After the "double reduction", what is the confidence of Jin Sun Education?

Author:Blue Whale Finance Time:2022.07.01

Picture source: Oriental IC

After the "double reduction", Jin Sun Education became the first education company to land on the US stock market.

On the first day of listing, the stock price opened high and rose over 390%, which triggered the fuse twice. The stock price on the next day was up to 29.64 US dollars per share, an increase of 741%from the issue price of $ 4/share.

Why can this American stock "rookie" log in to the capital market against the trend?

Before the listing, the school -owned school was stripped, and the performance contribution last year contributed more than 30 %

According to public information, Jin Sun Education was established in Wenzhou, Zhejiang in 1997. Before the reorganization, Jin Sun operated a private primary school (Wenzhou Ouhai Art School) and a private middle school (Chongwen Middle School) through two independent entities; three children and adult counseling centers; Education companies (Shanghai Qin Shang Education), and a logistics company that provides logistics and consulting services.

These three children and adult counseling centers operate the following business: Wenzhou Yangfu Shan Gaofu School provides re -study courses for students who have re -examined the college entrance examination and college entrance examination; Foreign language teaching, as well as the re -study teaching of college entrance examinations and high school entrance examinations; Shanghai Jicai Education provides non -English language teaching for individual students, companies and other organizations.

In addition, its official website also clearly marked ten kindergartens under its own, including direct -operated and authorized chain kindergartens, all of which belong to the Shanghai Golden Sun Education Group.

Such a huge volume also gives Golden Sun's confidence in impacting listing. In May 2021, Jin Sun submitted a prospectus to the US Securities Regulatory Commission (SEC) for the first time and intends to be listed on the Nasdaq Exchange. At that time, it was expected to issue 5 million A type of ordinary shares, and the issue price of US stocks was expected to be $ 4-5. In August of the same year, the Golden Sun updated the prospectus and announced that the issuance scale will be reduced to 4 million shares.

After the implementation of the Regulations on the Implementation of the Civil Affairs Law and the "double reduction" policy, the Golden Sun still did not stop the listing. In November 2021, the golden sun updated the prospectus again.

In fact, Jin Taiyang is not without compliance pressure. In the updated prospectus, it announced two adjustments: one is to announce the increase in IPO issuance to 4.4 million shares again, and the other is to announce the reorganization of the reorganization in September of that year.

Regarding the reorganization, Jin Sun Education stated in the updated prospectus that all shares of Shanghai Jin Sun, which have been sold, and separated them from the contract through the contract. At the same time Termid the VIE protocol with the Haihai Art School.

According to the prospectus at the time, fiscal 2020 and 2021, the proportion of revenue from the above two schools accounted for 45%and 31%, respectively. Golden Sun also admits that the two businesses of stripping will have a significant adverse effect on its operations and finances.

After peeling off the business of civil -run schools, after the "cut tail survival", the Golden Sun finally successfully completed the listing.

Aiming at the college entrance examination and re -reading and small language, the reorganization profit after reorganization increased doubled

On June 22, the Golden Sun Education Group officially landed on Nasdaq with a stock code of GSUN and issued 4.4 million ordinary A shares A shares at a price of $ 4 per share, with a total fundraising of 17.6 million US dollars. At the same time, it has announced that the underwriter has obtained the options of green shoe, which can subscribe for a public offering price of no more than 660,000 ordinary shares within 45 days after the transaction.

On the first day of listing, the stock price opened high and rose over 390%, which triggered the fuse twice. The stock price on the next day was up to 29.64 US dollars per share, an increase of 741%from the issue price of $ 4/share.

According to the latest prospectus information, after the reorganization, the above -mentioned three children and adult counseling centers under Jin Sun Education; Qinoshang Education, a company that cooperates with high school to provide students with non -English language tutoring courses; and a school for the company's school Logistics companies that provide logistical services with the counseling center are reserved.

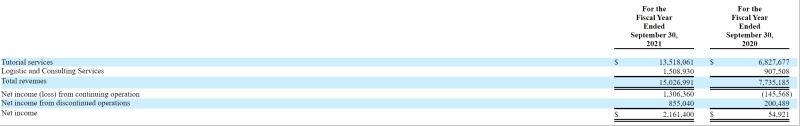

Financial data also pointed out that as of the fiscal year of September 30, 2021, the total revenue of Golden Sun Education was $ 15.027 million, an increase of 94.27%from US $ 77.352 million in fiscal 2020, an increase of 78.68 from US $ 8.41 million in 2019 in 2019 in 2019 %.

In terms of sub -business, in fiscal 2021, the tutoring business contributed 13.5186 million US dollars, an increase of 97.99%year -on -year, an increase of 70.53%over the fiscal year in 2019, accounting for 89.96%of revenue.

Among them, according to the financial report data, Qinhang Education, established at the end of 2019, cooperates with high school to provide students with non -English foreign languages (Spanish and French as a second language) counseling service. It is reported that as of May 2022, Qin Shang Education has cooperated with 62 schools to provide services to about 2,732 students in 7 provinces in China. In fiscal 2021, Qinoshang's income increased by about 4.4 million US dollars compared with the fiscal year 2020. In the 2020 and 20121 fiscal diligence, education revenue accounted for 4.74%and 31.73%, respectively.

Logistics and consulting services in fiscal year in fiscal year were 1.5089 million yuan, an increase of 66.27%year -on -year from fiscal 2020, and an increase of 212.49%over 2019. However, the proportion of revenue is still small, only 10.04%.

In addition to revenue, in fiscal 2021, the profits of Jin Sun Education have also achieved significant growth. In fiscal year in 2021, Jin Sun Education achieved a total of US $ 2.1614 million in net profit, an increase of 383.55%from a net profit of US $ 50,000 in fiscal 2020. Among them, in fiscal 2021, Jin Sun Education continued to operate business to achieve net profit of US $ 1.3064 million, and a net loss of US $ 145,600 in fiscal year in 2020; Ten thousand U.S. dollars.

It can be said that after the reorganization, Jin Sun Education's continuous operation of business has achieved significant development. Regarding future development, Golden Sun Education also pointed out in the prospectus that the total fundraising of this listing is 17.6 million US dollars. The financing income will be mainly used to expand the scale, including the acquisition of the college entrance examination non -English foreign language tutoring center, and overseas schools and tuition centers; Expand the research and development of non -English -speaking courses for the college entrance examination, the college entrance examination non -English foreign language operation center; the acquisition of language training and counseling centers; recruitment and retained teachers and managers, as well as providing funds for operating funds and other general companies.

Regarding the future goals, the Jin Sun Education Group stated that it will continue to improve and improve the status of private education service providers in the Yangtze River Delta region and non -English foreign language (especially Spanish) tuition service providers. Significantly expand the network of cooperative schools across the country, providing Spanish as a second foreign language course, continue to expand the school and tuition center network, and integrate these physical campuses to make it to the greatest extent.

The debt repayment pressure is high, and the policy risk still exists

The private school business, which is one of the original core businesses, has now successfully landed on U.S. stocks and is highly sought after. The golden sun aimed at the college entrance examination and the teaching of small language, and it looks brilliant in the future.

But is this really the case? Policies may still be the risk of uncertainty to face.

First of all, the controversial is the re -reading business of the college entrance examination. With the advancement of the "double reduction" policy, many institutions have terminated extra -curricular counseling business in high schools. Whether the college entrance examination will be listed as "discipline counseling" is still uncertain.

Some people in the industry have told the media that the college entrance examination school may not be affected by "double reduction". "Although the 'double reduction' policy stipulates, the management of the discipline training institutions of ordinary high school students is implemented with reference to the relevant provisions of this opinion. "

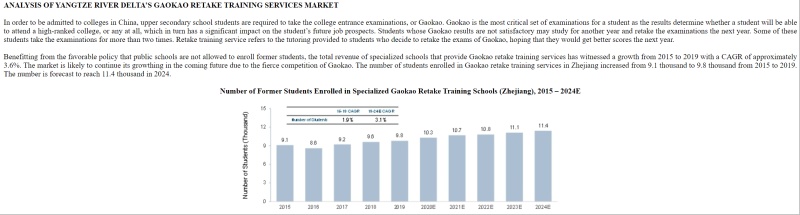

For future development, Golden Sun Education is also confident. The prospectus pointed out that according to the Ministry of Education's "Notice of Several Issues on Strengthening the Management of Basic Education to Enhance the Management of Basic Education", public schools must not recruit previous students who want to repeat the college entrance examination. The total income of professional schools that benefit from the above preferential policies that provide college entrance examination training services will grow from 2015 to 2019, with a compound annual growth rate of about 3.6%. Due to the fierce competition of the college entrance examination, the market may continue to grow in the future. Taking Zhejiang Province as an example, from 2015 to 2019, the number of students who participated in the college entrance examination and re -examination training services increased from 9,100 to 9,800, and it was expected to reach 1,1400 in 2024.

Jin Sun Education stated that the company currently evaluates the discipline of the Chinese compulsory education system, so it is not subject to the requirements and restrictions of the "double reduction" policy. However, if related regulations are expanded in the future, covering any aspects of our business or operation may have a significant adverse effect on our business and financial prospects.

At the same time, it also admits that the company's development may also face the relevant policy risks of "camps and non -".

According to the "People's Republic of China and National Affairs Education Promotion Law", private schools are divided into profitability and non -profitability. Among them, the organizers of non -profit schools may not obtain benefits from running schools, and the school's cash surplus should be reused to the school's operation. The organizers of profitable private schools can obtain benefits from running schools. The school's cash balance is processed in accordance with the "Company Law of the People's Republic of China" and other relevant laws and administrative regulations. In addition, the specific measures for non -profit private schools are formulated by the people's governments of provinces, autonomous regions, and municipalities directly under the Central Government; the charging standards of profit -making private schools implement market regulation, and the school is independently determined by the school.

In this regard, Jin Sun Education stated that local government regulations of Zhejiang and Shanghai where their non -profit schools are located are generally allowed to have autonomy in school operations, including autonomy in tuition pricing. Therefore, local governments in Shanghai and Zhejiang did not directly intervene in the determination of tuition pricing in their non -profit schools, and the company could charge fees according to market conditions.

However, Jin Sun Education also stated in the prospectus that although the company's business, operations and income are not affected by "profitability" or "non -profit". However, it also believes that if local governments begin to restrict the charging standards for non -profit school tuition fees, their income of non -profit schools may be negatively affected.

It is worth noting that in addition to the uncertainty of the policy risk, there are many uncertainty in the performance of the Golden Sun's own performance.

The prospectus shows that the total assets of Golden Sun Education as of September 30, 2021 were US $ 66.359 million, a decrease of 61.96%from the total assets of September 30, 2020.

In contrast, as of September 30, 2021, the total liabilities of Golden Sun Education were US $ 14.2764 million, a decrease of 42.48%from US $ 24.818 million from September 30, 2020. As of the end of the fiscal year of 2021, the asset -liability ratio of Jin Sun Education was 215.14%, a significant increase from 142.26%as of the end of fiscal year.

In addition to the rise in asset -liability ratios, the short -term debt repayment capacity of Golden Sun Education may also face a lot of challenges. In the prospectus, it frankly said that as of the end of the fiscal year of 2021, its various unpaid bank loans were about $ 2.1 million, respectively, an increase of 31.25%over the US $ 1.6 million at the end of fiscal 2020. It also signed an irrevocable operating lease agreement for multiple offices and operating facilities, and the lease will expire in 2029.

Among the loans, the lease that will expire within one year is US $ 1.0379 million, and bank loans will be US $ 1.068 million, totaling US $ 2.1063 million. As of the end of 2021, the balance of cash and cash equivalent in the hands of the gold sun was US $ 1.1928 million, a decrease of 62.84%from the end of 2020.

Although the risks are still existing, the landing of Golden Sun Education to the US stocks and the soaring stock prices have also led some investors to re -ignition their confidence in stock markets in the US stock market. Some people even call the Jin Sun listing as "a new benchmark for the rejuvenation of stocks in education". But in fact, Jin Taiyang has been submitted for more than a year since submitting the IPO prospectus for the first time. During the period, the update has changed many times.

On the other hand, the Golden Sun Education itself, the re -reading of the college entrance examination, and the teaching of small French language, the market size is still limited. Although listing can make up for its cash, the future development still depends on whether the policy is stable. Whether the company can continue to maintain competitiveness in non -English foreign language training and college entrance examination training track.

However, in response to its short -term stock price, there are also analysis that it is more because the total market value of Golden Sun education is only 424 million US dollars, and the scale of listing and distribution is also limited. The long -term stock price trend depends on whether the company's healthy development can continue in the future.

- END -

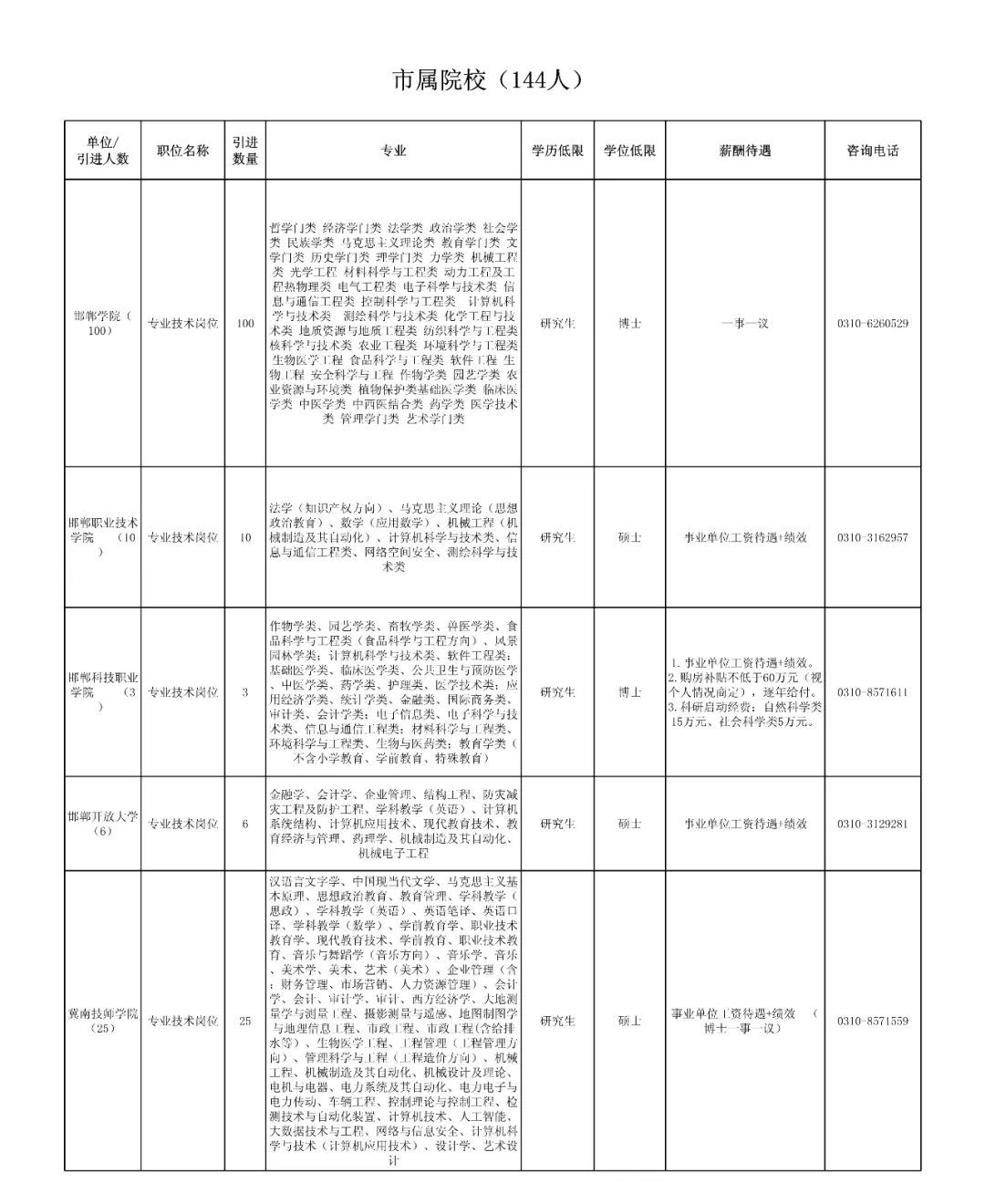

1307 people!The latest Bo Shuo quoted announcement

The latest release of the Office of the Talent Leading Group of the Handan Municip...

Give the best and most beautiful children!The new kindergarten service in this area in Shenzhen

On the afternoon of June 17, the live selection of the catwalk show in Longhua Dis...