The two departments issued a clear legal aid subsidy related tax policy

Author:State Administration of Taxati Time:2022.08.26

General Administration of Taxation of the Ministry of Finance

Announcement on the tax policy on legal aid subsidies

The General Administration of Taxation of the Ministry of Finance Announcement No. 25, 2022

In order to implement the relevant provisions of the "Law of the People's Republic of China", the announcement of the tax policy on legal aid subsidies is as follows:

I. Legal assistance personnel obtained the legal aid subsidies obtained by the Law of the People's Republic of China in accordance with the provisions of the Law of the People's Republic of China to exempt VAT and personal income tax.

2. When the legal aid agencies pay legal aid subsidies to legal assistance personnel, they shall apply for the tax exemption of personal income tax for labor tax remuneration for legal aid personnel who obtain subsidies.

3. The judicial administrative department and the taxation department establish an information sharing mechanism. Before each annual personal income tax comprehensive income is settled, the tax -related information obtained by legal aid subsidies is exchanged.

4. The legal aid agency referred to in this announcement refers to a legal aid agency established in accordance with Article 12 of the Law of the People's Republic of China. If the group organization shall conduct legal aid work in accordance with Article 68 of the Law of the People's Republic of China, in accordance with Article 68 of the Law of the People's Republic of China, it shall handle tax exemption declarations for legal assistance personnel in accordance with the provisions of this announcement, and submit the relevant information of the legal aid subsidies to the judicial administration. department.

5. This announcement will be implemented from January 1, 2022. According to the value -added tax that should be exempted from this announcement, if it has been levied before issuing this announcement, the value -added tax has been levied to the taxpayer to pay the tax period or refund it. The special VAT invoices apply for tax exemption after recovering the special invoice; if the personal income tax that should be exempted from this announcement shall be levied before the issuance of this announcement, the deduction unit shall apply for tax refund in accordance with the law.

Special announcement.

General Administration of Taxation of the Ministry of Finance

August 5, 2022

- END -

Don't be greedy and cheap!The woman picked up the medical insurance card and brushed the only 2 yuan left

Recently, Ms. Yang, Nanjing, called the police that she had lost her medical insur...

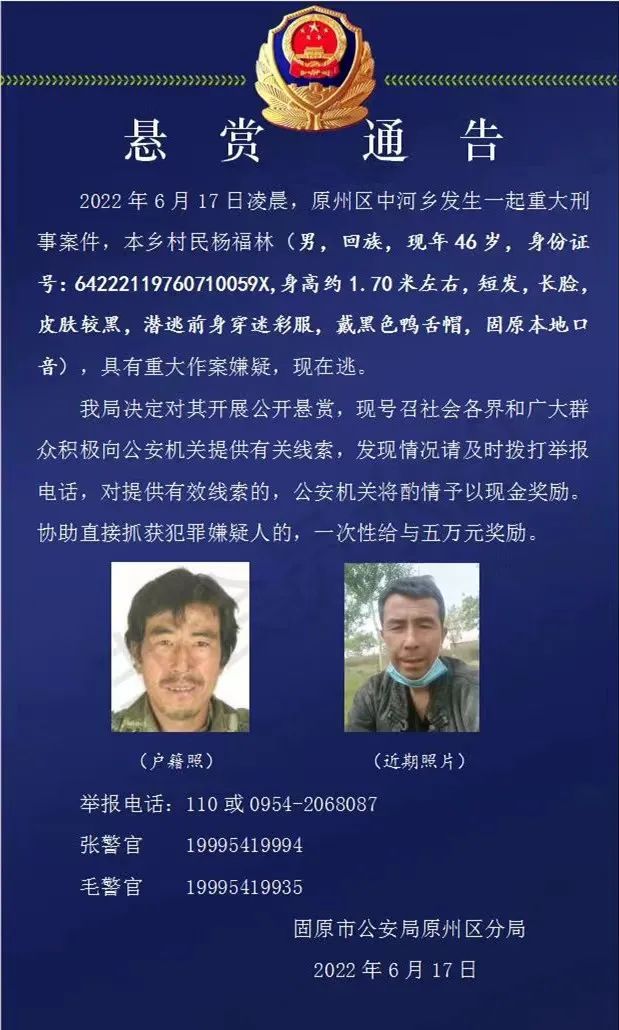

Reward 50,000!This person involves major criminal cases

If there is a clue, please call the police immediately!Source 丨 Ping An Guyuan