"One person to buy a house for the whole family"!Hebei 1 city issued a new provident fund policy

Author:Yanzhao Metropolis Daily Time:2022.07.06

July 5th

Tangshan issued the latest notice

To implement the decision -making arrangement of the Tangshan Municipal Party Committee and Municipal Government

Effectively solve the needs of employees to buy a house

Effectively alleviate the pressure of employees' house purchase

Give full play to the role of housing provident fund affairs

Tangshan Housing Provident Fund Management Center

Introducing the "one -person home gang" policy

Starting from July 15, 2022

The details are as follows:

Scope

After June 1, 2022, Tangshan City pays employees who use housing provident fund loans and commercial loans to buy houses in the administrative area of Tangshan City. Children and parents can be used as co -repayments and can handle the provident fund withdrawal business. Different loans are still implemented in accordance with the original policy.

Applicable situation

(1) Children buy a house

Single employee loans to buy a house, and their parents can provide loan repayment as a common repayment person; the married employee's loan to buy a house, and the parents of both parties can provide loan repayment help as a common repayment person.

(2) Parents buy a house

Parents' loans to buy a house, children or married children and husbands can provide loan repayment assistance as joint repayment.

Calculation method of housing provident fund loan repayment capacity

Parents or children use housing provident fund loans to buy houses in the administrative area of Tangshan City. With insufficient loan repayment capabilities, children or parents who pay employees as provident fund can be used as joint repayment people, participating in the calculation of loan repayment capabilities, the maximum limit Meet the demand for the loan amount of employees.

(1) The maximum amount of personal housing loans in the household housing provident fund of dual and dual employees is 800,000 yuan.

(2) Those who purchase new passive ultra -low -energy independent homes for two -star and above green building standards, and the maximum loan amount is 960,000 yuan.

(3) The highest loan amount of Tangshan's "Phoenix Talent" personnel is 1 million yuan.

(4) The maximum loan amount of high -end innovative talents introduced by China (Hebei) Free Trade Zone Caofeidian District is 1.2 million yuan.

(5) If the two -child and three -child family use the housing provident fund loan to buy a house, on the premise of meeting the requirements of the loan repayment ability, the maximum loan amount of the two -child employee can increase the maximum maximum increase of 100,000 yuan, and the family of three -child employees can increase up to 20 10,000 yuan.

Provident fund loan withdrawal condition

(1) Conditions for loan repayment on a monthly basis:

Parents or children use housing provident fund loans to purchase their first self -occupied housing or second -improved housing in the administrative area of Tangshan City. Those who are involved in the joint repayment of children or parents can hold a house purchase contract, provident fund loan contract, ID card, marriage certificate Prove that the relationship between parents and children signed the loan agency to sign a loan repayment agreement. After handling the loan repayment business, the monthly loan quota should be automatically deducted in the loan or joint repayment of housing provident fund accounts monthly. After the loan is settled, the balance of the previous year can be extracted from the front desk, and the total amount of extraction does not exceed the actual purchase expenditure.

(2) Conditions for loan repayment by year:

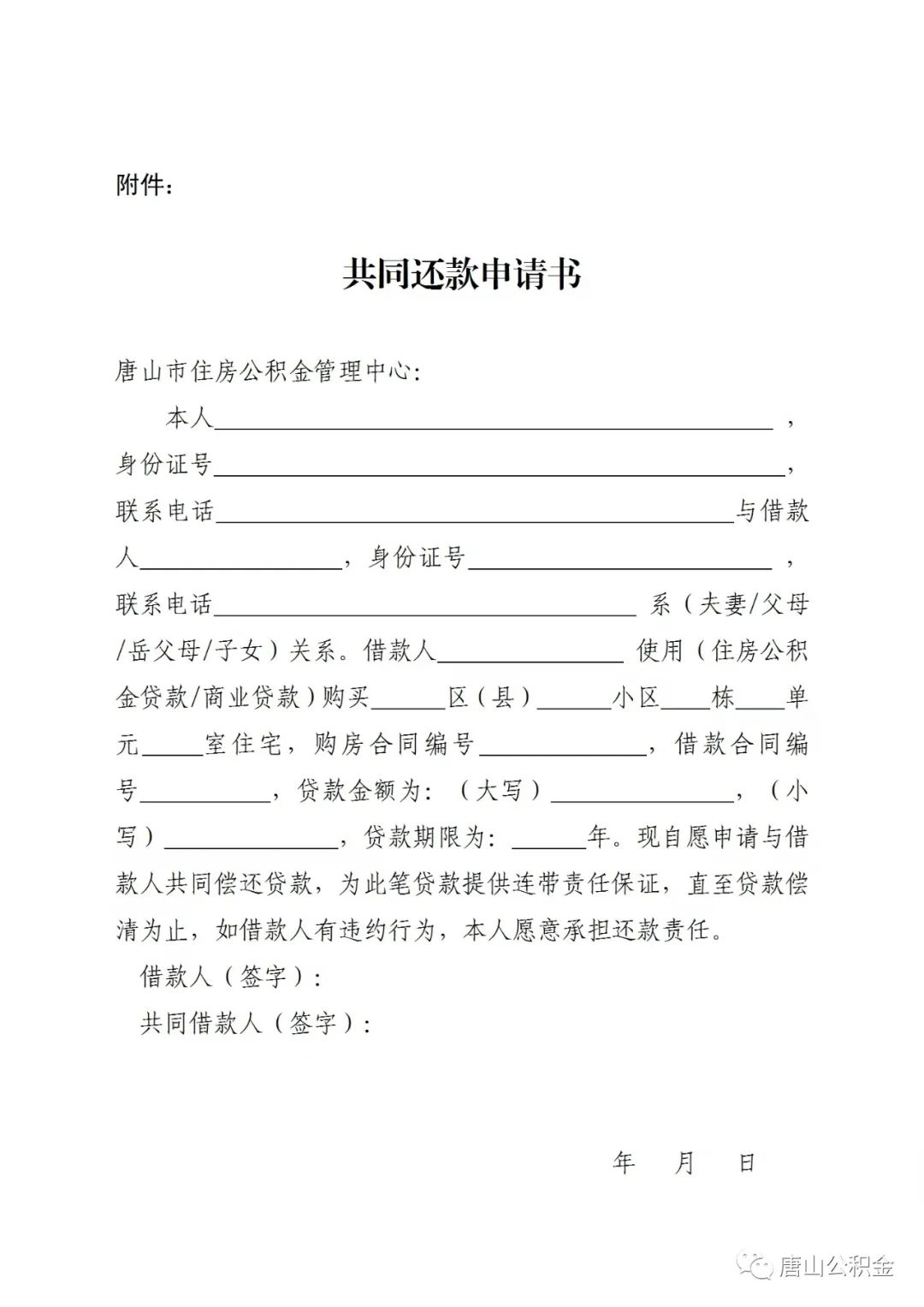

Those who fail to apply for a loan repayment business, children or parents participate in the common repayment, can hold a house purchase contract, provident fund loan contract, my ID card, husband and wife marriage certificate, parent -child relationship certificate, housing provident fund card to the front station signing when the first withdrawal After the "Common Repair Application", the previous year was extracted from the borrower or the housing provident fund account of the borrower or the common repayment of the housing provident fund account for the year. After the loan is settled, the balance of the previous year can be extracted from the front desk, and the total amount of extraction does not exceed the actual purchase expenditure.

(3) Other extraction materials:

The provident fund loan purchase withdrawal is based on the loan information in the central business system. It does not need to provide the "House Information Inquiry Results". Only the person's identity card, parental relationship certificate and housing provident fund card are provided.

After the loan is settled, the "House Information Inquiry Results" issued by the real estate registration department required for the real estate registration department of the real estate register is required as a certificate of not being sold in the real estate.

Conditions for repayment of commercial loans

(1) Extraction conditions:

Parents or children use commercial loans to purchase their first self -occupied housing or second -improved housing in the administrative area of Tangshan City. If the children or parents participate in the common repayment, the commercial loan can be paid before settlement. People or joint repayments are stored in the housing provident fund account; after the commercial loan is settled, the payment balance of the previous year can be extracted on the year, and the total amount of the withdrawal does not exceed the actual purchase expenditure.

(2) Provide information:

When repaying commercial loans for the first time withdrawal, you need to provide his ID card, a marriage certificate for both husband and wife, certificate of parental relationship, housing provident fund card, housing purchase contract, value -added tax invoice, loan contract, repayment details, and all from the real estate registration department of the real estate registration department. After signed the "Common repayment application form" to the front desk of the relevant provident fund institutions within one month, the loan repayment amount can be withdrawn every year. , Housing Provident Fund Card, repayment details, and the real estate registration department issued by the real estate registration department of the real estate registration department; the sharing of commercial loan information has not been provided, and the repayment details are not required.

Other related matters

(1) Those who have not settled the loan of housing provident fund loans and commercial loans if their parents or children have not settled the policy.

(2) For the first time, the extraction business requires parents and children to bring relevant documents to the front desk of each branch and management department.

(3) Certificate of parental relationships: The only child and daughter certificate including ID card information, "Medical Birth Certificate", a notarization of the same household registration book or notarization department.

(4) When the borrower handles the housing provident fund loan, due to insufficient loan repayment capacity and other reasons, the parents as a common repayment person, during the repayment period, the income of the borrower's income, meet the requirements for repayment loan capacity, and ensure the implementation of the loan claim of the housing provident fund. You can apply for the joint repayment responsibility of your parents. The conditions for handling are the normal repayment of the borrower for 12 months. The provident fund account is in normal state, 60%of the monthly deposit base of the provident fund is greater than the monthly repayment principal and interest. Second-rate. If the borrower is voluntarily paid for the individual, it cannot handle the business of the common repayment person. After the liability of the common repayment, the loan repayment and extraction business of the real estate will no longer be handled. (5) For employees to buy a house before marriage, their spouses and their parents can apply for participation in the joint repayment after marriage, and apply for the extraction business in accordance with regulations. When extraction, it is necessary to provide a person's ID card, marriage certificate, parent -child relationship certificate and housing provident fund card.

(6) Order of the deduction of loan repayment and loan repayment: borrower, common repayment person.

(7) The buyer should be responsible for the authenticity of the provision of the information. Behavior, restricting its housing consumption extraction and loan within five years; the joint credit punishment that refuses to return and is suspected of crime shall be transferred to the relevant departments in accordance with the law and punished according to law and regulations.

(8) After the employee is extracted, the purchased house is traded again to stop the implementation of the policy. If this house is traded again within 365 days after withdrawal, the "Notice on Determining the Relevant Policies on Dedicated Housing Provident Fund on the same set of housing provident funds" issued by the center will be issued in accordance with the center The rules are dealt with.

(Published by Tangshan)

- END -

Announcement on applying for affordable rental housing

Announcement on applying for affordable rental housingRecently, it was found that someone issued false information related to policies related to affordable rental housing through Douyin, today's head...

Policy banks in many places to implement the "one -person home gang" policy bank lending to speed up again

Reporter Peng YanOn July 6, the Shenzhen Municipal Housing and Construction Bureau issued a notice on publicly soliciting the Regulations on the Management Regulations of Shenzhen Housing Provident F