ICBC, CCB, etc. announced: suspension!

Author:Global Times Time:2022.07.19

The densely released of multiple notices conveys the investment signals of precious metals to accelerate tightening.

Recently, ICBC and CCB have announced the suspension of the purchase, conversion transactions and fixed investment plans of precious metal business in the account of precious metal business.

Some analysts believe that from the current trend, the bank's adjustment of the precious metal business has gradually strengthened. Next, banks may gradually turn off the trading type of precious metal investment products, and finally retire customers to retain only physical investment products.

ICBC and CCB announced: pause!

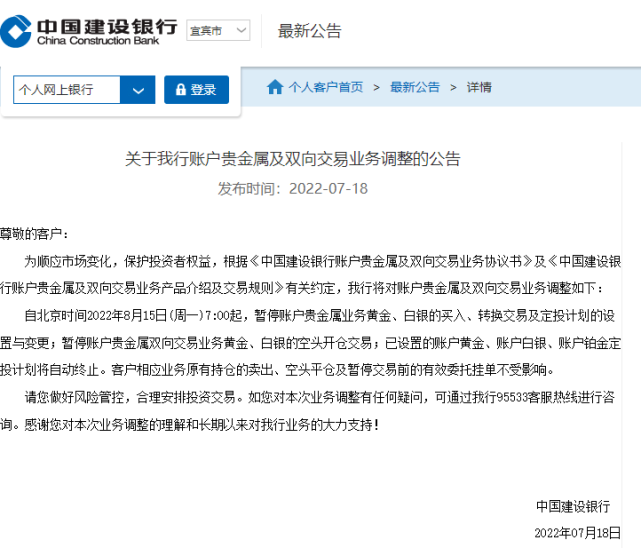

On July 18, the official website of China Construction Bank issued an announcement saying that starting from August 15, 2022 (Monday), Beijing time, it has suspended accounts for the purchase, conversion transactions and fixed investment plans of precious metal business in the account ; Paralysis of the two -way trading business of precious metal trading business in the two -way transaction of the precious metal trading business; the set of account gold, account silver, and account platinum fixed investment plan will be automatically terminated. Customers' corresponding positions, short positioning and valid commissioning orders before the transaction are not affected.

Earlier, on July 15th, ICBC issued a notice saying that from 8:00 on August 15th, the account gold and the account of the account of the account of the account will be suspended. The liquidation transaction is not affected.

ICBC also stated that considering that the international commodity market has a large uncertainty, it is recommended to control the scale of positions carefully and pay attention to the risk of preventing and controlling their own risks for customers with a large number of markets. This is the second time ICBC this month, and the seventh time the precious metal transaction is restricted during the year. Since this year, many banks have restricted the transactions of precious metals.

The bank's precious metal business is tightened again

Industrial and Commercial Bank of China has frequently "punch punches" this year. Since July, ICBC has twice tightened precious metal business. On July 4, ICBC just issued a notice to adjust the personal trading business of the Shanghai Gold Exchange's personal trading business. Among them, AU (T+D), MAU (T+D), AU (T+N1), AU (T+N2) and other contracts such as the standard transaction margin ratio will be increased from 34%to 42%. According to incomplete statistics, this is the sixth time ICBC raised the proportion of proxy personal precious metal extension trading margin.

The remaining five adjustments are: January 26, March 10, March 31, April 28, and May 30. The ratio of contract margin such as AU (T+D) is raised from 23%to the current 42%, and the AG (T+D) contract margin ratio is raised from 27%to the current 46%.

For the reasons for adjustment, it is mentioned that considering the uncertainty of the international commodity market.

ICBC is not a special case in the market. In fact, since the previous year, banks have begun to reduce the leverage of precious metal transactions. At present, more than 20 banks have been involved. Since the beginning of this year, Construction Bank, Huaxia Bank, and Industrial Bank have issued relevant business adjustment announcements, which have tightened the precious metal business.

In accordance with the previous announcement of Construction Bank, the newly opened warehouse transaction was suspended for the extension of the personal precious metal trading business of the Shanghai Gold Exchange, and the liquidation transaction was not affected;

Huaxia Bank also stated on May 5 that the suspension of personal customers Shanghai Gold Exchange's precious metal spot extension of the position and the real -stock real market buy transaction; Essence

From the suspension of new open positions to the upper increase of margin ratio, how do you think of the bank's concentrated signal of adjustment of precious metals? A notification from the Shanghai Gold Exchange is worth paying attention. Earlier this month, the Shanghai Gold Exchange stated that due to international factors, the price of commodities around the world has fluctuated sharply, and the market risks have increased significantly. Member units improve their awareness of risk prevention, make a good risk emergency plan, and remind investors to do a good job of risk prevention.

"It may be because of the influence of the" crude oil treasure "incident. The bank realized the risk of such products, so it repeatedly contracted the transaction leverage. Previously, my deposit could be 10%, that is, 10 times lever. It can only be two times at most. For professional golden guests, the shackles of transactions have greatly increased, and of course risks have also decreased significantly. "Senior gold investor Lin Rong said that he started professional investment gold since 2008.

Lin Rong believes that not only limits the proportion of leverage, but also shorten the transaction time. Previously, his energy was mainly at night. "Because after the opening of Europe and the United States, the fluctuations of gold will intensify, but now most of the banks have canceled the night trading, which is equivalent to the volatility, and investors can only watch outside the door."

Source: Southern Metropolis Daily

- END -

"Du" has a better future!

On June 28, the Nine Cities Concentric to the Future -The Metropolitan Circle of W...

How to break through island law enforcement difficulties?Watch Shengsi "play"

Zhejiang News Client reporter He Yizheng Dai Rui Yun Sharing Alliance Shengsi Stat...