Shin Kong Yuancheng's delisting countdown, the richest man, Zhou Xiaoguang, who was the richest man, Zhou Xiaoguang was abandoned in criminal prosecution

Author:Economic Observer Time:2022.06.17

After three years before and after, the Zhou Xiaoguang couple was exempted from criminal prosecution. Xin Guangyuancheng has also delisted and the debt platform has been high.

Author: Zhang Xiaohui

Figure: Tuwa Creative

Guide

One || It took three years before and after, and the Zhou Xiaoguang couple was exempted from criminal prosecutions. Xin Guangyuancheng has also delisted and the debt platform has been high.

|| When the backdoor of Shin Kong Group was listed, it was the highlight of Zhou Xiaoguang and Yu Yun. The company's stock price reached the highest price of 16 yuan per share, with a market value of nearly 30 billion.

Three || From listing to delisting, from the richest man in Yiwu to the court to lose their trustworthy people, Zhou Xiaoguang's adventure and high performance gambling have led to the current defeat.

On June 17, 2022, Shin Kongyuancheng Co., Ltd. (002147.SZ, hereinafter referred to as "Xin Guang Retirement" or "Xin Guangyuancheng"), which was forced to delist due to continuous losses Essence It stated that as of June 17, 2022, the company's shares will be traded for 12 trading days, and the remaining 3 trading days will be terminated to be listed. Investors are requested to invest cautiously and pay attention to risks.

On the 17th, the stock price of Xinguang retired was only 0.40 yuan. The transaction was light, and the minimum was only two cents.

Shin Kong Yuan Chengai was listed on the backdoor through the shell of the righteous woman Zhou Xiaoguang and Yu Yun's new couple in 2016, through Shin Kong Holdings Group (hereinafter referred to as "Xintuang Group"). Now they have reached the end of the delisting. At all, it is sighing.

Give up criminal prosecution

On June 2, 2022, Shin Kong Yuancheng, which was in the period of delisting, issued an announcement saying that the actual controller Zhou Xiaoguang and Yu Yunxin received the "Decision of the No Prosecution" and the "Decisive Decision of the Purchase of Bulletin".

The announcement shows that in March 2019, Shin Kongyuan Cheng was investigated by the CSRC for investigation by the CSRC due to violations of regulations and large shareholders' funds. On January 4, 2021, Xinguangyuan made an announcement saying that the Ma'anshan Public Security Bureau decided to obtain bail pending trial on the actual controller of the company, Zhou Xiaoguang and Yu Yunxin, and calculated from December 21, 2020.

On June 2, 2022, Shin Kong Yuancheng received the "Not Prosecution Decision" issued by the People's Procuratorate of Maanshan City, Anhui Province.

Zhou Xiaoguang and Yu Yunxin implemented the "Criminal Law of the People's Republic of China" before the amendment of the Criminal Law of the People's Republic of China (11). According to Article 37 of the Criminal Law of the People's Republic of China, no punishment is required. According to the provisions of Article 177 of the Criminal Procedure Law of the People's Republic of China, Zhou Xiaoguang and Yu Yunxin were decided not to prosecute.

Article 161 of the Criminal Law refers to "illegal disclosure and not disclosing important information": companies, companies that negative information disclosure obligations in accordance with the law, enterprises provide shareholders and the public to provide false or concealed financial accounting The report, or other important information that should be disclosed in accordance with the law, is not disclosed in accordance with regulations, seriously harms the interests of shareholders or other people, or other serious circumstances, and the person in charge and other direct responsible persons who are directly responsible will be sentenced to less than three years in prison for three years. Or detention, and a fine of more than 20,000 yuan or less than 20,000 yuan.

After three years before and after, the Zhou Xiaoguang couple was exempted from criminal prosecution. Xin Guangyuancheng has also delisted and the debt platform has been high.

Zhou Xiaoguang was once a well -known female richest man in Yiwu, Zhejiang. After making money by operating jewelry, after making money in the jewelry business, Zhou Xiaoguang and his husband Yu Yunxin acquired the listed company Fang Yuancheng in 2016, and then renamed it "Xin Guang Yuancheng". It is made from the name of the two husbands and wives.

In March 2009, Zhou Xiaoguang said in an interview with the reporter of the Economic Observation Network, "I always feel that we have to do our best. How much we have to do, how much we do. Money is done. Those who have money in this way will be particularly cautious and saves it.

In fact, the backdoor listing of Shin Kong Group was a big adventure for Zhou Xiaoguang.

Lystone listing to delisting

In 2016, Shin Kong Group was listed on the market with all equity of all equity of Wanxia Real Estate and Shin Kong Building Materials City. Subsequently, Fang Yuanzhi was renamed Shin Kong Yuancheng, becoming a dual -main listed company that focuses on real estate development and business operations, and supplemented by production and operations.

Prior to this, Shin Kong Group also tried to go public in 2015, but ended in failure.

When Shin Kong Group was listed in the backdoor, it was the highlight of Zhou Xiaoguang and Yu Yun. The company's stock price reached the highest price of 16 yuan per share, with a market value of nearly 30 billion.

Infinite scenery is at the peak.

Behind the backdoor listing, Zhou Xiaoguang signed a high -amount gambling agreement. Shin Kong Group promises that Shin Kong Yuancheng's non -net profit in 2016 is not less than 1.4 billion yuan; the cumulative deduction of non -net profit in 2016 and 2017 is not less than 2.7 billion yuan; the cumulative deduction of non -net profit from 2016 to 2018 is not less than 4 billion yuan Yuan.

The high performance against the gambling eventually down the listed company.

In 2018, Shin Kong Yuan became a loss of 212 million yuan, and in 2019, the loss further expanded to 5.085 billion yuan. In the 2019 annual report, Shin Kong Yuancheng stated that the main cause of losses was to provide large amount of guarantee loss and asset impairment preparation. The large amount of guarantee was not disclosed to the outside world. The guarantee amount of this part was close to 3 billion yuan. In 2020, Shin Kong Yuancheng continued to lose 3.257 billion yuan.

By 2021, Shin Kong Yuancheng's net profit of the listed company's platform was anxious to turn a profit of 700 million yuan, but it was announced by the accounting firms to make an audit announcement for reserved opinions.

Although Xin Guangyuan turned his losses in 2021, he did not escape the fate of delisting.

In April 2022, the Shenzhen Stock Exchange decided that Xin Guangyuan was forced to delist due to the reservation of financial reports.

Countless investors have lost their blood on Shin Kong Yuan into this stock.

In the interaction of the Shenzhen Stock Exchange, many investors asked the company where the compulsory delisting appeal was: "Hello, the secretary, did you hand over the materials described in the following?" "What day is the company's participation in the hearing? Will the hearing date be issued? "" Is there any process review? No chance will be not a chance? "

Xin Guangyuan replied that the company had attended the hearing on May 20, and then there was no following.

The delisting has become the end of Shin Kong Yuanyuan.

Falling into the abyss of debt

The Chinese referee documents search for "Zhou Xiaoguang, Yu Yunxin", and there are hundreds of related judicial documents, all of which are borrowing disputes and contract disputes. The amount ranges from millions to hundreds of millions.

The recent judicial document was March 14, 2022, which was made by Jinhua Intermediate Court. China Cinda Asset Management Co., Ltd. Zhejiang Branch applied to Jinhua Intermediate Court for compulsory implementation. Practical execution. The target is 30422402.59 yuan and corresponding interest.

Zhou Xiaoguang and the new couple of Yu Yun have been listed by the court.

In addition, after the investigation of the CSRC's case, Shin Kongyuancheng was also sued by many investors for compensation because of the previous information disclosure of violations.

The most dense year of Xinguangyuan's intensive thunder is 2019. At that time, 12 of the 15 bonds issued by Shin Kong Group had 12 defaults. The actual total declaration of creditors was 53.9 billion yuan, of which 14.7 billion yuan in claims and 39.2 billion yuan in ordinary claims. Shin Kong Group faces multiple lawsuits and arbitration cases. Its subsidiaries such as Shin Kong jewelry have applied for bankruptcy reorganization. Zhou Xiaoguang and Yu Yunxin were also listed by the court as the executor.

The two sons of the Zhou Xiaoguang couple were involved in the debt black hole.

On February 8, 2021, the Jinhua Intermediate People's Court issued a "reward for debt chase" to the 500 million yuan debt and interest owned by Yu Jiangbo and his two sons Yu Jiangbo and Yu Jiangming.

The outside world can hardly understand the total debt of the Zhou Xiaoguang couple.

From the listing to the delisting, from the richest man of Yitu to the court to the court, Zhou Xiaoguang's great adventure and high performance gambling have led to the current defeat.

On the afternoon of June 17, 2022, a reporter from the Economic Observation Network called Xinguangyuan to the Office of the Director of the Director and asked about his plan after delisting, and no one answered the phone.

Super major anchors are absent from 618, where the traffic goes, and the Zhengzhou red code incident rectification of excessive epidemic prevention needs institutional guarantee

- END -

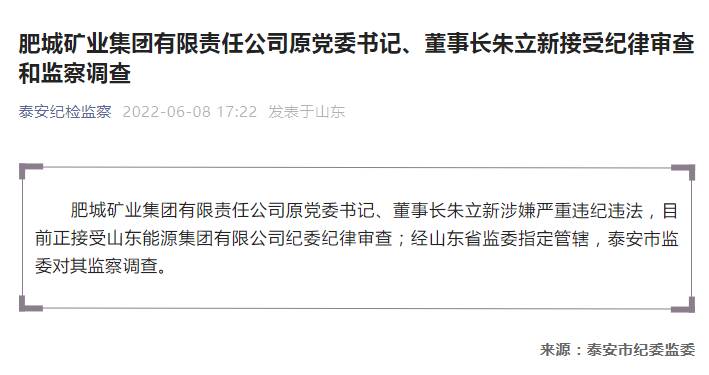

The former party committee secretary and chairman of Feicheng Mining Group Co., Ltd. Zhu Lixin recei

Qilu.com · Lightning News June 8th. The reporter learned from the Tai'an Disc...

Nine responsible persons involved in Tianjin Defending accidents were controlled

Tianjin's June 21 gas leakage explosion accident survey team issued an announcement on June 22:After the gas leakage of the gas leakage of Baodi District, Tianjin, the city and district -level healt...