China released 丨 Another online anchor to evade taxes!A total of 108 million yuan is pursuing taxes, adding late fees and fines of 108 million yuan

Author:Chinese network Time:2022.06.17

China Net June 17th. Recently, the Taxation Bureau of Fuzhou City, Jiangxi Province, through the analysis of big data analysis of taxation, found that the online anchor Xu Guohao (Momo anchor, Momo: Xu Ze) was suspected of evading taxes. Tax inspections were carried out.

After investigation, Xu Guohao obtained live reward revenue from 2019 to 2020. He did not apply for tax declaration tax in accordance with the law for less than 17.5557 million yuan in personal income tax. Pay other taxes and fees of 2.1896 million yuan.

The Inspection Bureau of Fuzhou City Taxation Bureau of Jiangxi Province, in accordance with the "Personal Income Tax Law of the People's Republic of China", "The Management Law of the People's Republic of China", "The Administrative Penalty Law of the People's Republic of China", and other relevant laws and regulations, in accordance with the "Jiangxi Provincial Tax Administrative Penalty Tailoring of Taxation Administrative Penalties Standard "Standard", recovered taxes on Xu Guohao, received late fees and fined a total of 108 million yuan. Among them, the personal income tax that did not apply for tax declaration in accordance with the law was 17.5557 million yuan, and the fine was 1,755,700 yuan; 38.2838 million yuan. A few days ago, the Inspection Bureau of the Fuzhou Taxation Bureau of Jiangxi Province has sent the decision to the tax administrative handling of tax administrative treatment to Xu Guohao in accordance with the law.

In recent years, with the rapid rise of new formats such as webcasting, some anchors are lucky to evade taxes. Its behavior is to destroy and trample on social fairness and justice. The environment causes tax losses in the country. The taxation department strictly follows tax laws and regulations, and seriously investigate and deal with tax evasion of online anchors. It not only shows the fairness and justice of society, but also better regulates the healthy development of the online live broadcast industry.

In March 2022, the National Internet Information Office, the State Administration of Taxation, and the State Administration of Market Supervision and Administration jointly issued the "Opinions on Further Regulating the Healthy Development of the Industry" for further regulating the healthy development of the industry, and requiring the webcast publisher to regulate taxes and enjoy tax discounts according to law. It is also required to perform the obligations of the deduction and payment in accordance with the law. Camping online anchor tax evasion illegal behavior and improve the tax supervision of the online live broadcast industry, so that the law can truly "bright swords", in order to better rectify the chaos, improve practitioners' tax law compliance, create a fair and fair tax environment, promote the industry to grow from barbaric growth towards barbaric growth to Standardize development.

Relevant person in charge of the Taxation Bureau of Fuzhou City in Jiangxi Province said that the tax department will further strengthen the tax and fees and tax supervision of employees of the online live broadcast industry in accordance with the law. Relying on the analysis of the big data of taxation, if the risk of tax -related risks, in accordance with the "reminder, urge to urge to urge The "five -step work method" of rectification, interviewing warnings, investigation, and public exposure "is dealt with, and continuously enhance the compliance of the tax law of employees in the online live broadcast industry, and promote the long -term standardized healthy development of the industry.

- END -

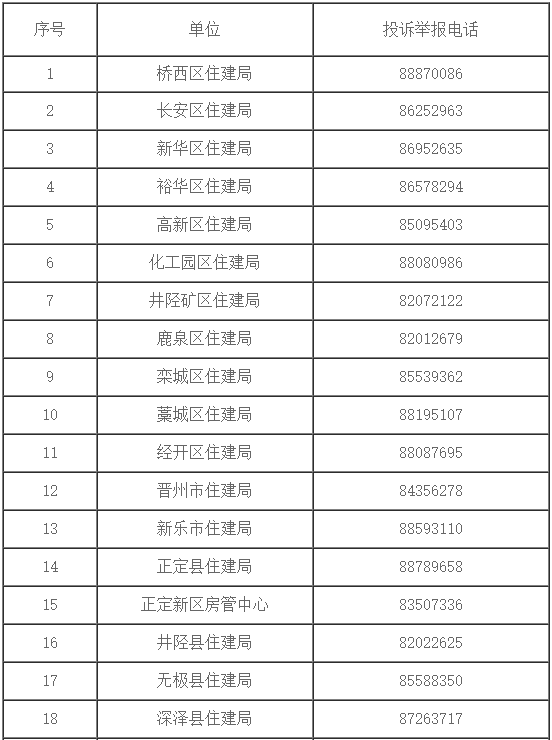

Report the phone call!The latest announcement of Hebei 4 cities

ShijiazhuangA notice on the release of special actions for fraudulent publicity is...

Dongchuan launched a "cracking down on pension fraud" publicity campaign

In order to further promote the special action of preventive risks, hidden dangers...