After the housing enterprise is in danger, why is the owner and creditors solve the sleep?

Author:China News Weekly Time:2022.07.04

not

In the face of the "Evergrande Dilemma", there are far more than one out of insurance.

"Recently, Shanghai Greenland Group announced opinions on the exhibition period of bonds expired on June 25. This is the only state -owned enterprise in the top 50 housing companies that announced the bond exhibition or breach of contract. Although the actual number is not large, the shock of the market is comparison. Large. Because the previous default or exhibition period, that is, what we usually call the thunder, is basically private housing enterprises. This time, local state -owned enterprises have also experienced similar situations. It has not ended. "Sheng Songcheng, a professor of economics and finance at the International Business School of China and Europe and the Department of Investigation of the People's Bank of China, said in a recent public speech, talking about the debt risk faced by real estate companies," the financing constraints of housing companies It is still relatively large, especially for private housing companies, only a few companies with good financial indicators have received credit support. "

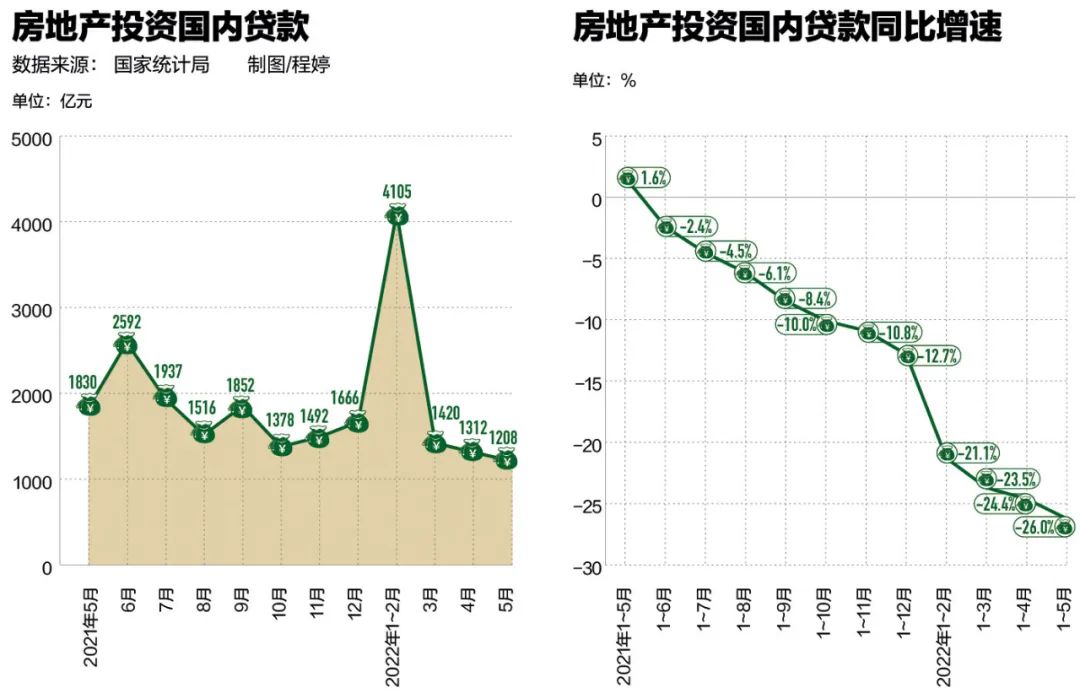

Although the regulatory layer shouted several times, the situation of the financing side of the real estate enterprise has not improved. Taking bond financing as an example, Huatai Securities Research Report data shows that in the first four months of this year, the domestic debt issuance of housing enterprises was about 195 billion yuan, a year -on -year decrease of more than 40 % , Overseas bonds issued about 45.6 billion yuan, a decrease of nearly 70 % year -on -year. In addition, the domestic debt -issuing real estate enterprises are mainly state -owned enterprises and state -owned enterprises, and private housing companies account for only 7 %, let alone a large number of private housing companies that have already been in danger.

On September 24, 2021, Evergrande Cultural Tourism City under construction. Photo/Visual China

The financing channels have not yet opened, and the coldness of the property market has restricted the intensity of the real estate company's sales payment. Under the attack, the number of new insurance companies in the top 100 real estate companies this year has not declined. Essence

In the second quarter, the US dollar debt of a large number of real estate companies expired and became another risk point. The insurance real estate enterprises represented by Evergrande are practicing the strategy of "changing space with time", hoping to keep bonds without breach of contract through debt exhibition. However, financing tightening and weak sales. Last year, the "insured transit" self -rescue strategy set by Evergrande's exit and real estate companies was still difficult. Some project funds had large gaps and urgently needed external blood transfusion rescue. However, in the current market environment In the bottom, the external blood transfusion is also very cautious.

In fact, there are more than one out of insurance companies that face the "Evergrande Dilemma".

"Only waiting"

At the end of June, Lang Xing received a letter from Evergrande's subordinate property company. He was the owner of the future city of Kaifeng Zheng Kairong. Since July 1 last year, he has not paid the property service fee for a year. Lang Xing, who received the letter of the letter, asked the property staff, "Do you know how much money Evergrande owes me?"

Lang Xing's company as a legal person is Evergrande supplier. The cooperation time is more than 7 years. The currently arrearting business tickets and payables exceed 2 million yuan. Broken, the first year of the year, he spent in Evergrande Project Company. He hoped that the other party would pay some arrears. He finally found that he could only wait, and he was more helpless.

Recently, an investor's liquidation was invited, and Evergrande's debt reorganization pushed Evergrande to the wind.

On June 27, a strategic investor of Evergrande RV Treasure made an application to the Hong Kong court to ask Evergrande to liquidate. On June 28, Evergrande had a response to the claimer's request for liquidation, saying that he would oppose the above invitation. It is expected that the invitation will not affect the company's reorganization plan or timetable. As of now, China Evergrande's total of about 19.285 billion U.S. dollars has officially defaulted. This operation will increase the difficulty of the Evergrande's resumption of trading, and it will also affect the construction of the Evergrande project. In this regard, the Hong Kong court will hold a hearing on August 31 to investigate the matter, and it is not ruled out that more creditors may ask for liquidation in the future.

On October 18, 2021, Suihua City, Heilongjiang, is located in the Suihua Hengdorian Cultural Tourism Kangyang City Project on the north bank of Songhua River. Most of the construction sites are in a state of stopping work. Some of the generally completed real estate are closed to the construction unit. Figure/IC

今年4月底至5月,恒大曾迎来一波境内债券偿还高峰,4月底,恒大地产曾在5天内接连召开三笔债券持有人会议,分别审议表决“19恒大01”“21 Evergrande 01 "Payment Payment Period and" 19 Evergrande 02 "principal and interest payment exhibition proposal.

In fact, it is not individual housing companies facing the pressure of redemption. In June 2022, housing companies once again ushered in a wave of debt repayment. In the month, 44 bonds expired, totaling about 63.9 billion yuan. According to the statistics of the Kerry Research Center, from June to July this year, 200 core housing companies' domestic and foreign debts expired at a due date of about 175.5 billion yuan, of which private housing companies accounted for 67 %. In June, four overseas priority notes expired by Jiazhaoye, a priority bill that expired in Xinli Real Estate and a happy overseas debt in Huaxia had already appeared in interest breach of interest.

As the main body of the bond issuance in Evergrande, Evergrande Real Estate has a total of 13 deposit bonds, with a total renewal scale of 55.853 billion yuan, and there is no breach of bonds. Evergrande hopes that the domestic bonds during the exhibition period will not break the contract during the exhibition. On March 22, Evergrande convened a conference call for the global creditors. The exhibition work is advancing in an orderly manner.

The exhibition period and the offer to be replaced have become the main way for the pressure of mitigation debt in real estate companies. According to statistics from CICC, in the first May 2022, a total of 22 domestic bonds have been exhibited in real estate. There are also exchanges with investors when the exhibition period is hopeless. As of early June, housing companies have issued a total of 26 US dollars of bonds this year, of which 16 were exchanged for appointments, accounting for 61.5 %. For Evergrande, the bond exhibition period was awarded the time for the debt restructuring plan. On June 20, China Evergrande Group once again confirmed in the announcement that the debt restructuring plan will be announced at the end of July.

Evergrande's debt is composed of three parts: suppliers represented by non -payment business tickets to pay unpaid, unpaid wealth products, that is, financial management, and financial institutions borrowing. Many large wealth products holders told China News Weekly that after the Spring Festival this year, they can receive 8,000 yuan of redemption funds every month.

On the day of Evergrande Real Estate seeking "15 Evergrande 03", Zhang Yun was close to noon to participate in a online court trial. The marketing company she operated became an Evergrande supplier in 2015. Tickets are nearly 30 million yuan. As early as September 2021, the company had filed a lawsuit on overdue business tickets. At that time, cases involving Evergrande's business tickets needed to be transferred to the Guangzhou Intermediate Court to concentrate. The trial can only wait. "

In April and May this year, the requirements of concentrated jurisdictions were loose. The ticket holder could sue in the court of the issuer, that is, the location of the Evergrande project company, which made Zhang Yun see hope. Since the participating projects were mostly in Henan, in June, she went to the courts of Henan to filed a lawsuit, and there were more than a dozen cases of cases.

On November 16, 2021, a real estate project developed by Jiazhaoye Group in Shanghai. Photo/Visual China

Zhang Yun's company holds hundreds of Zhang Evergrande business tickets, and some smaller business tickets even have only thousands of yuan. It has been overdue in July last year. For one year, Zhang Yun has not waited for the redemption plan. The number of civil lawsuits corresponding to hundreds of business tickets is not a minority. "I did not enter the account for a whole year, but I had to pay litigation costs, lawyers' fees, etc.".

Zhang Yun's branch of Henan Land City has all been dissolved. In May this year, Shaanxi Provincial Branch was difficult to support. "It can only promise to help employees pay five insurances and one fund to the end of this year as compensation." There are only about 10 people in Zhengzhou's headquarters. She deliberately leaves a legal affairs and is responsible for subsequent lawsuits. The number of employees in her company once exceeded 300.

Of course, even if Zhang Yun obtained the court's decision, it does not mean that the debt can be settled.

Shi Jiang, who participated in many Hengdian projects in Jiangsu and Zhejiang, is carefully searching for an account that Evergrande Project Company except for supervision accounts. He hopes to find assets that can be disposed of in the court. After 300,000 yuan, he hurriedly called the judge, hoping that the court would give priority to this part of the assets and the need for emergency their company's salary.

Including business tickets and unpaid payments, Evergrande's company owed to Shijiang more than 1,600 million yuan. He is the earlier group of Evergrande suppliers. , Civil litigation has been filed for all arrears, the court's judgment has been made, but it is still encountered in the implementation session. "

After Evergrande's thunder, all projects in various places were included in government supervision accounts, preferentially used for "guaranteeing the property", and the old account was hung. Fund in.

The judge who made relevant judgments told China News Weekly that even if the court had frozen the regulatory account, it was impossible to enforce the implementation of the project involved in the project involved in the project. ", That is, the developer handles the initial confirmation of the real estate in accordance with regulations. After receiving the" Real Estate Rights Certificate ", if there is still balance in the regulatory account, the court can deal with it. "At present, the funds in the regulatory account can only be used for the money required by the local government's residential construction department. This rule is not only suitable for Evergrande, but also for other insurance housing companies."

Obviously, the funding demand for "guaranteeing the property" is placed in a more important position, but this also means Fall. Suppliers can only wait for the resumption of work and re -production to keep the property, but because the old account cannot be settled, the supplier is involved in the "guarantee of the property" or there is very little interest, or it is unable to paid. The enthusiasm is limited.

Embarrassing "guarantee to the building"

"An overdue business ticket expired at the end of March last year, and the ticket value was worth more than 400,000 yuan." Guo Zhou told China News Weekly that the arrears involved Evergrande's project in Hubei has not given a redemption plan. "The project company does have no money. At present, the local government has set up a special work class. The strategy adopted is 'new account, hanging old account', that is, the" old account "that has been arrears, and the" new account "generated by the" guarantee of the property " '".

Some members of the government work bluntly said to reporters: At present, they are mainly "guarantee to the building". As for existing debts, no money, and no energy disposal.

Regardless of whether in Evergrande's self -rescue strategy and the list of targets of the regulatory authorities, the "guarantee of the property" is in the primary position.

At the re -production and resumption of production held in late October last year, Xu Jiayin announced the first announcement of self -rescue strategy. The first item was to go all out to realize the resumption of work and re -production. Evergrande has repeatedly emphasized the importance of re -production and re -production protection. This time Xu Jiayin emphasized that only by re -production and production and restoring sales and operations can we hand over the building to the owner to solve the business tickets of upstream and downstream partners. Only to complete the redemption of wealth products, and we can gradually return the loan of financial institutions. At the press conference of the National New Office of the Spring Festival this year, Wang Menghui, then Minister of Housing and Urban -Rural Development, also said that it must resolutely and effectively dispose of the risk of overdue delivery of individual real estate enterprise projects.

According to data from Evergrande officials in early April, as of March 27, Evergrande Group had 734 re -construction projects, with a re -work rate of 95 %. Among them, 424 projects have returned to the normal construction level, accounting for 55 %. The total number of resumptions in the country reached 154,000.

However, under the strategy of "new accounting and hanging old accounts", the progress of some projects in Evergrande's projects and re -production insurance is still difficult to speak.

"If a" Baojiao Building "project has only five or six workers construction, can this be called resumption of labor and production? If this is also considered a resumption of work and re -production, when will the project be completed?" An Evergrande Henan supplier told reporters that reporters told reporters that More than 80 % of the projects involved are "non -normal re -production and re -production". "There may be many people at the scene of the re -production and re -production conference, but there are only a few workers who actually construct at the construction site."

Evergrande's "Insurance Communications" chosen partners are more of the original suppliers. At the end of 2021, Evergrande found Zhang Yun, hoping that her company would participate in the "Insurance Building" of the Xin Zheng Yuelong Bay project. Zhang Yun's business involved was an essential link to the owner before handing over the house. "The project company proposed that September 2021 2021 The newly incurred costs re -signed a three -month contract and cash settlement. However, the project manager admits that it is unknown whether it can be obtained in the project three months later, and the project currently owes more than 600,000 yuan. " Zhang Yun finally did not participate in the "guarantee of the property".

On the evening of June 22, a project company of a state -owned background real estate business called Zhang Yun, hoping that she could accept the "insurance delivery" business of a certain project, and the payment cycle agreed in the contract was 8-12 months. After querying the credit rating of this real estate business, Zhang Yun directly pushed off the business of finding the door, and did not even give the quotation. "Other projects promise the three -month payment cycle to dare to accept it, let alone 8 to 12 months "".

Even if some suppliers participate in the "insurance diplomacy", the progress of the project is not normal. Although Evergrande still owes nearly 16 million yuan in project funds, Zhang Nan told China News Weekly that his company began to participate in some "insurance delivery buildings" project last year, because his company has "consumed inside" "Before the company's subcontractor as a listed construction company has been participating in the project construction. After Evergrande burst, the listed company withdrew. As the actual contractor of the project, the project is halfway, even the project volume cannot be calculated, and the accounts are not without accounts. It may be cleared, so only to be completed as possible. "

However, he admitted that after Evergrande's explosion, as an actual contractor participated in the "guarantee of the property", it was more formal. "You need to settle the project money at any time, otherwise you will stop work after a period of time. For example, if you do it for a month, a certain output value will be formed. It also involves multiple parties such as material providers. If the materials cannot be in place and there is no conditional construction, the supplier has been dragged miserable. For example, the total contract of the project of a project often faces thousands of legal lawsuits because of the arrears, which also leads to 'insurance The efficiency is relatively low. "

This dilemma involves whether the funds of the "guarantee of the property" are sufficient. After Evergrande's risk in 2021, local governments set up special work classes under the housing and construction department. More functions were to strictly control the expenditure of regulatory accounts. The government's level to prevent higher companies from taking off funds. " However, the funds in some regulatory accounts are obviously not enough to support the "guarantee of the property."

Zhang Nan said to reporters for example that the output value of the company's project in Evergrande is 89 million yuan, and there are still unsuccessful project funds. After participating in the work of "insurance delivery" last year, the payment progress is very good. Slowly, it only paid a total of less than 2 million yuan. According to his estimation, Evergrande needs hundreds of millions of yuan to complete the "insurance property" of this project.

Someone close to Evergrande Hubei Branch told China News Weekly, taking a total of three projects of Evergrande's three projects in a city -level city in Hubei as an example. In 2021, the three projects of Evergrande Breaking Thunder have different progress. At the end of last year, the government After taking over, I found that the three projects had a funding gap of about 1.1 billion yuan. Even if some of the garage that had been built was sold, the funds gap was 89 billion yuan, and it did not include the old account of the project. More than 10,000 yuan.

"Even these more than 30 million yuan are spending one after another, including paying several general contractors. One of the projects has been paid to the contractor millions of yuan, but the contractor is more symbolic to send workers to the construction site to knock on the construction site and beat the construction site. Playing and turning to the tower crane. "According to him, Evergrande has two of the three local projects in the state of stopping or semi -stop. Delivery, but the construction period is stretched. It is currently planned to be delivered to the building in September. "

Obviously, the progress of the resumption of labor and re -production insurance depends to a large extent on the amount of funds in the regulatory account, and the re -production and re -production are facing financial pressure. A reporter from Evergrande Jiangsu "One -Floor Plan Plan on the starting project" by the reporter from China News Weekly shows that the balance of the pre -sale supervision account of the project is 300 million yuan, even if it is calculated that 777 million yuan has been sold without repayment, And the subsequent value of the unpaid -selling buildings, it is still unable to cover the project's unpaid payment, the non -payment business ticket, and the various expenditures before the delivery of the property, a total of 2.9 billion yuan. It is necessary to achieve its own balance by reaching its own balance through the unpaid forensic building. To complete this part of the project, the expenditure is needed to be 2.56 billion yuan. Fund pressure is evident.

"The company proposed a 'guaranteeing building' last year, but the progress of progress was different in different provinces, cities, and even different projects. Live projects. "The aforementioned those who were close to Evergrande Hubei Branch told reporters that for example, compared with Hubei and Hunan, Hubei promoted the" insurance delivery building "to Hunan. Pinded to advance the speed faster, but some projects require government coordination and will only have asset realization, such as selling, mortgage parking spaces, residential houses, etc. as the source of funds of the "guarantee of the property", and the progress is slow. "

He admitted to reporters that the government now comes forward to guarantee, such as special funds, and then delayed development loans. The problem of funds later is still easy to solve. Find the receiver. "

The "one -floor plan for the start of the project" describes the funding dilemma faced by the suspension project as "no new financing lending and a severe sales decline in sales". Waiting for the outbound housing companies, it is undoubtedly looking forward to the "white knight" to take over, bringing incremental funds.

Where is the solution to the "item"?

As early as January of this year, due to the pressure of "guaranteeing the building", Evergrande will transfer the equity transfer of some project companies held by Evergrande. Within half a year, the equity transfer has occurred in the project company.

On January 13, 100 % equity of Kunming Hengtuo Real Estate Co., Ltd. (hereinafter referred to as "Hengtuo Real Estate") was transferred to the Ministry of Fortune International Trust Co., Ltd. (hereinafter referred to as the "Minmetals Trust") by Evergrande Real Estate Kunming Co., Ltd.. As early as September 2020, 100 % equity of Hengtuo Real Estate was pledged to the Ministry of Fortunately. The equity transfer was considered to be "debt with stocks."

The Hengda Linxi County Project under Hengtuo Real Estate won the land for half a month at a price of 689 million yuan in April 2020, and the project started. Mi, the unit price of hardcover houses is about 11,000 yuan/square meter. However, the project had been suspended in September that year, and 7 of the 17 planned houses were capped.

People close to the project told China News Weekly that the general contractor of the project construction was Jiangsu Construction Industry Group Co., Ltd.. In early November, the construction party lock the door of the construction site and prohibit any personnel from entering and exiting. At that time, except for a small part of the project's main structure, most of the remaining subjects had been completed, and the total output value was about 254 million yuan. The progress model is 121 million yuan.

Although AMC has reached cooperation with some housing companies, it has not yet announced specific cooperation projects and models. Photo/Visual China

This is not the only project company equity of the Ministry of Trust. At the end of February, an announcement stated that the company signed a cooperation agreement with the Everbright Trust and the Ministry of Five Mine Trust to sell the four projects related to the two trust institutions. Earlier, the two trust institutions were shareholders of four project companies.

This announcement also clarifies the cooperation model after the trust company takes over. The two trust institutions have invested all funds required for development and construction according to actual needs. Evergrande does not need to invest any additional funds to the project company. On the one hand, the sales of related projects are used to settle the short -term operation and debt payable of the project company, and on the other hand, it is used to repay the investment of the project before and after the trust agency to take over. If there is a surplus, it is used to repay the early investment in Evergrande of China.

In other words, the trust company will still ensure the investment of the trust company first after receiving it. Some project creditors told reporters that the Minmetals Trust did check the debt situation with its debt before the transfer of the transfer of the equity, but did not give the debt settlement plan.

At the global creditors conference held on March 22, some creditors asked questions that the company will continue to adopt the "equity transfer+custody operation" model in the future to revitalize the real estate project of the country? Evergrande's non -executive director Liang Linlin said that in the current situation of the company's liquidity, the above model is the real choice of maintaining the company's orderly operation and ensuring the legitimate rights and interests of all parties. The building, the follow -up company will continue to work hard to continue to promote the resumption of work.

Evergrande creditors analyzed to reporters that the assets of the trust company were relatively high -quality, which is located in Guangzhou, Foshan, Dongguan and other places, and there are subsequent assets to deal with it. For example, when the Minmetals Trust takes over Evergrande Real Estate, there are only 5 of 17 houses. Building obtained a pre -sale license.

Liu Shui, the person in charge of the enterprise and business department of the China Finger Research Institute, told China News Weekly that in the solution of risks in various places, "financial institutions to acquire mergers and acquisitions+agencies" are a more feasible approach. It is difficult to re -production by enterprises by themselves. The insurance enterprises themselves lack funds and do not have incremental funds. It is difficult for the project to continue to build. In the "Financial Institutional Institutional Calenda+Development Construction" model, financial institutions receive mergers and acquisitions of insurance enterprises to provide financial support for the project, and entrust real estate development enterprises with strong operating capabilities to build management Ensure that financial institutions, buyers and other rights. However, whether financial institutions can recover their investment depends to a large extent on project sales.

According to the data disclosed by Evergrande in May, the contract sales in April were 3.09 billion yuan, compared with the sales of 20 million yuan to 30 million yuan per month from September last year to March last year, but compared to last year last year The contract sales of 68.1 billion yuan in a single month before the insurance were still far apart. "Without sales, it is impossible to get out of the predicament and pay off debts." Xu Jiayin said.

Obviously, the downturn in the real estate market has hindered financial institutions to assist housing companies to resolve the debt crisis.

今年4月,监管部门曾为资产管理公司(AMC) 提供了一份包含12家房企的名单,其中包括:恒大、世茂、融创、融信、佳兆业、中梁、中南建设、绿地、 Aoyuan, Rongsheng, Sunshine City, R & F, so that national AMCs can participate in real estate companies' rescue work.

Zhao Limin, Vice President of Cinda Assets, was one of the seven members of the Evergrande Risk Resolution Committee established last year. Since the beginning of this year, AMCs such as Great Wall Assets and Huarong Assets have also successively reached cooperation with real estate companies such as Jiazhao and Zhongnan Construction. , Joining cooperation projects, etc. to carry out business. However, there have been no specific cooperation projects and models.

Liu Shui analysis believes that both insurance housing companies and AMC are concerned. First of all, the insurance enterprises are unwilling to touch the core high -quality assets prematurely. If the project is eager to sell the project now, the first is that the assets may be pressed, and the return of funds will not be expected, and it will also affect the valuation of the inventory in the hand. Maintaining later operations, although the current financial risks are alleviated, new operating risks have been added in the long run. Secondly, AMC is more cautious about the acquisition of the project. At present, the real estate market is still in depth adjustment, and the debt structure of some insurance enterprises projects is relatively complicated. AMC has improved the evaluation standards for the acquisition projects and pays attention to preventing and controlling risks.

Regarding the financial difficulties facing real estate companies, Sheng Songcheng suggested to support real estate project acquisitions. In 2021, 20 % of real estate projects across the country were developed by a number of real estate companies. This means that an enterprise or project is risky, and cooperative housing companies will inevitably be affected. "If you can acquire insurance projects or difficult housing companies through high -quality enterprises, you can control risks within a certain range, which is also conducive to the stability of the entire industry and society."

(Wenzhong Langxing, Zhang Yun, Shijiang, Guo Zhou, and Zhang Nan are all pseudonyms)

Send 2022.7.4 Total Issue 1050 "China News Weekly" magazine

Magazine title: How do I solve their dilemma?

Reporter: Chen Weishan ([email protected])

Edit: Min Jie

- END -

Lingshanwei Street, West Coast of Qingdao West Coast New District held 2022 new commercial housing promotion

Popular Network · Poster Journalist Pan Chao Liu Hang, a trainee reporter Dong Qi...

Residents voluntarily use their own housing for affordable rental housing. How to apply?How to determine?"Operation Guide" is here!

On July 6, the reporter learned from the Chengdu Housing and Urban Construction Bureau that in order to accelerate the establishment of a housing system with multi -main supply, multi -channel guarant