I see the "recession trading" overseas

Author:Huaxia Times Time:2022.07.20

Zhong Zhengsheng

The "recession trading" of overseas markets was at the time.

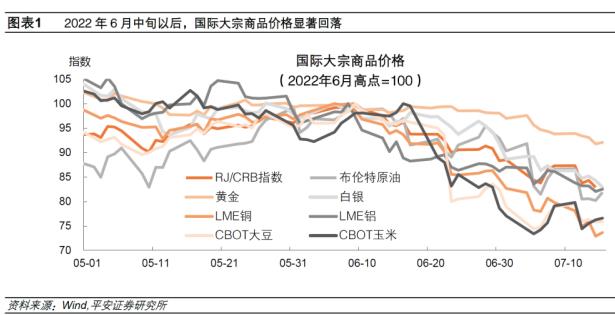

As of early July this year, the RJ/CRB product index was reduced by more than 15%from the highest point in June, and the prices of almost all varieties of goods decreased. The price of crude oil in the "King of Commodities" has fallen by nearly 20%, and the deepest decline in the "Dr. Bronze", which is highly sensitive to economic prosperity, has fallen by more than 20%, and international soybeans, corn and wheat "three brothers" have fallen by more than 25%.

As of early July this year, the maximum increase in the US dollar index was only about 5%. The impact of appreciation of the US dollar on commodity pricing was difficult to hide the actual price adjustment of goods. The recovery of the US bond market implies that the economic recession is expected to rise, and the yield of 10 -year US bonds fell from 3.5%in mid -June to 2.8%in early July. The 10 -year and 2 -year US debt yields have been "inverted" since April this April this year, but the difference is that this time the inversion occurs during the downward period of US bond interest rates, and the characteristics of "recession transactions" are more obvious.

The decline in the European market is expected to be more strong. As of July 5th, the German DAX and Italian ITLMS indexes have reached 15%in depth, and this year has fallen by more than 20%.

The downward signal of the United States and Europe has become stronger

The recently announced economic data has been frequent, indicating that the economic downturn in the United States and Europe has accelerated. In terms of consumption, the US consumption expenditure in May only increased by 0.2%month -on -month, and the growth rate of expenditure was below the revenue growth rate since December 2021. In terms of investment, the construction expenditure in the United States in May was -0.1%month-on-month, the first negative growth in the past year. Since July, the U.S. Federal Reserve model predicted that the US economy will shrink by about 1-2%in the second quarter of this year. Considering that the US economy has shrunk by 1.5%in the first quarter, this means "technical recession" or is coming. Although the growth rate of GDP is not the only ruler for economic recession, the word "recession" is undoubtedly more concretely displayed in front of the market. Another series of indexes with leading economic prosperity and confidence have continued to write downward trends. The PMI index of the United States and Europe's manufacturing and service industry has slipped to the lowest level in the past two years; the US Small Consumer Confidence Index in June is below the 2008 subprime mortgage crisis level. The level of the European debt crisis broke out.

The Radio of the United States and the European Bank of the United States increases the risk of recession. The Bank of the United States and Europe has been mighty since June, and has made the most "eagle" statement in the year, exacerbating the market's concerns about the "hard landing" of the economy. The European Central Bank announced on June 9 that it would stop the debt purchase plan in July and will start the first rate hike for 11 years. The Fed announced on June 15 that it would raise interest rates by 75bp and guide the market to believe that the US policy interest rate at the end of the year will reach a "restricted" level of about 3.5%. The leaders of the United States, Europe, and Britain gathered together on June 29 to unify the front of anti -inflation. They all believed that inflation is the number one enemy of monetary policy, and has been ready to take "stronger action".

It is worth noting that the currency tightening of the US and European currencies has not been instinct for the curbing effect of inflation: the Federal Reserve has accumulated a total of 150bp this year. New high since the year. The tough attitude of the central bank has stirred up in the financial market: In the first half of June, the yield of short -end Treasury bonds in the United States and Europe has continued to rise and renewed the high loan crisis. Breaking 0, the financial system has been the most tense level since May 2020; as of the end of June, the 30 -year mortgage interest rate in the United States has reached the highest level since the end of 2008.

Falling expectations may make the risk of financial fluctuations a closer step

Throughout history, the financial crisis is often one step ahead of the economic crisis, which may not be accidental. The weakening of economic expectations increases the risk of fluctuations in the financial market. Because the market is prone to pessimism in the process of asset pricing, and it may cause distrust of monetary policy, it will give birth to more extreme trading behaviors. In fact, since June, the overseas financial market has continued: European side, the inflation situation has deteriorated sharply after the Russian and Ukraine conflict, and continuously forced the European Central Bank to accelerate the support of the withdrawal policy, the contradiction between the currency tightening and the loose fiscal, or the threat to the sustainability of the debt in the euro zone , Treating the bond market for sale. In mid -June, 10 -year Italian Treasury interest rates exceeded 4%of the "warning line", and the new round of "European debt crisis" appeared. In Japan, the rapid depreciation of the Japanese yen since this year, and the predicament of Japan's inflation and foreign trade deficit, has continuously suspected the market for the sustainability of the Bank of Japan's loose policies. On the eve of the meeting of the Bank of Japan on June 15th, investors bet on the Bank of Japan may give up the yield curve control (YCC). At the time of closing, the target of the Bank of Japan is 2.1 basis points. Later, under the guidance of the monetary policy in Japan and the euro zone, the European bond and the daily debt market temporarily resumed calmness, but these storms still sounded our alarm.

How to interpret the "recession" faces three major uncertainty. First, whether the market will underestimate the toughness of the economy. The latest announcement of 372,000 new non -agricultural employment in the United States in June, the number of people before the new crown epidemic was only about 200,000 people. The tight employment market hinted that there was still a distance between the economy and the recession. In addition, there is a self -regulation mechanism for economic operations. If the price of commodities is substantially declined, the investment and consumer demand that is suppressed by inflation in the early stage is expected to be repaired to a certain extent. Second, whether the market will underestimate the vulnerability of the supply. Since the end of June, the current delivery price of the US WTI crude oil ship is about $ 2/barrel than the futures price, highlighting the current "separation" of the current terminal supply and demand pattern and market expectations. As of the end of June, US crude oil inventory was still at the lowest level since 2004, and it was about 10%lower than the inventory level of oil prices in 2014. In the next few months, the demand for crude oil may not have fallen sharply, and supply may be difficult to repair. Moreover, the output of OPEC members represented by Libya's output, the strike of Norwegian oil workers, and the suspension of the supply of oil supply in the Lihai Pipeline Alliance are still staged in turn.

Third, whether the market will underestimate the flexibility of policies. If this round of commodity prices continue to be adjusted, overseas inflation pressure may usher in breathing. Based on the strong correlation between the inflation rate of oil prices and the US CPI since 2000, in the second half of this year, every half of this year, every $ 10/barrel of oil prices may decrease by about 0.4 percentage points year -on -year. In addition, whether for the trust of monetary policy or concerns about economic recession, recent inflation expectations have changed positive changes. For example, the 10 -year TIPS Tips Treasury bonds are expected to fall to 2.3%in early July, the lowest level in the past nine months. If the inflation situation improves, monetary policy may pay more attention to the risk of economic downturn and financial instability, and then choose to "step on the brakes" at the appropriate time and try to achieve the economic "soft landing".

Renminbi assets come out of the "independent market"

Since the new crown epidemic, under the guidance of the "modern currency theory" ideas, the United States and Europe seem to have relied on currency and fiscal stimuli, which has caused inflation results to a certain extent. On the other hand, strong and powerful epidemic prevention measures, supplemented by moderate counter -cyclical regulation, have achieved the global leadership of the post -epidemic recovery. The efficiency and restraint of macro policies make the economy steady.

In the first half of this year, the US -Europe economy was in "overheating" due to the conflict between Russia and Ukraine and the price increase of goods. Staged pressure.

Looking forward to the second half of the year, the downward risk of overseas economy is one step closer, and the current economic recovery of China's economic recovery needs to be released. Therefore, in the "economic dislocation" of recovery and overseas decline in China, RMB assets since June this year are not afraid of surrounding "independent markets". force. As the world's second largest economy, the stable performance of China's economy and market will play a role in "cockpit stone" in the Asian and even global markets, bringing a ray of sunlight to the original global economic prospects.

(The author is the chief economist of Ping An Securities)

Editor -in -chief: Fang Fengjiao Editor: Cheng Kai

- END -

Premiere!"The Great Works" (Sichuan Version) Get the way to obtain here →

6 yearsJay Chou bring the new albumThe Great Works debutDetonate hot searchAnd Unc...

In the end of 0.3 kilometers, the East Bund Youth Park was completed

Since the opening of the East Bund Youth Park earlier this year, it has quickly be...