The US dollar bond welcoming the peak of expiration, analysts said that the housing company's funding pressure during the year

Author:Securities daily Time:2022.06.27

Wen | Li Zheng

"This year is the peak period of the US dollar debt repayment. The scale is much larger than last year. In addition, the economic downward pressure is greater, the buyers' willingness to buy a house is weakened, and the real estate industry or experience is severe." The Securities Daily reporter said that with the arrival of the debt repayment in June and July, it is expected that there will be a phenomenon of debt defaults or interest breach of housing companies. According to a reporter from the Securities Daily, with the gradual tightening of domestic regulation and control policies in 2017, housing enterprises' financing channels are blocked, and many real estate companies choose overseas financing. From 219.3 billion yuan in 2017 to 454 billion yuan in 2020, the total debt continued to rise, and the number of US dollar bonds issued by domestic real estate companies was 3-5 years. The debt expires. " After the first wave of debt repayment in March 2022, domestic housing companies will once again usher in a "test" of debt repayment in July. The latest statistics from third -party institutions for long -term finances show that in June and July 2022, the number of US dollar bonds due to USD 7.804 billion and US $ 6.557 billion, respectively, far exceeding the remaining five months in the second half of the year. According to incomplete statistics from DM research, in July 2022 alone, 40 overseas real estate bonds faced interest. Among them, more than 5 US dollar bonds were faced with interest payment, and more than three housing companies had more than 3 bonds to pay interest. As the dollar debt is approaching, some real estate companies have "unable to sit." Recently, an old real estate company announced that in the context of the current real estate industry sales and weak liquidity status, in order to improve the company's overall financial status and maintain sustainable capital structure, the company's wholly -owned subsidiary intends to From the 17th to July 7th, the exhibition consent will be solicited for its 10 U.S. dollar priority notes. In this regard, there is a voice in the industry that although it is no new to apply for debt exhibition in housing companies, it is very rare that all US dollar bonds are seeking to seek the exhibition period at one time. Xiao Yunxiang, a senior analyst at the Tongzhe Research Institute, believes that under the common effect of multiple factors, this year's housing companies seeking US dollar debt exhibition or debt defaults and interest breach of interest will become frequent. In fact, as Xiao Yunxiang said, there were already interest defaults in real estate companies. Recently, Beijing Hongkun Weiye Real Estate Development Co., Ltd. has fallen into a financial difficulties. As of June 20, 2022, the company failed to pay off the principal and interest of domestic and overseas bonds within 30 days of exemption, which has triggered a number of bonds crossing the contract. Public information shows that Hongkun Weiye issued an announcement on May 10th that it expired on April 8 to deal with US $ 14.2338 million in interest, and after 30 days of wide -time limited time, the company failed to pay before the expiration of the wide limit. According to Xiao Yunxiang, from the perspective of redemption peaks, 2022 and 2023 have been the two years in recent years, the largest US dollar debt payment amount, and related companies will bear a large degree of redemption pressure. Although the regulatory policies in various places this year have frequent winds, the real estate market has recovered slowly. From the perspective of financing, although the signals released by the regulatory layer are already clear, private enterprises and potential insurance companies are still facing difficulties in financing.

Recommended reading

The revised rules of the Securities and Futures Commission strictly manage the "fake foreign capital" to further improve the Shanghai -Shenzhen -Hong Kong -connected mechanism

Supreme Law: Four aspects of escort New Third Board and the North Stock Exchange reform and development

Image | Site Cool Hero Bao Map.com Editor | Caushan Dan Trial | Xie Ruolin Final Audit | Zhang Ye

- END -

Huangpu District Science City adds an old renovation project, Qin Chengda officially signed the renovation of the old village of Changlong Film

Text/Yangcheng Evening News all -media reporter Liang Dongxian Picture/Interviewee...

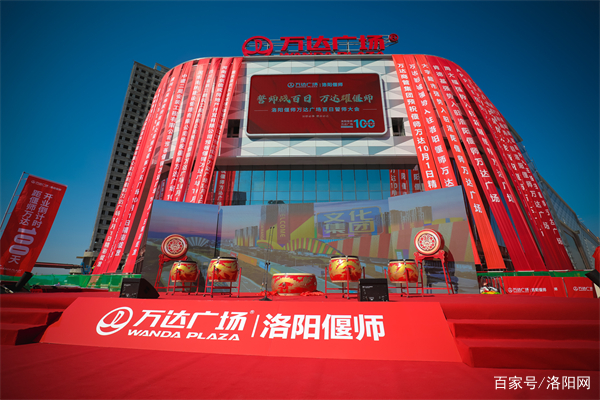

"Vowing Hundred Days, Wanda Yao Yan Shi" Luoyang Yanshi Wanda Plaza Hundred Days Oath Teacher Conference was successful

On June 18th, Luoyang Yanshi Wanda Plaza's 100 -day oath in Luoyang Shi Shi Plaza,...