The investigation and punishment of violations of the capital market has increased by 1.4 times year -on -year investigation.

Author:Securities daily Time:2022.07.08

Tongluxun data shows that since this year (January 1 to July 6, the same below), there have been 71 cases of investigation by the A -share market. Among them, there were 26 people who were investigated as a listed company; more than 3 investigations were investigated as listed companies, executives, and shareholders; Company, actual controller, brokerage firms, etc. In contrast, there were 29 cases of investigation by the A -share market in the same period last year. Based on this calculation, the matters of the investigation this year increased by about 1.4 times year -on -year.

For the reason why this year's Shanghai and Shenzhen cities have been filed for investigations, Lawyer Wang Xiaodong, senior partner of Beijing Hairun Tianrui Law Firm, explained in an interview with the Securities Daily that with a number of securities supervision related to securities supervision The laws and regulations and policy documents have been promulgated and implemented one after another. The regulatory authorities adhere to the "zero tolerance" attitude towards the capital market illegal and illegal acts, and effectively increase the investigation and punishment of illegal and illegal acts.

The illegal letter is still the cause of the case

Among the above -mentioned investigation, suspected information disclosure of violations is relatively large. Among the 71 cases of investigation during the year, 35 were suspected of disclosure of information disclosure.

In an interview with the reporter of the Securities Daily, Lawyer Wang Zhibin, Shanghai Minglun Law Firm, said that many listed companies were investigated for cases such as suspected information disclosure of illegal regulations and insider trading. The activity adheres to the attitude of "zero tolerance", and puts forward higher requirements for the scientific management and compliance operations of listed companies, and has become clearer for the responsibilities of intermediary agencies such as accounting firms and law firms. The requirements for information disclosure are getting higher and higher, which will help protect investors' legitimate rights and interests.

For companies that have been filed, relevant responsible subjects will face more risk of performance. "If the independent directors, the management of listed companies, and the intermediary agencies do not perform their duties well, they will bear the corresponding legal responsibilities. The severity of some responsibilities may exceed expectations, and it will be a good warning effect on the relevant responsible person." Wang Zhibin told the "Securities Daily" reporter that in accordance with relevant regulations, after the listed company was investigated, investors who suffered losses could file a lawsuit. However, the specific situation of different cases will be very different, depending on the degree of loss of investor rights.

"Seeing the door" faces new challenges

Under the current regulatory environment, intermediaries such as accounting firms, law firms, sponsor and other intermediaries also face new challenges.

For example, the announcement issued by Harchou shares on the evening of July 1 showed that his wholly -owned subsidiary Jiang Hai Securities received the "Notice of Filciting Case" by the China Securities Regulatory Commission. When the financial consultant of funds was suspected of not being diligent, the documents produced and issued were false records, misleading statements or major omissions.

"Responsibility for the return of intermediary agencies is an important part of improving the quality of information disclosure of the capital market, an important basis for preventing securities fraud fraud, protecting the legitimate rights and interests of investors, and an inevitable requirement for deepening the reform of the capital market and promoting the high -quality development of the capital market." Lawyer Wang Xiaodong told the Securities Daily reporter.

Wang Xiaodong suggested that the employees of the intermediary can ask themselves from three aspects. The first is to improve the professional level, to identify the legal problems and financial issues existing in the enterprise in a timely, effective and accurate manner, and propose a solution; the second is to enhance the understanding of the importance of the compliance operation of the enterprise. The question is responsible for supervision; the third is to adhere to practicing morality, and do not assist or even guide the company to engage in the 'fraud' activity.

Wang Xiaodong believes that "Dong Jian Gao participated in the daily business decision -making decisions of listed companies, and should be responsible for the company's shareholders, employees, creditors, and partners. At the core, the issuer's information disclosure documents are carefully signed for confirmation. When there are objections, they should dare to speak and ask the issuer to disclose written opinions and reasons. Independent directors and external supervisors represent the interests of small and medium shareholders. Without the responsibility of the "watchman", after a problem with the listed company, just a speech such as "non -professional professionals' or 'company management concealment'." )

![]()

[Editor in charge: Li Tong]

- END -

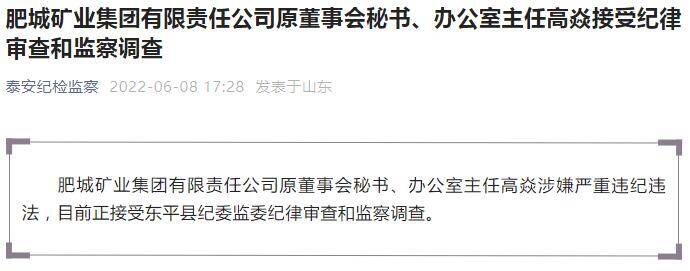

The former board secretary and director of the office of Feicheng Mining Group Co., Ltd., Gao Yan, r

Qilu.com · Lightning News June 8th reporter learned from the Tai'an Disciplin...

Sweeping pornographic betting, anti -electrical fraud, and transportation rectification, "Thund

On June 13, the news ventilation meeting of the Wuhan Public Security Bureau. Corr...