"It's equivalent to one Hong Kong!"I didn't expect him to be the number one "big landlord"

Author:Global Times Time:2022.07.07

The Associated Press reported that Microsoft founder Bill Gates had just obtained legal approval and allowed him to purchase 2100 acres (1 acre about 6 acres) farmland at $ 13.5 million in North Dakota. Earlier, Bill Gates purchased farmland, which once triggered dissatisfaction with local residents and caused the state's highest prosecutor to intervene in the matter. In fact, this is not the first time that Gates has invested in buying land in the United States. He has purchased nearly 269,000 acres in more than a dozen states in the United States, equivalent to 1.63 million acres, which accounts for almost 1%of the national farmland. The largest farmhouse in the United States. In the context of global high inflation and stock market fluctuations, there are more and more "landlords" for farmers in European and American countries.

Equivalent to "1 Hong Kong" and "3 Berlin"

Yahoo Finance Network reported on the 6th that it has just purchased 2100 acres of Liangtian from North Dakota, which has expanded Gates's land territory again. According to the data released by the Fortune Top 100 Land Report in 2021, Gates purchased more than a dozen states in the past few years, including 242,000 acres of farmland, 1234 acres of leisure land, and other land of 25,700 acres. Farmland transitions to residential and commercial purposes. The acquisition of North Dakota will make the total land holding more than 270,000 acres, and the area is almost equivalent to the entire Hong Kong as a large, which can be worth 3 Berlin.

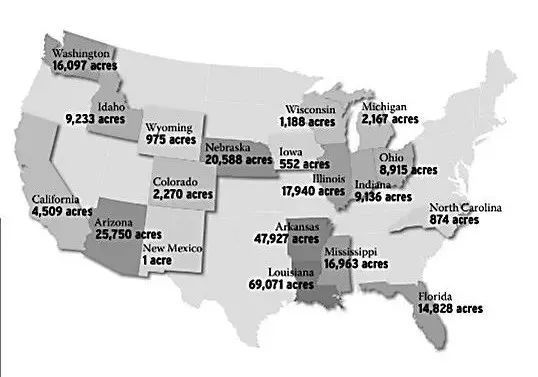

Bill Gates area held in various states in the United States

报道称,盖茨购买的农地包括路易斯安那(6.9万英亩)、阿肯色(4.8万英亩)、内布拉斯加(2万多英亩)、亚利桑那(2.5万多英亩)、密西西比、印第安纳、 Washington and Florida in the south. The National Broadcasting Corporation (NBC) reported that the land of nearly 20 states included farmland such as carrots, soybeans and potatoes, some of which eventually became French fries that eventually became McDonald's.

According to US media reports, although Gates is the largest private owner of the United States, he is not the largest land owner in the United States. The largest land owner in the United States has another person -billionaire John Malong, known as "the godfather of cable TV", has 2.2 million acres of land in the United States.

In addition, the well -known Amazon e -commerce giant Jeff Bezos also has 420,000 acres of land. In addition to cultivated land, there are a large number of forests and unread land. American media giant Ted Turner, ranked 65th in the "2021 Forbes Global Rich List" with a wealth of $ 25 billion in wealth, is the owner of the top land in the United States. It can be seen that the big landlord is a super rich man.

The rich in Europe also love to buy land

In European countries, there are more and more "landlords" who buy farmland. Bosille is the head of a furniture company in Saxony in Germany. He told the Global Times reporter that his family bought 10 to 20 hectares (1 hectares equal to 15 acres) in surrounding areas for investment every year. In addition to agricultural land, there are also forests. Forest wood is used for his enterprise, and farmland is rented to local farmers.

Bosell told the Global Times reporter that 20 years ago, they bought less than 10,000 euros per hectare, and the price of 15,000 euros 10 years later, now it has exceeded 30,000 euros. This price is relatively low in Saxony under the agricultural state. He told reporters that the land they bought has never been sold so far, and generations have been inherited. According to the regulations of Germany, if you buy factories, apartment buildings, etc., the approval will be strict. When Bosell signed a lease contract with local farmers, it will explain the use and precautions of the land in detail.

"In the past two years, Germany has appeared in buying land." Rudiger Rudig, Land and Real Estate Investment Consultant, said in an interview with the Global Times reporter that U.S. billionaire's investment in agricultural land is to protect themselves from inflation. Private non -agricultural buyers are relatively easy to obtain American farmland and forests. In Germany, investors are more strict supervised by investors' purchase of agricultural land. Authorities hope to avoid farmland as speculative objects, less than 1%of farmland traded each year.

But now the German government has relaxed land trading, such as stipulating that buying farmland can build solar parks to generate electricity. Some cities have more than ten solar park projects. Of course, more people buy land for farms or rental. However, there are also doubts that the rich are suspected of obtaining high agricultural subsidies through buying land. But Rudig said that if the buyer does not produce, it is difficult to get subsidies within the European Union.

The German "Agricultural Today" magazine said that not only the price of German agricultural land rose sharply, but the agricultural land prices in most European countries were also rising. For example, the price of the most expensive Netherlands in 2020 is close to 70,000 euros per hectare. In the past 10 years, the price of Dutch land has risen by nearly 40%. In another country Romania, the price of land has been more than five times in the past 10 years, and in 2020 reached 7,163 euros per hectare, the price even exceeded the agricultural power France.

"The oldest and best long -term investment"

"High returns, low risk", German Economic News network generally summarizes the trend of investment in land buying land. Investment legend, Volon Buffett, once said that buying farmland in many places is "the oldest and best long -term investment."

In general, the farmland has always been a favorable investment. The return of investing in farmland is better than the vast majority of other investments, and it can even be comparable to stocks. According to the U.S. Forbes, in the past 29 years (1992-2020), the return on investment in American agricultural land is higher than most assets. There are also data that since 1972, the annualized return on the US farmland is about 10%, while the US real estate is only 9%, and the US stock market (S & P 500 Index) and gold have only increased by about 7%each year. Especially for the recent surge in food prices, agricultural land investment has more potential. Rudig believes that from the investment of the man, buying land is also a good stock, which requires long -term investment. Data from the US Department of Agriculture show that there are more than 370 million hectares of farmland in the United States, 2/3 of which are owned by farmers and 1/3 are large investors. The data also shows that 39%of the landlords of the farmland do not plant land themselves, but lease the farmland to farmers. 80%of these landowners are investors. Obviously, the cash flow caused by rent is a direct and considerable income for many investment agricultural land. Secondly, as a farmland, the income of the crops is also one of the main returns, especially for the farmers of the real land. Some people purchase agricultural land, in addition to being a relatively stable value -added investment, at the same time use it as a place for vacation and leisure. Some people also make the farm a place to celebrate weddings, birthdays and other celebrations.

Although the East Coast of the United States where the Global Times is located in the United States does not have a vast farmland in the Midwest, farms will also be seen everywhere in the suburbs. Many farms are mainly planting fruit trees. A larger farm has one picking festival every year. In addition to picking fruits, before Halloween, pumpkins everywhere are also for people to pick. It is worth mentioning that these farms often have a food grocery store selling their own products, and some are almost a large food supermarket. Such farm grocery stores are very popular with locals and even become a landmark place in the community.

The American agricultural land has always been a good investment variety, but the early period of buying agricultural land is very high, which is not suitable for ordinary investors with small amounts of funds. In recent years, the rise of the US agricultural real estate investment trust fund and various crowdfunding platforms have greatly reduced the investment threshold for investment in this asset. Harvesst Returns CEO Chris Rolly said that for ordinary investors, buying farms require huge amounts of funds, but if a large number of investors are gathered, they can focus on buying agricultural land, forest land, or greenhouse vertical farms, "We us That's it. "

Global Times Special Correspondent in the United States and Germany/ Feng Dimei Qingmu Xinbin

- END -

Sudden!Former Japanese Prime Minister Shinzo Shinzo Speaking!Being in a state of cardiopulmonary stop!

No longer take turns to dismantle each other's national flag?Canada and Denmark's long -term Arctic territorial dispute dispute drawing

According to Reuters reported on June 15, Denmark and Canada divided the unmanned ...