[Turn] The unwillingness of Baiji Shenzhou

Author:Yaizhi.com Time:2022.08.17

Source: Deep Blue View/Tan Zhuozhen Secret Cong

In the eyes of more accustomed to the logic of the traditional pharmaceutical industry, or more conservative people, "Baiji is a good luck company, but it is not a good company."

Its good luck comes from the three places in the capital market to be listed in the three places, and it has merged nearly tens of billions of money -it was established for only 10 years, and it has been working hard in the Chinese market for half a century. The market value of Hengrui is comparable.

What is even more popular is the financial reports of Baiji Shenzhou in recent years. It always shows losses, losses, and losses, but it is continuously listed, listed, and made money.

People of it as a BIOTECH company have always been patient with enough patience: innovative medicines are dead for a lifetime, which is a game of burning money and high valuations; but with the passage of time and the changes in the market, more people have begun to start Biotech is regarded as a Biopharma, and began to stare at the number of the sales column in the financial report. In 2018 "-47 billion yuan"; "-69 billion yuan" in 2019, this number in 2021 became "-11.3 billion yuan "Yuan", more and more people began to keep an eye on, when "-" narrowed or even disappeared.

For those who regard Baiji as BIOPHARMA, seeing the financial report in 2021, they almost sentenced the future of Baiji to the death penalty -believe that the speed of sales monetization can not run the speed of burning money. Because the market value is too high, no one will take over, it will die in the window period.

The declining person calculates a account: 16 commercial products, and now only 8 products have sales, three of which are independent research and development. what does that mean? Half of the products need to burn money to develop, and it still takes time and sales costs in the future. The speed of realizing 8 products that has been sold seems to be unable to be objective.

Including sales of 8 products, technical authorization and R & D services. The operating income of Baiji in 2021 was 7.58 billion yuan, an increase of 257%year-on-year, half of which were 3.499 billion yuan (PD-1 overseas rights on overseas rights and interests. Model and TIGIT down payment) -only less than $ 600 million for 8 medicines. The sales of these 8 drugs and 6 varieties in 2021 exceeded US $ 60 to 70 billion, and the share of Baiji accounted for only 0.5 ~ 0.8%of them.

A investor lamented: "What else do you play in the whole follow -up?"

Baiji and Novarton's PD-1 and "Tigit, which have smashed a billion" License OUT transactions, in the opinion of the above-mentioned people, it is "a very big pit". The biggest benefit of its existence is to make the reports of Baiji 2021 look better. Otherwise, its losses will change from 9.7 billion to 13 billion.

Moreover, the total transaction value is 2.8 billion US dollars, which looks beautiful, but among Novarta's 300 million U.S. dollars in Tigit's down payment, the initial research and development costs should be $ 15 to 200 million. Essence The remaining money is to be realized after the sales are sold.

Compared to the pessimism of the pure singing decline, the optimist believes that this view is too cruel.

Compared to the big pharmaceutical factory that has a century -old history, Baiji, ten years old, has just started. From scratch and major manufacturers with mature channels around the world, you can never ask for the share of other people's 2030s from the beginning. Essence From the perspective of optimists, the share of 0.5%-0.8%of Baiji is not static.

The indications and combined medications of Baiji PD-1 are expanding, and even the head opposite experiments with K-drug. If these clinical clinical landing one by one, PD-1 will increase the market share worldwide;

BTK has achieved excellent efficacy with Ibetinib (selling the best BTK) head test data, which means that it has absolute advantages in the indications of chronic lymphocyte leukemia (R/RCLL). Although it has only been approved by the Hua's giant galvin, and as the subsequent indications are approved, the market share will also be expanded.

When the front and back were inaccessible, Baiji Shenzhou disclosed the financial report in the first half of 2022 on August 4. Data show that the product revenue in the first half of this year was 3.676 billion, which was close to the entire year of last year. The product revenue of the same period last year was 1.583 billion yuan. In other words, product income has doubled more than doubled.

PD-1 performance anti-Ultimate Da Da, BTK growth momentum, and the double growth rate of overseas revenue-the highlights in these financial reports undoubtedly add a weight to the optimist side.

Later, the upper PD-1

When the Rayleyzumi was listed in China, Baiji Shenzhou was passive in the PD-1 big melee.

Although Tripley Mipide of Junshi Bio, Xin Dili Mipida of Cinda Bio, Hengrui's Karelizabi Mipido is tied as a domestic PD-1 "Four Little Dragons", but the PD-PD- 1 "Light is the shallow". In terms of approval, it was late for one year, and he was half a year later.

In the era of innovative medicines, it means that it will be available to others to get rid of some market share first.

And companies who seize the market opportunities often step on the rhythm points and have a stable start-the first PD-1 of the Junshi Biological List, which brought it to 7.74 of the real gold and silver in 2019 Increase of 100 million yuan; Cinda's PD-1 dropped 63.73%of this year, becoming a domestic PD-1 exclusively for medical insurance. In 2020, the price of price volume is obvious. 100 million yuan; Big Brother Hengrui has to say that it has mature tumor drug sales channels, and it is not ambiguous in research and development. In the past two years, the PD-1 PD-1 alone has been lacking.

Later, Hengrui's Karelizabi Mipide rode a red dust with a sales of about 4.8 billion a year, winning the "monoclonal king of monoclonal anti-resistance" in 2020. This year's sales of Cinda Biological PD-1 is 2.2 billion, Junshi creatures were 1.4 billion, and Baiji Shenzhou was 1.1 billion. One year later, Hengrui still won the championship with 4.141 billion, and Nobuna's revenue of over 3 billion ranked second. Baiji Shenzhou ranked third with a revenue of 1.621 billion.

Under the surge of dark waves, PD-1 sales ranking again in the first half of this year. The domestic sales of Rayleyzab were 1.251 billion yuan in China, while the sales of Xindi Midu was only 1.071 billion yuan. Baiji finally climbed from the bottom of the position to the second challenge.

However, the commercial competition of innovative medicines cannot be around the action of "burning money". Baiji, because of the genes of its financing, are the most questionable one. Regarding the commercialization of Baiji, a foreign company sales staff affirmed his advantages in clinical data, promotion models, and product curative effects. He also did not politely pointed out that Baiji's "wealth is thick, regardless of cost, and did not care about the input output ratio" Essence

In addition to the more mature pharmaceutical companies such as Hengrui, compared with the sales costs of the three in 2021: 735 million yuan in Junshi Biological, 846 commercial teams, and per capita expenditure of 868,000 yuan. Cinda Bio was 2.54 billion yuan, 2768 commercial teams, and per capita expenditure of 918,000 yuan. The sales expenses of Baiji Shenzhou were 4.452 billion yuan, 3100 commercial teams, and per capita expenditure was 1.4361 million yuan.

Burning money has never been a derogatory term, but the market habitually treats it with the "upstart". Some people who are optimistic about Baiji believe that there is money and spending money on ideas is the key to Baiji who can stand out under the hospitality. Money is a kind of strength, not weakness.

See the indication certificate, the advantage is fleeting

The approval of new indications has always been the inherent motivation of the PD-1 market.

In a report on Tower Jian's research, the researchers gave such a formula: PD-1 market size = the number of adaptive certificates annual disease*penetration rate*price.

In the field of PD-1, the strategy of many pharmaceutical companies is to cut in from a relatively easy small adaptation certificate. After it is quickly listed, it turns to large adaptation certificates. In this way, you can avoid the positive confrontation with the large variety and quickly go public. However, the applicable population is relatively small, and it is destined to have a low sales volume.

Choose large indications such as non -scale non -small cell lung cancer, gastric cancer (HER2 negative), liver cancer, and squamous non -small cell lung cancer. There are more players, which will inevitably play a price war. However, there are still many players willing to join. After all, the big variety can sell a large price, and the industry has always been concluded that "the big adaptation of the witness to get the world".

For a long time, Hengrecari Pearl Mipido is the domestic PD-1 with the most adaptive certificates, and it is also the best domestic PD-1. It has a wide range of applications and mainly covers large indications.

Picture source: Deep Blue View

However, on June 10, Baiji Shenzhou issued an announcement saying that the ninth new application certificate approved by Rayleyzaba in China was approved. This means that the Correrzumab (8 items) who have surpassed Hengrui for Rayleyzumab have become the domestic PD-1 monoclonal resistance with the most approved certificates.

An industry person believes that the two major advantages of Baiji are the development vision of global business from the perspective of capital, because they can participate in the globalization layout in advance. Clinical, cost is a big problem;

The other is that under the continuous increase of the Baiji clinical team, the adaptation can be kept up in time. "From the perspective of existing indications, the incidence of domestic lung cancer is the second to none, and the PD1 of Cinda and Baiji and Hengrui both already has the front line of lung cancer."

But under the PD-1 roll, the advantage of the indication is also fleeting. The above person believes that "in order to achieve long -term occupation of the main market share, to ensure that they can enter the medical insurance directory, and to accelerate the progress of the development of the large -scale application for the research and development, we need to continuously expand the progress of joint drug research and development."

Under compliance, new gameplay of scientific research

Under the anti -corruption and medical compliance of the hospital, the old set of simple and rude sales of gold with gold is no longer so spiritual. Instead, it has allowed a hundred years of investment in clinical research, and has some unique advantages in the business promotion session.

An industry person revealed that some tumor hospital leaders will have a meeting every time to ask pharmaceutical companies for a wave of resources. The gameplay of each pharmaceutical company is different. Some pharmaceutical companies are purely spend money; larger pharmaceutical companies may invest in the laboratory; the style of Baiji is a clinical trial.

In June 2021, the State Council issued the "Opinions on Promoting the High -quality Development of Public Hospitals", which requested to build a national and provincial high -level hospitals. Among them, "the research and achievement transformation of cutting -edge medical scientific and technological innovation and achievements" is an important content. The purpose is to drive the national medical level to "go to a new big step." The old way to expand the standard and strive to collect this giant hospital is about to be tested. Instead, the high -quality development of scientific research output and results transformation has been put on the agenda.

This is an opportunity for pharmaceutical companies willing to invest in clinical research. Baiji happened to catch up with this wave of "scientific research".

"Doctors in the big three want to do scientific research very much. They have a simple motivation. The country has given the hospital's scientific research and transformation of such an opportunity. Test is an important indicator of the national assessment of scientific research hospitals. The original evaluation criteria are national topics.

Public hospitals will also be divided into two echelons, and prefecture -level hospitals hope to use clinical research to achieve curve overtaking. The provincial junior junior is also under pressure to be chased. It will feel that these emerging land hospitals are developing rapidly and light plates.

The re -election of some hospitals has greatly shaken the connections of old pharmaceutical companies. The original old director was not very interested in clinical trials. But young and middle -aged doctors have the energy to do things. In the subtle way, doctors will have more understanding of pharmaceutical products. The set of gold with gold will naturally not become the only bargaining chip to be overwhelmed.

When the government's request is on the bright side -the hospital is going to do a registered clinical experiment, it is best to do the international multi -center experiment. You have to do a period of test and cannot do the equivalent effect. The advantages of Baiji are naturally revealed. Its first phase of clinical is basically the best or similar in the world, and the gold content is very high.

A person familiar with the matter mentioned that there are many pipelines that need to be opened for clinical clinicals, and the quality requirements for clinical trials have always been harsh. Because of its internationalization, Baiji's experiment was from the beginning of the design of the FDA EMA global declaration. Many hospitals also saw the advantages of Baiji to actively seek strategic cooperation. Regardless of the team size and comprehensive level, Baiji now has an international clinical operation team, which is completely separated from CRO's restraint.

But this set of game rules is a test of Baiji's business and R & D team. The above -mentioned people revealed that Baiji's pharmaceutical representatives often have flight exams. These representatives need to introduce the advantages and disadvantages of experimental design to the doctor. In addition, how to balance the company's operating ability in the clinical orientation of commercial orientation and the new drug itself to do.

In addition, under PD-1 price reduction, sales will still face the pressure of performance. Baiji's new gameplay still needs to be converted into an input -output ratio in the capital market.

Internationalization, two sides of the coin

In the latest financial report released by Baiji Shenzhou, Baiji BTK (Baiyueze) sales in the United States increased by 500%year -on -year, making many people shine. This is mainly due to the continuous growth of the number of prescriptions in the United States. In addition, the increase in the use of clinicians in the approved adaptation, such as cases of lymphoma, Hua's giant giant galvin ledmia, and edge region lymphoma.

"The biggest highlight of this financial report is BTK's sales in the US market. It has established foreign sales channels instead of License Out, and gives sales to multinational pharmaceutical companies." An industry insider analyzed that domestic pharmaceutical companies can achieve such pharmaceutical companies in China. rare. "At least in the field of blood tumors, it has opened up the commercial channels of the United States." At present, the drug has more than 40 drug administration declarations worldwide, and its commercialization has covered 50 countries and regions.

Beroyer sold in the US market, but the threshold for Rayleyzab did not enter the US market.

As early as September last year, Baiji Shenzhou submitted the PDA-1 antibody second-line treatment of esophageal squamous cell carcinoma (ESCC) to the FDA. 12th.

Since the establishment of Baiji Shenzhou, the positioning of itself is an international pharmaceutical company. "The two largest pharmaceutical markets in the world — establishment of commercial platforms in China and the United States, and high -quality production capacity with advanced levels of the world."

Although it comes with an international aura, the road to sea is not smooth.

On July 14, Baiji Shenzhou issued an announcement that due to factors such as the epidemic -related travel restrictions, the FDA could not complete the on -site inspection of the on -site inspection in China as scheduled.

The results of this year's review are still unpredictable, and Baiji Shenzhou has also planned to go to sea in 2023. Public information shows that it will continue to provide support for the newly submitted application of the Baizean's new indications submitted by the partner Novarty Pharmaceutical in 2023, including submitting a listing application for multiple indications for the treatment of tumors in the United States.

In the latest financial statements, there is also an unsolved growth data -R & D expenditure expenditure and sales, general and administrative expenses (SG & A) expenditures, and the year -on -year growth of 13.49%and 51.06%in the first half of 2022.

The title of "Medicine R & D" in Baiji Shenzhou is a record high from its high R & D expenses.In 2021, the total investment of Baiji Shenzhou has invested over 9 billion yuan in R & D. In the first half of this year, the research and development costs reached 5.183 billion yuan (US $ 768 million). According to this trend, the research and development cost of this year may exceed 10 billion yuan.Many of its pipelines have entered the later period of clinical clinical. It is the most powerful burning money. It is no wonder that the high R & D expenses are high, but this time the SG & A cost increases by half a year -on -year increase of 4.25 billion yuan (US $ 626 million).EssenceIn fact, the expenses have exceeded operating income ($ 648 million).Some insiders said that after the sales cost increases, the pressure on the new pipelines behind it will not be small.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform.If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

A neck pattern is 10 years old, and lapherbopic thyroid surgery will solve your worries for you

Since ancient times, there have been traditions of praising women's necks. They of...

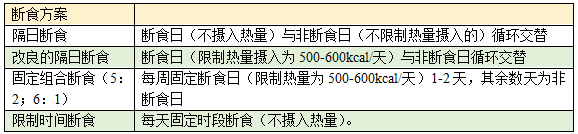

"Intermittent fasting": New method of weight loss

Physician Daily Channel follows usToday, a chubby paper in my thirties came in in ...