After completing Li Xianlong, Huang Xuncai will be the Prime Minister of Singapore by 2025, saying that the rich should pay more taxes.

Author:Daily Economic News Time:2022.08.16

According to CCTV News, Singapore Deputy Prime Minister and Minister of Finance Huang Xuncai revealed in an interview on August 15, local time that he would take the position of the Prime Minister from the current Prime Minister Li Xianlong before 2025, or earlier.

Earlier, Singapore Prime Minister Li Xianlong announced on April 16 when he held a press conference in the Presidential Palace that Huang Xuncai, then Minister of Finance, had determined to be the next Prime Minister of Singapore and was the leader of Singapore's fourth -generation leader. On June 6, Huang Xuncai was appointed Deputy Prime Minister.

Singapore Deputy Prime Minister and Minister of Finance Huang Xuncai Source: Visual China VCG31N1235530025

According to surging news, Huang Xuncai, a 49 -year -old Singapore Deputy Prime Minister and Minister of Finance, said that the gap between Singapore's income from the Gini coefficient is narrowing, but the government may need to "further inclined to more inclusive growth."

"Everyone is paying taxes, but people with strong financial resources -rich and high -income -people -must be paid more. This can not only be achieved through the tax system, but we can also use transfer payment and expenditure to do it to do it to do with expenditure and expenditure. At this point, ensuring expenditure is aimed at low -income people and people with greater demand. "Huang Xuncai said in an interview with Bloomberg News editor John Micklethwait on Monday.

In fact, the Singapore government has raised personal income tax, real estate tax and luxury car and luxury house tax in the fiscal budget of 2022. On February 18, Huang Xuncai issued a statement of the 2022 fiscal budget of Singapore in terms of taxation.

In terms of personal income tax, Huang Xuncai pointed out that letting those people who earn more contribute more still. He also announced that starting from the 2024 estimated tax year, the tax revenue should be paid from more than 320,000 Singapore to 500,000 Singapore dollars, and the marginal tax rate remains at 22 %; Raiders to 23 %; the marginal tax rate of more than 1 million Singapore will be raised to 24 %.

"It is expected that this growth will affect the personal income tax taxpayer with a maximum of 1.2%, and will increase the tax revenue of S $ 170 million each year." Huang Xuncai said.

For wealth tax, Huang Xuncai said that the wealth tax is an important part of the tax system. It helps to reduce some wealth stock to the economy, thereby reducing social inequality. Therefore, wealth taxes need to be levied to establish a more fair society.

Daily Economic News integrated from CCTV News, Surging News

search

copy

Daily Economic News

- END -

Turkey and Saudi Arab

Xinhua News Agency, Ankara, June 22 (Reporter Xiong Sihao) Turkish President Erdogan met with the visiting Saudi Arabian Crown Prince Mohammed Salman on the 22nd. The leaders of the two countries stat

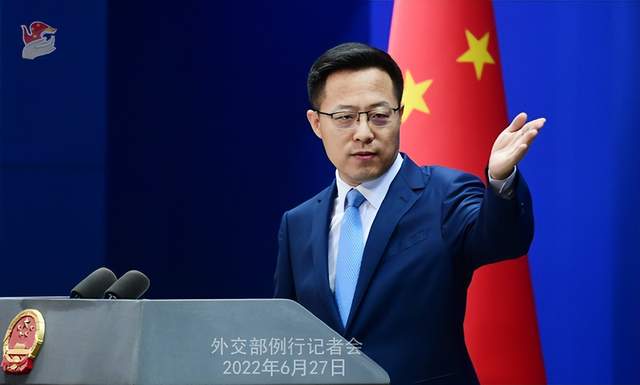

China invites ten Pacific island countries to hold video conferences with the foreign minister Wang Yi next month?Ministry of Foreign Affairs

June 27, 2022 President Zhao Lijian, a spokesman for the Ministry of Foreign Affai...