Your mortgage interest rate has dropped again!Millions of loans are 2,500 yuan a year, and it will be reduced in the future

Author:Zhongxin Jingwei Time:2022.08.22

Zhongxin Jingwei, August 22 (Xue Yufei intern Wu Ao) On the 22nd, the National Banking Interbank Borrowing Center announced the loan market quotation interest rate (LPR) this month, and the 1 -year LPR was reduced from 3.70%to 3.65%, 5 years, and 5 years. The above LPR is lowered from 4.45%to 4.3%. Among them, the LPR of more than 5 years has been lowered this year, and a total of 35 basis points have been reduced.

The lowering of LPR above 5 years has brought direct favorable benefits to the property market. According to the requirements of the first set of commercial loans than the "LPR-20 basis points", the interest rate of the first house loan was further decreased to a minimum of 4.1%. For those who are repaying the mortgage, with a loan of 1 million yuan and an equivalent principal and interest of 30 years, 4.45%drop to 4.3%, the total interest saves about 31,900 yuan, and the monthly supply is about 88 yuan. If the cumulative decline of the three times this year, the monthly supply decreases a larger scale. It is 207.66 yuan less monthly than in January this year, and the year is close to 2,500 yuan.

The decline of LPR above 5 years is slightly more than expected

The 1 -year LPR lowered 5 basis points, and 15 basis points were reduced by LPR above 5 years, which basically met market expectations.

On August 15 this year, the central bank announced that the MLF operating interest rate this month was 2.75%, and the last month was 2.85%; the 7 -day reverse repurchase rate of 7 days on that day was 2.0%, and the last time was 2.1%. Liang Si, a researcher at the Bank of China Research Institute, said to China Singapore. Since the LPR reform, China's interest rate transmission mechanism has further opened up, "Policy interest rate (MLF) → market benchmark interest rate (LPR) → market interest rate (loan interest rate)" conduction is basically basically based on the basis Establishing, financial institutions issued loan interest rates to linked with LPR with LPR, and the lower limit of the hidden loan interest rate was broken. In the past three years, driven by LPR reform, the credit interest rate of financial institutions has continued to decline, and corporate financing costs have a new low. At the end of the second quarter of 2022, corporate loan interest rates have fallen to 4.16%, which is the lowest in history. LPR reform has strongly supported the real economy development. Essence

Oriental Jincheng analysis said that the downward settlement of the LPR offer in August reflected that under the guidance of policy interest rate cuts (MLF interest rates down), a new round of row will have a faster low -down trend, which will drive the rebound of valid credit demand to recover from wide credit. Support policy intentions of stable growth. This means that after the implementation of a package of the macroeconomic market in May, a new round of steady growth measures are increasing, and its focus is on the supply end of the logistics blocking point and promoting the re -production and re -production. The macroeconomic needs such as consumption and investment.

Many analysts believe that compared with the 1 -year LPR, 15 basis points have dropped sharply by 15 basis points, some of which are slightly more than expected, and this time is more favorable for the real estate market. Yan Yuejin, research director of the Think Tank Center of the E -House Research Institute, said that the LPR of more than 5 years was reduced by 15 basis points, which slightly exceeded expectations. "At present, the real estate recovery encounters a new situation. The financial loan department must actively publicize the low -cost housing loan policy and encourage reasonable housing consumption , Make good use of credit policies to promote the recovery of the housing trading market. "

Zhang Dawei, chief analyst of Central Plains Real Estate, said that according to the data of the National Bureau of Statistics, the number of cities with low house prices in 70 cities in July increased again, and the sales price decreased increased. Although the policy of stabilizing the property market was frequent, buyers' confidence was still sluggish. This reduction will enhance the psychological expectations of the buyer.

35 basis points in the year or a new low in 13 years

The lowering of LPR above 5 years reduces the pressure on the home loan of the buyer.

Zhongxin Jingwei takes a loan of 1 million yuan and equivalent principal and interest 30 years of repayment as an example. If it is calculated at 4.45%of the loan interest rate, it will be paid 5037.19 yuan per month, and the total interest expenditure is about 813,400 yuan. It is necessary to pay 4948.71 yuan per month, a decrease of about 88 yuan, and the total interest expenditure is about 781,500 yuan, a decrease of about 31,900 yuan.

Extend the timeline, since 2022, LPRs of more than 5 years have been reduced by 3 times, and a total of 35 basis points have been reduced. Specifically, in January this year, LPR above 5 years was reduced from 4.65%to 4.6%; in May, more than 4.6%or more LPRs were reduced from 4.6%to 4.45%; in August, more than 4.45%or more LPRs were reduced from 4.45%to 4.3 %.

It still takes a loan of 1 million yuan and the equivalent principal and interest 30 years of repayment as an example. If it is calculated at 4.65%of the loan interest rate, it will be paid 5156.37 yuan per month, and the total interest expenditure is about 856,300 yuan. This means that compared with January, the buyers who are repaying the mortgage can pay 207.66 yuan a month, and the year less than 2491.92 yuan.

It should be reminded that the buyers who are repaid cannot immediately enjoy the benefits brought by the LPR bearing by more than 5 years. After the batch of mortgages in 2020 was transformed into an LPR quotation, some buyers chose to adjust the mortgage interest rate on the date of signing the contract, and some people chose to adjust in January in the new year. No matter which method choose, the mortgage interest rate only changed once a year. Therefore, when the loan interest rate is reduced, it depends on the date of mortgage adjustment.

For those who are ready to buy a house, the benefits of the lowering can be quickly enjoyed. In May of this year, the Central Bank and the Banking Insurance Regulatory Commission issued a notice. For the household households who purchased ordinary home housing, the first set of housing commercial personal housing loan interest rates were adjusted to not less than less than the corresponding period of loan market quotation, and the two sets of housing were reduced. The lower limit of the interest rate policy of commercial personal housing loan shall be implemented in accordance with the current regulations. Therefore, after the LPR of more than 5 years dropped to 4.3%, the lower limit of interest rates for the first house of commercial personal housing loan was 4.1%, and the lower limit of the interest rate of the two sets of mortgages dropped to 4.9%. The lower limit of the first home loan interest rate is 4.1%. What is the historical level? Zhang Dawei said to Zhongxin Jingwei: "From the perspective of in recent years, the year of the lowest loan interest rate was 2009. At that time, the mortgage interest rate was generally 50%off, and the first house loan interest rate was 4.158%. It's. "

The loan interest rate is relatively high in the future, there is still room for decline in the future

The industry believes that more than 5 years of LPR will still have room for decline in the future.

Dongfang Jincheng believes that the current mortgage interest rate of residential residents is still relatively high, and it needs to reduce the quotation of LPR above 5 years or above to pave the way for the further downward downlink of the mortgage interest rate. According to the latest quarterly data of the central bank, the new mortgage interest rate was issued in June by 4.62%, a significant decrease of 87 basis points from March, mainly due to the "double drop" of the mortgage interest rate in May (May, the nation's first mortgage interest rate was reduced by 20 down 20 down to 20, 20 of the country's loan interest rate was reduced by 20 down 20, 20 Base point, 15 basis points for LPR quotation above 5 years). The current mortgage interest rate is near a historical low.

According to the agency, compared with the trend of general loan interest rates, the mortgage interest rate is still at a high level: June, the general loan interest rate, including mortgage and corporate loans, is 4.76%, which is 151 basis points lower than the historical average, and while the historical average point is 151 basis points, and and the historical average point, and it is 151 basis points, and the historical average point is 151 basis points. The mortgage interest rate is 96 basis points lower than the historical average. This means that the mortgage interest rate in June is still relatively high.

Dongfang Jincheng predicts that LPR still has a certain amount of room for adjustment in the second half of this year, especially if LPR above 5 years will have a significant decline in 15-20 basis points. On the one hand, with the fluctuation of the epidemic, consumption restoration will be mild in the second half of the year, and real estate will run low for a period of time. In addition, under the shadow of the global economic recession, there is a slowdown in exports that have had a large role in economic growth. These factors means that the policy may further increase the stable growth, focusing on stimulating the overall demand in China. On the other hand, the domestic price situation in the second half of the year is generally expected to maintain stability. The structural inflation driven by the rise in pork prices is difficult to cause comprehensive and significant increase in prices. The core CPI that deduct food and energy prices will continue to maintain a low level of below 2.0%(August is in August is for it. 0.8%), will not form a large constraint on future macro policies. At the same time, in the process of tightening the policy tightening in the second half of the year, the Federal Reserve and other overseas central banks will consider the risk of economic recession brought by it, and the pace of policy tightening may slow down. This means that the external constraints of loose domestic policies are also decreasing.

Zhang Dawei also believes that more than 5 -year LPR may still decline in the future. On the one hand, the real estate market has not yet been fully stable and requires the support of financial policies. On the other hand, the interest rate of the stock mortgage is high, there is a need to reduce interest rates and promote residents to make other consumption. (For more report clues, please contact the author [email protected]) (Zhongxin Jingwei APP)

Copyright Copyright Copyright, without written authorization, no unit or individual may be reprinted or extracted in other ways.

Editor in charge: Luo Yan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

"Linzi Linzi" Zhutai Town specially broadcasts

Linzi Rong Media News On the evening of August 12, Linzi Rong Media's large -scale...

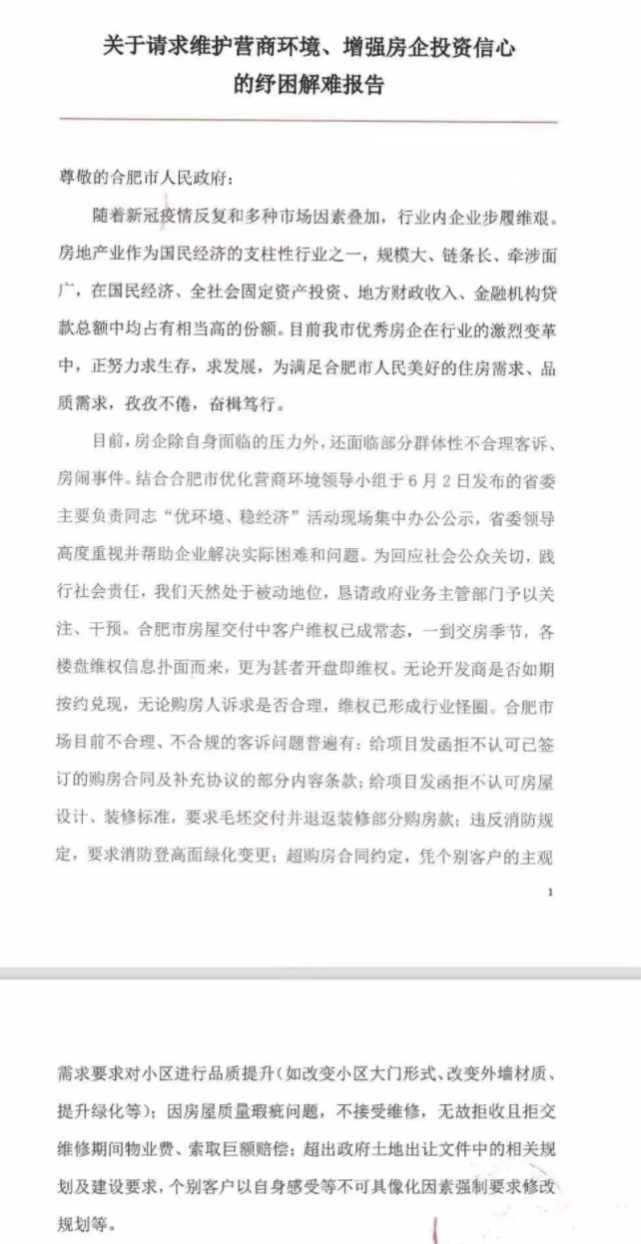

17 housing companies requested the government to crack down on "malicious rights protection"

On August 12, a document entitled Report on the Research Report on Request to Main...