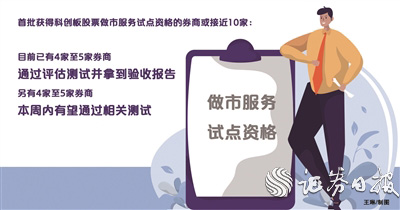

The science and technology board as the first batch of pilot qualification brokers or nearly 10 pilot qualification brokers or nearly 10

Author:Securities daily Time:2022.07.19

The science and technology board of the city's business system has officially entered the implementation stage.

On July 15th, the Shanghai Stock Exchange issued and implemented the "Implementation Rules for the Implementation of the Shanghai Stock Exchange Science and Technology Innovation Board Stocks" and "Shanghai Stock Exchange Stock Exchange Business Guide No. 8 -Science and Technology Board Stocks" Create boards make more specific and detailed transactions and regulatory arrangements. At this point, securities firms can conduct a series of technical testing and submitting application for the city's transaction business in accordance with the relevant requirements of the "Securities Company's Capital Stocks for the Municipal Transaction Business Pilot Regulations" issued by the CSRC in May.

The "Securities Daily" reporter's employees were exclusively informed that the first batch of securities firms who obtained pilot qualifications or nearly 10. Specifically, 4 to 5 securities firms have passed the multi -round technical system evaluation and tests organized by the Shanghai Stock Exchange, and have obtained the acceptance report issued by the exchange to prepare to submit the relevant materials for business qualification applications to the Securities Regulatory Commission. In addition, there are 4 to 5 securities firms being conducting technical system improvements and other work, and are expected to pass related tests this week.

"The science and technology board system has both innovative and challenging, and it has also brought development opportunities to securities firms." Ni Haiwei, the manager of the city business department of Tianfeng Securities, told the Securities Daily reporter that the Science and Technology Board Doing the market business helps to increase the stickiness of securities firms and science and technology board listed companies. While following the development of the company, brokers can derive more business income. At the same time, do a good job in science and technology boards and market services. Through accurate and stable quotation capabilities to provide liquidity support for investors in the science and technology board market, it will help improve the competitiveness and brand effects of securities firms.

Brokerage companies are working for science and technology boards to do the city business

Have a first -mover advantage company or in -depth benefit

The above rules encourage securities companies with relevant qualifications to provide science and technology board stocks for market services, which has attracted brokers to run into the market. Tang Shengqiao, executive director of China Merchants Securities Derivative Investment Department, predicted in an interview with a reporter from the Securities Daily that "As far as I know, the securities firms currently meet the requirements of the market are preparing to make a city business qualification application. There are 10 securities firms through the board of directors or shareholders' meetings on the development of science and technology boards to do the city business, and then apply for administrative license to the CSRC, and then sign a related municipal business agreement with the Shanghai Stock Exchange. City business. "

China Merchants Securities is preparing to prepare the science and technology board for the city's qualification application in accordance with the institutional arrangements of the CSRC and the exchange. Tang Shengqiao introduced, "The company's board of directors has decided to apply for a municipal trading business qualification and pilot to engage in science and technology board stock business as a market trading business. The next step is to submit the business qualification application materials to the regulatory agency."

Guojin Securities is also preparing for relevant applications. Relevant person in charge of the company's investment bank told the "Securities Daily" reporter, "Recently, Guojin Securities has completed the Shanghai Stock Exchange Science and Technology Board Stocks for Municipal Transaction Business Technology Test and Special Inspection. , Will submit materials to the CSRC as soon as possible, and strive to become one of the first batch of cities in the city trading business of science and technology innovation boards. "

In terms of the city system, the above -mentioned person in charge introduced that Guojin Securities Science and Technology Innovation Board Stocks and Team personnel are equipped with complete, internal control systems and risk control measures, system construction and emergency mechanisms. It meets the overall requirements of the science and technology board stocks.

The same hopes to obtain the first batch of pilot qualifications are Tianfeng Securities. Ni Haiwei said, "The Board of Directors of Tianfeng Securities has recently agreed to the company to carry out science and technology board stocks as a market transaction business. Next, it will submit an application for business qualifications to the regulatory agency as soon as possible. It is also convenient for the company to expand the city category on the basis of this business in the future. "

Ni Haiwei also predicts that the first batch of brokerage companies that have obtained the pilot qualification of science and technology boards will be in front of the industry in the future of the entire listing securities. Expansion, these brokers will have the lead in the market model and market strategy of listed securities.

Speaking of the changes in the business structure of the securities firm who have obtained pilot qualifications in the future, Tang Shengqiao believes that because the science and technology board stocks are still in the pilot stage, the early stage of the "qualification certificate" may not bring significantly to the company's company. Profit changes, but I believe that with the expansion of the pilot in the future, the company's income weight will gradually increase.

From the perspective of Guangfa Securities, with the expansion of the scale of the market market and the intensification of industry competition, securities firms with scale effects and first -mover advantages will continue to occupy the leading position. As a municipal business market, it will show Matthew effects.

For securities firms that have not passed the relevant tests and do not meet the relevant regulations for the time being, Tang Shengqiao said that each broker should keep up quickly, but there are certain difficulties. "After all, this requires that brokers have certain reserves in the market business, including talents, systems, systems, etc."

Guangfa Securities also believes that there is a high barriers to do the market business and require long -term investment trading experience accumulation and investment in IT technology to maintain a profit level.

Provide a new direction for the source of income from securities firms

The industry expects supporting policies to launch as soon as possible

At present, there are already listed funds in the market as a city business, options to do the city business. Tang Shengqiao believes that there are two obvious differences between the market trading business of science and technology board.

"The level of influence is different." Tang Shengqiao held an example, and the option to do the market business is more priced for market volatility; the marketing fund to do the market business is to valuation on the theme industry and other indexes. The influence surface is relatively macro or mid -view. And the science and technology board stock market transaction business belongs to my country's capital market for the first time in the stock market to do the market business. The listed company is the most micro structure, so the influence is more micro. At the same time Lord, the traffic demand is greater and the market fluctuations are even greater. "In addition, the pricing mechanism is different." Tang Shengqiao further analyzed that individual stocks were more affected by emotions and messages, so the difference between market price and theoretical valuation may be greater, and professional institutional investors need to pricing. At this time, the introduction of the science and technology board as a city business system is one of the necessary links for my country's registration system to reform steadily.

When talking about the introduction of the business mechanism of the science and technology board, the impact of the market business mechanism will bring to the capital market, Tang Shengqiao believes that it can achieve the "win -win" effect.

From the perspective of listed companies in the science and technology board, securities firms can provide comprehensive and full -chain intermediary services such as underwriting sponsor to research consulting to trading markets. At the same time, the listed company of science and technology boards is a scientific and technological innovation enterprise, which requires the market to provide them with a reasonable pricing in accordance with the prospects of the industry in order to better develop business. The introduction of the business mechanism of the city can fully fully play the direct financing function, more effectively allocate social resources, and attract social capital into key areas such as national scientific and technological innovation.

For ordinary investors, it can solve the problem of investment channels. The securities firms have the advantages of communicating directly with listed companies, and the company's research is relatively clear and thorough. The securities firms perform the identity of the city merchant, but they can study related companies for ordinary investors and give reasonable pricing to reduce the cost of "stepping on the pit" and the cost of investors. Solving information asymmetry and other problems, relieve investors' worries about entering and exiting, so as to enjoy the development dividends brought about by Chinese scientific and technological innovation.

As far as Chinese securities firms are concerned, it can improve the comprehensive financial service capabilities of securities firms and support the development of the real economy higher quality. Tang Shengqiao further analyzed that the science and technology board stock market can provide securities firms with another relatively low -risk capital intermediary business, reduce the investment volatility of its own funds, and maintain performance stability. At the same time, it can also enhance the competitiveness of Chinese securities firms in the international market.

From the perspective of Guojin Securities, the service dimension of the science and technology board can broaden the business of securities firms as the market trading business. By providing liquidity to multi -level capital markets, the service boundary of the business service of securities firms is extended. The science and technology board can provide new profit growth points for the securities company's own capital business, enrich the income dimension of the current own capital business, and provide a new expansion direction for the source of business income. The science and technology board is a city business that can extend the original investment banking business service chain of the broker. Brokerage can provide market quotation services by the science and technology board project of their own underwriting, to better play the synergy effect with the investment banking business, extend the customer service chain of the customer service chain It has enhanced the stickiness of the science and technology board as the city's customers, and laid a good foundation for subsequent excavation of customer diversified comprehensive financial needs.

Tang Shengqiao hopes that science and technology boards including securities transaction stamp duties and other science and technology boards are launched as soon as possible to support the supporting policy of the city business mechanism to support the futures business of the "Qualification Certificate".

Our reporter Chang Xueyu

- END -

up to date!One -positive personnel from other places were announced in Hebei!Urgent

Zhangjiakou City Wanquan District Announcement of the Office of the Leading Gro...

Promote the 100 -day safety competition event of the summer to take root with the "three guarantees"

The hidden danger can be eliminated early to be safe. In order to comprehensively ...