CPI refreshes 40 records, and the United States has intensified the risk of economic recession

Author:Golden sheep net Time:2022.07.14

China News Service, July 14th. According to the data released by the United States Department of Labor on the 13th local time, the US Consumer Price Index (CPI) rose 9.1%year -on -year in June, renovating the highest record in 40 years. U.S. President Biden responded that although the data was "unacceptable", it was "outdated."

However, analysis generally believes that this data will further squeeze American families and cause severe damage to the Bayeng government. The CPI in June will cause the Federal Reserve to raise interest rates again, which will cause market anxiety. Media analysis pointed out that the United States has intensified the risk of economic recession, and the inflation data of "high fever" has led the American people to heating up the economy, and in the mid -term elections, it brings major political risks to the Bayeng government and the Democratic Party of Congress.

Data Map: US President Biden.

The Federal Reserve may have increased the risk of economic recession again

Many media pointed out that such a high level of inflation will make the Federal Reserve very likely to raise interest rates at the end of July.

The Associated Press said that the continuity of inflation has made Fed Chairman Powell and other officials feel uneasy. They are adopting a series of fastest interest rate hike measures since the end of the 1980s to curb inflation. Powell emphasized that the Bank of the United States hopes to see the "convincing evidence" that is slowing down before stopping interest rate hikes. He said that such evidence needs to be "a series of monthly inflation data decline."

Some economists are worried that the desire of the Federal Reserve to suppress inflation may cause it to raise interest rates too quickly, and the United States has intensified the risk of economic recession.

On March 6, local time, the vehicle passed a gas station in San Matio County, California.

Standard Chartered Bank predicts that the probability of decline in the United States in the next 12 months is 40%-50%. Many voices believe that in the context of high inflation, the Fed's more radical monetary policy has pushed the US economy into a decline in time. Powell also acknowledged when attending the Congress hearing in late June that the possibility of decline in the US economy and realizing soft landing will be very challenging.

The analysis believes that if the pace of interest rate hikes of the Fed continues to advance at such aggressive speed, the future development of global economy will encounter major challenges. According to the British "Guardian", after the U.S. inflation rate exceeded 9.1%, the US dollar index rose sharply, and the euro fell against the US dollar below the parity. The market believes that a series of radical interest rate hikes, including the central banks, including the Federal Reserve, and the slowdown in economic growth will continue to put pressure on the euro and promote investors to the US dollar to avoid risks.

People are worried that the warm -ups are facing challenges in the mid -term election

Although Biden said in a statement that the overall inflation data announced on the same day was "unacceptable, it was outdated. Today's data has not reflected all the influence of oil price decline in nearly 30 days." Worries.

The British "Financial Times" pointed out that recent data shows that American individual consumption has weakened. Standard Chartered Bank strategist Steve England said that consumers have weak confidence, rising interest rates and inflation and erosion consumption capacity may suppress consumers' needs in the next few months.

Inflation has a cruel impact on many families' financial conditions, and the price of many daily necessities is soaring faster than the growth rate of income. The rise in prices has led to a sharp decline in confidence in consumers in the economy and lowered the support rate of US President Biden. During the midterm election, it will bring major political risks to the Democratic Party of Congress.

On April 28, local time, customers were dining in a restaurant in Manhattan, New York City, USA.

In June polls, 40%of the American adults believe that response to inflation should be the first task of the government this year. The United States "News Weekly" pointed out that recent polls show that most Americans are dissatisfied with Biden's response to economic and inflation. People are generally worried about the existing economic situation, which also highlights that it is difficult for Biden to believe that most Americans believe that their financial situation has improved by his leadership compared to his previous period.

According to the "Investigation Survey of Consumer Expectation" released by the New York Fed in June 2022, more Americans expressed concern about the deterioration of family financial conditions in the next year. Among the respondents, the proportion of household financial conditions in the next year will be "significantly worse" or "slightly worse", which will reach 51%, which is the first time for the first time.

Mark Zandei, chief economist of Moodle Analysis, said: "The US economy is still fragile, and people's pessimism is the worst I have ever seen."

- END -

Russian media: Two Ukraine surrender soldiers request not to be exchanged, hoping to become a Russian citizen

According to the Russian News reported on the 23rd, the two Ukrainian active soldi...

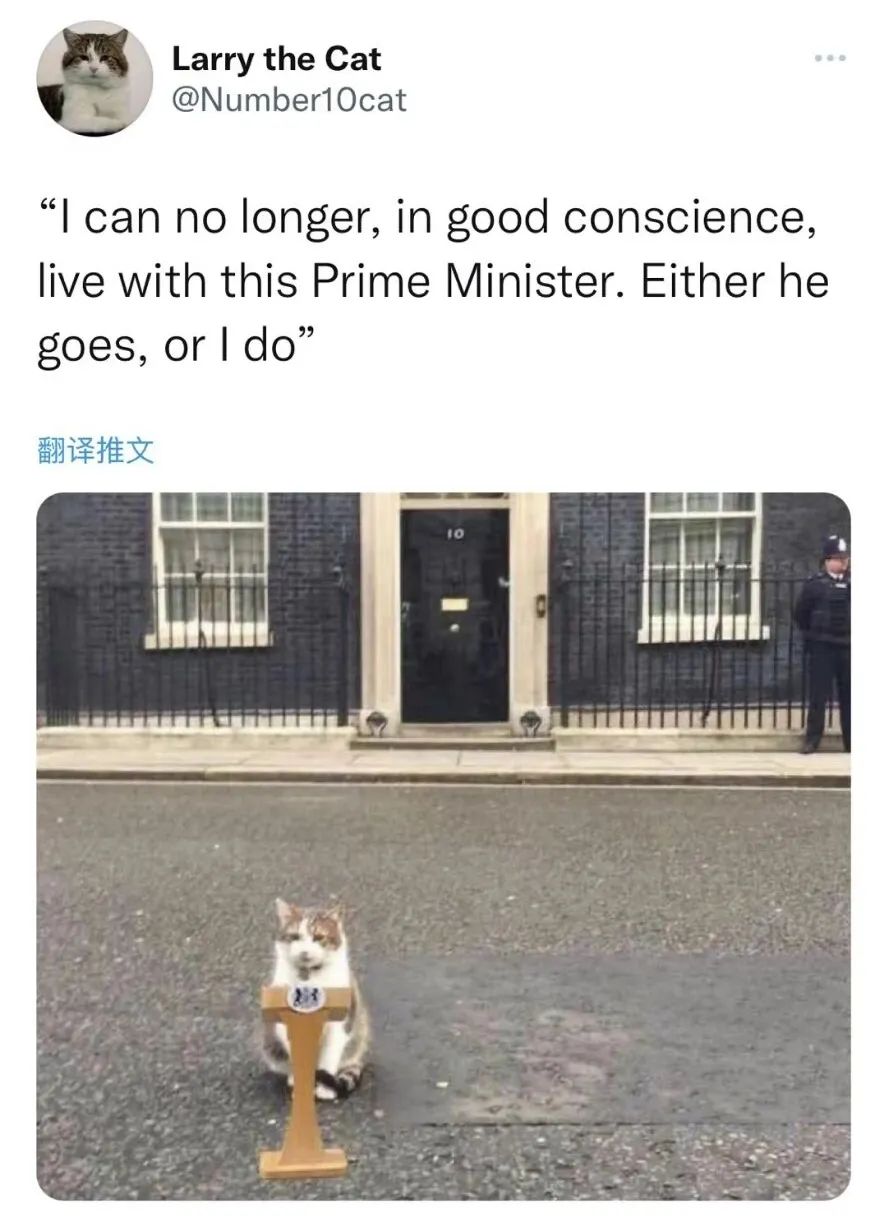

It's serious, even it has to resign

The cat of the British Prime Minister's official residence, Mouse Catcher Larry: e...