Is it responsible for entrusting a third party to pay social security?

Author:Chinese law Time:2022.07.03

Basic case

Li is an employee of an electronic company with a work location in City A. The two parties signed a labor contract, and the labor contract stipulated that Li's social insurance commissioned a human resources company A to pay in the city of A.

In November 2012, Li had brain stem bleeding during his work. He died after rescue and was not effective after rescue. As the social security department of the city did not pay claims, Li's family applied for arbitration and asked a company to pay for the support of relatives' pensions, a disposable work of 43,6200 yuan and a funeral subsidy of 28,032 yuan.

Court trial

During the trial, the company advocated that social security has been entrusted to pay in City A, so it cannot be claimed. It should be resolved through administrative reconsideration or administrative litigation. The company should not bear the liability for compensation.

After trial, the court believed that, according to the labor contract signed by the company and Li, the decision decision and other evidence of the decision of work injury can be determined that from March 2011 to November 2012, there is a factual labor relationship between Li and a company. According to the "Regulations on Work Injury Insurance", employees should be regarded as working injuries during working hours and working positions. Therefore, the electronics company shall pay the funeral subsidies, support relative pensions, and disposable labor subsidies to Li's close relatives in accordance with regulations. As for the company's defense on the grounds of commissioning a company's company to pay social security, the court was not adopted due to the violation of the laws of the law.

In case of interpretation

According to Article 72 of the Labor Law, social insurance funds determine the source of funds in accordance with the type of insurance, and gradually implement social overall planning. Employers and workers must participate in social insurance according to law and pay social insurance premiums. Therefore, social insurance is mandatory, and both employers and workers have the obligation to pay social insurance premiums.

At the same time, Article 57 and 58 of the Social Insurance Law stipulate that employers shall apply to the local social insurance agency for social insurance registration within 30 days from the date of establishment within 30 days from the date of establishment. The employer shall apply for social insurance registration to the social insurance agency within 30 days from the date of employment. It can be seen that the legal subjects of social insurance account registration and insurance registration are "employers who establish labor relations with workers." In this case, a company entrusted a company to participate in the insurance, which changed the main body of social insurance registration and did not comply with legal provisions. Therefore, the consequences of the unable to claim shall be borne by a company.

Source: Labor Law Focus

- END -

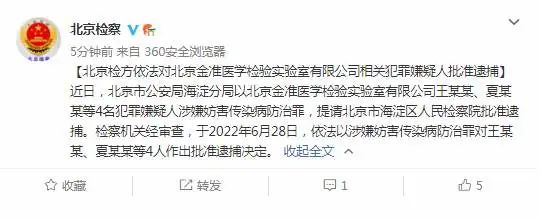

Beijing reported that 4 people were arrested

Recently, the Haidian Branch of the Beijing Public Security Bureau shall submit th...

Supreme Procuratorate: When strictness is strict, it will be severely hit!

According to the official website of the Supreme People's Procuratorate, on June 1...