up to date!House prices in 70 cities in the country change!34 cities fell back 2 years ago

Author:Science and Technology Finance Time:2022.07.20

After the epidemic, the development of the property market in various places has also undergone profound changes.

The first financial reporter According to the changes in the sales price of 70 large and medium -sized cities in June 2022 issued by the National Bureau of Statistics and the data control of the data of the same period of the year, the housing prices including 34 cities including Tangshan have been lower than 2 years ago, that is, 2020, 2020, 2020 The level of June accounts for nearly half of the 70 cities; house prices in 27 cities are less than 3 years ago, which is the level of June 2019; in addition, house prices in six cities, including Zhengzhou, have fallen back to the level 5 years ago.

It should be noted that the house price data released by the National Bureau of Statistics every month is a relative number of changes to reflect the overall changes and changes in housing sales prices. Due to the factors such as limited price, sales, and structural factors, in contrast, the second -hand housing market can better reflect the actual situation of changes in housing prices in various places.

Compared with the data in June 2020, the cities in the forefront of house prices in the two years are Beijing, Guangzhou, Shanghai, Chengdu, Haikou and Hangzhou, covering the three first -tier cities in Beijing, Shanghai, Guangzhou, and three provincial capital cities. Come to the property market hotspot cities.

In contrast, 34 cities were below June 2020, including Wuhan, Qingdao, Tianjin, Zhengzhou, Jinan, Taiyuan, Guiyang, Harbin, Tangshan and other central cities and economic markets. Among the 34 cities, the top five of the decline were Mudanjiang (15.8%), Harbin (10.1%), Anqing, Guiyang, and Taiyuan.

Among them, Tangshan, the first economic city of Hebei, fell 0.8%compared to two years ago. In the 2020s of the adjustment cycle in the property market, Tangshan's house prices once led the country. In August 2020, the sales price index of Tangshan New House rose 15.4%year -on -year, and second -hand housing rose 14.6%year -on -year, ranking first in the country. However, due to various aspects of policies and housing enterprises, the area has gradually slipped into the property market.

Judging from the trend in the past three years, compared with June 2019, the 7 cities with the rise in house prices are Shenzhen, Wuxi, Chengdu, Ningbo, Beijing, Shanghai, Guangzhou, including four first -tier cities and the largest population of the provincial capital City Chengdu and two long triangle economic markets.

On the whole, after the epidemic, the role of emerging industries on the regional economy was further prominent. In recent years, emerging industries in developed areas such as the Yangtze River Delta and the Pearl River Delta have been very prominent, and the population has flowed rapidly. Especially young talents, the power of buying houses is more sufficient, and funds have further gathered to these areas.

Data show that 27 cities have second -hand housing prices less than 3 years ago, including central cities such as Qingdao, Jinan, Zhengzhou, Tianjin, Shijiazhuang, Taiyuan, Harbin, Nanchang, Wuhan, Changchun, Hohhot and other central cities. On the whole, the provincial and central cities in North China and Northeast China are more concentrated. In addition, some third- and fourth -tier cities in the northeast, central and western regions, especially southwest, and central and south are also concentrated.

According to analysis, housing prices in some third- and fourth -tier cities in the Northeast, North China, and the central and western regions have fallen significantly, mainly due to population and talent liquidity factors. In recent years, the overall talent has grown up the triangle, the Pearl River Delta and other places. On the other hand, many third- and fourth -tier cities in the northern region are resource -exhausted cities, industrial movements, and labor population flow. This is not enough for long -term support for house prices.

These declined cities are not always falling. In the years after 2015, many third- and fourth -tier cities in the central and western regions have also grown rapidly. Due to the rapid rise and insufficient support, the fundamentals of the city are not particularly solid. This has also led to the current regional differentiation. In the context, the fall of house prices in these cities will be more obvious.

Of course, it is not just third- and fourth -tier cities. Some second -tier cities and new first -tier cities with more population flow are also obvious. Compared with June 2019, Zhengzhou's second -hand house prices fell 6.9%, Guiyang fell 11%, Tianjin fell 7.1%, Shijiazhuang fell 8.8%, Jinan fell 5.9%, and Qingdao fell 4.8%.

In the past five years, the sales price index of second -hand housing in 70 large and medium -sized cities changes

▲ Calculate and organize according to the data of the National Bureau of Statistics

Source: First Finance. Reporter: Lin Xiaozhao

- END -

The second phase of Yingyuehu Lake is exposed!Nanhai 30,000 m² Ecological Park is open →

latest news!The third phase of Wenhan Lake Park at the end of the second phase of ...

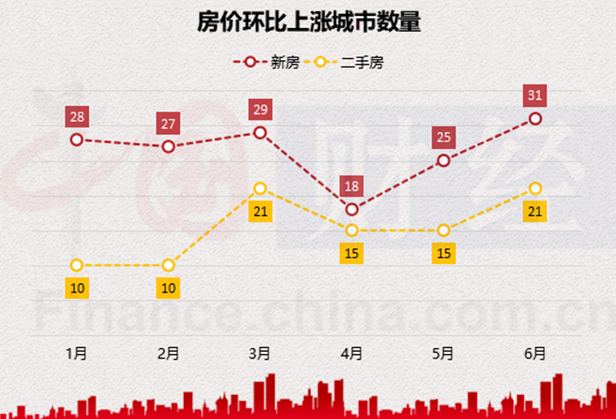

The effect of stabilizing the property market has gradually appeared: housing prices VII V -type recovery

China Net Finance July 16 (Reporter Li Chunhui) The property market support polici...