The first half of the drug revenue of 1.78 million operating funds depended on external financing, etc.

Author:Daily Economic News Time:2022.08.16

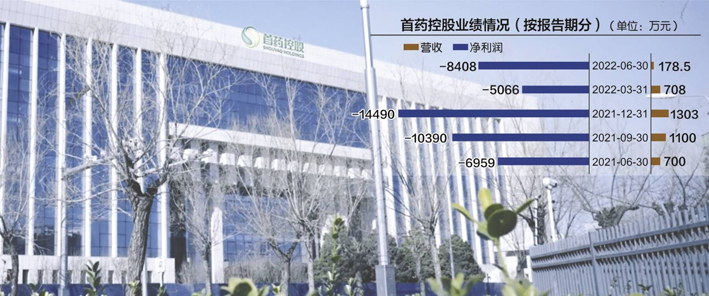

On the evening of August 15th, the first medicine holding (SH688197, a stock price of 23.98 yuan, and a market value of 3.566 billion yuan) disclosed the performance report of the 2022 semi-annual performance. 84.753 million yuan, compared with -69.5931 million yuan in the same period last year, the loss expanded by 20.81%year-on-year.

As a pharmaceutical company without commercial products, the first medicine control landed in the Science and Technology Board in March this year. At present, operating funds mainly depend on the milestone income obtained by cooperative research and development and continuous external financing. For the company's fastest self -developed projects, the risk of competition in similar drug markets is high.

In the future, "running with time" is the main theme of the first drug holding to promote clinical clinical, and it is also the "open source" path of the company's cash flow. But before that, it is still an indisputable fact that investing in heavy money.

Data source: Listed Company's Financial Report Map of Listed Company's official website Liu Hongmei Map

Cumulative loss of 530 million yuan has not been made up

As a pharmaceutical company that focuses on the research and development of small molecular anti -tumor drugs, the first drug control has been believed that "the estimated market value is not less than RMB 4 billion, and the main business or product needs to be approved by relevant state departments. The market space is large. At present Obtain staged results.

However, with the first quarter of this year, the company announced the revenue of 707.96 yuan. The market value of the first medicine control dropped to about 3.5 billion yuan, which caused the market to re -examine the market -free product pharmaceutical company.

On the one hand, the first drug holding takes the new anti -tumor drug as its core direction, and a number of drugs are positioned as "domestic leadership" or "global level"; on the other hand, the company has continued to lose money. As of the end of June this year, the cumulative cumulative drug control has not been made up for the first time this year. Losses reached 530 million yuan.

Regarding the decline in operating income in the first half of the year, the first drug holding stated that "the company's R & D products have not achieved sales revenue, and the current income comes from cooperative R & D revenue. Since 2022 During the reporting period of the company, operating income decreased significantly compared with the same period last year. "

It is worth noting that from January to June, 2020, 2021 and 2022, the net cash flow generated by the first drug control operation activities was -93.1737 million yuan, -104 million yuan, and -516.99 million yuan, respectively.

With the advancement of the new drug research and development project and the promotion of innovation projects, the investment in the first drug holding research and development has continued to increase. In the first half of 2020, 2021 and the first half of this year, the research and development costs of the first drug holding were 85.0327 million yuan, 157 million yuan, and 94.4919 million yuan, respectively.

On the one hand, there is a meager income, and on the other hand, it is huge expenditure. The milestone income and continuous external financing of the first medicine holding in the future have become the key to supporting the company's new drug research and development project. However, in the context of the coldness of innovative drug financing environment, the greatest hope of the first medicine holding is still at the fastest candidate drug in listing.

The semi-annual report shows that at present, the fastest progress or phased results in the 22 projects of the first drug control are SY-707, which is the second-generation ALK inhibitor SY-707, and is in the clinical period II and III. It is an independent research and development project. Among the remaining projects, 4 clinical trials of stage II, 11 clinical trials in phase I, NDA1 have been declared, and 2 are about to enter the IND declaration stage. There is still a distance from the official listing.

And due to the large number of research pipelines and large investment in R & D, the first medicine holding is bluntly in the interim report that "(the company) will still be in a state of unable to make a profitable state in the future."

The self -developed drug market competition is fierce

In the first half of this year, the research and development cost of the first medicine holding was 94.4919 million yuan, an increase of 44.01%year -on -year. The total investment in R & D investment accounted for 5293.02%of the operating income, an increase of 4355.66 percentage points from the previous period.

Among them, over half a cost is used to accelerate the development of SY-707, a second-generation ALK inhibitor in the clinical II and III phase.

The semi-annual report shows that SY-707 is the core project independently developed by the first drug holding. It is currently being carried out simultaneously in the phase II clinical trials of ALK-positive non-small cell lung cancer (second-tier medication) for Kizotinininin. ALK -positive non -small cell lung cancer patients (first -line medication) phase III clinical research.

Among them, after the second -stage clinical trial of ALK -positive non -small cell lung cancer is completed and the expected results are completed, the second -line medication can be approved to be approved for listing.

However, this fastest self-developed new drug and another SY-3505, which is also an ALK inhibitor, also face fierce market competition.

According to the semi -annual report, as of the end of June, a total of 6 ALK inhibitors drugs in the Chinese market have been approved, of which 5 are imported drugs and 1 models are domestic drugs; 4 of them have entered the medical insurance catalog, which may have further reduced prices in the future.

In addition, the company's SY-1530 is a BTK inhibitor for the treatment of lymphoma for cellular lymphoma. As of the end of June, there were three BTK inhibitors in China that treated the lymphoma in cells in China, all of which have entered the medical insurance catalog. Many companies have carried out clinical research on research products for the same indications.

In the future, if other products in the first medicine are under research, there will be the same indications, target listing or clinical competition products, and market competition will continue to intensify. The company may abandon some pipelines after strategic balance.

On August 16th, the reporter of "Daily Economic News" called the Ministry of Holding the Securities Department of the first medicine control. Phase II clinical trials of Phase III patients with Phasein (second -line medication) of ALK -positive non -small cell lung cancer (second -line medication) have also been completed. In addition, the clinical trials of SY-707 combined with Tripley Mutterum and Gascibabi for advanced pancreatic cancer have been carried out at Shanghai Fudan Cancer Hospital.

The person said that although the ALK inhibitor field is fiercely competitive, SY-707 and SY-3505 have formed the only domestic first-tier, second-line, and third-line sequence treatment in China, which has unique competitive advantages among similar drugs. It is expected that the company's independent R & D and cooperative research and development projects will continue and rapidly advance in the future.

It is worth noting that even if you choose the "Fifth Set Listing Standard" to land on the science and technology board, the first medicine holding is also the same as other listed companies to face the assessment of profit and revenue, that is, the fourth complete accounting from the date of listing. In the year, if the net profit before and after the deduction is negative and the revenue is less than 100 million yuan, it will be ST; if the following year still does not meet the standard, it will be delisted directly.

This means that after the listing of the first medicine holding, it is necessary to run with time, accelerate the launch of new drugs in the next few years, and quickly realize the commercial sales of drugs until profitable.

Daily Economic News

- END -

Taishan District launched a regional full -member nucleic acid test on June 16

Taishan DistrictNotice on the development of regional full -staff nucleic acid det...

This kind of cancer camouflage!Women's "leakage" every year is actually cervical adenocarcinoma.

Wuhan Evening News June 21 (Correspondent Liu Shanshan) Ms. Chen, 42, has been emb...