Abbott Century Demolition Revelation: How to cultivate new "medicine kings"?

Author:Kenji Bureau Time:2022.07.23

This is a well -known pharmaceutical giant in the world.

On January 2, 2013, Albervi officially split from Abbott and was listed on the New York Stock Exchange independently. At that time, the global biological industry was in the ascendant, and Bai Qianli, CEO of Abbott, decided to independent Albervi, which mainly engaged in biological agents, and left the main Abbott of the main medical equipment and generic drugs.

This year is the 125th anniversary of the establishment of the Abbott Lab. After removing the best business, Abbott has only traditional businesses such as diagnosis, equipment, milk powder. Relatively speaking, Abbott's drug business is the weakest. In 2021, Abbott relying on the operating income of in vitro diagnosis and other sectors reached US $ 43.075 billion, and the pharmaceutical sector only kept about $ 5 billion.

Abbott's split Albervi has always been prosperous. In 2021, Albervi revenue reached US $ 56.197 billion, with a total market value of 270 billion US dollars, which has completely surpassed Abbott. A variety of heavy drugs such as "Medicine King" Xiu Meile, Ibetinib, Ruishazab, and Paputinib even made Albervi rank among the "Top Ten Pharmaceutical Giants in the world".

Abbott is a classic case for a large -scale pharmaceutical company. In recent years, medical device companies represented by minimally invasive and Lepu have launched spin -up listing work, and many have also achieved success in the capital market. However, Pharmaceutical companies such as Hengrui have almost did not spin the innovation pharmaceutical sector. The innovative pharmaceutical business basically circulates in the company's system.

The splitting pays attention to the timing and is also facing risks. Abbott's story can give some inspiration for domestic pharmaceutical companies that seek spin -off.

Starting from a small workshop to start a fortune by war

When it comes to Abbott, the first impression of Volkswagen is a milk powder company. In fact, Abbott has always been medicine.

In 1888, 30 -year -old Wallace C. Abbott innovated in Chicago, USA, and named it with its own name "Abbott". At that time, the drugs he developed not only contained active substances of plants and herbs, but also made tiny "dose granules". The effect was better than ordinary drugs.

With the invention of this technology, the sales of Abbott in the first year of opening reached $ 2,000, which was 5 times the annual income of American workers at that time. Abbott was considered a small fortune.

The founder of the Abbott Lab, Wallace Kevin, Abbott Bo

With herbal medicine extraction, the Abbott business is getting bigger and bigger, and has been opened in New York, San Francisco and Seattle. By 1905, Abbott was a large company selling $ 200,000 an annual sales. At that time, the FDA of the United States had not yet been established, and the new drugs did not need to be approved, so the number of new products in Abbott was as high as 700.

In 1907, Abbott decided to "internationalization" and set up offices in London and Toronto, Canada for the first time, and even some products sold to Europe and India through dealers.

With the outbreak of the First World War and the decline in the sales of alkaloid drugs, Abbott also turned the focus of research and development to synthetic drugs, and it was mainly war -related drugs. British chemist Dr. Henry Dakin invented the hypochlorite solution for wound anti -inflammatory and produced in the factory of Abbott.

Abbott also launched two anesthesia two anesthesias in Prubin and Barbich. During the First World War, the United States issued a restrictions on "trade against enemy". Two of Norva Cakin and Veneral produced in Germany could not be sold in the United States, allowing Abbott to take advantage of market opportunities.

Abbott has since been puzzled with the field of anesthesia. In the 1920s, Abbotts successively developed a number of anesthesia preparations such as Tintaine, sodium Tobabi, and sulfur spray sodium. The war made Abbott make a lot of money.

Start diversified transformation and establish three major businesses

In 1929, the United States entered the Great Depression. This year, Abbott logged in to the capital market and was listed on the Chicago Exchange. The stock price continued to rise.

Even in 1932, the most difficult in the US economy, Abbott's company's business continued to expand. The American "National Commercial Magazine" has commented that: in the Great Depression era, it is a proof that you can have such achievements in the Great Depression.

In 1933, Clarv, with a distinctive personality, replaced Berdiek and became the new CEO of Abbott. He actively innovated reform and developed a number of products such as anesthesia and penicillin. However, after World War II, various pharmaceutical companies competed to enter the field of anesthesia and antibiotics. The traditional advantages of Abbott were challenged and began to start diversified operations.

At this stage, the new spring of Abbott was opened: In 1964, Abbott acquired nutritional giants M & R DieTetics, which has obtained formula milk powder business. Since then, it has become a global leader in nutrition. , Rubber gloves and sweeteners, the company also sold experts from Lu Huaong as the head of the department.

Although nutritional and milk powder has a large turnover, the profit level is much lower than medicine. Abbott is also developing medical device business. In 1972, Abbott launched the ABA-100 hematochemical analyzer and AUSRIA, a radio immunohistor detection product for detecting hepatitis bacteria in serum, marking Abbott's launching in vitro diagnostic industry.

As of the end of the 1980s, Abbott launched a total of more than 70 new diagnostic products. Among them, the sales of blood analyzers exceeded $ 1 billion, which accounted for almost half of the revenue of medical products. To this day, Abbott, Roche, Danna, and Siemens are also called the top four in the IVD industry.

As the diagnosis business has advanced, Abbott's drug research and development has also rejuvenated the second spring. In 1987, Tetrazazine was approved for pregnancy hypertension. Subsequently, cephalosporin and Liangbingrelin were also approved to be listed. At the same time, Abbott successively established 75 subsidiaries or manufacturing factories in more than 30 countries. In the 1980s' performance, Abbott established a strategic direction with drugs, nutrition and in vitro diagnosis as its core, allowing the company to enter a period of rapid development.

Subsequently, Abbott launched a global merger and acquisition plan: In 1996, MediSense, a blood glucose meter manufacturer at a price of $ 867 million; in 1997, Abbott spent another $ 200 million to buy a large infusion product line from the Sanofi American subsidiary.

These two mergers and acquisitions in the history of Abbott are unknown, but they have opened the prelude of the Abbott global mergers and acquisitions.

Dipping off innovative drugs Focus on the diagnosis of equipment

Around the 21st century, Abbott cares more about the device business compared to the pharmaceutical business.

In 1999, Abbott spent $ 600 million to acquire PerClose after the surgeon; in 2002, Abbott acquired VYSIS company and entered the field of molecular diagnosis; in 2003, it acquired TheRasense blood glucose instrument company to consolidate the rivers and lakes that measured the blood glucose system worldwide in the world. status.

Abbott's drug sales have always been only 1/3 of total revenue. Although the $ 6.9 billion in Abbott took the Pharmaceutical Department of BASF, with heavy drugs such as club -chiro, Sibukoming, and left methyl -like gland ainine, the light of the IVD industry covered the results of Abbott medicine.

Until the "Medicine King" Xiu Meile was listed.

At the end of 2002, Adamab's "Xiu Le Mei" was approved to be listed in the United States, and sales in 2005 reached $ 1.4 billion. Subsequently, through mergers and acquisitions, Abbott controlled niacin, fluoribatamison/Fumatlo, tobaccoic acid/Luocean, Suwa, bears, bears, oxygen acid, oxygen and pancreatase and other products. Essence

Relying on the heavy varieties such as Xiu Meile, the sales of the Abbott pharmaceutical sector have made rapid progress, and the pharmaceutical business has entered the top ten multinational pharmaceutical companies in the world.

However, Bai Qianli, then the Global CEO of Abbott, came up with an amazing idea: stripped Abbott's innovative drug business, established a new company and listed independently. Abbott's body continues to engage in the remaining business.

On January 2, 2013, Albervi ’s listing ceremony on the NYSE

Different from Chinese companies' emerging businesses to financing to the capital market, Abbott chooses to peel off mature business, which is considerate. At that time, Abbott management predicted that although Xiu Meile could bring a generous return to the company, the product patent in 2016 would expire. By splitting the listing, the debt is passed to the new company, so that the original business of Abbott can be stable and the performance can be developed in the long run.

Unexpectedly, Abbott's old conspiracy still did not count the market.

Whether Xiu Meile is as "short -lived" as Prediction of Abbott management, so far in the global pharmaceutical market. Albervi also broke through the variety of Xiu Meile. In 2021, Albervis's operating income reached 56.197 billion US dollars, of which Xiu Meile's sales exceeded $ 20 billion. The remaining more than half of the other varieties.

Nine years after splitting, Abervi's total market value reached US $ 264.2 billion, and it has anti -Surremoral's $ 187.4 billion.

Abervi is a successful split in the history of Abbott. Judging from the results, Albervi was launched in a timely manner after incubation in Abbott, and has obtained a good capital income. Abbott itself focuses on the advantageous business and has also achieved good results. If you continue to keep Abervi's business in the body and develop, you may not be able to do more.

Do you want to do biomedicine?

After successfully splitting Albervi, Abbott focuses on the IVD industry and has created a huge market.

In 2014, Abbott launched the "Auxiliary Shan" transient dynamic glucose monitoring system; in 2016, Abbott launched the ALINITY immune diagnosis system again; in 2017, Abbott set the largest acquisition of the company and acquired Santa Medical for $ 25 billion. This It also allows Abbott to compete in various fields of cardiovascular health, and ranks among the top in the market.

According to the then CEO Bai Qianli plan, Johnson & Johnson is used as a benchmarking company, and the company's strategy is dominated by medical devices. The diagnostic reagent is a company strategy with a growth point, which promotes Abbott to quickly become a world -renowned medical and health company.

It is at this time that Abbott has pushed a new round of internationalization, and business radiation in Europe, the United States, Asia, Africa, and La. In 2014, emerging markets accounted for 50%of total global sales. At that time, Abbott had become India's largest pharmaceutical company.

Abbott also actively deploy the Chinese market. In 2016, the Abbott China R & D Center was officially opened. The R & D center is the only R & D center in the world's only integrated nutrition and diagnosis of the world.

The most rare thing is that the development of Abbott has been walking with milk powder and health products so far. The mainstream of the world today, such as Pfizer, GSK, Merhado, etc., have stripped or sold consumer business, leaving only the pharmaceutical sector. Abbott is unique to even the world's first -class pharmaceutical companies.

According to the financial report, in 2021, Abbott's total revenue was US $ 43.075 billion, of which the diagnostic business revenue was US $ 15.644 billion, and the revenue of equipment was US $ 14.367 billion, which accounted for nearly 70%of these two items.

In contrast, the Pharmaceutical Industry of Abbott has been adjusting, selling generic drugs, and acquiring CFR Pharma and Veropharm, but the income has always increased weakly.In 2021, the revenue of the pharmaceutical sector was only $ 4.718 billion, which has almost stopped in two years.In 2020, Bai Qianli, who has been the CEO of Abbott in 2020, officially retired, and Robert B. Ford, who has worked in Abbott for 23 years.

If you don't want to chase the current biomedical trend, rely on the IVD industry and selling equipment, Abbott can also keep the location of the first camp of the world pharmaceutical company.

If you still want to make breakthroughs, you must invest a lot of research and development, and create another "Albervi" internally.

The 134 -year pharmaceutical giant was split with its century, and wrote an enlightenment recorded by the latecomers.

### ###

- END -

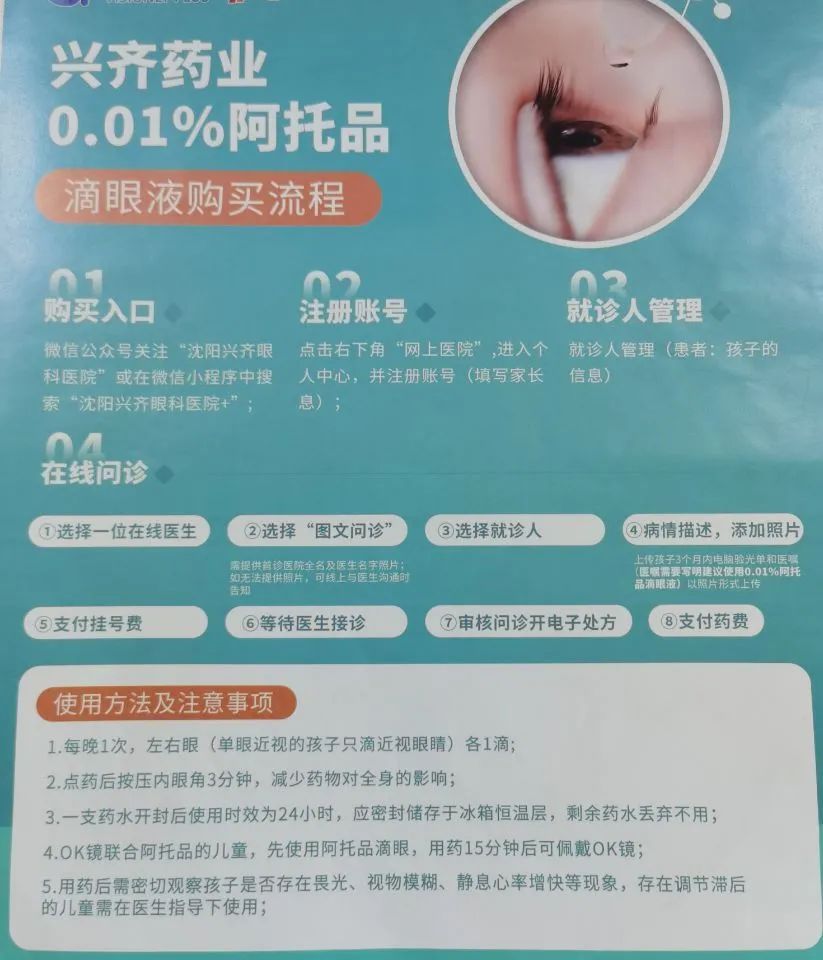

With the "OK Mirror+Atto" two major myopia prevention weapons, Opangshi still has hidden concerns

Image source: Reporter GetThe huge myopia group not only attracted the magic medic...

The seventies of the elderly often wrestled and mistakenly thought that it was a glasses caused by a stroke.

Wuhan Evening News July 22 (Correspondent Ao Panpan) 71 -year -old lady Zhang alwa...