Watermelon Garlic Magic changing houses, Poly sells a house for 200 pounds of pigs ...

Author:Beijing Commercial Daily Time:2022.06.30

For real estate companies, two nodes of the year are the most important, one is the year and the other is the end of the year. In June, major housing companies began to sprint for the transcripts of the year. The magical way of selling houses also made people eat melon "have never seen it." The heated discussions on garlic and wheat changing houses have not stopped, and the watermelon changing houses have been swiped again. The promotion method of "Boyi Eyes" all exposes the urgency of selling houses for various housing companies.

According to Kerry Real Estate research data, among the listed real estate companies that publicly disclose annual targets, most companies' goals as of the end of May were less than 30%, and nearly half of the enterprises were even less than 25%.

On the other hand, with the decrease in the willingness to buy a house, the growth rate of personal mortgage loans has narrowed for 6 consecutive months. For major real estate companies, the problem with the greatest performance of the six -year sprint is not the "traffic" of the project products, but the "lying" willingness of buyers. The recovery of the industry requires the support of purchasing power.

Housing company fancy promotion sprints in the middle of the year

After the end of "630", it officially ended in the first half of 2022. Through the fancy promotion method of garlic, wheat, and watermelon, you know the "warm" level of sprint in the year of the year. Even the state -owned enterprise Baoli also sacrificed the marketing method of buying a house to send pigs. The poster was clearly written. When you buy a house, you will send 200 pounds of soil pigs. Some people say that in 2022, it is destined to be a year of fancy rescue market, and the magic operation here may be just the beginning.

Image source: network

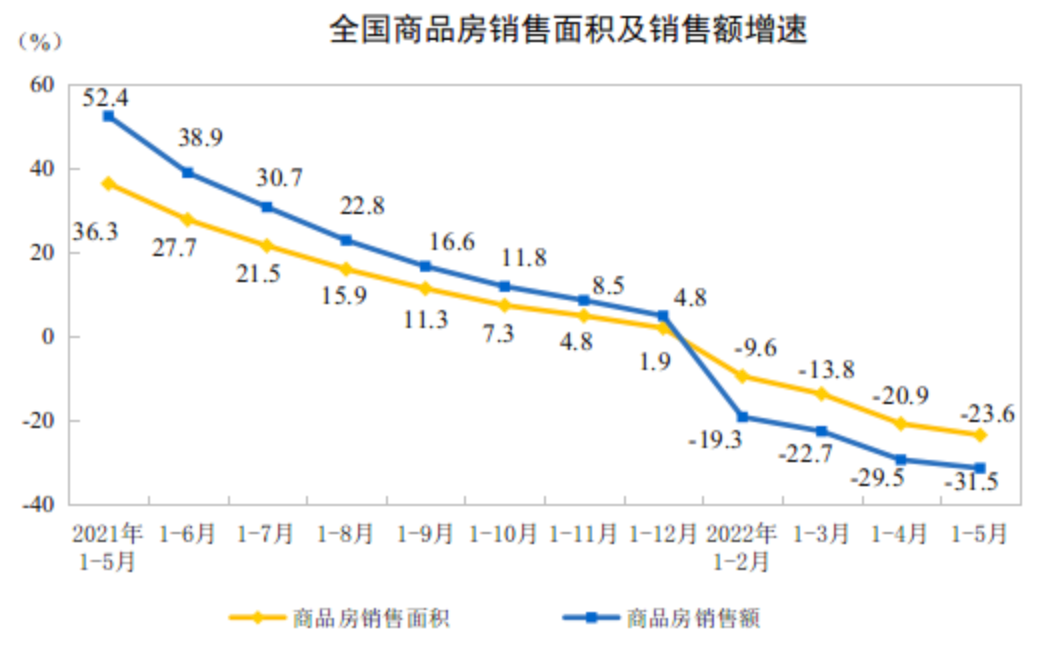

Why is a real estate company urgent? The important reason for the current sluggish property market is that confidence has faded, and pessimism is related to the "decrease of 23.6%and 31.5%" of the property market data.

According to data from the National Bureau of Statistics, in the first May of this year, the sales area of commercial housing nationwide was 507.38 million square meters, a year -on -year decrease of 23.6%; of which, the residential sales area fell by 28.1%. The sales of commercial houses were 4833.7 billion yuan, a decrease of 31.5%; of which, residential sales fell by 34.5%. As of the end of May 2022, the area of commodity housing for sale was 55.433 million square meters, a year -on -year increase of 8.6%. Among them, the area of residential residential sales increased by 15%.

Picture source: Screenshot of the website of the National Bureau of Statistics

"Now not only the housing companies are serious, but also the demand for house purchase is not optimistic." A person in a large -scale real estate enterprise said that the annual performance of the middle of the year has been taken through with anxiety. I did not expect this year.

The downturn with a look is a manifestation of poor demand. "The overall area of our region in the second quarter was 1/20 of the same period last year, which was about 30%of the first quarter. The epidemic had an impact, but the greater impact was the abrupt end of the demand." The person in charge of the organization of the institutional area bluntly stated.

If you pay attention to the mid -term performance of real estate companies in the past few years, major housing companies will use the "early collision line" to show their strength. The task in 2022 seems to be more difficult than 2021.

According to Kerry Real Estate research data, among the listed real estate companies that publicly disclose their performance targets, most enterprises' target completion rate as of the end of May was less than 30%, and nearly half of the enterprises were even less than 25%. The goal completion of almost all companies from January to May is significantly lower than the same period last year. The goals of some enterprises decreased by 15 percentage points from the same period last year.

It is worth mentioning that in 2022, many real estate companies including Country Garden and Vanke no longer disclose sales targets, and some real estate companies have also proactively reduced their sales targets. But even so, the performance of most housing companies is still less than expected, facing sales pressure.

Real estate analyst Yan Yuejin said that for major housing companies, the biggest problem with the most sprint semi -annual performance is not the "traffic" of project products, but the "lying" willingness of buyers. The recovery of the industry requires the support of purchasing power. It can be seen that currently housing companies are not only sprinting for the performance of the middle of the year, but also to reduce the pressure of performance in the second half of the year. If there is a sales window period, we must strive to "sell" myself.

Keep the "bottom" of cash flow

When housing companies no longer talk about sales, they talk about sales repayments, and they know that their "attention points" have changed. With the continuous tightening of the financing environment of real estate companies, in recent years, housing companies have paid more attention to cash flow control. More and more real estate companies regard "cash as king" as the "moat" that the enterprise is stable and safe.

If the house can't be sold anymore, you will get less land to build a house. According to institutional statistics, in the first five months of this year, the total land of the top 100 housing companies had a total of 468.1 billion yuan, a decrease of 64.7%year -on -year, and the decline expanded by 8.8 percentage points from the previous month. In the TOP100 of the land acquisition from January to May, the number of top 100 housing companies accounted for only 34%, and more than 60%of the real estate companies did not take it.

"We guarantee the opening of the market for 3 months and 6 months. Even so, the group does not allow us to get the land." The reason is to control the outflow.

Affected by the real estate industry and market, recently, international rating institutions have waved their "big knives", and many real estate companies have been lowered by rating. The rating of rating agencies is also another test of housing companies' money bags.

In the case of less than expected, the housing enterprise reported to the defense war, which was more "survival." It is foreseeable that in this year's housing enterprises, the safety of cash flow is still quite a lot.

It takes time to reach the bottom of the rebound

As the vane of the industry, Vanke maintains the keenness of market changes, and its judgment on industry trends has also received widespread attention in the industry. At the 2021 shareholders' meeting held by Vanke on June 28, Yu Liang, chairman of Vanke's board of directors, talked about the real estate industry situation: The short -term market has bottomed out! However, as Yu Liang said, real estate sales rose faster in June, and the biggest reason was that the base in May was relatively low in May. Even with the bottom, market recovery is still a slow process.

Li Yujia, chief researcher at the Housing Policy Research Center of the Guangdong Provincial Planning Institute, said that the bottom of the bottom is already a conclusion, but the rebound is early. The risk is still in the process of release, and the worries about the difficulty of delivery still exist. "Residents' expectations for continuous rebound in housing prices in the future, and the pressure of stable economic stability, the market's expectations for future income and work are not optimistic."

Song Hongwei, the research director of the Tongzhe Research Institute, said that at present, the real estate market has not yet bottomed out, and the marginal improvement of market conditions is limited to the narrowing of the decline. It is expected to show negative growth in the third quarter. From the perspective of the property market itself, only a few cities' market data rebounded. For example, the rapid rebound in Shanghai was due to the release of the demand for squeezing during the prevention and control of the epidemic. The city as a whole is still relatively sluggish.

Song Hongwei said that from the prediction of the second half of the year, the most promising is real estate investment. It is expected that the fourth quarter will be positive from negatively to achieve a cumulative year-on-year growth. It is expected that the year-on-year increase will be 0.5%-1%. In the second half of the year, it will be in a downward trend of negative growth. The enthusiasm of housing companies is not high, and land purchase will also show a decrease of more than 15%. "To a certain extent, if the environment of private enterprises' financing does not change, there will be a risk of breaking the capital chain in the second half of the year, and the developer's confidence and the confidence of buyers will not recover."

Reporter 丨 Wang Yinhao

Edit 丨 Zhang Yajing

Picture 丨 Vision China, Yitu.com, National Bureau of Statistics, etc.

- END -

Official announcement!Such housing allows rent first and then sold

June 22Hubei Housing and Urban -Rural Development DepartmentIntroduce the Regardin...

Pickings new places!The urban balcony project of Sanming Sixth Road Business District passed the acceptance and acceptance

Recently, the sixth road business district urban balcony project, which was respon...