Tracking |*ST amethyst for nearly 100 million yuan deposit is deducted for no reason?Suspecting is related to the chairman's informal guarantee guarantee

Author:Red Star News Time:2022.06.17

Red Star Capital Bureau News on June 17,*ST amethyst (amethyst storage, 688086.SH) issued an announcement saying that Henan Rural Commercial Bank deducted nearly 100 million yuan for its deposit. At present, it has filed a lawsuit with the court, and the case has been accepted but has not yet opened trials.

The Red Star Capital Bureau noticed that the*ST amethyst received the "Notice of File C case" from the China Securities Regulatory Commission in February this year, and was investigated for investigations on violations of laws and regulations for suspected information disclosure. The deposit dispute was related to the illegal guarantee in the notification.

Picture according to IC Photo

The listed company claims to be deducted for nearly 100 million yuan for no reason

A lawsuit has been filed, and the court has accepted the case

Public information shows that the ames storage provides customers with big data light storage products and solutions, known as "the first share of light storage". In February 2020, the amethyst storage landed on the science and technology board, and its stock price once reached 86.59 yuan/share.

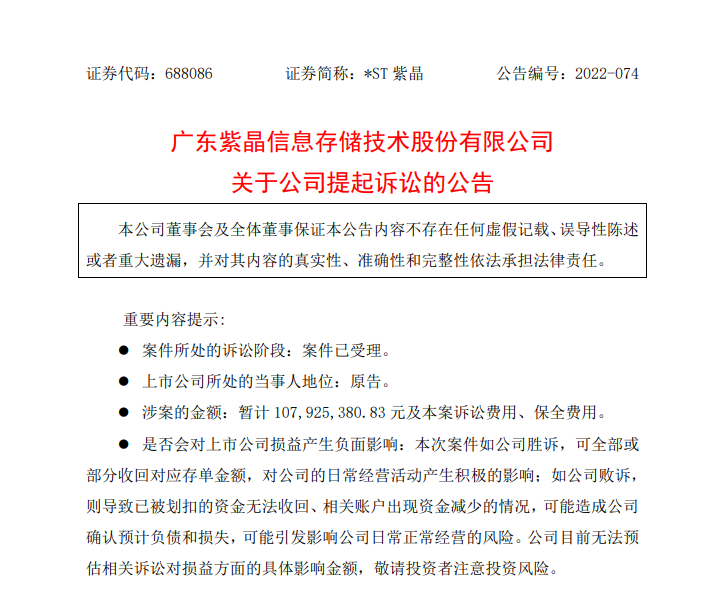

On June 16,*ST amethyst issued an announcement, revealing the dispute over the savings deposit contract with Henan Lu's Rural Commercial Bank Co., Ltd. (hereinafter referred to as "Henan Lu's Rural Commercial Bank").

According to the announcement, from April 2021 to February 2022,*ST amethyst opened multiple bank accounts at the Rural Commercial Bank of Henan, and deposited 85 million yuan as a regular deposit. On March 20 and March 28 this year, Henan Lu's Rural Commercial Bank successively deducted its deposit of 75.755 million yuan and 22.9254 million yuan. Bank UKEY loss and capital transfer business.

*ST alarm says that Henan Lu's Rural Commercial Bank deducted a total of 98.6839 million yuan in deposits. After several negotiations, the Lu's Rural Commercial Bank of Henan only agreed to transfer 3.393 million yuan to refuse to handle the remaining 9.2415 million yuan in bank capital transfer business.

The announcement shows that*ST amethyst has filed a lawsuit with the Intermediate People's Court of Sanmenxia City, Henan Province, and received the "Notice of Acceptance Case" on June 14. As of the announcement date (June 16), the case has not yet been tried.

"Regarding the above -mentioned deductions and refusing to apply for the bank UKEY loss and capital transfer, the plaintiff (referring to*ST amethyst) repeatedly requested the defendant (referring to the Rural Commercial Bank of Henan) to return and cooperate. In order to safeguard the legitimate rights and interests of the plaintiff, the above -mentioned claims were filed to the court to safeguard the legitimate rights and interests of the parties. "*ST ameter announced.

According to the above announcement, the litigation request of*ST amethyst is: ① Henan Lu's Rural Commercial Bank returned to its bank deposit of about 108 million yuan and paid interest;

Screenshot from*ST amethyst announcement

On June 17, the Red Star Capital Bureau called the contact number disclosed in the financial report repeatedly, but the phone was quickly hung up after the phone was connected.

In February this year, he was filed for investigation

Consistent with the amount of this case, the chairman of the illegal guarantee department has instructed

The Red Star Capital Bureau noticed that in February of this year,*ST amethyst received the "Notice of File C case" from the China Securities Regulatory Commission, which was investigated for investigation by illegal laws and violations of laws and regulations.

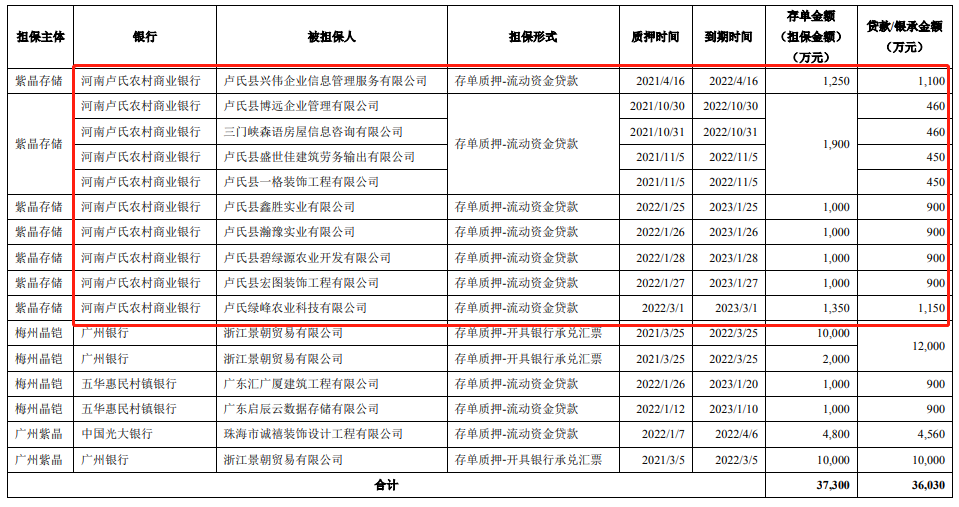

On March 14, the*ST amethyst announcement disclosed its self -investigation involving illegal guarantees. As of March 10, the total amount of illegal pledge guarantee for regular deposit deposits of*ST amethyst and its subsidiaries was 373 million yuan.

According to the statistics of the Hongxing Capital Bureau, 10 of the 14 guarantors involved in the illegal guarantee disclosed by their disclosure are from Lu's County, Sanmenxia City, Henan Province, involving a total of 85 million yuan. -Lli -funded loan, and the banks involved are the Rural Commercial Bank of Henan Lu's Rural Commercial Bank.

This is consistent with the amount of regular deposits of 85 million yuan mentioned earlier.

Screenshot from*ST amethyst announcement

According to*ST amethyst announcement at the time, these violations were one of their actual controller and chairman Zheng Mu's intention to be completed. The listed company did not fulfill the obligations or information disclosure obligations stipulated by the regulations and the company's articles of association.

Public information shows that Zheng Mu is 50 years old. He and Luo Tiewei and Luo Tiewei holding 29.48%of the equity of*ST amethyst through Zichen Investment and Zihui Investment. 997,600 yuan.

Zheng Mu had apologized to investors and promised to assume liability for compensation. Before the*ST amethyst, he will plan the funds of its or subsidiaries as soon as possible to fill the funds of the funds of the funds as soon as possible.

Zheng Mu screenshot from*ST amethyst official website

According to*ST amethyst self -examination, the above 10 Lu's county enterprises have the same natural person's cross -term or holding of customers with the same natural person, and the public information shows that the contact number is the same.

Taking Sanmenxia Lingyun Big Data Technology Co., Ltd. as an example, it is a client of*ST amethyst, but from the contact information disclosed on the Tianyan check app, 2 of the guarantors are the same , Supervisor Cui Jia has a cross -service situation.

The financial report is issued and unable to express an audit report

Already lawyers are collecting investors' claim information

The financial report shows that in 2021, the revenue of*ST amethyst was about 458 million yuan, a year-on-year decrease of 6.69%; the net profit attributable to shareholders of listed companies was about -229 million yuan, a year-on-year decrease of 379.85%.

However, the financial report was issued an audit report that could not be expressed. One director (Wen Huasheng) and two independent directors (Wang Tielin and Wang Huang) also said that they could not guarantee the authenticity, accuracy and integrity of the report. In this regard, the Shanghai Stock Exchange Science and Technology Board Company Management Department sent a question letter to the*ST amethyst on May 5, requiring it to explain related matters, reply and disclose it publicly. At present,*ST amethyst has been postponed many times, and as of press time, it has not been replied.

The Red Star Capital Bureau noticed that at present, many lawyers teams have posted claim information in the shares of*ST amethyst, saying that they can work for investors' claims.

Among them, the conditions given by a lawyer are: buying shares of*ST amethyst from March 10, 2021 to February 11, 2022, and still holds investment in the stock on February 11 this year. For those, you can claim.

As of the closing of June 17, the stock price of*ST alarm was reported at 8.32 yuan/share, with a total market value of about 1.584 billion yuan. Compared with its highest price on the first day of its landing, its market value has evaporated by about 15 billion yuan.

*ST ameter stock price trend chart

Henan Rural Commercial Bank, which is involved in the incident

Natural initiator holds nearly 70 % of the shares, and the name is not disclosed

The 10 families from Lu's county mentioned earlier, the banks involved in the relevant violation guarantee are Henan Rural Commercial Bank.

The Hongxing Capital Bureau inquired through the official website of the Bank of China Insurance Supervision and Administration Commission and found that the institutional residence of the Rural Commercial Bank of Henan is located on the south side of Jinghua West Road, Lu's County, Henan Province. The approval date is August 26, 2011. Insurance Supervision Branch.

The above page shows that the business scope of Henan Lu's Rural Commercial Bank includes the absorption of public deposits, issuing short -term, medium -term and long -term loans, handling domestic settlement business, handling bill acceptance and discounting, agency issuance, agency redemption, and underwriting government bonds.

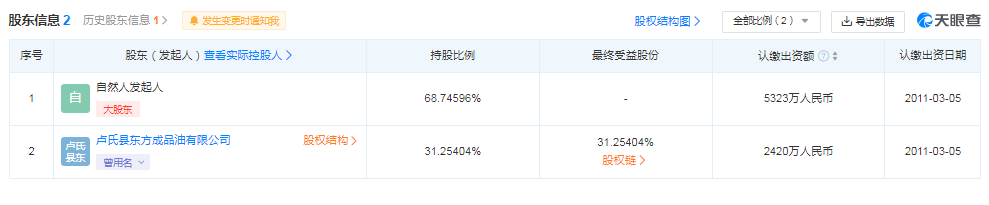

According to Tianyancha APP, there are two shareholders of the Rural Commercial Bank of Henan.

First, the natural initiator with a shareholding of 68.75%, but did not disclose the name of the natural initiator; the second is that the 31.25%of Lu's Dongfang refined oil products Co., Ltd. (hereinafter referred to as "Lu's refined oil company")

Screenshot

Among them, the Lu's refined oil company was established in September 2000. The registered capital and real -time payment were 3.5 million yuan, and the number of participants was only 4. To.

When the company has been canceled, Shi Fan'e also serves as a legal representative at Wangjia Village Gas Station and Lu's Datang Advertising Co., Ltd. at Wangjia Village Gas Station and Lu's County.

Li Jianli is also shareholders of companies such as Lu's Kerry Bus Transport Co., Ltd., Lu's Datang Advertising Co., Ltd. and Sanya Kyushu Documentary Wedding Photography Co., Ltd.

On June 17, the Hongxing Capital Bureau called Henan's Lu's Rural Commercial Bank's disclosure call on the business channel, but no one answered.

Red Star News reporter Yang Peiwen

Editor Ren Zhijiang

- END -

Analysis of the highlights of the draft draft law enforcement law of the civil forced enforcement law

Xinhua News Agency, Beijing, June 21: Analysis of the highlights of the draft law ...

A bank savings in Beijing have never left Beijing with huge sums of money for nearly 20 years, and bought three houses

Li Wei, a savings at Beijing Bank, fled after a cash of nearly 2 million yuan in c...