What is the potential of Nuo Chengjian from Biotech to Biopharma?

Author:Yaizhi.com Time:2022.08.09

What is the potential of Nuo Chengjian from Biotech to Biopharma?

Source: Yaizhi.com/Sweet Orange

Recently, the CSRC issued an announcement saying that in accordance with the legal procedures, Nuocheng Jianhua Pharmaceutical Co., Ltd. (referred to as "Nuocheng Jianhua") first publicly issued stock registration on the science and technology board. 100 million yuan for projects such as new drug research and development, drug research and development platform upgrade, marketing network construction, informatization construction, as well as supplementary funds. Since then, Nuo Chengjian has launched a new journey of "Science and Technology Board+Hong Kong Stocks".

Where is the research and development pipeline?

Nuocheng Jianhua, as an innovative pharmaceutical company based on the accumulation of early technological achievements or innovative business models to achieve the source of innovation and leapfrog development, is committed to developing the best or similar drugs for treating cancer and autoimmune diseases.

At present, the company has 2 drugs that have been approved for listing and 16 clinical and clinical research on new drugs. Among them, two drugs that have been approved for listing are Obntinib, which is attached to the listing, and products introduced from Incete. , TAFASITAMAB (Minjuvi®), which only has the rights and interests of Greater China.

1. Obatinib (ICP-022)

Obutinib is a good security and effectiveness of the good security and validity of Bluetonic tyrosine kinase (BTK) inhibitors based on 2 I/II clinical trials (ICP-CL-00102 and ICP-CL-00103) based on 2 I/II clinical trials Sexual data has been approved for listing in China on December 25, 2020 for treatment: (1) patients with lymphoma (MCL) who have been treated at least one treatment. (2) Patients with chronic lymphocyte leukemia (CLL)/small lymphocyte lymphoma (SLL) patients who have received at least one treatment in the past. Obo has been included in the 2021 "Guidelines for CSCO lymphoma diagnosis and therapy" and is listed as a level recommendation scheme for recurrence or refractory CLL/SLL and recurrence or refractory MCL treatment. At the same time, Obitinib has been Incorporate the medical insurance directory in 2022.

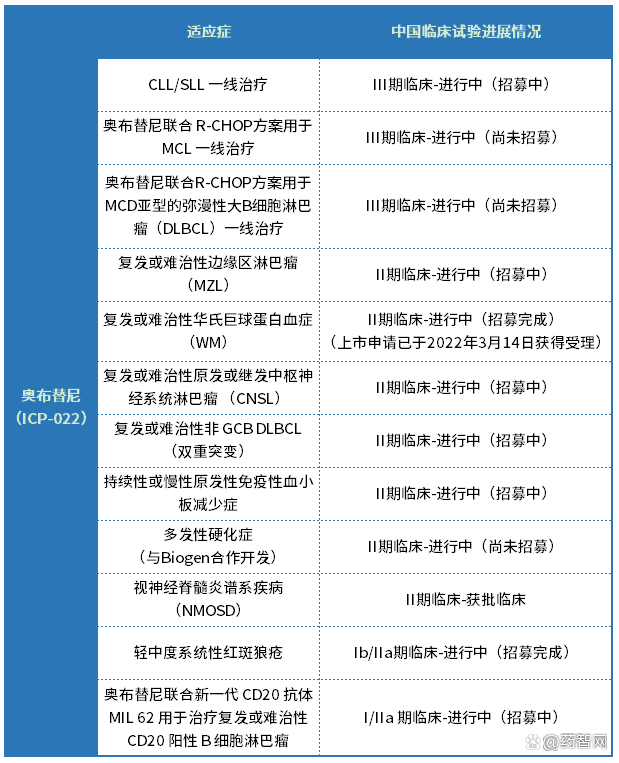

At present, Nuocheng Jianhua has layout clinically in China for multiple indications, including hemoma and autoimmune fields. The specific progress is shown in Table 1 below. At the same time, the dose of the dose of Phase I/II clinical trials for B -cell lymphoma has been completed in the United States, and the dose extension of the test has been activated. In December 2020, Obitini obtained the qualification certification of orphan drug qualifications for recurrence or refractory MCL granted by FDA. In June 2021, Obitinini was determined by the breakthrough therapy for recurrence or refractory MCL awarded by FDA.

Table 1 Obutini China's clinical trial progress

(Data source: Yaozhi.com database, CDE)

According to the analysis of Fhstan Sandlf, by 2030, the global BTK inhibitor market size will reach approximately US $ 26.1 billion, and China's BTK inhibitor market will reach 22.5 billion yuan.

At present, there are 5 types of BTK inhibitors that have been approved in the world, namely Obitinib, Ibntinib, Akatinib, Zabitininib, and Telraotinib, including Obitinib, Iginib, Idinib, Igini Butinib and Zabitini have been approved to be listed in China.伊布替尼研发进度相对靠前,除了MCL、CLL/SLL之外,还获批用于WM,同时,作为全球首个获批上市的BTK抑制剂,伊布替尼所占市场份额仍然是The biggest, but with the listing of other drugs, the growth rate has gradually slowed down. Obitinib, as a latecomer, has a relatively small market share in 2021 without medical insurance coverage, which is not obvious compared to the technical advantages of Ibetinib and Zabitinib. In 2022, under the blessing of medical insurance, the price advantage is expected to achieve volume and broaden market share.

2.icp-192

ICP-192 is a high-selective, irreversible pan-FGFR inhibitor independently developed by the company. It is another core candidate product of Nuo Chengjian. Its clinical experimental data shows that compared with ERDAFITINIB, which has been approved, it is approved. ICP-192 has higher target selectivity and comparable target inhibitory capabilities, and at the same time can overcome the acquisition resistance of the first-generation FGFR inhibitor. At present, ICP-192 is conducting three clinical trials of ICP-192 treatment of bile duct cancer and urinary epithelial cancer. According to data released by ASCO Annual Meeting in 2021, data from I/IIA clinical trials of I/IIA in I/IIA showed that among 12 patients who completed at least one tumor assessment and carrying the FGF/FGFR gene mutations, ORR reached 33.3%, of which Three patients reached partial relief, and 1 patients with bile duct cancer were fully relieved; the disease control rate was 91.7%.

According to the data of Fhstrilin, the variation and abnormal activation of FGFR are related to the development of a variety of cancers. About 7.1%of physical tumors (including bile duct cancer, breast cancer, lung cancer, head and neck cancer, gastric cancer and urinary epithelial cancer) Found FGFR abnormalities. Thousands of people. In 2020, the number of new patients with FGFR mutations reached 401,000, and the number of new patients in 2030 is expected to reach 507,000. It is expected that the global pan -FGFR inhibitor market size will increase to $ 15.6 billion in 2030, and the market size of the Chinese pan -FGFR inhibitor market will increase to $ 800 million.

At present, there are already three drugs with pan -FGFR inhibitors in the world, namely Johnsona's Edarini, Incete/Cinda Bio, and Qedtherapeutics/Helsinn's INFIGRATINIB, of which INCYTE/ Cinda Bio -biological Peminib was approved in China on April 6, 2022 to be listed in China for at least one systemic treatment, and it was confirmed that there were advanced and transferring of FGFR2 fusion or reunion. Or the treatment of adult patients with bile duct cancer, which is not surgical, is the first pan -FGFR inhibitor to be listed in China. 3.icp-723

ICP-723 is a second-generation pan-trk small molecular inhibitor. It is expected to treat patients with NTRK genes that have resistant to the first-generation TRK inhibitors that have not been used in the first-generation TRK inhibitor. TRK is mainly expressed in nerve cells. Through a combination of endogenous ligands-neurotic nutritional factors to activate relevant signal pathways, to play a physiological role such as regulating cell differentiation, proliferation, survival, and pain perception. At present, the company is conducting a clinical trial of ICP-723 in China in China to treat advanced physical tumors in phase II. At the same time, a clinical trial of phase I for advanced physical tumors in the United States is conducted in the United States.

According to the analysis of Fhstanalin, the Chinese market of TRK inhibitors will reach US $ 1.14 billion by 2030. At present, there are two types of TRK inhibitors that have been approved in the world, namely Bayer's Larotrectinib and Roche Entreginib. There are no approved TRK inhibitors in China.

In addition to the above three core products, Nuo Chengjian also has the TYK2 inhibitor ICP-332, TYK2 transformation inhibitor ICP-488, selective KRASG12C inhibitor ICP-915, and the targeted CD19 introduced from InCyte. Popular targets such as TAFASITAMAB optimized by the FC domain optimization are research products. Boao Lecheng International Medical Tourism Pioneer area is used to treat adult patients who are not suitable for autologous stem cell transplantation (ASCT) conditions. Thanks to Boao's policy, TAFASITAMAB (Minjuvi®) jointly opened the first one in Boao Lele, and completed the first domestic injection in Ruijin Hainan Hospital for a qualified DLBCL patient.

Advanced from "biotech" to "biopharma"

Nuocheng Jianhua, as one of the few companies in BIOTECH companies that realize product commercialization, has built product pipelines covering multiple popular targets, and increased year by year in R & D investment. In 2019-2021, the amount of R & D investment has reached 234 million respectively. Yuan, 423 million yuan and 732 million yuan. At the same time, through the laying of marketing pipelines and strong BD capabilities, the commercial development cooperation with large pharmaceutical companies has been achieved, and the company's independent research and development of products has been initially verified.

Data show that in 2021, Nuochengjianhua realized operating income of 1.043 billion yuan, an increase of 76368.70 % year -on -year. Among them, Obitini achieved sales revenue by more than 200 million yuan throughout the year. At the same time, in July last year, he reached a license agreement with Biogen on Obesinib and received a $ 125 million down payment.

Nuocheng Jianhua has gradually established a complete life cycle management team from R & D, clinical to listing to listing, and opened the way from "Biotech" to "Biopharma". This is also the conventional growth of many domestic Biotech to BioPharma. model. However, the fundamental, such replication model does not achieve all Biotech companies. The premise of perfectly copying this model must be supported by strong differentiated technologies. The commercial team is the reasonable path from "Biotech" to "BioPharma".

参考资料:Phase I result of ICP-192 (gunagratinib),ahighlyselectiveirreversibleFGFRinhibitor,inpatientswithadvancedsolidtumorsharboring FGFR pathwayalterations.https://ascopubs.org/doi/abs/10.1200/JCO.2021.39.15_suppl.4092

- END -

just!The office of the new crown pneumonia epidemic prevention and control leading group of Luliang City issued a health reminder

Health Tips for the Office of the Leading Group for the Prevention and Control Group of the New Guan Guan Pneumonia EpidemiumRecently, the domestic epidemic has shown multiple distributions and freque

National teachers are Sichuan Forest Fire Training Sports Teachers

Asian weightlifting champion Yuan Wangjian explained demonstrationOn July 6, the S...