Huawei issued debt again, and the financing scale of the year has been twice as much as last year!Hongmeng 3.0 is coming, and you still have to enter the online taxi?

Author:Broker China Time:2022.07.20

Huawei, which has transformed a critical period, has significantly increased the "blood replenishment" of financing.

On July 19, Huawei disclosed in the inter -bank market that the fourth midterm of this year's mid -term bill was purchased, and it was planned to raise 4 billion yuan to supplement the operating funds of companies and subsidiaries.

Chinese reporters from securities firms noticed that Huawei especially increased the domestic market financing. In the past three years, the total amount of Huawei bond issuance has been controlled below 10 billion yuan. It will reach 21 billion yuan, more than twice the debt issuance in 2021.

At the same time, Huawei has frequently moved in the near future and has received widespread attention from the outside world. On the one hand, Huawei officially announced on July 28 to release Hongmeng 3.0 and a variety of terminal products to expand to richer industry scenes; on the other hand, Huawei also reported After entering the news of the online car, it launched Petal (petal) travel applications to aggregate domestic online car -ride suppliers to take a taxi, and has been tested in some cities.

This year's debt issuance is innovative

Huawei's debt issuance is not new, but after inventory, the frequency and amount of Huawei issuance of debt unknowing high.

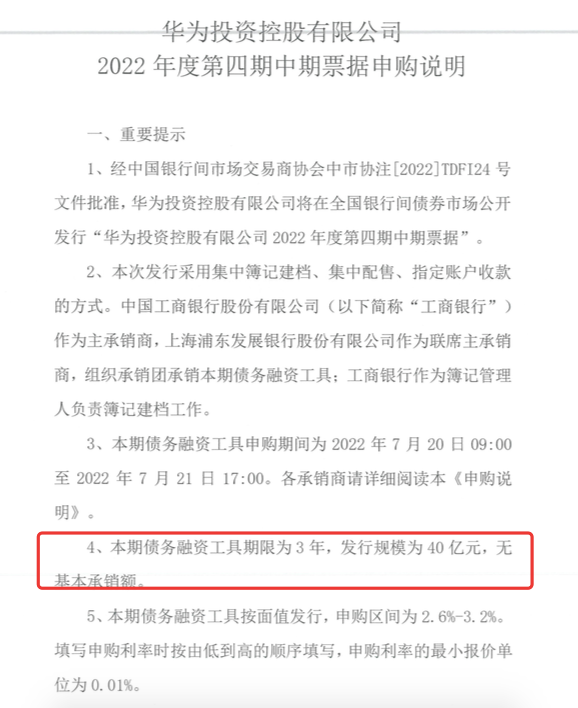

On July 19, Huawei disclosed instructions for the purchase of mid -term bills in the fourth phase of this year. The issuance scale was 4 billion yuan, the period was 3 years, and the subscription period was from 9:00 July 20 to 17:00. Essence

According to the fundraising instructions, from 2019 to 2021, the consolidated caliber achieved operating income of 849.646 billion yuan, 882.877 billion yuan, and 630.698 billion yuan, a year-on-year increase of 18.8%, 3.91%, and -28.56%. 13.84%.

From 2019 to 2021, Huawei consolidated caliber to achieve net profit of 62.783 billion yuan, 64.603 billion yuan, and 113.591 billion yuan, respectively. Among them, the net profit increased under the decline in revenue in 2021, mainly due to the investment income of 61.7 billion yuan Yuan, and investment income in 2020 was 480 million yuan.

At the same time, as a global leading technology company, Huawei is also huge in R & D expenditure. From 2019 to 2021, Huawei's cash expenditure for the consolidated caliber operation activities was 939.346 billion yuan, 1019.805 billion yuan, and 706.719 billion yuan, respectively, and R & D expenditure was 131.466 billion yuan, 141.951 billion yuan, and 142.567 billion yuan.

Huawei said that the company's overall operations are stable and financial results are in line with expectations. In order to support the development of various business development and key strategies, the company plans to issue 4 billion yuan medium -term bills this time, which will be used to supplement the operating funds of the company's headquarters and subordinate subsidiaries.

Looking back on Huawei debt issuance, 2019 is a clear watershed. Before 2019, Huawei mainly issued debt issuance overseas. After 2019, domestic debt issuance began to increase and gradually became the main debt issuance channel.

As of the signing of the instructions for this time, there were 11 domestic bills of Huawei's existence, totaling 34 billion yuan; 2 ultra -short -term integration of 2 trips for the existence of 6 billion yuan; the issuer's subsidiaries had three US dollar bonds, totaling a total of US $ 3.5 billion Essence

Let's look at the annual pace of debt issuance. From 2019 to 2021, the total amount of debt issuance of Huawei domestic bond issuance is 6 billion yuan, 9 billion yuan, and 8 billion yuan, respectively. In 2021, Huawei issued two middle -term bills, with a total financing of 8 billion yuan. Since 2022, as of April 15th, a total of 3 mid -term bills and 2 ultra -short -term financing vouchers have been issued, with a total of 17 billion yuan. The 4 billion yuan medium -term bills that were issued this time reached 21 billion yuan. Huawei's financing and total amount of financing issued this year was far greater than in previous years, and it also reached a record high.

In the future, Hongmeng 3.0 will enter the online taxi?

Huawei's recent focus can be described as one of the focus of the market. On July 19, because Huawei Hongmeng 3.0 will launch, Huawei's concept stocks have been enthusiastic.

On July 18, Huawei terminal announced that it will be held on July 27th to hold a new product launch conference in Huawei. At that time, HarmonyOS 3.0 (hereinafter referred to as "Hongmeng 3.0") and a variety of end -of -end products, such as cloth mobile phones, smart screens, notebooks, notebooks, notebooks, laptops , Tablet, headphones, etc.

According to Huawei, HarMonyOS3.0 removes the 2.0 bloated part, which is mainly promoted in interactive design, multi -equipment interconnection, performance, user care, etc. Mate50 will be the first native model with HarMonyOS 3.0.

In 2021, after smart wear, smart screens and other products, more and more Huawei products are combined with HarMonyOS, such as HarMonyOS to log in to mobile phones, tablets, and car cockpits. Rich full -scene life experience.

On April 28 this year, Yu Chengdong, the executive director of Huawei and CEO of the terminal business, said at the time that the number of Huawei equipment equipped with Harmonyos exceeded 240 million units and the shipments of ecological equipment exceeded 150 million units.

It is worth mentioning that in the field of smart travel, in addition to the claim to help car companies to create good cars and help car companies sell well, enter the Internet car ride action to make the outside world refreshed.

It is reported that Huawei has launched an application called "Petal Travel" in the application public test. The details page shows that this is a fast application that aggregates domestic high -quality online car suppliers. Similarly, only Beijing, Shenzhen and Nanjing cities with testing services are provided. However, a Chinese reporter from the securities firm asked Huawei on the issue of Huawei's entry into the online car rental sector. As of press time, no response was obtained.

People in the industry believe that the Huawei Hongmeng system has many users and has the advantages of traffic. At the same time, Huawei Hongmeng system also directly connects to many car planes, which is convenient for drivers to directly use car planes to place orders. Stir the competition in the online car.

According to the Huawei midterm bill raising instructions, HUAWEI HICAR has established in -depth cooperation with more than 30 mainstream car companies brands, and multiple car companies have achieved full platform integration. In 2021, HUAWEI HICAR supported more than 100 models, completed integration on more than 30 industry platforms, and accumulated a total of more than 10 million vehicles. In addition, Huawei also provides users with car services with HMS for Car with the industry manufacturers and preset cloud services into the vehicle. At present, HMS FOR CAR has cooperated with car companies such as Volvo and officially launched related businesses, and will gradually cooperate with more car companies.

Responsible editor: tactics

- END -

The lottery scrapes the limited edition "jade seal"?alert!

Recently, the nation's public security organs have launched a special operation to...

Looking forward to meeting, friends of "City of Sky" ~

From June 20th to 23rd, Qiantang District, Hangzhou, ushered in a special delegati...