Tangshan: Buying a house and repayment, do not worry about the provident fund to launch the "one person to buy the whole family gang"

Author:Dahe Cai Cube Time:2022.07.05

Beginning on July 15, 2022, Tangshan Housing Provident Fund Management Center purchased a house to repay the new policy: "One person to buy a house for the whole family." Policies stipulate that in the area of Tangshan City, single employees to buy a house, their parents can provide loan repayment help as joint repayment; married employees to buy a house, and parents can provide loans for repayment as joint repayment. Parents' loans to buy houses or married children and husbands can provide loan repayment help as joint repayment. For insufficient loan repayment capabilities, as a common repayment person allows participation in loan repayment capabilities, the amount of loan is increased. The above personnel must pay employees for the housing provident fund of our city. The introduction of this policy has three "gold points".

The first is to promote the healthy and stable development of the local real estate market. In accordance with the relevant requirements of the provincial and municipal policies for the stability of the economic market, in order to boost the market, promote the market, promote consumption, and effectively solve the housing needs of new citizens, youth groups, and close retirees, and introduce this policy. This policy is not only applicable to housing provident fund loans, but also for commercial loans to buy houses for business loans.

The second is to increase the amount of housing provident fund loans and enhance the guarantee and mutual assistance. In response to the current entrepreneurship of new citizens and youth groups and foreign talents, the biggest obstacle to the use of loans to buy a house is that the wage income is not high, the ability to repay the loan is insufficient, and the maximum loan limit cannot be reached. In addition, there are also demand for improving house purchase by retirement employees. The biggest obstacle is that the loan period can only be extended to five years after the legal retirement age. The problem that cannot reach the highest limit due to insufficient loan repayment capabilities, as a common repayment person, the rigidity has improved the parents' loan repayment ability, and realized improvement of housing purchases through the "family gang".

The third is to awaken "sleep funds" and turn the family's "dark supplement" into the "bright supplement" of the housing provident fund. There is a difficulty in buying a house repayment due to the monthly repayment of loans and reducing the difficulty of disposable cash consumption in the family. Usually, the salary of parents or children will be supported and subsidized. After this policy is introduced, parents or children, as a common repayment person, can realize the explicit supplement of the provident fund by awakening the capital account funds that could not be used. It becomes easier and improves the happiness index of the entire family.

This policy stipulates that all employees in Tangshan can enjoy the New Deal on June 1 this year. The New Deal will be handled on July 15, 2022.

The notice of the Tangshan Housing Provident Fund Management Center on implementing the policy of "one person to buy a house" policy

Each employee, each branch center, management department, and all offices of the agencies:

In order to implement the decision -making and deployment of the Municipal Party Committee and Municipal Government, effectively solve the needs of employees 'house purchase, effectively alleviate the pressure of employees' purchase of houses, and play the role of housing provident fund affairs.

1. The scope of the policy of "one person to buy a house" policy

After June 1, 2022, employees in the city's deposits in the administrative area of Tangshan City use housing provident fund loans and commercial loans to buy houses. Children and parents can be used as joint repayments and can handle the provident fund withdrawal business. Different loans are still implemented in accordance with the original policy.

2. Application for the policy of "one person to buy a house" policy

(1) Children buy a house

Single employee loans to buy a house, and their parents can provide loan repayment as a common repayment person; the married employee's loan to buy a house, and the parents of both parties can provide loan repayment help as a common repayment person.

(2) Parents buy a house

Parents' loans to buy a house, children or married children and husbands can provide loan repayment assistance as joint repayment.

3. Calculation method of "one person to buy the whole family" policy housing provident fund loan repayment ability calculation method

Parents or children use housing provident fund loans to buy houses in the administrative area of Tangshan City. With insufficient loan repayment capabilities, children or parents who pay employees as provident fund can be used as joint repayment people, participating in the calculation of loan repayment capabilities, the maximum limit Meet the demand for the loan amount of employees.

(1) The maximum amount of personal housing loans in the housing provident fund of the dual and dual employees is 800,000 yuan.

(2) Those who purchase new passive ultra -low -energy independent homes for two -star and above green building standards, and the maximum loan amount is 960,000 yuan.

(3) The highest loan amount of Tangshan's "Phoenix Talent" personnel is 1 million yuan.

(4) The maximum loan amount of high -end innovative talents introduced by China (Hebei) Free Trade Zone Caofeidian District is 1.2 million yuan.

(5) If the two -child and three -child family use the housing provident fund loan to buy a house, on the premise of meeting the requirements of the loan repayment ability, the maximum loan amount of the two -child employee can increase the maximum maximum increase of 100,000 yuan, and the family of three -child employees can increase up to 20 10,000 yuan.

Fourth, "One person to buy a house for the whole family" compensation for the provident fund loan withdrawal condition

(1) Conditions for loan repayment for monthly: Parents or children use housing provident fund loans in the administrative area of Tangshan City to purchase the first self -living house or the second improved house. The housing contract, the provident fund loan contract, the ID card, the marriage certificate, the parental relationship certificate of the parent and the child and the child and the child are signed the loan to the loan repayment agreement. The automatic deduction in the storage balance should repay the loan amount. After the loan is settled, the balance of the previous year can be extracted from the front desk, and the total amount of extraction does not exceed the actual purchase expenditure. (2) Conditions for loan repayment and loan: Those who have not handled the loan repayment business, the child or parents participated in the common repayment, the house purchase contract, the provident fund borrowing contract, the identity card, the marriage certificate of the husband and wife, the parents of the husband and wife, the parents of the couple After the children's relationship certificate, the housing provident fund card to the front desk signed the "Common repayment application", the previous year's repayment amount was extracted in the annual borrower or the housing provident fund account of the housing provident fund account for the year. After the loan is settled, the balance of the previous year can be extracted from the front desk, and the total amount of extraction does not exceed the actual purchase expenditure.

(3) Other withdrawal information: The provident fund loan purchase is extracted, which is based on the loan information in the central business system. It does not need to provide the "House Information Inquiry Results". Only the person's ID card, the parent -child relationship certificate and the housing provident fund card are provided.

After the loan is settled, the "House Information Inquiry Results" issued by the real estate registration department required for the real estate registration department of the real estate register is required as a certificate of not being sold in the real estate.

5. "One person to buy a house for the whole family" compensate for the recruitment of commercial loans

(1) Extraction conditions: Parents or children use commercial loans to purchase their first self -occupied or second -improved housing in the administrative area of Tangshan City. The annual loan repayment amount withdrawn from the borrower or the common repayment of the housing provident fund account to store the balance; after the commercial loan is settled, the payment balance can be withdrawn in the previous year, and the total amount of withdrawal does not exceed the actual purchase expenditure.

(2) Provide information: When repaying the first extraction of commercial loans, you need to provide his ID card, the marriage certificate of the husband and wife, the certificate of parental relationship, the housing provident fund card, the house purchase contract, the VAT invoice, the loan contract, the repayment details, all the withdrawal of the house to buy a house to buy the house The "House Information Inquiry Results" issued by the Land Real Estate Registration Department within one month after signing the "Common repayment application form" at the front desk of the relevant provident fund institution, you can withdraw the loan amount annually. After each extraction, you need to provide an withdrawal person's ID card, marriage Certificate, parental relationship certificate, housing provident fund card, repayment details, and real estate registration departments issued by the real estate registration department will be shared by commercial loan information, no repayment details have been provided.

6. Other related matters

(1) Those who have not settled the loan of housing provident fund loans and commercial loans if their parents or children have not settled the policy.

(2) For the first time, the extraction business requires parents and children to bring relevant documents to the front desk of each branch and management department.

(3) Certificate of parental relationships: The only child and daughter certificate including ID card information, "Medical Birth Certificate", a notarization of the same household registration book or notarization department.

(4) When the borrower handles the housing provident fund loan, due to insufficient loan repayment capacity and other reasons, the parents as a common repayment person, during the repayment period, the income of the borrower's income, meet the requirements for repayment loan capacity, and ensure the implementation of the loan claim of the housing provident fund. You can apply for the joint repayment responsibility of your parents. The conditions for handling are the normal repayment of the borrower for 12 months. The provident fund account is in normal state, 60%of the monthly deposit base of the provident fund is greater than the monthly repayment principal and interest. Second-rate. If the borrower is voluntarily paid for the individual, it cannot handle the business of the common repayment person. After the liability of the common repayment, the loan repayment and extraction business of the real estate will no longer be handled.

(5) For employees to buy a house before marriage, their spouses and their parents can apply for participation in the joint repayment after marriage, and apply for the extraction business in accordance with regulations. When extraction, it is necessary to provide a person's ID card, marriage certificate, parent -child relationship certificate and housing provident fund card.

(6) Order of the deduction of loan repayment and loan repayment: borrower, common repayment person.

(7) The buyer should be responsible for the authenticity of the provision of the information. Behavior, restricting its housing consumption extraction and loan within five years; the joint credit punishment that refuses to return and is suspected of crime shall be transferred to the relevant departments in accordance with the law and punished according to law and regulations.

(8) After the employee is extracted, the purchased house is traded again to stop the implementation of the policy. If this house is traded again within 365 days after withdrawal, the "Notice on Determining the Relevant Policies on Dedicated Housing Provident Fund on the same set of housing provident funds" issued by the center will be issued in accordance with the center The rules are dealt with.

7. This notice will be implemented from July 15, 2022.

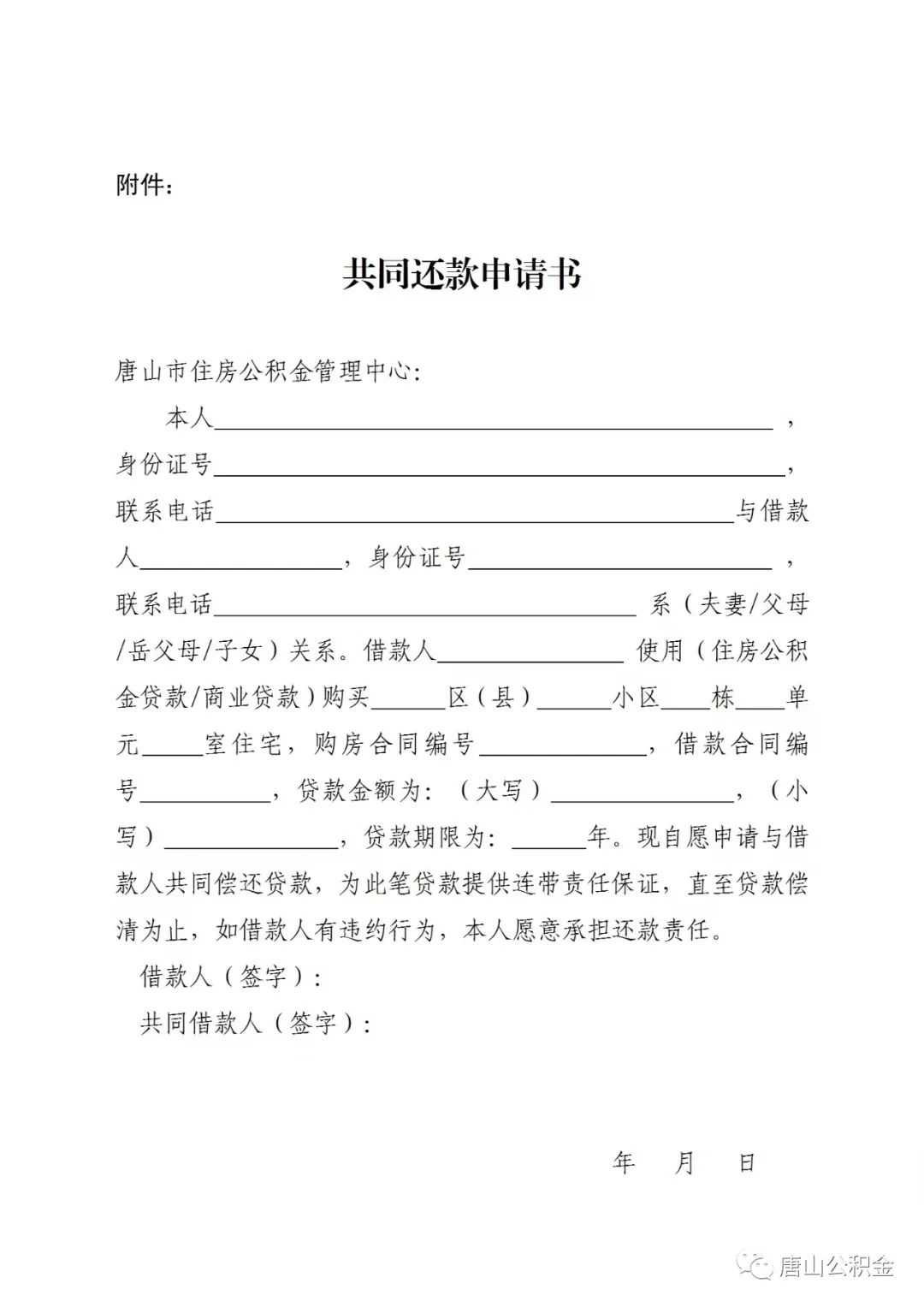

Attachment: Common repayment application

Tangshan Housing Provident Fund Management Center

July 5, 2022

Responsible editor: Yang Zhiying | Audit: Li Zhen | Director: Wan Junwei

- END -

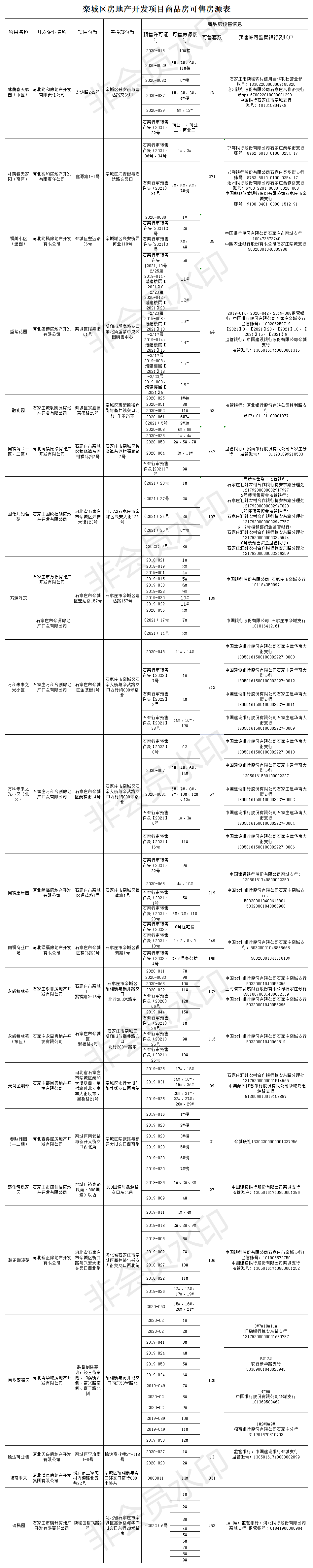

Real estate development project in Luancheng District, Shijiazhuang City can be sold for sale

In order to further disclose pre -sale behaviors of commercial housing, to the gre...

In June, there were 36 buildings in Taiyuan in Taiyuan obtained a pre -sale certificate

In June just ended, there were 36 buildings from 18 real estate in Taiyuan obtaine...