Experts in many places to increase the amount of many children's family provident fund loan quotas said that it is beneficial to enhance the enthusiasm of buying a house

Author:Chinese network Time:2022.08.04

Recently, many cities have raised the highest loan amount of housing provident fund, and gives many children's families preferential policies. Not only that, the speed of bank loans is also accelerating.

Industry insiders pointed out that raising the maximum loan amount of housing provident funds can not only improve the payment capacity of buyers, but also reduce the interest burden of buyers, and reduce the cost of buying a house on the ground.

Relax housing provident fund policy in many places

Since the beginning of this year, the efforts of the "policy of the city" in the property market have been increasing. The housing provident fund policy has become an important direction to optimize and adjust the real estate policy since this year. It is mainly reflected in increasing the amount of housing provident fund loans, reducing the proportion of housing provident fund loans, expanding the scope of housing provident fund use, and strengthening the guarantee of housing provident fund to related talents and many children's families. For strength and other aspects.

Recently, there have been many prefabricated housing provident fund maximum loans to support rigid and improving housing needs. On August 3, Liu'an City, Anhui Province, issued the "Notice of Several Policies for Printing and Distributing the Policies of Enterprises in the Real Estate Market" of 10 departments such as six departments such as Liu'an Housing and Urban -Rural Development. " Provident fund loan quota. Among them, the maximum of 600,000 yuan for the two employees is 600,000 yuan, and the maximum of 400,000 yuan in the family who pays a single employee is 400,000 yuan. Hengshui City has recently issued the "Notice on Adjusting the Policies for Adjusting Some Housing Provident Fund" stating that starting from August 1, Hengshui will increase the amount of housing provident fund loans. Among them, the maximum loan amount of the husband and wife paid the housing provident fund increased from 400,000 yuan to 500,000 yuan; the maximum loan amount of the husband and wife deposited housing provident fund increased from 600,000 yuan to 700,000 yuan.

In addition, there are multiple grounds to launch preferential property markets to multiple children's families, including increasing the amount of housing provident fund loans and granting subsidies for house purchase. On August 1, the Hangzhou Housing Provident Fund Management Committee issued the "Notice on Implementing the Promotional Policy on the implementation of the three -child housing provident fund" stating that the first set of ordinary self -living housing in Hangzhou's three -child family and the first application for housing provident fund loans, the loan amount can be available for Determined by the maximum loan limit of the family's current period; if the three -child family has no housing housing withdrawal housing provident fund, the withdrawal limit will be determined by 50%of the amount of the quota. On August 2nd, the leading group of the stable and healthy development of the real estate market in Jiaxing City released the "Implementation Opinions of Jiaxing City to further improve the stable and healthy development of the real estate market." Families of two -child and three -child residents in this city will give a house subsidy of 300 yuan per square meter (a single set of not more than 50,000 yuan) and 500 yuan per square meter (a single set does not exceed 100,000 yuan).

Li Yujia, chief researcher at the Guangdong Housing Policy Research Center, told reporters that there are two benefits to raising the maximum loan amount of housing provident fund: first, some of the unspeakable housing provident fund can be released; second, it can improve the down payment capacity and reduce monthly supply.

"The adjustment of this round of housing provident fund policy is major favorable for the development of the property market. It can not only improve the ability of buyers to pay, but also reduce the interest burden of buyers. The distribution of house purchase subsidies is a direct encouragement to buyers entering the market." IPG China China Chief Economist Bo Wenxi predicts that in the future, first- and second -tier cities may also launch relevant stimulus policies.

According to the incomplete statistics of the Zhuge Housing Data Research Center, as of now, super 90 cities have moderately relaxed the housing provident fund loan policy, which has a certain positive significance for boosting market confidence.

It is expected to improve the enthusiasm of buying a house

"Compared with commercial loans, the interest rate of housing provident fund loans is lower, which can effectively reduce the cost of buying a house." A person in charge of a real estate intermediary in Hengshui City told the Securities Daily reporter.

Some industry analysts told the Securities Daily that the interest rate of housing provident fund loans and convenient repayment methods have always been favored by buyers. However, the amount of housing provident fund loans is limited, and it is usually restricted by the account amount and house price. After the housing provident fund loan quota is increased, you can make money on the commercial bank to make money and pay less interest, which will undoubtedly reduce the pressure on house purchase.

In the interview, many improved buyers told reporters that "Originally planned to replace a large house for two years, but now the amount of housing provident fund loans has increased, and the impact on improving the demand for improvement of house purchase is quite great, so it is decided to consider re -consideration A house purchase plan. "A citizen of Hengshui City told reporters," Recently, a commercial house with a unit price of 8,000 yuan and an area of 130 square meters, with a total price of 1.04 million yuan. Because it is a two -child family, calculated at 20%of the down payment, the provident fund loan The maximum energy loan is 800,000 yuan, and you only need to pay more than 200,000 heads to pay. "

Since the beginning of this year, in addition to the "loosening" of housing provident fund loans, bank housing loans have also been significantly loose, and the issuance of housing loans has also increased significantly. Taking the Hebei region as an example, an individual loan manager of a bank said that the loan time for commercial loans is usually faster, which takes about 1 to 2 days. If it is a housing provident fund loan, it takes half a month from the transfer to the loan, but it has accelerated than the previous loan time.

The staff of a state -owned bank Hangzhou Branch also told reporters that if a commercial loan is chosen, when the applicant submits complete information, the house can be transferred within one week after the mortgage is completed. About half a month.

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, told the reporter of the Securities Daily that the market confidence in the real estate industry is weaker than expected, but as good news continues to increase, real estate companies will start to be active, and market transaction data will also be available.The improvement of improvement, coupled with the comprehensive support of the supply of funds such as housing provident fund, will help enhance the confidence of market participants.(Editor in charge: Wang Chenxi)

- END -

Latest release!When buying a new house, you must look at these seven items first

Buy a new houseBe sure to look at these seven!Wuhan Housing Management Bureau releasedThe latest house purchase noticeBefore buying a house, apply for a house purchase qualification, check the public

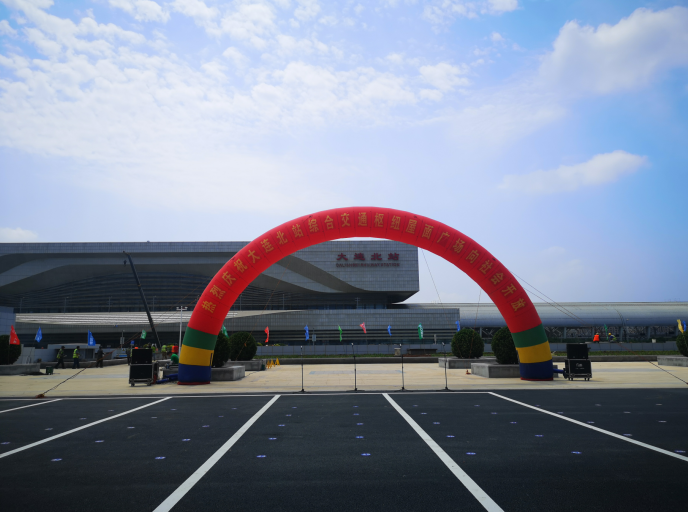

Dalian North Station Comprehensive Transportation Hub Roof Square Open

On July 1, Dalian North Station Comprehensive Transportation Hub Roof Plaza was of...