A number of public offering agencies are warmly involved in the fixed -increase market recovery

Author:Economic reference Time:2022.07.20

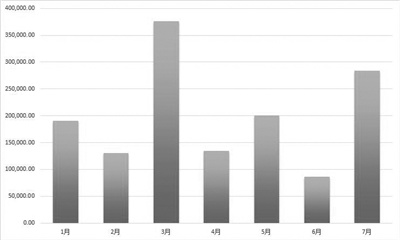

Since July, with the gradual recovery of the fixed -increase market, public funds have participated in the increase in the fixed increase, and many institutions including Caitong Fund and Guangfa Fund have participated in the fixed increase projects. According to Wind data, as of July 19, the total cost of participating in public fund products has reached 14.027 billion yuan since this year, of which the participation since July has reached 2.837 billion yuan, and it has been second in the year.

In July, the Fund participated in the fixed increase and heating up

Recently, multiple announcements from public funds showed that its products are actively participating in listed companies' fixed increase in purchase.

On July 19, Guangfa Fund issued an announcement that six fund products including the flexible allocation of Guangfa Duo Factors participated in the subscription of the non -public offering of the shares of the well -off shares. Previously, on July 15th, products including Qianhai Open source, rich, southern, and Huaxia and other fund companies all issued the announcement of the final increase of listed companies.

Since July, public fund products have participated in the number of fixed increase and investment amount of listed companies have increased significantly. According to Wind data, as of July 19, the fund has participated in the directional addition of 67 listed companies during the year, and the total cost of participation was 14.027 billion yuan. Among them, the total cost of participating in the fixed increase in March was the highest, with a total of 3.764 billion yuan. It is worth noting that although the total cost of fixed increase in the fixed increase in the fixed increase in the fixed cost of the fund has not yet ended in July, far exceeding June and May data.

In terms of specific projects, the large -scale fund -raising amount since this year is mainly new energy, pharmaceutical biology, coal and other industries. For example, at the end of June, the Ningde Times announced 45 billion yuan to settle down, and finally 22 subscribed targets received strategic allocation. In the public offerings, Ruiyuan Fund, Caitong Fund, Boshi Fund, and Golden Eagle Fund were all available for sale.

However, overall, the total amount of the fund participation in the year was still shrinking compared to the same period last year. According to Wind data, the total public offering fund participated in the orientation of 110 listed companies in the same period last year, with a total cost of participating in 31.629 billion yuan. Compared with the same period last year, the fund participated in the fixed increase over 50 % during the year.

From the perspective of single funds, Huaxia Panrui is set to be the fund with the highest total cost of fixed -increase costs within a year. Yuan; followed by another product of Huaxia Fund, Huaxia Panyi, which was opened in a year, and participated in a total of 16 listed companies. The total cost of participating was 846 million yuan. In addition, the cumulative amount of 10 funds including Wanjia Industry and Yifangda Double Debt Enhancement also participated in the fixed increase during the year.

Better -up distribution market recovery

While the public offering participation in the fixed increase has increased, since July, the fixed - -term distribution market has also significantly recovered.

On July 19, Wuxi Zhenhua, ST Jiuyou, and Yichang Technology all issued an announcement saying that A -share shares were issued to specific objects. According to preliminary statistics from reporters, the planning date of the plan is the statistical standard. As of July 19th, 38 listed companies including Realwei and Liancheng CNC have released a fixed increase plan since July 19, and the total funds raised for a total of 40.779 billion yuan.

Since May, the number of fixed -increase plans for A -share companies has increased significantly. In May and June of this year, there were 79 and 66 listed companies released in May and June of this year, which are far higher than 43 in January and February this year. , 31.

From the perspective of implementation, the actual amount of actual fundraising during the year is not as good as the same period last year. Wind data shows that the issuance date as the statistical standard, as of July 19, a total of 126 listed companies have implemented a targeted additional issue, while the same period last year was 251, a year -on -year decrease of 49.80%. The total amount of funds was 239.066 billion yuan, a decrease of 32.64%compared to 354.883 billion yuan in the same period last year.

Affected by market shocks, the increasing income has also been significantly different from this year. As of the closing of July 19, the closing price of 30 stocks fell by more than 10%compared to the previous fixed increase. Among them, compared with the fixed increase price of the closing price of the Sifang Jingchuang, the price of the fell more than 45%, the excellent engraved-W fell more than 38%, and the UFIDA network fell more than 34%. Increased price increases by more than 20%. On the whole, of the fixed -increase projects participating in public funds since this year, the latest closing price of 35 listed companies is positive, accounting for about 50 %.

Liu Ye, assistant and investment manager of Boshi Fund Equity Investment, said that in the context of the large market fluctuations this year, the fixed increase needs a certain discount space for investors to choose from, and the distribution of the distribution will naturally fluctuate. Since the quarterly fluctuation, the fixed increase has also recovered.

The research report of open source securities shows that the current increase in the fixed -increase market is greater than demand. As of the end of May, the total amount of bidding fixed -rate increase was 763.75 billion yuan, which has reached a new high since this year. However, in May, the announcement of the issuance projects was excessive subscribed, and the fixed increase of fixed -rate discounts on the bottom of the market brought investment opportunities. The fixed -increase price has been greatly attractive.

- END -

Woman!The car fell into the river and 3 people lost contact

On the morning of July 6, in the water street in Luocheng Street, Luoding City,...

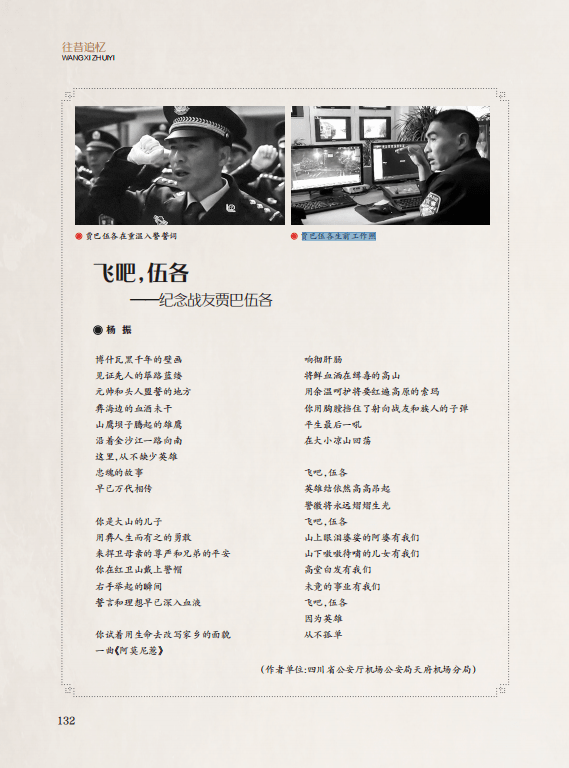

[Poetry] Fly, Wu Du -Memorial comrade -in -arms Jiabawu, Yang Zhen

This article contains Bashu History, No. 2, 2022Fly, Wu Du——Early commemorate co...