[Circle depth] The past and present life of American student loans

Author:Global Times Time:2022.08.31

[Global Times Comprehensive Report] U.S. President Biden recently announced a large -scale reduction and exemption loan, which caused a strong dispute in the United States. According to reports, the United States currently has a total of more than 40 million people owed a total of $ 1.7 trillion. A well -known talk show host of the United States has ridiculed on the show that the Federal Ministry of Education has become the largest financial institution in the United States. This has become a joke that makes Americans laugh. Aid loan, as the name suggests, was to help students go to school, but later became the "shackles" of many people's life. How the student loan has evolved into a social crisis, which is inseparable from some important nodes in the history of American development.

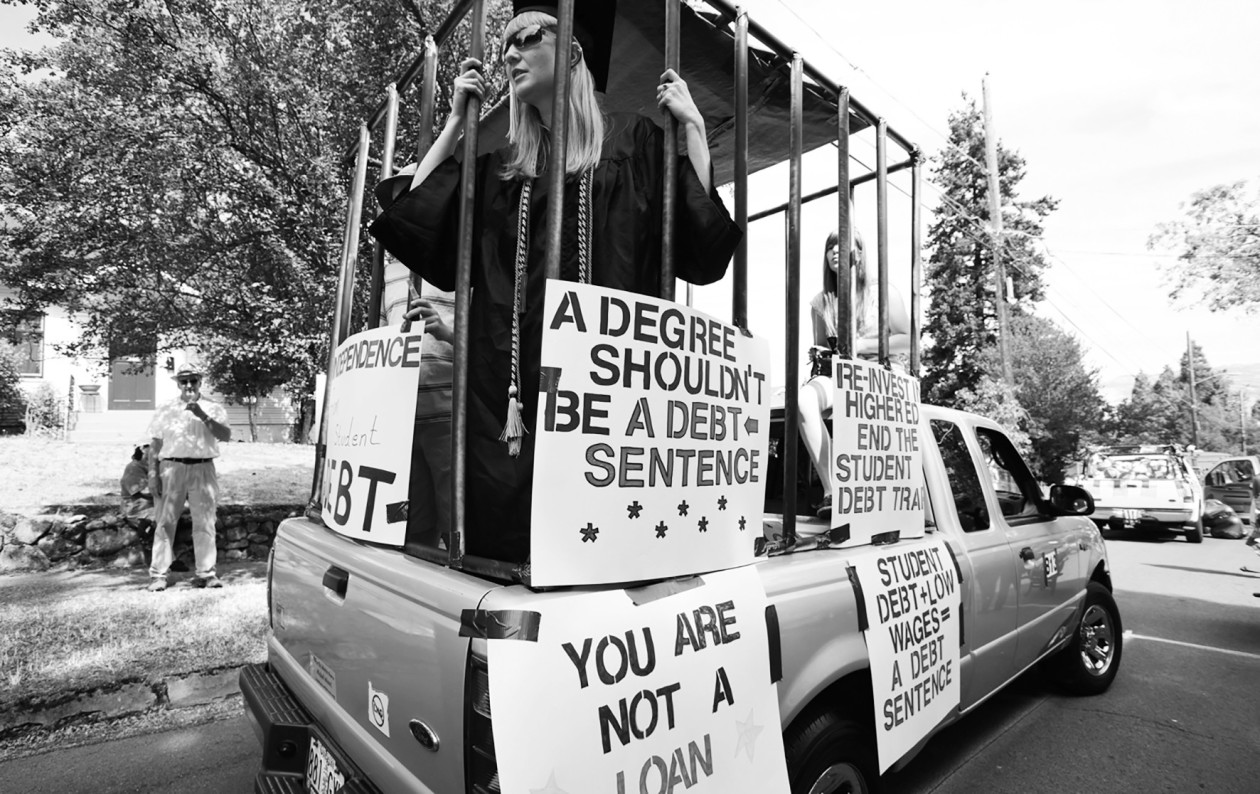

The debt crisis brought by the American people's protests of student loans is like a life cage.

Beginning in Harvard, rejuvenating in World War II

In the 1930s, the establishment of several schools in Harvard University and the Ivy League marked the beginning of the US higher education. Initially, these schools followed the precedent of European universities to provide students with scholarships and scholarships. However, the director of the American Education Association of Education Charity believes that the money obtained in the form of gifts has promoted the "laziness, idleness and luxury" atmosphere, and decided to change most of the ways of prizes and scholarships that do not need to be returned to receipt. People only need to return half of the amount, and then change to students must pay it in full. In this way, some "poverty and excellent young people" cannot enter the higher education institution for further studies because of economic reasons. In 1840, in order to help these young people, Harvard University used the donation of the rich to open its own student loan fund and distributed the first student loan in American history.

The Federal Ministry of Education was established in 1867, but the Ministry of Education did not involve any student loan project at that time. The U.S. government began to intervene in affairs related to higher education, after World War II. During World War II, more than 16 million soldiers in the United States went to the battlefield. In order to properly resettle a large number of veterans, the US government issued the "Veterans Rights Act" in 1944, which was funded by the government to go to college. It can be said that this bill has completely changed the appearance of American university education from several aspects. The first is the conceptual change. The bill changes the concept of only elite levels to be educated in universities. Secondly, the transformation of university capacity. Due to the influx of veterans in the United States, the universities in the United States have rejuvenated their vitality. Many schools are equivalent to using government funding to complete the expansion and expand the enrollment scale. The most important thing is that the government is in disguise to use this funding method to deeply intervene in the management of higher education affairs.

Soon, American universities ushered in the wave of veterans. According to statistics, about half of the 2.3 million college students in the United States in 1947 were veterans of World War II.

Cold War to become loan help

The "Veterans Rights Act" brings Americans a new era of higher education popularization, so that Americans believe that anyone should have the right to receive higher education. According to statistics, when the application period of the bill expired in 1956, a total of 450,000 engineers, 240,000 accountants, 238,000 teachers, 91,000 scientists, 67,000 doctors, 22,000 dentists, and 22,000 dental doctors added to the United States, and More than 1 million in other fields have received college education talents.

The US government, who tasted the sweetness, naturally brought this thinking to the Cold War. In 1957, the Soviet Union successfully launched the first artificial satellite. At that time, Americans generally believed that the United States was behind in the field of science and technology and education. Immediately, in order to catch up with the Soviet Union, the U.S. government regained the opportunity in the Cold War, improved the US education system and enhanced national defense competitiveness. Based on this method, the student loan guaranteed by the US government was launched, but only some students who were "national defense" at that time could receive funding, mainly including college students with elective engineering and scientific degrees.

In 1965, the US federal government launched the first federal student loan project for higher education lending legislation. This is the first law promulgated in the history of American history to determine the method of funding and the amount of funding in the economic difficulty of students. But soon, under the influence of serious economic crisis broke out in the 1970s, this approach to educational equity as the original intention was difficult because of the difficulty of the United States. In order to solve the dilemma, the United States established a company that specializes in running a student loan for government operations during the Nixon administration, and began to gradually adopt a more market -oriented way to operate student loan matters.

By the 1980s, affected by the economic crisis and severe stagnation, the tuition fees of American universities gradually rose, and more and more students were on the path of loan reading. The U.S. government has continuously revised relevant laws and regulations, incorporated students' parents into a student loan project, and the composition of loans and repayment regulations have become more market -oriented. In the 1990s, the previous economic crisis and the government's social welfare policy led to high national fiscal deficit. In order to reduce the budget, the US government carried out several reform of the student loan system. The main measures for reform include issuing more commercial direct school aid loans and gradually increased the proportion of direct loans. According to statistics, the proportion of colleges and universities participating in direct loans increased rapidly from 5%in 1994 to 50%in 1997. The move did reduce the government's financial burden to a certain extent, but as a lender's students and the pressure on the parents who assumed the responsibility, the pressure on the entire society was increasingly heavier. This also laid a fuse for the later student loan crisis. Obama repaid the loan in 21 years of repayment

In the new century, the tuition fees for American universities continued to increase, and the amount of student loans continued to increase. From the micro level, in 1993, about half of the university graduates in the United States bears a student loan with an average debt of more than 10,000 US dollars. Twenty years later, 70 % of college graduates who were carrying school aid loans accounted for $ 35,000. From a macro level, as of the end of 2020, the total amount of student loans in the United States has reached 1.7 trillion US dollars, of which about 1.57 trillion US dollars came from the Ministry of Education of the United States. Especially Around 2008, the U.S. subprime crisis broke out, accompanied by unfavorable factors such as economic downturn, rising tuition fees, and employment difficulties, the repayment and payment of US student loans became more and more stretched. At this time, the young people had the actions of a beautiful dream loan to study in college, which became the nightmare of many Americans.

At this time, in the process of the United States student loan, the capital of "getting on the car" in the second half was exposed clearly. On the one hand, no matter whether students graduate or not, they will start to return loans after leaving the school for 6 months. On the other hand, student loans will not be exempted from the bankruptcy of the debtor, and the parents of the debtor must also bear the repayment responsibility of the company. In addition, the interest rate of student aid loans has also risen, from 5%in the 1950s to 9%of parent loans in the 1980s, and to the influence of direct loans in the 1990s. Moreover, some student loans adopt the compound compound calculation method to repay the profit. The longer the arrears, the more the amount. In recent years, the demonstrations that have erupted in many places in the United States because they are not yet on student loans. There are a set of numbers on the sign of a woman who participated in the parade: the amount of the amount of student loan is US $ 26,000, and it has been repaid without stopping the repayment. In 23 years, the amount has been paid $ 32,000, and the amount of debt is still $ 45,000;

In 2018, the Wall Street Journal also reported a list of repayment lists from a doctoral loan of a doctor of Utah. The 37 -year -old doctor had a debt in the debt of student loans of $ 1.06 million. He repayed $ 1,600 a month, but this was not enough to cover the loan interest generated every month. And according to this repayment speed, when the doctor was 57 years old, his student loan debt amount would be as high as $ 2 million! Former US President Barack Obama, who had studied at Harvard University, also paid off his school aid loan 21 years after graduating from undergraduate. At that time, it was 2004, and he was at the high level of federal senators.

- END -

Putuo District: 20 candidates for middle and college entrance examinations are controlled in the community to ensure that candidates should take the test and do not fall into a press conference on the epidemic prevention and control

At the press conference of the municipal epidemic prevention and control work held...

The Hong Kong University of Science and Technology (Guangzhou) was approved officially!City University of Hong Kong (Dongguan) is also coming

Recently, the Ministry of Education approved according to lawFormally set up Hong ...