Ten billion private equity bosses happened again!It was forced to execute 550 million, which has been restricted before!Company emergency response

Author:Broker China Time:2022.08.05

Private equity, fell into a lawsuit of hundreds of millions of yuan again!

On August 4th, China Judgment Web.com showed that Beijing Xinzhongli and actual controller Wang Chaoyong (ID name: Wang Chaoyong) was classified as the executed person, and the implementation of the subject was more than 554 million yuan. First Intermediate People's Court.

On the evening of the same day, ST Xinli urgently released the "Beijing Xinzhong Investment Investment involved in the Progress of Arbitration (Revised)" stated that the Beijing Arbitration Commission was received on June 10, 2022, No. 1537, which was made on June 2, 2022 Arbitration decision.

This arbitration was applied by the Great Wall Life Insurance, and the Beijing Arbitration Commission finally ruled that Beijing Xinli Investment Payment Payment Great Wall Life Insurance Partnership shares transfer RMB 500 million and liquidated damages and other expenses. Responsibility, etc.

It is worth noting that Wang Chaoyong has been listed many times before, and in early July, he also received a restricted consumption order from the Shanghai First Intermediate People's Court, which was restricted to high consumption.

However, from the perspective of Wang Chaoyong's circle of friends, it remains normal and always pays attention to the dynamics of the venture capital market.

NelTee Emergency Replenishment Announcement

Wang Chaoyong, who had lost contact for 37 days due to being detained last year, still did not get rid of the dilemma of breaking funds.

On the evening of August 4th, ST Xinli released the "Beijing Xinzhong Investment Investment Involved in the Progress of Arbitration (Replenishment)" stating that the Beijing Arbitration Commission was received on June 10, 2022 No. 1537 arbitration decision.

That is, as early as June 10, Xinzhongli received the arbitration decision, but it has not been announced. Xinzhongli stated in the "Revised Instructions Announcement" that "because the business manager failed to sort out the documents received in time due to resignation and transfer, the company failed to disclose the notice of the lawsuit in time."

Announcement of arbitration progress shows that this major arbitration is applied by Great Wall Life Insurance, and the date of arbitration acceptance is August 11, 2021. The respondent was for Beijing Xinzhongli Investment Co., Ltd., Beijing Xinli Equity Investment Management Co., Ltd., Wang Chaoyong.

The reason for the dispute is that Great Wall Life Insurance signed the "Partnership Share Transfer Agreement" with Xinzhongli and Wang Chaoyong. Limited partnership) (referred to as "Yongxin Fund") all partnership share.

In the end, the Beijing Arbitration Commission's arbitration is as follows: Xinzhongli to the Great Wall Life Insurance Payment Partnership share transfer price of 500 million yuan; payment of overdue payment liquidated damages of 10.360 million yuan. Two times as an appropriate interest rate for overdue payment liquidated damages to the actual settlement of the actual settlement; the payment lawyer fee is 325,500 yuan and the insurance liability insurance premium is 218,400 yuan; Wang Chaoyong shall bear the liability of the applicant's payment obligations.

In addition, Xinzhongli and Wang Chaoyong's joint payment to Great Wall Life Insurance to pay a difference of 40 million yuan, and the transfer price of partnership shares is calculated as the calculation base, and the annual interest rate is calculated until the actual settlement date; 26.83 million yuan, the premium of 5,000 yuan.

Xinzhongli and Wang Chaoyong were executed 550 million yuan

On August 4th, China Judgment Web.com showed that the matter had entered the execution stage, and Wang Chaoyong, a actual controller Wang Chaolong and the actual controller Wang Chaoyong, was classified as the executed person, and the implementation of the subject was more than 554 million yuan. The intermediate people's court, the case for the case is July 25, 2022.

Xinzhongli said in the announcement that the company recently negotiated with the relevant matters related to the Great Wall Life Insurance on the relevant matters related to the Yongxin Fund, and will also seek negotiation and promotion of other implementation solutions. At the same time, the company will recently submit a procedure to the court and does not give an application to safeguard the legitimate rights and interests of the letter.

According to the China -China Union Kaixinbao data, Yongxin Fund was established in June 2017 and recorded in May 2019. The registered capital and actual payment capital are 1.82 billion yuan. company. Great Wall Life Insurance is one of the funds of this fund, with a shareholding ratio of 27.4725%. In addition, the fund has 6 LP, one of which is Soochow Life Insurance, which is 200 million yuan and 10.9890%of the shareholding ratio. Essence

The dispute between Soochow Life Insurance and Nobella and Wang Chaoyong has been sentenced in March and April this year.

The People's Court of Huqiu District, Suzhou City, Jiangsu Province made a civil judgment and civil ruling of the first instance of civil junior instance on the Soochow Life Insurance and Wang Chaoyong contract disputes. Frozen the property of the respondent Wang Chaoyong Bank of 17.8018 million yuan or property that seizes and seizes its corresponding value.

In the debt crisis, Wang Chaoyong was also limited to high consumption

It is worth noting that due to the debt crisis, since April 2021, Xinzhongli and Wang Chaoyong have been taken to restrict consumption measures.

In July 2021, due to the violation of the property report system, the first announcement of the letter was included in the list of people who were dishonest. On February 22 this year, Xinzhongli disclosed the announcement that due to the obligations determined by the effective legal documents, the company and the relevant subject and the actual controller Wang Chaoyong were incorporated into the executor of the dishonesty by the Beijing Third Intermediate People's Court, and 740 million were executed. Yu Yuan.

In September 2021, Wang Chaoyong was criticized by the Shenzhen Stock Exchange due to the failure to disclose the company's major incidents in a timely manner. In addition, the national small and medium -sized enterprise shares transfer system limited liability company decided to take self -discipline supervision measures with alert letter. Public information shows that from 1987-1998, Wang Chaoyong served as the US Morgan Chase Bank, the United States Standard, Morgan Stanley, and served as the head of the China Morgan Stanley China. Essence

Wang Chaoyong founded the Capital Capital Group in 1999 and has been the chairman. Xinzhongli is one of the earliest batch of investment institutions engaged in venture capital and private equity investment in China. The size of its management funds once exceeded 30 billion. Waiting for listed companies at home and abroad, Wang Chaoyong ushered in a high time in 2015.

In May 2016, Wang Chaoyong purchased 11.1%of Huicheng Technology's 11.1%of Huicheng Technology for 1.65 billion yuan. Compared with Huicheng Technology's 8.89 yuan stock price at the time, the premium was as high as 113.7%. The high premium of the debt acquisition of Huicheng Technology made Wang Chaoyong defeat the Waterloo.

The crisis of broken capital chain continued to come. In the early morning of December 16, 2021, private equity Wang Chaoyong was exposed for two weeks, and finally obtained the bail pending trial on January 6, 2022.

According to the website of the China Fund Industry Association, Beijing Xinli Equity Investment Management Co., Ltd. is 50 to 10 billion yuan, the number of funds is 26, and its scale is more than 10 billion yuan a few months ago. On April 19, 2021, the Beijing Securities Regulatory Bureau took administrative regulatory measures to be ordered to make corrections, involving violations of the fund partnership agreement, insufficient investor management, the minimum income of the commitment, and the non -timely disclosure of major lawsuits and equity frozen matters.

Editor -in -chief: Wang Lulu

- END -

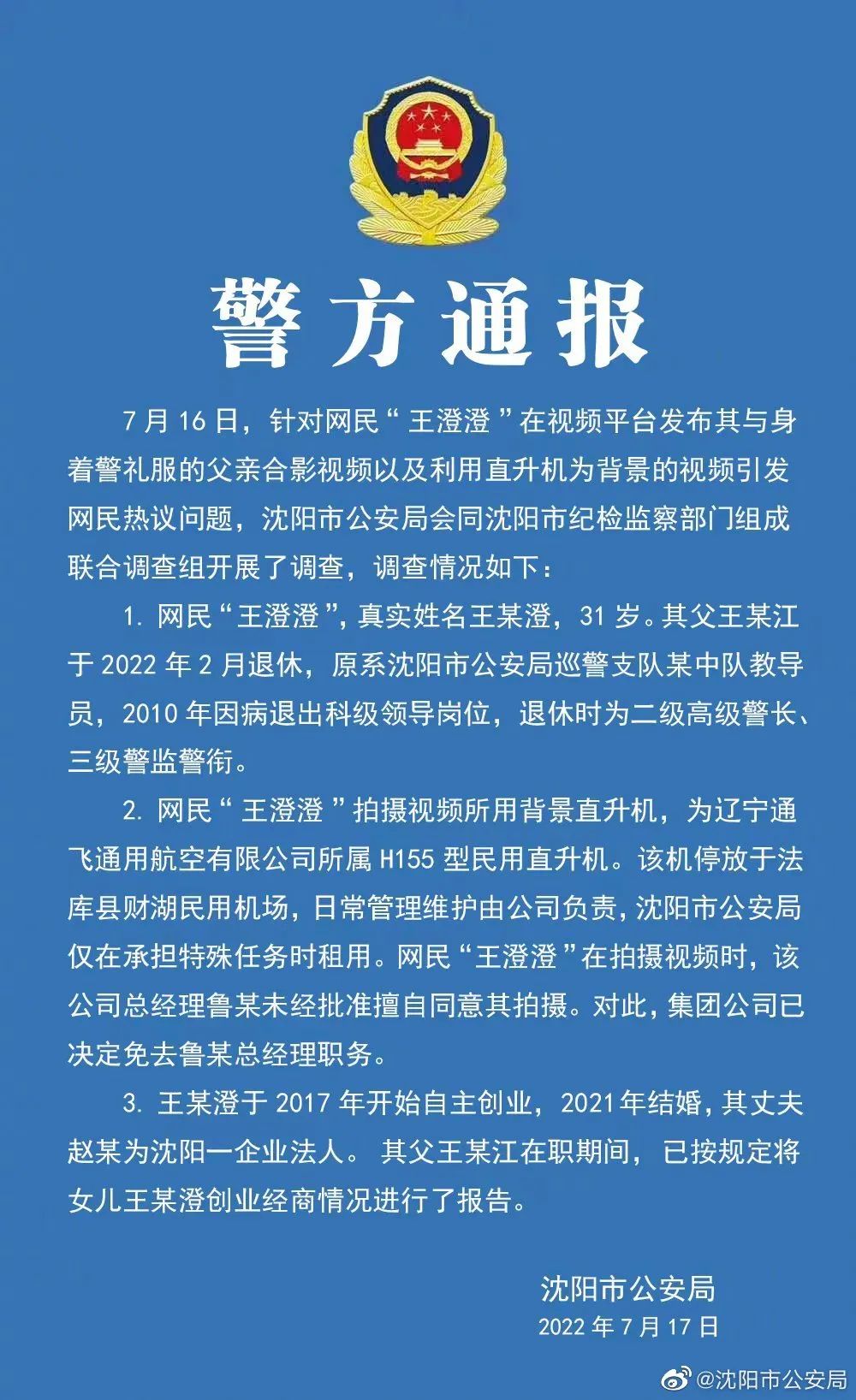

Shenyang police responded to the "Wang Chengcheng Incident"

Data-nickName = China Youth Network Data-ALIAS = YOUTHZQW Data-Signature = Youth T...

China Release 丨 Supreme Law: The Court of the Guangdong -Hong Kong -Macao Greater Bay Area in the Mainland Court of Mainland can conclude 53,600 cases involving Hong Kong and Macao in 3 years

China Net June 23 (Reporter Zhang Yanling) On the 23rd, the Supreme People's Court released the Report on the Construction of the People's Court of Service and Guarantee of the Guangdong-Hong Kong-Ma...