The market share of the core product of Xuantai Pharmaceuticals has been divided by the deputy president of the melon.

Author:Jin Ziyan Time:2022.06.24

"Golden Syllabus" northern capital center Qiu Xi/author Bai Qi Huan Sheng/Risk Control

In 2021, the national pharmaceutical collection entered the normalization. The normalized operation of volume procurement aims to squeeze out the irrational moisture of generic drugs. With the continuous advancement of collection, low -end ordinary generic drugs have entered the era of micro -profit. Surprisingly, as a member of the track industry track, Shanghai Xuantai Pharmaceutical Technology Co., Ltd. (hereinafter referred to as "Xuantai Pharmaceutical") with its core product Bohakangzole entero, the performance in 2020 was significant in 2020. increase.

However, on the other side of the performance, Xuantai Pharmaceutical may face the slowdown of the growth rate of core product applications. In addition, with the listing of competing products, Xuantai Pharmaceutical Polkarzole entero -soluble tablets are facing the dilemma of "melon" in the market. It is worth noting that Wu Jianfang, deputy general manager of Xuantai Medical, had a supervisor and financial leader in the affiliate during his tenure. This vision maintained for two months. , During the period to avoid suspicion? What is regrettable is that as of the end of June 2021, Xuantai Pharmaceutical "hand in hand" of 248 million yuan in currency funds, and has no long -term borrowing, and its fundraising "blood nourish" reasonable is doubtful.

1. The sales volume of the core product application field has declined, and the overseas market share has been "melon" to grow or bears the pressure

The single silk is not a line, and the wood is not a forest. The relationship between the enterprise and the industry is also the same, and the development of enterprises is inseparable from the overall trend of the industry.

Among them, in 2020, Xuantai Pharmaceutical's Pohakolunzole entero -soluble tablets accounted for more than 70 % of the main business income, and it was mainly facing the US market. The main product is facing the dilemma of the growth rate of sales in the world and the decline in sales of mainstream IFD drugs in the US market.

1.1 In 2020, the income of Pohakangzole entero -soluble tablets accounted for more than 70 % of the main business income

According to the prospectus signed by Xuantai Pharmaceutical on January 17, 2022 (hereinafter referred to as the "prospectus"), the main products of Xuantai Pharmaceutical include generic drugs and CRO services. Azolunol tablets, pyrone -hydrochloride puffed tablets, Popopatone sustained -release capsules and other products.

Among them, Polshazozazole is the second -generation triazole antifungal medicine, which is mainly used to treat invasive mold or pearl Candida. ").

From January to June 2020 and 2021, Xuantai Pharmaceutical's main business revenue was 60 million yuan, 138 million yuan, 316 million yuan, and 156 million yuan, respectively, accounting for 97.17%of its current operating income, respectively, respectively, respectively, respectively, and respectively. 99.49%, 99.01%, 99.77%.

In the third quarter of 2019, Pohakolunzo -soluble tablets of Xuantai Medical were approved to enter the market in large quantities. From 2019-2020 and January to June 2021, Xuantai Pharmaceutical's Pohakangazole entero-soluble tablets have revenue of 53.4566 million yuan, RMB 25,359,300, and 12.02139 million yuan, respectively. 38.69%, 79.23%, 77.16%.

It can be seen that from January to June 2021, Xuantai Pharmaceutical's Pohakangzole intestinal revenue accounted for more than 70 % of the current main business income, which is the most important product of Xuantai Pharmaceutical.

1.2 Since 2019, Xuantai Medicine exceeds 50 % of the income from abroad

According to the prospectus, from January to June 2020 and 2021, Xuantai Pharmaceutical's overseas sales revenue was 19.6392 million yuan, RMB 78.235 million, 26,9816,700 yuan, and 120.177 million yuan, accounting for its current main business income ratio. They were 32.99%, 56.55%, 85.39%, and 77.14%.

During the same period, Xuantai Pharmaceutical's sales revenue in the United States was 19.639 million yuan, 78.1235 million yuan, 26,981.67 million yuan, and 116.4641 million yuan, accounting for 32.99%, 56.55%, 85.39%, 74.75%of its current main business income, respectively. Essence

As of June 2021, Bo Shakangzole enteropolic tablets of Xuantai Pharmaceuticals are mainly facing the US market.

It can be seen that from 2019 to 2020, Xuantai Pharmaceutical Polyzazole entero-soluble tablets accounted for the proportion of main business income, and the proportion of sales revenue in the United States accounted for the main business income.

It is worth noting that in recent years, the number of IFD drug sales has fallen worldwide and the growth rate of the US market.

1.3 From 2018-2020, the growth rate of mainstream IFD drugs in the world has declined

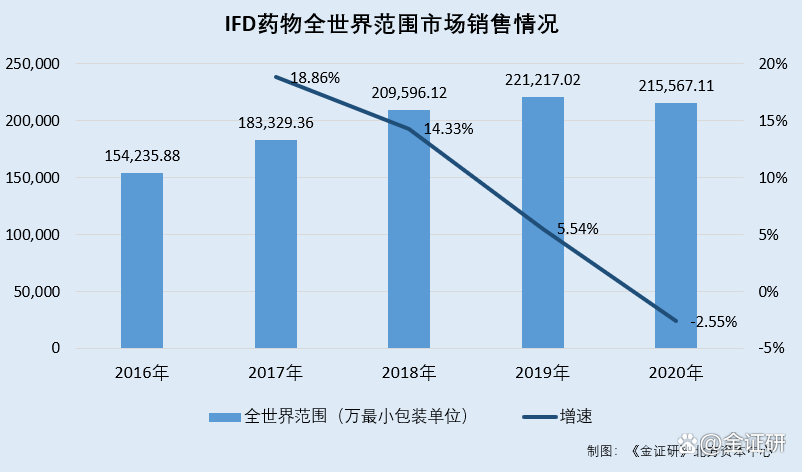

According to the prospectus quoted from IMS data, from 2016-2020, the number of mainstream IFD drugs in the world was 154,235,800 minimum packaging units, the minimum packaging units of 183,329,600 minimum packaging units, and the minimum packaging units of 2,21,21,21,200,200,200,567.11 million minimum minimum minimum packaging units. Packaging unit.

From 2017-2020, the growth rate of mainstream IFD drugs around the world was 18.86%, 14.33%, 5.54%, and-2.55%, respectively.

From 2016 to 2020, the number of mainstream IFD drugs in the US market was 103.3165 million minimum packaging units, the minimum packaging unit of 104.2452 million, the minimum packaging unit of 11.039 million, the minimum packaging unit of 11,360.68 million minimum packaging units. From 2017 to 2020, the sales of mainstream IFD drugs in the US market were 0.9%, 6.52%, 2.31%, and-4.28%, respectively.

It can be seen that from 2018 to 2020, the growth rate of the mainstream IFD drugs in the US market decreased year by year, and it fell into negative growth in 2020.

However, with the listing of competing products in the US market, the market share of Xuantai Pharmaceutical Pohakangazole entero tablets has been affected.

1.4 With the listing of competing products, Xuantai Pharmaceutical Pohakangazole entero -soluble tablets are facing the dilemma of the market "melon"

According to the prospectus, Merck Sharp & Dohme Corp (hereinafter referred to as "Merhado") is a company located in Kenyos, New Jersey, USA. Original pharmaceutical manufacturer of Pipononine.

AET PHARMA US LLC (hereinafter referred to as "AET") is mainly engaged in the research and development and production of innovative drugs and generic drugs. In February 2021, the Bubreviated New Drug Application (hereinafter referred to as "Anda") approved by AET developed by AET.

And Xuantai Pharmaceutical said that in February 2021, AET's Pothaconzazole entero -soluble tablets have been approved. The approval of AET has had a certain impact on the sales of Xuantai Pharmaceutical Portrazole Tablets in the US market.

Specifically, according to the prospectus quoted from IMS data, in 2020, Xuantai pharmaceutical market share was 41.34%, and the market share of Meroshadong was 58.66%. From January to June 2021, Xuantai Pharmaceutical's market share was 38.86%, a decrease of 2.48%. The market share of Meroshadong was 53.81%, a decrease of 4.85%, and the AET market share was 7.33%. With the approval of AET's Poposzole enteropolic tablets in 2021, the market share of Xuantai Pharmaceutical and Merosharto Polyzol enteripoilizer has declined.

In this regard, Xuantai Pharmaceutical also stated that the sales of Bo Shakangzozozolic tablets for a single product have a great impact on the company's operating performance. If the US market competition increases, or the sales of AET products in the US market will continue to increase, it may be possible The risk of a significant decline in its operating performance.

That is to say, Pothakazole entero -soluble tablets that contribute over 70 % of Xuantai Pharmaceutical's main business are not only facing the dilemma of the decline in the growth rate of the world's mainstream IFD drugs in the United States, but also their US market is also facing the US market. The situation of being "melon" by competitors.

Not only is the overseas market facing competitive pressure, but the sales of Xuantai Pharmaceutical Pohakangzole entero -soluble tablets in the domestic market may also be under pressure.

1.5 Polocascazole entero -soluble tablets are approved in China, while the growth rate of domestic generic drugs and IFD drug markets has declined

According to the prospectus, Xuantai Pharmaceutical Polyzozole enteropolic tablets were approved by the National Drug Administration for listing in January 2021.

According to the prospectus signed by Wuhan Hongrang Biomedical Co., Ltd. on December 20, 2021, quoting data from the "Victory Blue Book (2021 Edition)", in 2013-2020, the domestic generic drug market size was 631 billion yuan, 7,111, respectively. 100 million yuan, 777.2 billion yuan, 840.3 billion yuan, 891 billion yuan, 934.1 billion yuan, 970.7 billion yuan, 808.7 billion yuan.

According to the research of the Northern Capital Center of the "Syllarsians", from 2014-2020, the domestic generic drug market size growth rates were 12.69%, 9.3%, 8.12%, 6.03%, 4.84%, 3.92%, -16.69%, respectively.

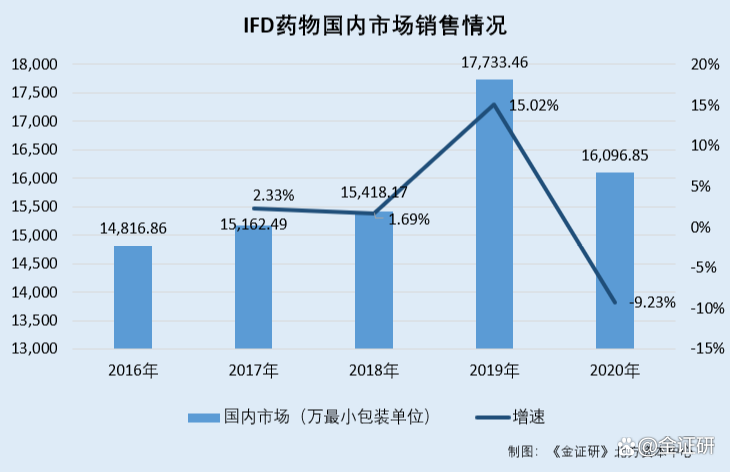

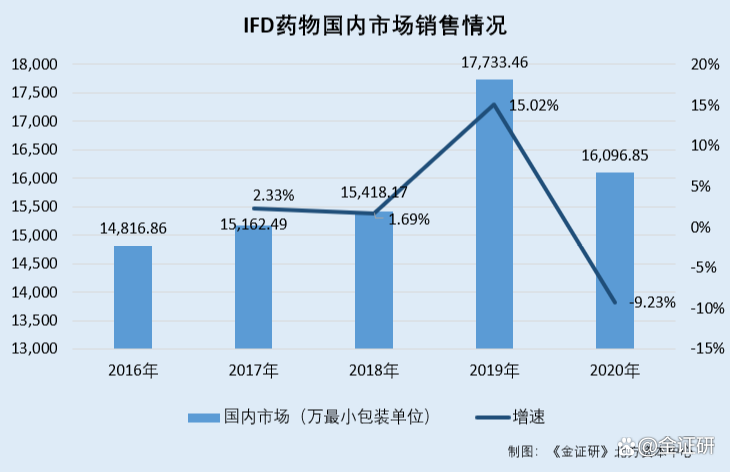

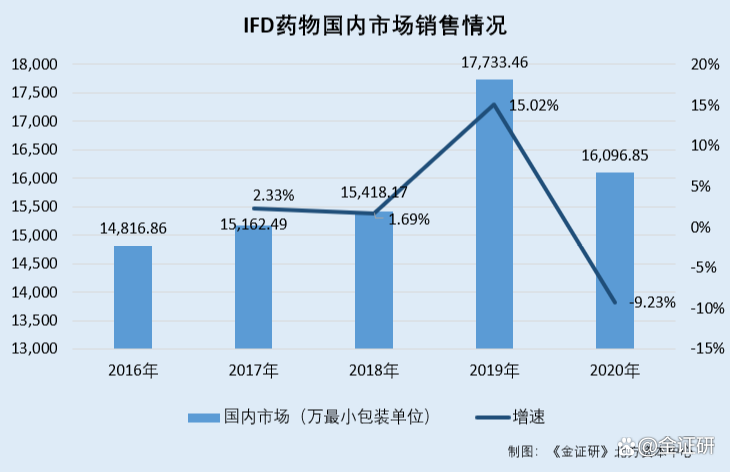

According to the prospectus quoted from IMS data. From 2016-2020, the number of mainstream IFD drugs in the domestic market was 148,81,600 minimum packaging units, the minimum packaging unit of 151.6249 million, the minimum packaging unit of 15.41817 million, the minimum packaging unit of 177.334 million, and the minimum packaging of the minimum packaging of the minimum packaging unit.

From 2017-2020, the sales of mainstream IFD drugs in the domestic market were 2.33%, 1.69%, 15.02%, and -9.23%, respectively.

It can be seen that from 2014 to 2020, the growth rate of the domestic generic drug market continued to decline. Coincidentally, from 2017-2020, the growth rate of the mainstream IFD drug sales in the domestic market showed a downward trend as a whole, and in 2020, the domestic generic drug market size and the number of mainstream IFD drug sales in the domestic market were negative.

From the above situations, from 2019 to 2020, the proportion of product revenue of Xuantai Pharmaceutical Polytizazizole Tablets increased year by year, while the growth rate of the sales of mainstream IFD drugs in the US market declined as a whole trend. To make matters worse, Xuantai Pharmaceutical's US market also faces the "melon" of the listing of competitors. Not only external problems, but also internal worry. From 2017-2020, the growth rate of the domestic generic drug market and the growth rate of sales in the IFD market slowed down. In this case, Xuantai Pharmaceutical's future growth space or pressure. The problem has not ended.

2. Vice President Wu Jianjian was at the same time as the supervisor and financial leader of the affiliated party and hurriedly withdrew for 2 months.

According to the "Company Law", directors and senior managers shall not be concurrently served as supervisors.

It is worth noting that Wu Jianjian, the vice president of Xuantai Pharmaceutical, was appointed by the former shareholder to Xuantai Pharmaceutical Director and stepped down after the reform of Xuantai Pharmaceutical Stock. What is strange is that in April 2020, Wu Jianjian joined Xuantai Pharmaceutical, and in August 2020, he entered Xuantai Medical Management again and served as Deputy General Manager. Back to history, during the deputy president of Xuantai Pharmaceutical, Wu Jian may be served as supervisors and financial personnel at the same time.

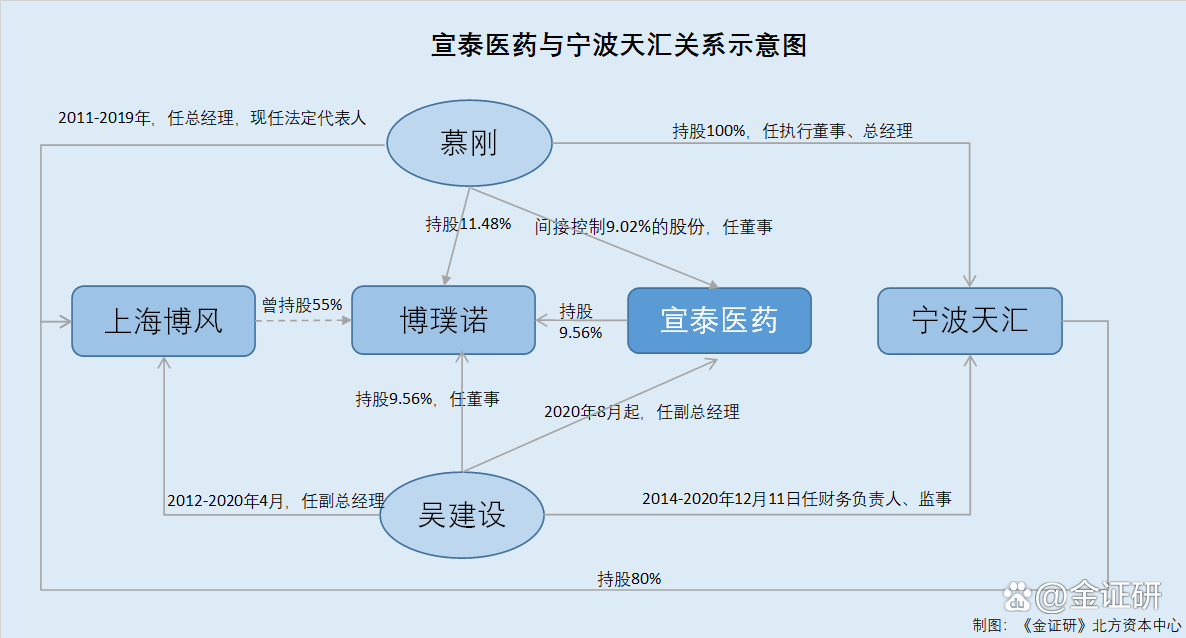

2.1 Shanghai Bofeng once held 9.02%of Xuantai Medicine, withdrawing from Ningbo Qi and receiving in May 2020

According to the prospectus, Shanghai Bofeng Enterprise Group Co., Ltd. (hereinafter referred to as "Shanghai Bo Feng") is a former shareholder of Xuantai Pharmaceutical.

According to data from the Market Supervision and Administration Bureau, Shanghai Bofeng was established on January 31, 2011. As of June 2, 2022, the legal representative of Shanghai Bofei was Mu Gang. Ningbo Tianhui Investment Co., Ltd. (hereinafter referred to as "Ningbo Tianhui") and Shanghai Qizhou Business Service Center holding 80%and 20%of Shanghai Bo Feng.

According to the data of the prospectus and the Market Supervision and Administration Bureau, on April 17, 2018, Xuantai Pharmaceutical changed investors. Holding 0.01%equity of Xuantai.

After the equity transfer of June 2018 and July 2019, Xuantai Co., Ltd., on July 3, 2019, Shanghai Bofeng's equity of 9.02%of Xuantai was limited to Xuantai.

On May 6, 2020, Shanghai Bofei transferred 9.02%of the equity of Xuantai held by him, and transferred it to Ningbo Meishan Bonded Port District Qihe Enterprise Management Partnership (Limited Partnership) (hereinafter referred to as " Ningbo Qihe ").

As of January 17, 2022, Ningbo Qiqi and 9.02%of Xuantai Pharmaceutical were held.

2.2 Director Mu Gang through Ningbo Tianhui, indirectly holding 80%of Shanghai Bofeng's equity

According to the prospectus, Ningbo Qihe was established on May 12, 2020, and the executive partners were Mu Gang.

Moreover, Mu Gang Xuantai Pharmaceutical is currently the deputy general manager and 9.02%of the shareholders.

According to the prospectus, from December 2011 to December 2019, Mu Gang served as the general manager of Shanghai Bo Feng; from July 2020 to the date of signing the prospectus, he was appointed director of Xuantai Pharmaceutical. As of the date of the prospectus, Mu Gang passed Ningbo Qi and indirectly controlled 9.02%of Xuantai Pharmaceutical's shares.

Among them, Mu Gang, Ningbo Tianhui Department, served as the legal representative, executive director and general manager, and controlled by Mu Gang. Mu Gang directly held 100%of the shares and was a related partner of Xuantai Pharmaceutical.

According to data from the Market Supervision and Administration Bureau, Ningbo Tianhui was established on February 8, 2002. On August 5, 2014, Mu Gang became a wholly -owned shareholder of Ningbo Tianhui. Since then, Ningbo Tianhui has no record of equity changes.

It can be seen that Mu Gang, deputy general general of Xuantai Pharmaceutical, indirectly holds 80%of Shanghai Bofeng's shares through Ningbo Tianhui.

2.3 Bo Yinuo, a shareholding company, was established by Shanghai Jinyuan, Shanghai Bo Feng and Xuantai Pharmaceutical

According to the prospectus, on November 2, 2015, Shanghai Jinyuan Donghe Chemical Co., Ltd., Shanghai Bofeng, and Xuantai Pharmaceutical jointly established Shanghai Boyeno Technology Development Co., Ltd. (hereinafter referred to as "Boluo Nuo"). Among them, Shanghai Bofeng invested 11 million yuan for currency, holding 55%of the shareholding ratio. Xuantai Pharmaceutical invested 3 million yuan in currency, with a shareholding ratio of 15%.

As of the date of signing the prospectus, Mu Gang, Wu Jian, and Xuantai Pharmaceutical held 11.48%, 9.56%, and 9.56%of Boluo Nuo. Boluo Nuo is a shareholding company of Xuantai Pharmaceutical.

In other words, Shanghai Bo Feng was once a shareholder of Xuantai Medical, and Shanghai Bofeng and Xuantai Pharmaceutical participated in the establishment of Boluo Nuo.

2.4 During the office of the deputy president Wu, he also served as a supervisor and chief financial officer in the affiliated party Ningbo Tianhui at the same time.

The prospectus shows that Wu Jianjian served as deputy general manager of Shanghai Bo Feng from January 2012 to April 2020; he joined Xuantai Pharmaceutical in May 2020 and is currently the deputy general manager.

According to Xuantai Pharmaceutical's signing date, "Report on the Review of the first public offering of shares on Xuantai Pharmaceutical and the review and inquiry letter on the science and technology board listing on the science and technology board" (hereinafter referred to as the "first round of inquiry reply" ), Shanghai Bofeng entered the Xuantai Co., Ltd. in April 2018, and in September 2018, Wu Jianjian was assigned to serve as a limited director of Xuantai.

According to the prospectus, on August 28, 2020, Xuantai Co., Ltd. was changed to a joint -stock company. After the overall change of Xuantai Co., Ltd. was changed to a company Co., Ltd., Wu Jianjian resigned as a director due to his work. Mu Gang, a new election of Xuantai Pharmaceutical, served as a director.

And the Boluo is a project in charge of the investment in Shanghai Bofeng, and is responsible for investing in the development prospects of Boluo. In May 2019, Wu Jianjian was conceded to Shanghai Bofei holding 15%of the equity of Bonno's equity of Bonno's equity. Essence Since then, Wu Jianzhan resigned from Shanghai Bo Feng in April 2020, officially joined Xuantai Pharmaceutical in May 2020, and served as senior managers of Xuantai Pharmaceutical in August 2020.

In addition, as of January 17, 2022, Wu Jianzhan was the director of Boluo Nuo.

It can be seen that in April 2018, after Shanghai Bofeng's investing in Xuantai Medicine, in September of the same year, he appointed Wu Jianzhu to Xuantai Limited as a director. In May of the following year, Wu Jianjian transferred 15%of Shanghai Bofeng holding 15%of the equity of Bo Yinuo, a shareholding company in Xuantai Pharmaceutical. As of the date of signing the prospectus, Wu Jianzheng served as Director Bo Yinuo.

According to data from the Market Supervision and Administration Bureau, on August 5, 2014, Ningbo Tianhui conducted a change of information on the filing of senior management personnel, and "Wu Jianzheng" appointed its supervisor. On December 11, 2020, Ningbo Tianhui carried out the record of senior management personnel and the change of financial personnel information.

According to public information, Wu Jian, the former financial leader of Ningbo Tianhui, has served as the executives. It can be seen that the "Wu Jianjian" who had worked in Ningbo Tianhui, which was the same person as Wu Junuo's director Wu Jian.

It can be seen that from August 5th, 2014 to December 10, 2020, Wu Jianzheng was a supervisor and financial leader in Ningbo Tianhui. In May 2020, Wu Jianzheng joined Xuantai Pharmaceutical, and since August 2020, he has served as the deputy general manager of Xuantai Pharmaceutical.

That is to say, since July 2020, Mu Gang began to serve as a director of Xuantai Pharmaceutical, and his control of Ningbo Tianhui was listed as a related partner of Xuantai Pharmaceutical. In August 2020, Wu Jianjian, who had worked in Shanghai for eight years in Shanghai, "changed jobs" to Xuantai Pharmaceutical and served as deputy general manager.

In addition, it is worth noting that Wu Jianjian has served as a supervisor and financial leader in Ningbo Tianhui in Xuantai Pharmaceutical, of which at least from August 2020 to December 10, 2020 At the same time, it may also be the financial leader and supervisor at the affiliated party Ningbo Tianhui. Wu Jianzheng will no longer serve as the financial leader and supervisor of the related party on December 11, 2020. Is it to "avoid suspicion"?

Not only that, Xuantai Medicine or "not bad money" anti -fundraising "blood replenishment".

Third, long -term borrowing "hand in hand" exceeds 200 million yuan, and the rationality of fundraising "blood replenishment" is doubtful

The use and supervision of fundraising funds are important parts of corporate governance and securities supervision. As of the end of June 2021, Xuantai Pharmaceutical's interest liabilities were 643,100 yuan and monetary funds were 248 million yuan. However, this time, Xuantai Medical plans to raise 83.9 million yuan for supplementary funds.

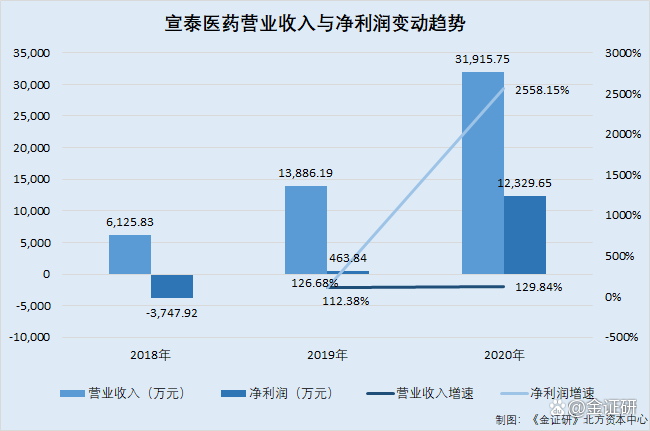

3.1 2019-2020, the growth rate of operating income and net profit exceeds 100%

According to the prospectus, from January to June 2020 and 2021, Xuantai Pharmaceutical's operating income was 61 million yuan, 139 million yuan, 319 million yuan, and 156 million yuan, and the net profit was -37.479 million yuan, 463.84, respectively. 10,000 yuan, 123.2965 million yuan, 36.9478 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", from 2019 to 2020, Xuantai Pharmaceutical's operating income growth rate was 126.68%and 129.84%, and the net profit growth rate was 112.38%and 2,558.15%.

It can be seen that from 2019 to 2020, Xuantai Pharmaceutical's revenue and net profit growth rate showed an upward trend. During the same period, Xuantai Pharmaceutical's operating income and net profit increased more than 100 percentage points. In 2020, the net profit growth rate exceeded 2,000 percentage points.

In addition, Xuantai Pharmaceuticals may not face debt repayment pressure.

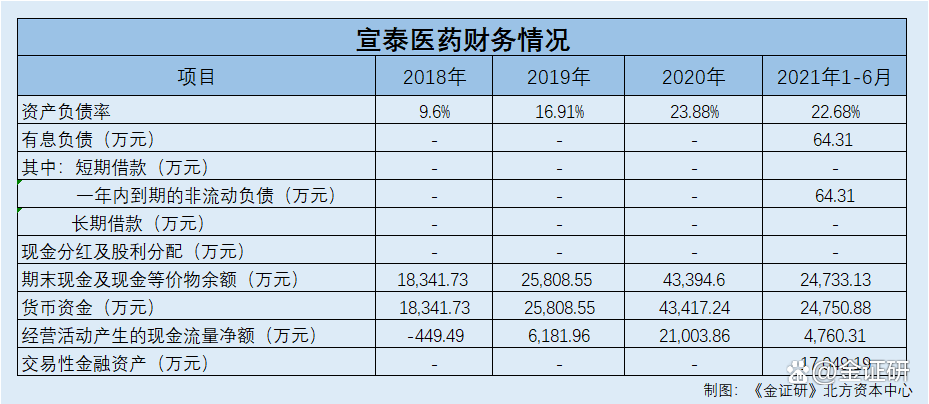

3.2 As of the end of the reporting period, Xuantai Pharmaceutical's interest liabilities are 643,100 yuan

According to the prospectus, Xuantai Pharmaceutical's counterparts are comparable to listed companies as Borui Biomedical (Suzhou) Co., Ltd., Jiangsu Hengrui Pharmaceutical Co., Ltd., Chengdu Yuandong Biopharmaceutical Co., Ltd. , Hunan Warner Pharmaceutical Co., Ltd..

At the end of 2018-2020 and at the end of June 2021, Xuantai Pharmaceutical's asset-liability ratio was 9.6%, 16.91%, 23.88%, and 22.68%, respectively. During the same period, Xuantai Pharmaceutical's average asset -liability ratio of the above -mentioned comparison peers was 28.77%, 27.72%, 19.55%, and 20.76%, respectively.

According to the prospectus, from the end of each period of 2018-2020 and January to June 2021, Xuantai Pharmaceutical has no short-term loans and long-term loans. During the same period, the non -current liabilities expired within one year of Xuantai Medicine were 0 yuan, 0 yuan, 0 yuan, and 643,100 yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", at the end of each issue of 2018-2020 and January to June 2021, the total interest liabilities of Xuantai Pharmaceutical were 0 yuan, 0 yuan, 0 yuan, and 643,100 yuan, respectively.

It can be seen that from 2018-2020, Xuantai Pharmaceutical's performance showed a high-speed increase, and the pressure on debt repayment was small, and the asset-liability ratio was lower than the comparison company average.

In addition, as of the end of June 2021, Xuantai Pharmaceutical "hand in hand" 248 million yuan in currency funds.

3.3 As of the end of the reporting period, Xuantai Medicine "hand in hand" 248 million yuan in currency funds

According to the prospectus, from 2018 to 2020 and January to June 2021, the net cash flow generated by Xuantai Pharmaceutical's business activities was -44.949 million yuan, 61.8196 million yuan, 21,38,600 yuan, and 4,760.31 million yuan, respectively.

At the end of each period of 2018-2020 and January to June 2021, the currency funds of Xuantai Pharmaceutical were 183 million yuan, 258 million yuan, 434 million yuan, and 248 million yuan.

From 2018-2020 and January to June 2021, Xuantai Pharmaceutical's trading financial assets were 0 yuan, 0 yuan, 0 yuan, and 170 million yuan, respectively.

Among them, from January to June 2021, Xuantai Pharmaceutical's trading financial assets were mainly bank wealth management products and structural deposits.

From 2018-2020 and January to June 2021, Xuantai Pharmaceutical has no cash dividends and dividend distribution. During the same period, the balance of cash and cash equivalents at the end of Xuantai Pharmaceuticals was 183 million yuan, 258 million yuan, 434 million yuan, and 247 million yuan, respectively.

As of the end of June 2021, Xuantai Pharmaceutical's monetary funds were 248 million yuan, and there were no long and short -term borrowings. Xuantai Medicine or "not bad money".

In this context, Xuantai Pharmaceutical still raises funds to supplement liquidity.

3.4 This listing, Xuantai Medicine plans to raise 83.9 million yuan to supplement mobile funds

According to the prospectus, this time it was listed, Xuantai Medical plans to raise 83.9 million yuan for supplementary funds.

It can be seen from the above situation that from 2019 to 2020, Xuantai Medical assets liability ratio is lower than those comparable to the company, and its revenue and net profit growth rate has grown rapidly. As of the end of June 2021, Xuantai Pharmaceutical had only 643,100 yuan in interest liabilities, and its currency funds were 248 million yuan. Based on the above situation, Xuantai Pharmaceutical wanted to raise 83.9 million yuan "blood", and the rationality may be on the question mark.

Husbands are often accumulated. Can Xuantai Medicine give investors a satisfactory answer in the future?

- END -

Shanghai new social diagnosis +2!The results of the epidemic flow of the three districts, Suning Tesco, Red Rose Beauty Salon and other epidemic flows →

Today (June 18) at 17:00, the Shanghai Municipal Government News Office organized ...

National Health and Health Commission: my country's epidemic situation has remained stable as a whole

On the 17th, the joint prevention and control mechanism of the State Council held a press conference on the relevant situation of college students' employment and return to home.The overall situation...