Liu Lijie: In July, LPR quotation remained unchanged, and the interest rate of Baicheng housing loan continued to explore

Author:Zhongxin Jingwei Time:2022.07.20

Zhongxin Jingwei July 20th.

Author Liu Lijie Shell Research Institute Market Analyst

On July 20, the People's Bank of China authorized the National Bank of China Interbank Borrowing Center to announce that the 1 -year LPR was 3.7%, and the LPR of more than 5 years was 4.45%, which was the same as last month. Data from the mainstream mortgage interest rates of the key cities of Shell Research Institute showed that in July 2022, the 103 key cities monitored by the Shell Research Institute was 4.35%, and the two sets of interest rates were 5.07%, which fell 7 from the previous month. 2 base points.

Low interest rates, low down payment help the release of house purchase demand

We believe that the continued volume of MLF (interim borrowing convenience) in July means that the current market liquidity is reasonable and abundant; Maintain at a more reasonable and slightly more level. From the perspective of the external environment, the US CPI reached a new high in June, the expectation of interest rate hikes has increased, and the global entry of monetary policy tightening cycles will reduce the loose space of Chinese monetary policy. Under the consideration of "internal and external balance", LPR will remain unchanged in the short term.

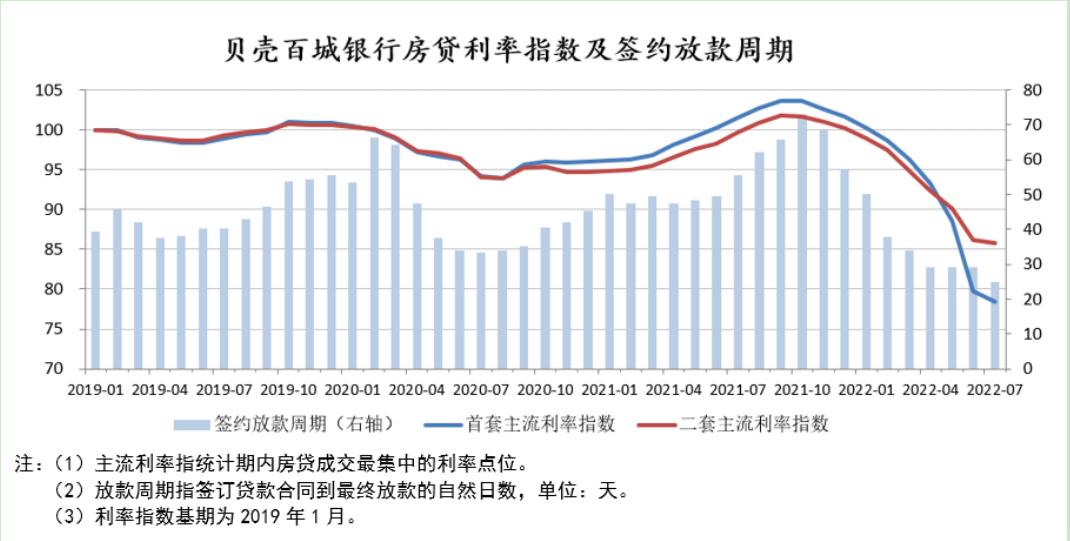

In July, the housing credit environment was further relaxed, and the overall mortgage interest rate reached a new low since 2019. The interest rate of the first and second sets of mortgages decreased by 139 and 93 basis points from the cumulative point in September 2021.

In the short term, LPR and additional rules are unchanged, and the mortgage interest rate still has room to decline but the space is narrowing. It is expected that the overall mortgage interest rate level will enter the bottom stage in the third quarter.

Low down payment overlay low interest rates will continue to benefit market restoration. The Shell Research Institute monitored, 49 cities including Wuhan, Nanchang, Changchun, Harbin and other provincial capitals in 103 cities performed the first set of first commercial loans of 20%of the down payment. Low interest rates and low down payment have essentially reduced the cost of buying a house, which helps to further release the demand for house purchase and facilitate market repair.

74 City interest rates touch the lower limit

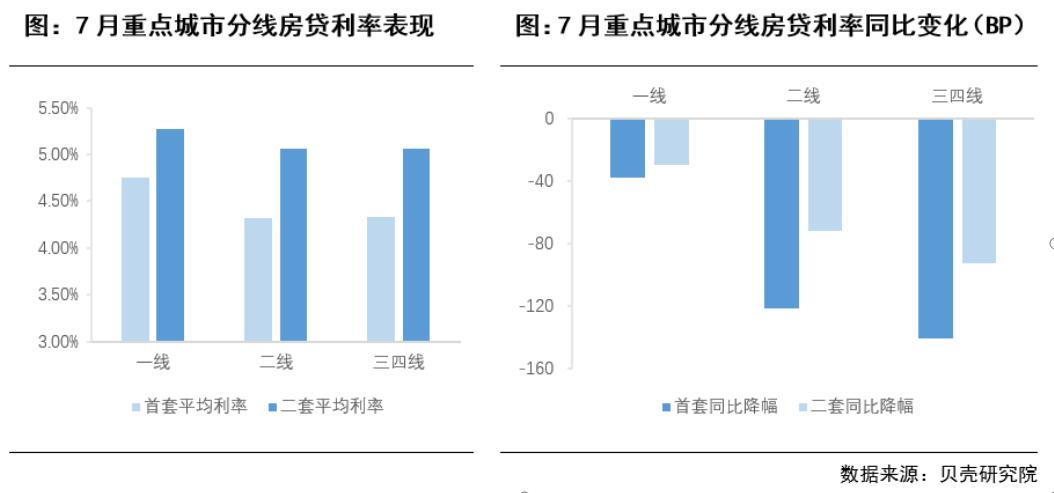

According to data from Shell Research Institute, in July 2022, the mainstream interest rate index of the first and second sets of mortgages continued to decline from the previous month. The first set of mainstream interest rates in July was 4.35%, and two sets of 5.07%, which fell 7 basis points and 2 basis points respectively. Compared with the highest point in 2021, 139 basis points and 93 basis points were settled, which was a new low since 2019.

In July, the bank lending cycle was shortened to 25 days, a decrease of 4 days from the previous month. From the perspective of cities, the 26 -city lending cycle is less than 15 days, and the city of the Yangtze River Delta region accounts for 15 cities.

In July, the mainstream interest rate of the 30 city mortgage loans continued to reduce. So far, the mortgage interest rate of 74 cities (June 58 cities) has fallen to the first set of 4.25%, and the two sets of 5.05%minimum interest rate standards. Among them, the interest rate of Hefei housing loans was reduced this month, and the first set of interest rates were reduced by 78 basis points from the previous month.

In terms of urban lines, the interest rate of mortgages in third- and fourth -tier cities has decreased the largest year -on -year. Only 38 basis points and 30 basis points. It is worth mentioning that Beijing topped the nation ’s 100%and 5.5%interest rate level at the first set of 5.0%and two sets of interest rates.

According to the monitoring of the Shell Research Institute, the minimum down payment ratio of the first set of commercial loans in the first set of housing houses is 30 % or more, which are mainly municipalities and strong second -tier cities. The minimum down payment ratio of the first home loan is 20 % (all banks) with 49 cities, including Changchun, Harbin, Nanchang, Wuhan and other provincial capital cities. On the whole, Beijing and Shanghai are the cities with the strictest mortgage credit environment in the country. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

[Jin Niu Academy] School of Management of International Fan'er, choose TA!

Dear studentThere are business in JinanGenome in the Guangdong -Hong Kong -Macao G...

3 cases of positive infected people in Nanchang City were announced

Announcement on the trajectory of 3 positive infected activities in our cityOn Jul...