"One city, one policy" gives local governments a greater regulation and autonomy

Author:Costrit Finance Time:2022.08.25

Liu Xiao, chief reporter of Fengkou Finance Liu Xiao

According to Xinhua News Agency, Premier Li Keqiang presided over the executive meeting of the State Council on August 24 to deploy a policy measure of a policy of stabilizing the economy. Reasonably support rigid and improved housing needs.

Experts said that the "one city, one policy" gives local governments greater regulation and autonomy, and at the same time, local policy is responsible for regulation and control. It is expected that under this guidance, except for individual key cities, the purchase restrictions on other cities, loan restrictions, etc. Policies will continue to relax.

Gives more local regulation autonomy

On August 24th, according to the WeChat public account "Changzhou Daily", the restriction policy of Changzhou City, Jiangsu Province is about to be adjusted. From September 1, 2022, Changzhou second -hand housing has completely canceled the sales restrictions. This adjustment is only for second -hand housing. Some analysis believes that after the implementation of the policy, the liquidity of the second -hand housing market may greatly improve, which will have a positive effect on the internal circulation and healthy development of the real estate market.

In addition, Langfang City, Hebei, recently released "Langfang City's solid measures to promote the stable and healthy development of the city's economy and the supporting policy of supporting policies". Among them, in terms of stabilizing the property market, it is officially proposed that "the restrictions on household registration, social security (individual tax) and other restrictions on the current real estate market situation."

Not only Changzhou and Langfang, in fact, recently, there are many places in the country that have joined the property market regulation and optimization. According to media reports, in July this year, the stabilization policy was issued by 85 cities. Entering August, relevant stable property market policies including Changzhou, Langfang, Jinan, Lianyungang and other places were introduced. According to institutional statistics, since this year, more than 210 regions in China have issued more than 550 related policies in the property market, which has played a key role in establishing confidence and stable expectations.

"The situation of each city is different, and the market performance is different. Therefore, the responsibility of the local government is to ensure the basic stability of the real estate industry, and to show more targeted measures according to the actual situation and the market. Feng Xianquan, a special expert in the Chinese Academy of Social Sciences invited real estate experts and special experts from the China Fangshi Think Real Estate Expert Group, told Fengkou Finance that in response to the overall appearance of the current real estate market, local governments will also introduce some rescue measures to ensure that the market tends to tends Stable measures to gradually establish confidence.

The Political Bureau of the CPC Central Committee held on July 28 analyzed the current economic situation and deployed economic work in the second half of the year. The meeting pointed out that it is necessary to stabilize the real estate market, adhere to the positioning of houses for living, not for speculation, because the city has used a good policy box to support rigid and improved housing demand, compact local government responsibilities, guarantee payment Lou, stabilize people's livelihood. On August 24, the executive meeting of the State Council proposed to allow local "one city and one policy" to flexibly use credit and other policies to reasonably support rigid and improved housing needs.

Wen Bin, chief economist of Minsheng Bank, told Fengkou Finance that the requirements of the Politburo Conference held on July 28 were one step further. Generally speaking, although the "policy of the city" means the relaxation of the real estate regulatory tone, it still has the meaning of central customization and top -down. "One city and one policy" gives local governments greater regulation and autonomy, and local policy is responsible for regulation.

Wen Bin said that under this guidance, except for individual key cities, policies such as purchase restrictions and loans in other cities will continue to relax, superimposed to the relaxation of the recent 5 -year LPR reduction and first house identification standards, residents residents The cost of buying a house will decline significantly. At the same time, localities should also increase support on the supply side. By increasing liquidity injection, we will promote the preservation of traffic, stabilize the people's livelihood, and then cut off the risk transmission chain to repair market confidence.

Yang Chang, chief analyst at the Institute of China and Thailand Securities Research Institute, said in an interview with the wind and economic interviews that "because of the policy of the city" and "one city, one policy", although the wording has changed, the policy of real estate on the sales side is based on local cities as the main body to continue the local cities and continue to continue. Sex will be stronger.

Fengkou said | another city in Jiangsu canceled second -hand housing restrictions. Who will be the next?

Be wary of the three types of risks of real estate companies

Fu Linghui, the director of the National Bureau of Statistics and Director of the Comprehensive Statistics Department of the National Economic Economic Comprehensive Statistics, pointed out that since this year, the localities have insisted on housing and housing. Due to the policy of the city, supporting rigidity and improving the demand for housing, and introducing a number of stable real estate market policies The overall downward trend of the real estate market has slowed down. Although there have been recent real estate project delivery problems, from the whole country, most of the construction period is more than two years. The construction of real estate development projects close to the delivery period has remained stable, and the overall risk is controllable.

Fu Linghui said that in general, the real estate market is showing a downward trend, and the current overall stage is at the bottom. With the continuous improvement of the long -term mechanism of the real estate market, due to the gradual performance of urban policy, the real estate market is expected to gradually stabilize and maintain stable and healthy development, and the impact on the economy will gradually improve.

Lian Ping, chief economist of Zhixin Investment, believes that in the second half of the year, the main risks of the real estate market are still gathered in real estate companies. They need to be alert to the three types of risks: business loss, liquidity shortage, and debt defaults of real estate companies. Since the fourth quarter of 2021, the housing financial environment has improved, but it is mainly focused on the "residential" interest rate level. The "real estate company" financing environment has not been substantially improved, especially the financing of private housing companies is still difficult. The slowdown in the sales of commercial housing sales expires. In the second half of the year, some housing companies will continue to face the above three risks, and there are signs of local spreading to the upstream and downstream industrial chains. Local areas may cause the phenomenon of rotten tail buildings. If the number of enterprises from real estate companies is gradually expanding, the impact of the construction of houses and the impact of real estate will be reduced, and real estate investment willingness will be reduced. Pang Ye, chief economist and director of the research department of the Zhongliang Filight, told Fengkou Finance that the changes in the recent model of residential house purchase behavior are a reflection of changes in residential decision -making functions and changes in the changes in the asset liability statement and changes in confidence. It can be said that the main variables affecting residential house decisions and commercial housing sales have become from factors such as real estate regulation and control policies before the epidemic, and the mortgage interest rates and other factors will become residents after the epidemic. Factors such as sex. In addition, changes in residential house purchase behavior models may further exacerbate the differentiation of real estate sales structures in the short term. Second -hand housing sales will be better than new houses and existing houses than future housing, which will also affect residents' asset liabilities and cash flow stages.

"Real estate risks have not been lifted, and real estate may affect the profit growth of many companies in the entire industrial chain, which will affect the economic recovery." Yang Delong, chief economist of Qianhai Open source Fund, told Fengkou Finance that from the policy point of view, the current monetary policy remains maintained. A relatively loose state, it is beneficial to stabilize the real estate market and boost market confidence.

Visual China Photo Conferry

There is still room for low loan interest rates

Just a few days ago, the People's Bank of China launched a 400 billion yuan medium -term loan convenience (MLF) operation. The MLF operation interest rate was reduced by 10 basis points to 2.75%. The 7 -day reverse repurchase interest rate was simultaneously reduced by 10 basis points to 2%, exceeding market expectations. On August 22, the People's Bank of China authorized the National Bank of China Interbank Borrowing Center to announce that the loan market quotation interest rate (LPR) on August 22, 2022 was: one -year LPR was 3.65%, and the LPR of more than 5 years was 4.3%. The one -year and five -year LPR diverted down.

"Under the circumstances where real estate sales have weakened again, residents' willingness to increase leverage, and the pressure of steady growth is still large, the quotation of LPR more than 5 years will be greatly reduced by 15bp again, which will help narrowing the gap between the interest rates of housing loans in previous years. Promoting the wide credit process. "Wen Bin believes that under the current environment of the real estate market, the LPR reduction has been used to drive the reduction of mortgage interest rates, which has become an important part of reversing market expectations and promoting the recovery of the property market. The reduction of LPR also helps reduce the interest rate of stock mortgages, delay the rhythm of the residents' reduction of leverage, and increase consumption expectations under the savings of mortgage interest, help consumption recovery.

Dongfang Jincheng chief macro analyst Wang Qing said to Fengkou Finance that combined with the executive meeting of the State Council "allowing local" one city, one policy "to use credit and other policies to reasonably support rigid and improving housing demand", it is estimated that the mortgage interest rate will still have a mortgage interest rate within the year. Slow down space around 60 base points. This will significantly reduce the pressure of home buyers.

For the trend of the market outlook, most institutions believe that the restoration of market expectations is the key. Only by excluding various adverse factors and improving market expectations, can various stable property market policies play a role to maximize the role, and the situation of market recovery can be truly established.

Pang Ye said that risk incidents in many places interfered with the trend of stabilizing the recovery of the real estate market, and constrained the industrial chain and credit cycle steadily out of negative spirals, making the investment and sales of the sales end continuously under pressure. In particular, we need to be alert to market confidence and emotional fluctuations to interrupt the recovery of the entire industry chain.

Luo Yan, a senior researcher at Zhixin Investment Research Institute, told Fengkou Finance that the current relevant indicators such as real estate sales continued to weaken, and the downward pressure on real estate investment was still large. However, as the real estate adjustment policy control continued to relax, real estate investment is expected to build a bottom in the third quarter.

- END -

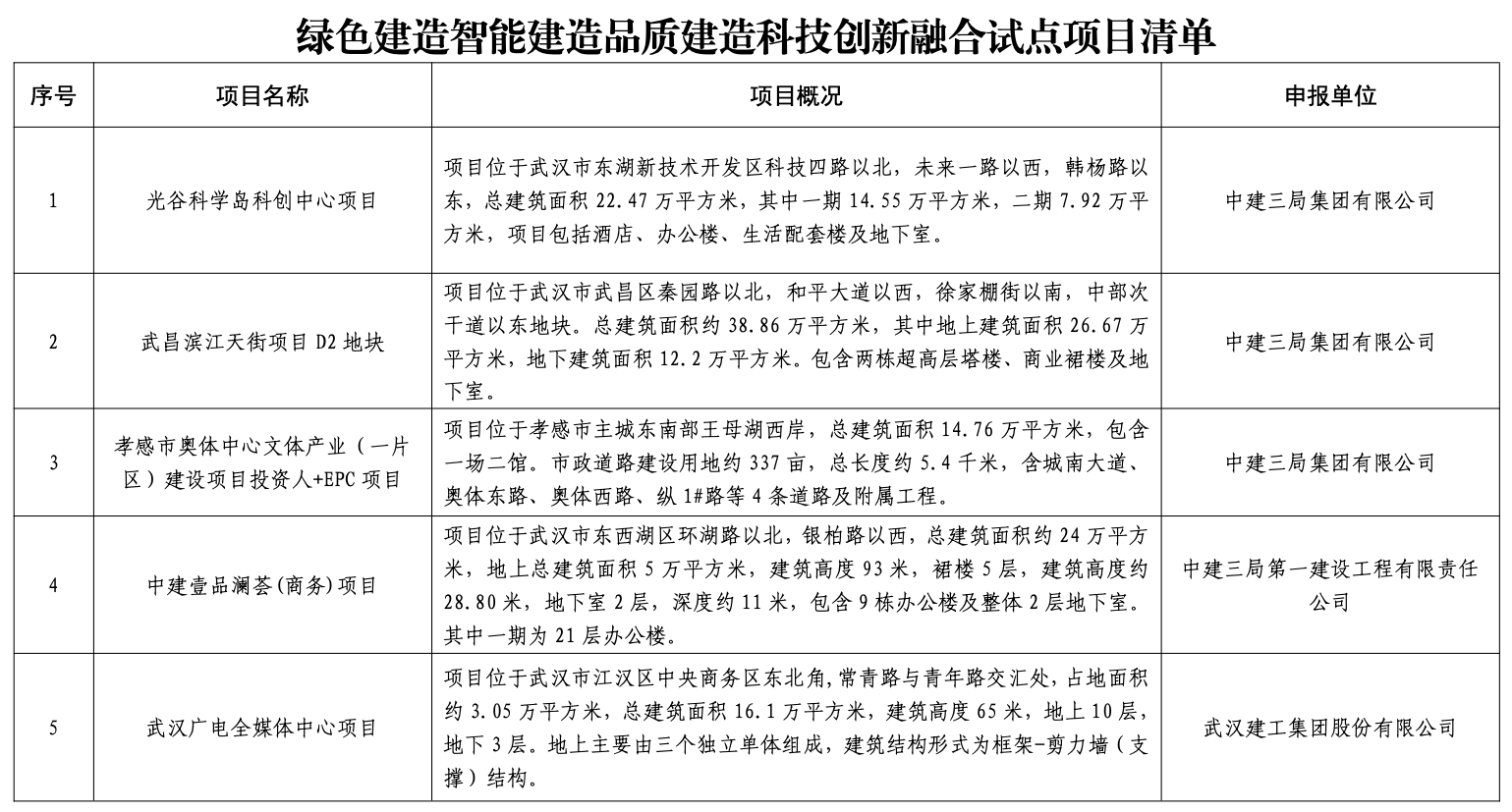

clear!These 16 projects are the pilot of integration of science and technology innovation

In order to promote the integration and development of three construction, expand ...

70 cities in May are released, do your house rise or fall?

Wen | Meng KeOn June 16, the National Bureau of Statistics announced the changes i...