Notice!This big bank three types of cards are about to delist sooner

Author:China Fund News Time:2022.07.19

Source: Financial Times Client

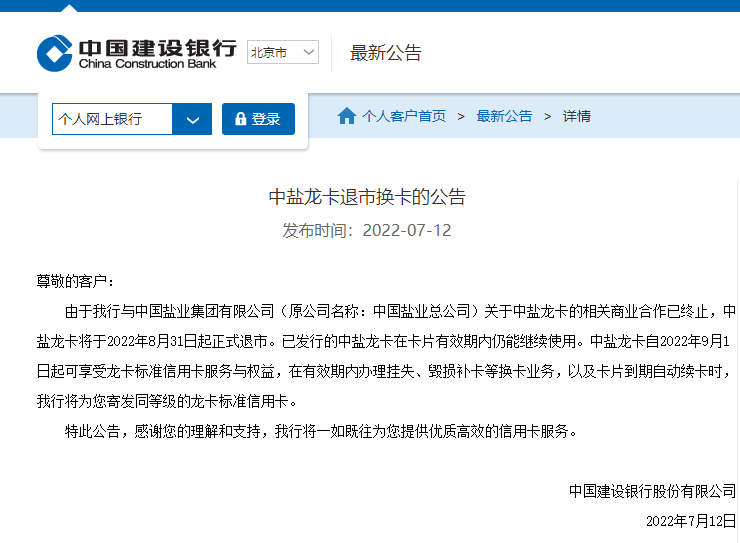

Recently, China Construction Bank announced that Zhongyan Dragon Card and Netease Yanxuan Dragon Card will be officially delisted from August 31. Last month, CCB announced that the Mango Travel Dragon Card Credit Card will be officially delisted on July 31.

At this point, CCB has recently announced the delisting of three joint credit cards.

The announcement shows that the delisting reasons for the three credit cards above are due to the termination of related business cooperation with the partner. The Chinese salt dragon card, Netease Yanxuan Dragon Card and Mango Travel Dragon Card Credit Card can continue to be used during the validity period of the card.

The Mango Travel Dragon Card Credit Card can enjoy the Dragon Card standard credit card service and rights and interests from August 1st. When the card changes such as reporting loss, damage to the card supplementary card during the validity period, and the automatic renewal of the card, the bank will send the same same customer to relevant customers Level Dragon Card Standard Credit Card. Zhongyan Dragon Card and Netease Yanxuan Dragon Card can enjoy the Dragon Card Standard Credit Card Service and Rights since September 1. When the card changes such as reporting loss, damage to the card supplement card during the validity period, and the automatic renewal of the card expire, the bank will be related Customers send the same level of dragon card standard credit card.

In recent years, credit cards have become the field of fierce competition in the banking industry. Each banking industry has cooperated with different institutions to launch a variety of credit cards to cover consumers in more use scenarios. However, as the bank credit card enters the era of refined cultivation from the "horse race circle". After achieving customers, various banks need to further realize living customers, and no longer rely on scale effects and market share to improve business quality.

Recently, the "Notice on Further Promoting the Healthy Development of Credit Card Business Standardized Healthy Development" issued by the Banking Regulatory Commission and the People's Bank of China proposed that the business scope of banking financial institutions to carry out joint card cooperation should be limited to the promotion and promotion of joint units and providing the rights and interests of their main business areas. Serve. If the joint unit provides other services such as data analysis, technical support, and collection, special contracts shall be signed separately, and the rights and responsibilities of both parties shall be agreed in accordance with the principle of income risk matching. Different cooperation content categories shall not be mixed with each other and cross -binding. At the same time, the co -branded units directly or disguise the credit card income or profit sharing in the joint -name card business cooperation, or if the charging standard is improperly linked to the indicators such as the overdraft amount of the credit card, the banking financial institutions should stop cooperating with them.

Boiled! Just now, Huawei detonated A shares, soaring! It's completely crazy: Two Super Demon Stocks rush to daily limit! A fighter crash and exposed on the spot

- END -

Changsha Changtie Community: Carry out fun theme activities to protect children's sunny and healthy life

New Hunan Client July 21st (Correspondent Mao Rong) On the afternoon of July 21, t...

Dear ~?

Yibin Public Security 2022-07-07 21:20 Posted on Sichuan in SichuanPlease go to th...