Professor of finance, 5 years of listed companies

Author:Changjiang Business School Time:2022.07.05

The following article comes from Tsinghua Management Review, author Mei Jianping and Chen Jian

On June 26, 2019, a biopharmaceutical company was born in the air and landed on the Nasdaq Exchange in the United States. The closing of the market rose more than 62%on the same day, and the market value reached 3.3 billion US dollars, winning the "largest biotechnology IPO" crown of the year.

This company is Bridgebio, a rare disease therapy company in the United States. Its founder of Luo Wenquan is a professor of finance at the Massachusetts Institute of Technology (MIT). In the past few decades, it is well -known in the economics and teaching in the financial market and asset portfolio theory.

Six relatives and friends, including their own mother, died of cancer within 4 years, let the professor of finance began to pay attention to the field of biopharmaceuticals and think about how to make a greater impact on his life.

Compared to the traditional model of gathering related scientists and investors in some diseases, Bridgebio has built a "quasi -platform" biopharmaceutical business model: the company has raised lower -cost funds and invested in more efficient drug research and development The project is in the middle of the resources required for each project to achieve a virtuous circle.

Regardless of investors, or for many patients waiting for drugs, Bridgebio's model symbolizes wider hope. Today's article is not only a display of a business successful entrepreneurial process, nor is it limited to analyzing its business model advantages. It is also worth pondering that in this era of change, how to make the most true vision and social responsibility, Transformed into a commercial innovation that benefits humans and practical and feasible?

Today, I will share with you Professor Mei Jianping and researcher Chen Jian of the Yangtze River Business School analyzing Bridgebio's case analysis, hoping to bring you inspiration and thinking.

Author | Mei Jianping Chen Jian

Source | Case Center of Changjiang Business School

Startup | Tsinghua Management Review

01

The original intention of the mother due to lung cancer, the professor of finance professors

A professor named Luo Wenquan (hereinafter referred to as "Professor Luo"), a professor named Luo Wenquan (hereinafter referred to as "Professor Luo"), has been in the past few decades. Research and teaching in combination theory and other aspects, enjoy the economics and financial industry.

However, since 2012, "because it is difficult to accept family and friends to die because of cancer," Professor Luo has continued to pay attention to the development of the biopharmaceutical market.

Professor Luo's mother suffered from lung cancer. When his mother was treated, he paid attention to a biotechnology company that was developing a set of techniques for lung cancer.

Hope Professor Luo thought that soon after, his mother was fortunate to be cured under this technology. Unfortunately, his mother could not wait for the advent of this therapy after all.

When it was learned that the progress of R & D is largely restricted by funds, Professor Luo was silent.

As an economist, he can probably understand the reasons behind; but as a son of dying patient, he is almost angry -when he heard that interest rates, stock market fluctuations, and Fed's policy may indirectly affect whether it is effective Methods to treat lung cancer may be difficult to accept.

With the further observation of the current status of the biopharmaceutical market, Professor Luo is worried about it, and the development of new drugs is becoming more and more difficult.

As shown in Figure 1, if the number of approved drugs that can be transformed by the R & D expenditure per billion US dollars per billion US dollars to reflect the efficiency of biopharmaceutical research and development, then in recent decades, the efficiency of biopharmaceutical research and development has declined significantly, which means that the development of new drugs is developing new drugs The cost is continuously pushing up.

In other words, the financial risks of drug development are more obvious -because of this, less funds flowing into the early pharmaceutical research and development stage are getting less and less. This trend of avoiding risks and uncertainty has led to the entire biopharmaceutical industry. The process of cancer and rare disease treatment is also slow because of the "financing" level.

Figure 1: Changes in the R & D efficiency of biopharmaceuticals in the United States in the United States

02

Bridge of hoping

Why is the traditional financing model of the biopharmaceutical industry increasingly difficult to raise the required funds?

This is closely related to the long -term operation model of the biopharmaceutical industry.

Usually, a potential value of drug development plans require repeated test development and testing before pushing to the market, which will consume various resources including funds.

According to statistics, in the early research, only one of the potential and effective compounds per 10,000 compounds will eventually obtain the approval of the regulatory agency -the US Food and Drug Administration (FDA). The approval process may take up to 15 years;

From the perspective of capital costs, as of 2019, a "future" candidate drug has transformed from the laboratory to FDA's final approval item, with an average cost of $ 2.6 billion;

And there are many drugs that have been approved, and they will eventually be discarded because of various factors.

Drug development is not a public welfare activity.

Even the US Congress, FDA and other institutions have promulgated a series of bills that support the research and development of cancer and rare diseases. The traditional biopharmaceutical funding sources represented by risk capital are still detouring early biomedical research and development due to high cost, high risk, and low returns. Phase and the majority of biopharmaceutical startups.

On the contrary, large pharmaceutical companies and venture capital institutions will prefer the successful startups and the ideal pharmaceutical plan of clinical trial effects.

Professor Luo believes that the profitability of capital is the underlying logic of market competition and resource allocation. We cannot change the risk preferences of large pharmaceutical companies and investors, but what can be changed is the source of capital and the development of early biopharmaceuticals and Operation mode. If based on financial technology, the capital risk of investing in biopharmaceuticals is lower, or the expected return rate is higher, then it can naturally win the attention of capital.

After a series of research and data simulation, Professor Luo put forward a new idea- "Megafund".

Imagine that if a 10 -year drug development plan requires an investment of 200 million US dollars, and the plan has a 5%probability of success in the 10th year, during the next 10 years of patent protection, you can get 2 billion yuan per year The income of the US dollar, then calculated at a cost rate of 10%, and the annualized return on the project of the project is about 11.9%, but the expected return standard difference reflects the risk is as high as 423.5%. This pair of rational investors In other words, they will be discouraged.

But what if the concept of combined investment is used, and at the same time invest in similar, 150 independent projects?

Although the scale required at this time has reached 150 times before, and the compound annualized yield is still 11.9%, according to the large number of laws of statistics, at least two projects in 150 independent projects can reach 99.6 %, The expected income standard deviation is reduced to 34.6%at this time -far below the risk of investing in single projects, and the $ 30 billion capital, because the return on investment is considerable, can be raised through wider financing channels, such as issuance, such as issuance, such as issuance Stocks, long -term bonds and other financial derivatives, even the government endorses a giant fund.

In this case, based on comprehensive consideration of risks and income, funds are expected to spontaneously flow towards this drug research and development project.

This is the idea of Professor Luo: the establishment of a fund operation entity, and at the same time support a large number of independent drug research and development projects, enough projects are concentrated together to ensure the reduction of risks.

A biotechnology company with a new operation model, Bridgebio (Pharma), came into being.

03

Bridgebio's rapid growth process

In 2015, Bridgebio was completed in the San Francisco Bay Area in California, USA. The original intention and mission of linked ".

At the beginning of its establishment, Professor Luo and Dr. Kumar decided to set the core research direction of biopharmaceuticals in a rare disease in a lack of inspiration.

Due to the low incidence of rare diseases in human groups, the total number of each type of case is less than 200,000. This is a very small space compared with the volume of people with high incidence such as diabetes and pneumonia.

However, according to statistics, although any rare disease only affects relatively small patients, it is estimated that there are more than 7,000 rare diseases worldwide, and the cumulative affected Americans are as many as 30 million, exceeding the number of cancer patients in the United States.

Under the concept of the "giant fund" provided by Professor Luo, Bridgebio chose to enter the game from the rare disease drug market, and he had a more practical confidence.

In addition, the development of rare diseases also actually has some unique advantages:

1. Rare diseases are almost all belonging to "Montel's Genetic Disease". Usually it is caused by the pathological characteristics of genetic defects. In the past 100 years, the understanding of genetics and genome in the field of biology and medicine is for genetic diseases. Monitoring, traceability, and treatment provide richer clue guidance.

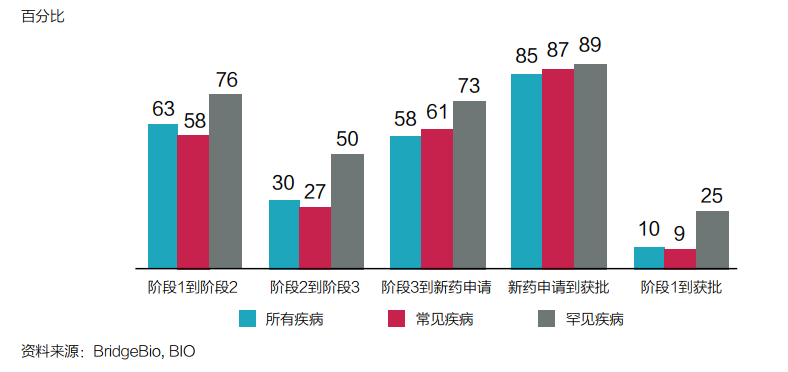

2. In 1983, the United States passed the Orphan Drug Law (ODA). With the support of the bill, the FDA would give priority to approval of the rare disease clinical trial plan. Data show that nearly half of the new drugs approved by the FDA in 2019 were given orphans.

3. The bill also considers the realistic problems of commercialization, and has introduced a series of incentive policies, such as the tax reduction and exemption of 50%clinical trial costs, the longer market ranking of market, and the higher amount of basic research funding subsidies given by the federal government Essence

"Due to some favorable factors in the rare disease field, the chance of the successful development of related drugs and therapy has increased, and the cost is also reduced accordingly. Therefore, 150 independent projects may be required to control risks in a reasonable range. Ten can be connected. "Professor Luo added.

With faith, with policies, and a new set of funds operation models, Bridgebio has begun to enter a high -speed development stage.

In the following two years, Bridgebio has been raising funds (see Table 1) to form a scientific research team.

In 2017, Bridgebio has initially set up a drug research and development platform covering the entire process of "exploration of the subject's genetic disease → studying disease therapy → clinical testing and testing → commercial production and clinical use".

On June 26, 2019, Bridgebio successfully landed on the Nasdaq Exchange in the United States. The closing of the market rose more than 62%on the same day, and the market value reached 3.3 billion US dollars, winning the "largest biotechnology IPO" crown that year.

Bridgebio has been founded from creation to obtaining the capital market for four years, and it is also one of the cases for startups to go public. Table 1: Birdgebio's financing data over the years

As of July 14, 2021, Bridgebio's market value has exceeded $ 9.3 billion.

04

Unique business model

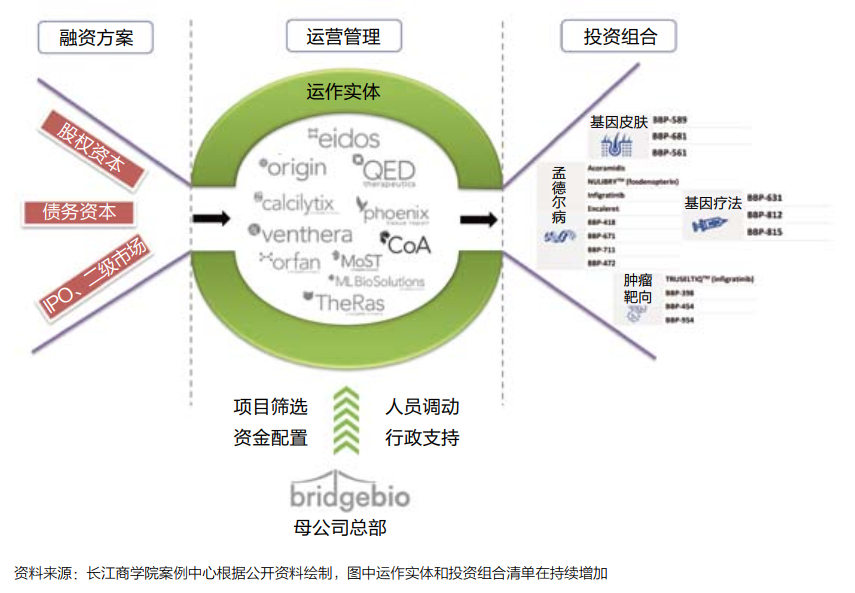

Bridgebio is essentially built a "quasi -platform" biopharmaceutical business model (see Figure 2): The company has invested in more efficient drug research and development projects by raising lower -cost funds, and is in the middle of the resources required for each project allocation. , To achieve a virtuous circle.

Figure 2: Bridgebio biopharmaceutical business model diagram

Financing plan

Compared with the traditional model, the biggest original intention designed by Bridgebio is to reduce the risk of capital and reduce investors' intervention in scientific research.

Therefore, more diversified funds are needed, and funds that are more "patient" for expectations are required. Long -term equity, bonds and other low -risk financial derivatives have become important financing channels for Bridgebio.

According to Professor Luo's estimates, a large number of investment portfolios can help Bridgebio reduce the risk of its overall failure of the project to the level that is similar to the risk of liquidation of high credit company bonds.

The government guarantees the issuance of bonds and raises an investment fund for rare diseases and therapy projects managed by the country. Government guarantees have enabled bond issuance to attract more traditional institutional investors, and even funds that do not care about biopharmaceuticals.

portfolio

The success of Bridgebio's business model also depends on the transformation of "giant funds" into many independent, potential value investment portfolios -rare disease drugs or therapy development projects.

Since its establishment in 2015, Bridgebio has concentrated a lot of energy and financial resources on acquisitions and established potential biotechnology companies or development teams to obtain drug development pipelines and technical patents.

In Professor Luo's research, the investment portfolio strategy must follow the most important investment portfolio theoretical system in financial science in large frameworks, but focusing on the practice of biopharmaceutical development projects, it also needs to pay special attention to the core elements of the industry.

For example, the potential market space and competition pattern, the probability of the final approval of drug development projects, and the stage of drug research and development projects.

In other words, Bridgebio's screening of the "target" of the investment portfolio is not in accordance with a completely randomization method, but on the basis of the "quantity" expansion of assets, further optimizes the "quality" of assets, focusing on the "structure of the structure of the combination of different stages of the combination of different stages "By ratio, dynamically promote the efficiency of the entire investment portfolio.

Taking rare diseases as the core area of asset allocation, it is a decision to consider factors such as drug development success and approval probability (see Figure 3).

Figure 3: The probability of rare diseases and other diseases at each stage comparison

Operating management

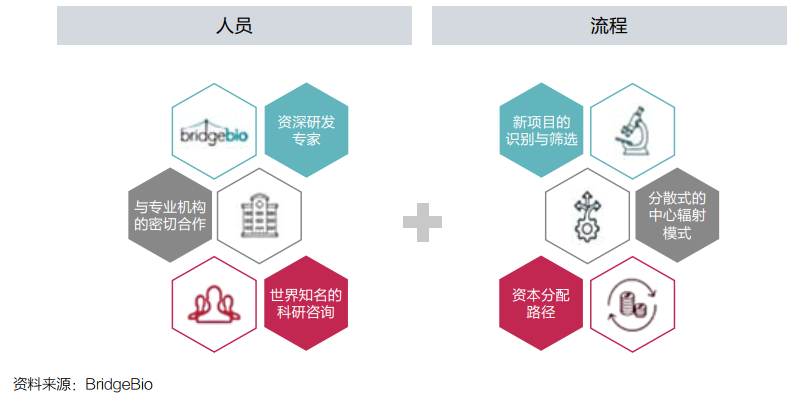

On the basis of a large amount of funds and investment portfolios, it is also important to allocate and operate resources. Bridgebio uses a "decentralized hub-and-spoke) (see Figure 4).

In Dr. Kumar's view, this architecture gives the company a great flexibility: "From the perspective of resource allocation, we are a top -down model; but the specific process of drug research and development, we can be regarded as one of them. Model from bottom to or from the bottom to the inside. "

Figure 4: Bridgebio's operating platform

Bridgebio split the project to its subsidiaries to promote it. The management team of the subsidiary is composed of members of different backgrounds, including entrepreneurs, experienced scientists, and other business and scientists. Organic team with superimposed advantages.

Bridgebio is responsible for the resources required for raising and allocation of each subsidiary to provide core support. At the same time, Bridgebio can transfer employees and funds between different development plans according to needs. In this way, if some plans fail, These resources can still be shared in other plans in large proportion.

This resource reuse has largely reduced the possibility of a fatal blow to biopharmaceutical startups.

05

The bridge extends to the distance: the promotion of the business model

Today, Bridgebio and its innovation models are gradually attracted by the biopharmaceutical industry and capital markets. There are also a "follower" follow the concept of "giant funds" and "investment portfolios" to develop the innovative model of biopharmaceuticals.

For example, since 2016, the US Investment Corporation Bain has set up two life science funds to provide support for biopharmaceutical companies with potential but capital dilemma.

ARCH, a well -known venture capital company in the American life and health, also announced that it has invested in the method of raising funds to invest in transformative biotechnology companies.

Bridgebio's success has not only developed profound inspiration to the biopharmaceutical industry in the European and American markets, but also brought new inspiration to the Chinese biotechnology market.

The first is the sharing of new drug development projects and potential clinical value.

On August 11, 2020, Lianbio was established. On its establishment day, it announced that it would cooperate with Bridgebio to expand its drug research and development project to China. According to the terms of the agreement, Lian Tuo Bioskin will obtain the commercial rights and interests of related mature drugs and therapies in China and designated the Asian market, and participate in the clinical study of the two drug plans existing in Bridgebio.

Secondly, there is an opportunity in business model.

At present, there are two types of mainstream biopharmaceutical business models in China:

One is the internal incubation and spin -off model of large pharmaceutical groups. These large companies will use their own funds to develop new projects, and after the project is mature, they will be split and split into subsidiaries.

The other is a model that is incubated by large capital, which is driven by the strong capital of multiple rounds to target some specific treatment fields, such as well -known Kangqiao Capital and Yaoming Kangde.

In summary, these two models depend on the investment of large group capitals. In the final analysis, this is also relatively weak with the basic research of biomedicine in my country. The current situation of survival is closely related.

Bridgebio and the US investment and financing model have experience that can learn from. In addition to the platform -type model represented by Bridgebio, the American biopharmaceutical investment model in the United States is diverse:

There are incubation model represented by the Silicon Valley entrepreneurial incubator Plug and Play, the capital and scientific research co -creation model represented by Flagship Pioneering, and the equity purchase model represented by Roivant.

These models of early biopharmaceutical investment have their own characteristics, and the combination of the scientific research system and the capital system is very close, thereby greatly improving the entire process efficiency of biopharmaceuticals from exploration, creation, research and development to listing.

06

Light up a lamp: social innovation and business to good

From Professor Luo's original intention in 2015 to new biotechnology companies with more than 30 drug research and development projects and market value exceeding $ 9.3 billion, the story of Bridgebio is not only a display of a business successful entrepreneurial process. Analyze its business model advantages.

What is more worthy of thought is that in this era of change, how to transform a copy of the most true vision and social responsibility into a business innovation that benefits humans and practical and feasible?

In the classic Western management theory, enterprises are defined as organizations that pursue interests. With the improvement of the market economy system, the status of enterprises in social operations has become increasingly improved. Enterprises and models seem to be abandoned by the times.

If commercial innovation can be based on the interests of consumers and the majority of users and the promotion of social welfare as the fundamental goal. While business to the good and contribute to the society, it can be given the highest state of value to the value of business innovation. It is the main trend of innovation and entrepreneurship.

As a biotechnology company, the success of Bridgebio is closely related to a professor of finance who does not understand biopharmaceuticals. Under the trend of knowledge explosion and the transformation and refined operations of various industries, the flow and integration of skills and professionalism have been greatly strengthened.

Just as academic research in many fields today has embarked on cross -disciplinary crossing roads. Perhaps, cross -domain entrepreneurship will also lead the trend of future business innovation.

Whether it is the industry or cross -domain and cross -border innovation, if it is based on the welfare of all humanity, its vitality and influence must be boundless.

In order to bring the hope of healing for more patients, only one Bridgebio is not enough. Bridgebio is more like a candle. It will light up more industry practitioners, and even inspire the government's policy orientation, and may provide guidance to the entire business society innovation orientation and innovation ideas.

He Mingqin, an internship assistant researcher, also contributed to this article.

The picture in the article comes from Tuwu's creativity, and the reprint needs to be authorized.

- END -

Can mosquito bites spread the disease?Popular Faculty Camp to allow children to open up their vision in mountainous areas

The Yangtze River Daily Da Wuhan client July 17th The thicker the mask, the better...

The man's headache was unbearable late at night, and his family only did one thing to save his life!

When people reach middle age, they are old and small, but because of a sudden dise...