct or did not affect

According to the prospectus and the first edition of the prospectus, from 2018-2020, the scope of the merger statement of the two version of the two editions of Yatong Precision and its changes.

Except for the scope of mergers, the accounting policies of the two versions of the prospectus are consistent, and the financial data of 2020 will not have an impact.

According to the prospectus, starting from January 1, 2019, the "Corporate Accounting Standards No. 22-Financial Tool Confirmation and Measurement" issued by the Ministry of Finance, March 31, 2017, and the Enterprise Accounting Standard No. 23 The transfer of financial assets, "Corporate Accounting Standards No. 24-Set Accounting", "Enterprise Accounting Standards No. 37-Financial Tools List", and traceable and adjusted the classification and measurement of financial instruments.

In addition, Yatong Seiko compares the comparative statement according to the financial report format [2019] No. 6 and Tanian [2019] No. 16, and adopts the subjects that are adjusted by the retrospective adjustment method to the "receivables and accounts receivables" in 2018. , "Notes receivables", "account receivables", "receivables and account payables", "bills payable", "account payable". Yatong Precision Workers' Executive Enterprise Accounting Standards No. 14 -Income "released by the Ministry of Finance on July 5, 2017 will be implemented on July 5, 2017. The revenue confirmation method covers the income confirmation of the sales business and providing service business. According to the prospectus, on April 30, 2019, the "Notice on Amending and Revised and Revised the Format of the 2019 General Enterprise Financial Press" issued by the Ministry of Finance requires enterprises It is divided into "receivables" and "account receivables", and adds "receivable financing" projects to merge "receivables" and "interest receivables" to "other receivables" projects.

Secondly, the Ministry of Finance requires enterprises to merge the "fixed asset cleanup" in the balance sheet to the "fixed assets" project, and to merge "engineering materials" to the "construction project" project. Disassemble the "payable bills and account payables" projects into "bills payable" and "account payables", merge "payable dividends" and "interest payable" to "other payables" projects, and "special payments". Merge to the "long -term payment" project.

Again, the Ministry of Finance requires enterprises to increase the details of the "financial assets measured at amplifier cost to terminate the confirmation income" under the income project in the profit statement. The "R & D expenses" project increased the amount of invisible asset amortization of the management expenses, and split "interest expenses" and "interest income" details projects under financial expenses projects.

According to the first edition of the prospectus, Yatong Seiko compiles comparative reports based on the financial statements specified in the financial account [2019] No. 6, and the accounting of accounting [2019] No. 16, and adopts the subjects that are adjusted by the retrospective adjustment method. Accounts receivable "," receivables "," account receivables "," receivables and bills payable "," bills payable "," account payable ".

In addition, Yatong Seiko has implemented the "Enterprise Accounting Standards No. 14 -Income" released by the Ministry of Finance on July 5, 2017. The revenue confirmation method covers the income confirmation of the sales business and providing service business.

According to the first edition of the prospectus, on April 30, 2019, the "Notice on the Revision and issued the 2019 General Enterprise Financial Statement Format" issued by the Ministry of Finance is required to "pay the bills and accounts receivables" in the balance sheet of the balance sheet The banking project is divided into "receivables" and "account receivables", and the "receivable financing financing" project is added, and "receivables" and "interest receivables" are merged to "other receivables" projects Essence

Secondly, the Ministry of Finance requires enterprises to merge the "fixed asset cleanup" in the balance sheet to the "fixed assets" project, and to merge "engineering materials" to the "construction project" project. Disassemble the "payable bills and account payables" projects into "bills payable" and "account payables", merge "payable dividends" and "interest payable" to "other payables" projects, and "special payments". Merge to the "long -term payment" project.

Again, the Ministry of Finance requires enterprises to increase the details of the "financial assets measured at amplifier cost to terminate the confirmation income" under the income project in the profit statement. The "R & D expenses" project increased the amount of invisible asset amortization of the management expenses, and split "interest expenses" and "interest income" details projects under financial expenses projects.

In addition, the two versions of Yatong Seiko did not have "accounting errors correction" and "major accounting estimation changes" and other related content.

The above situation means that the accounts of Yatong Seiko's accounting policy, changes in accounting estimates, accounting errors, income confirmation methods and traceability adjustments have not affected the above purchases of Yatong Precision.

In addition, the audit institution serving Yatong Seiko was issued a warning letter from 2021-2022.

2.3 Audit institution Rongcheng Accountants, was supervised and warned for audit issues

According to the prospectus, this time it was listed, Yatong Precident's accounting firms were Rongcheng Accounting Firm (special common partnership) (hereinafter referred to as "Rongcheng Institute").

According to documents of Beijing Securities Regulatory Bureau [2022] No. 72, on April 24, 2022, Rongcheng's LeTV Information Technology (Beijing) Co., Ltd. Co., Ltd. in 2010 to 2014, in the practice of auditing projects of financial statements Insufficient implementation and income audit procedures are not in place, and the Beijing Securities Regulatory Bureau has adopted supervision and management measures with alert letter.

According to the Shanghai Stock Exchange [2021] No. 19 Supervision measures, on November 15, 2021, Rongcheng Institute was the first public offering of shares in Saih Hak Smart Equipment Shanghai Co., Ltd. (hereinafter referred to as "Saah Smart") Apply for a project declaration accountant. Among them, Rongcheng Institute does not prudent the research and development investment in Saich Intelligent, has not strictly obeyed relevant practice specifications, has not fully paid attention to abnormal situations related to the internal control of R & D and invested in internal control. In violation of the relevant provisions of the "Shanghai Stock Exchange Science and Technology Innovation Board Stock Exchange and Listing Regulations", the Shanghai Stock Exchange was punished by the Shanghai Stock Exchange. In short, the 2020 steel procurement data disclosed in the two editions of the two editions of the two editions of the two editions of the two editions of the two editions. And in November and April 2022, Rong Cheng, Audit Institution of Yatong Precision, was warned for practicing problems. In this regard, is the real performance of Yatong Precision Data?

In addition, the fundraising project of Yatong Seiko is also "suspicious".

3. Prospectus or "exaggerated" fundraising projects, environmental protection investment, environmental assessment agencies were fascinated by the quality of environmental assessment reports due to the quality of environmental assessment reports

Observing environmental protection laws and regulations is the basic requirement for enterprises to perform social responsibility. It is strange that the environmental content involved in a raising project of Yatong Seiko is not in line with the "official announcement".

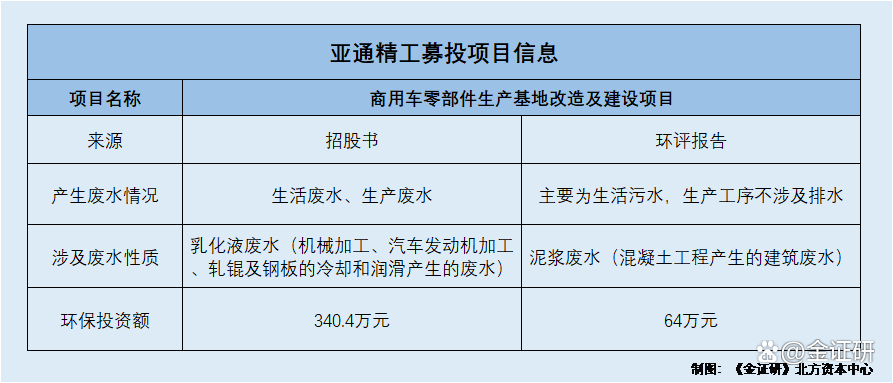

3.1 "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" is a fundraising project. The prospectus calls it involved in production wastewater

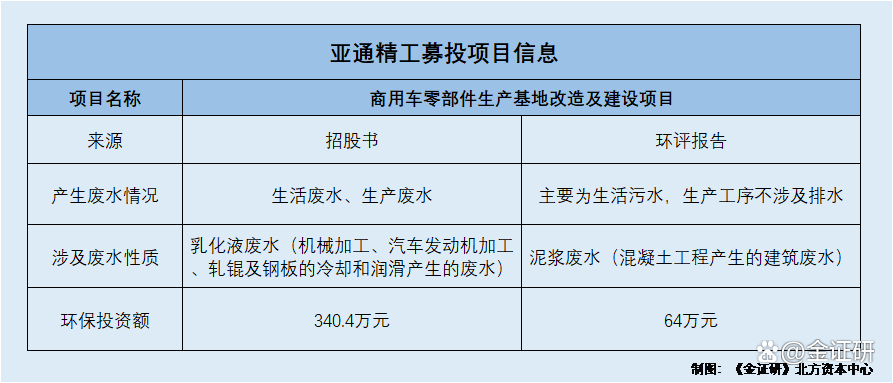

According to the prospectus, the "Reconstruction and Construction Project of Commercial Vehicle Parts Production Base" is one of the Yutong Precision Revolution. The total investment of the project is 264 million yuan. The project filing number is "Change of the Investment Technology Reform [2020] No. 87", and the EIA approval number is "Zhanghuan Report Form (Temperature) [2020] No. 134". The project implementation is implemented. The main body is Jinan Luxin Metal Products Co., Ltd. (hereinafter referred to as "Jinan Luxin").

The prospectus shows that the "Transformation and Construction Project of Commercial Vehicle Parts Production Base" includes two parts: technical reform and new construction. In order to use the existing factory area of Jinan Lulu, the technical reform part has existing constructs for technical transformation, increasing key equipment, and improving the automation level and production efficiency of the production line. The new part of the new part of Jinan Lulu is newly -welded plant and logistics door guards to add key process equipment to improve the level of process and equipment and product production efficiency, and meet the needs of production.

The pollutants generated by the fundraising project are mainly the domestic sewage produced by the personnel and the wastewater, noise, vibration, waste gas, dust, solid waste, etc. produced in the production process.

It should be noted that the production wastewater production of the project is mainly emulsified wastewater. It is artificially collected by units with artificial collection to relevant qualified units, and discharged after the processing is up to the standard. The domestic sewage is mainly a domestic sewage in the plant area. After the processing of the end -ended septic tank of the management network, it is arranged to the sewage drainage pipe network of municipal roads around the factory area.

And emulsified fluid waste water is a difficult industrial wastewater.

According to public information, emulsification solution is widely used in mechanical processing, automotive engine processing, cooling and lubrication of steel plates and steel plates. During the cycle use, it is affected by metal dust and the surrounding environment medium, and aging and deterioration must be replaced regularly. The replacement of the chemical properties of emulsification liquid wastewater is extremely stable, which brings great difficulty to handle. At the same time, emulsification fluid wastewater, as a difficult industrial wastewater, has a very high chemical stability and pollution load.

That is to say, Yatong Seiko claims in the prospectus that it will take corresponding prevention and control measures for production wastewater and living waste water generated by the "commercial vehicle parts production base transformation and construction project".

3.2 However, the pollutants generated in the environmental assessment report of the project are not like this

According to the EIA report, the wastewater of the project is mainly a domestic sewage and the production process does not involve drainage

According to the Zhanghuan Report Form (Ceremony) [2020] No. 134 "announced by the Jinan Ecological and Environment Bureau on October 9, 2020 (hereinafter referred to as the" EIA approval "), and the approval number is" Reconstruction of the Zhangxing Trial Investment Technology Reform [ 2020] EIA document (hereinafter referred to as "EIA Report"). The construction unit of "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" is Jinan Luxin and the total investment is 264 million yuan.

After comparing the EIA approval number, approval number, construction unit, project name, and investment amount of the EIA approval, it is consistent with the information of the "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" disclosed by Yatong Seiko Prosuction. The EIA approval project and the Yatong Seiko -investment project "Reconstruction and Construction Project of Commercial Vehicle Parts Production Base" is the same project.

According to the EIA report, the "Transformation and Construction Project of Commercial Vehicle Parts Production Base" itself does not produce wastewater. At present, the domestic sewage is treated in the greening of the factory area after the treatment of the Zhongshui Station of the plant. After the completion of the sewage treatment plant of Jidong Zhizhi New City Park, the domestic sewage is discharged into the sewage treatment plant of the Jidong Zhizhi New City Park for treatment.

The wastewater generated in the construction of the project is mainly a domestic sewage. According to the actual situation of the project, the amount of wastewater in the project is small, and it is used for comprehensive use of local transportation. During the construction period, basic engineering and concrete engineering will generate a small amount of mortar water, rinse water and other buildings such as wastewater. After the simple sedimentation tank is treated, it will be used for replacement, but it does not affect the surrounding surface water environment. Among them, the wastewater generated by the project construction period is mainly mud wastewater, and wastewater does not produce wastewater during the operating period of the project. In addition, the production process of the project does not involve drainage.

In other words, Yatong Seiko said in the prospectus that "the transformation and construction project of commercial vehicle components production bases" will produce wastewater production, the nature of wastewater is "emulsified wastewater", and the industrial wastewater that is dilemma is difficult, and the recruitment is the fundraising. The environmental assessment report of the investment project disclosed that the project did not generate waste water during the operation.

In addition, the project's environmental investment amount also "fights" with the EIA report.

3.3 The prospectus discloses the environmental investment amount of the fundraising project, which is more than 2 million yuan higher than the EIA report

According to the prospectus, Yatong Seiko ’s investment project has a total investment of 8.7289 million yuan. Among them, the environmental protection investment of the "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" is 3.404 million yuan.

According to the EIA report, the environmental protection investment of the "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" is 640,000 yuan.

According to the research of the Northern Capital Center of the "Syllarsians", the amount disclosed by the prospectus was 27.64 million yuan more than the environmental investment amount of commercial vehicle component production bases and the construction project of the construction project.

On the other hand, the environmental impact assessment unit of Yatong Seiko's fundraising project is included in the list of "key supervision and inspection".

3.4 The EIA unit of the fundraising project has cumulatively scored 10 points due to the quality of the report.

According to the EIA report, the environmental assessment unit of the "Commercial Vehicle Parts Production Base Reconstruction and Construction Project" is Shandong Jiayi Environmental Animal Management Co., Ltd. (hereinafter referred to as "Shandong Jiayi"), and the environmental assessment engineer is Zhang Hao.

According to the environmental impact evaluation credit platform, as of July 2, 2022, Shandong Jiayi was notified for criticism due to the quality of the environmental assessment report. Shandong Jiayi has two records of disciplinary punishment. The cumulative score is 10 points, which is currently included in the list of "key supervision and inspection".

According to Document [2021] No. 39, the environmental assessment reports compiled by Shandong Jiaan did not calculate the discharge and emission concentration of organic matter because they did not calculate the normal adsorption status, adsorption and parsing status at the same time, and did not give the analysis of waste gas. At the same time, the specifications and models of the environmental assessment reports compiled by Shandong Jia'an, the specifications and models of the CNC cutting machine, especially the CNC cutting machine, were notified and criticized and broke out by 5 points.

In addition, the environmental assessment reports compiled by Shandong Jia'an due to the unreliable wastewater treatment facilities, and the pollutant concentration of cleaning wastewater, the location of the wastewater treatment facilities, the plane layout, the sedimentation, the pollution removal rate and other parameters. Wastewater anti -overflow measures, wastewater guidance, and anti -seepage measures were notified to criticize and lost trust 5 points. In addition, Zhang Hao, the main preparatory staff of the EIA report, was also reported to be criticized and broke out by 5 points.

That is to say, Yatong Seiko ’s“ Transformation and Construction Project of Commercial Vehicle Parts Production Base ”, which is intended to raise 264 million yuan in investment, has the problem of production wastewater discharge and environmental investment. It is not consistent with the prospectus. In addition, as of July 2022, the environmental assessment unit of the project was included in the quality supervision and inspection list due to the quality of other environmental assessment reports prepared. In response, the quality of the EIA report of the Yatong Precision Investment Report project or the "question mark" should be put on.

Fake gold only uses real gold, if it is real gold and not gold. Focusing on the questioning project of Yatong Seiko, will the truth emerge under the test of the capital market in the future?

- END -

Oil price will change again!at……

The international oil price rebounded by 2.5%on July 1, and each barrel was closed...

4998 yuan a year!Mercedes -Benz's payment unlocking function is questioned charged charges

Recently, Mercedes-Benz launched a paid unlocking project and caused public doubts...