The top flowing Zhang Kun is approaching 100 billion again, and a large amount of positions add to pharmaceutical stocks!Open the word and fall, the monster stock rests vegetables

Author:Refer to the business Time:2022.07.20

Today, the main index fluttering throughout the line, the Shanghai Index re -stood on the 3300 -point intersection, and the Hong Kong stocks Hang Seng Index re -stood on the 21,000 mark.

On the disk, the two major tracks of military and semiconductor rose together. Medical beauty led the large -scale consumer sector to perform active, while agricultural, automobiles, electricity and other sectors were relatively weak.

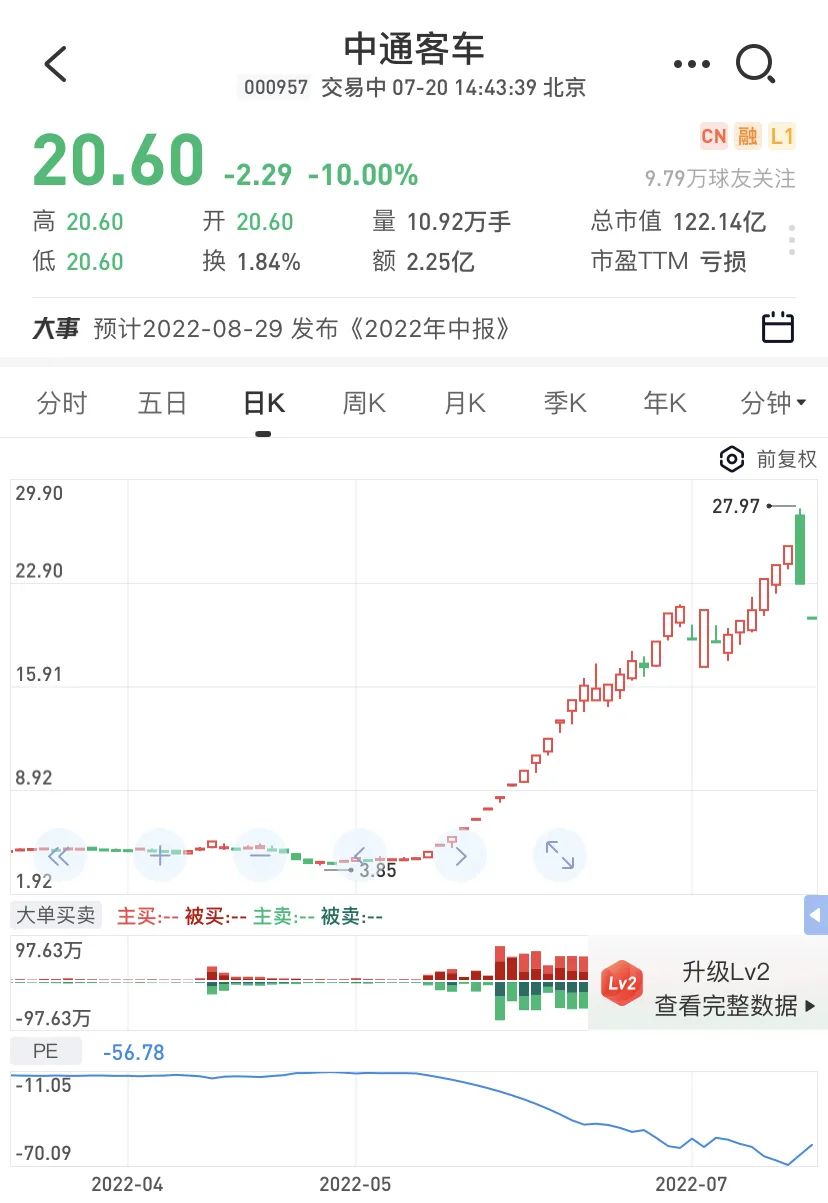

The hype of the subject matter stocks further ebb, and Zhongtong Bus and Jinzhi Technology fell in the same limit in early trading, and multiple high stocks fell sharply.

01

Sleeve brake! There are more high -level stocks falling down the limit

After yesterday's floor, Zhongtong Bus fell today.

Zhongtong Bus has recently become one of the focus of the market. It has been stir -fired in a row. The low stock price has been over 7 times since April, and the increase is up to 6 times. It is also an important emotional indicator of the short -term market.

Its weakening has driven a number of high -level stock prices to fall sharply: Jinzhi Technology's stock price continues to fall in the same time today after the limit of the limit of yesterday; Zhejiang Shibao and Evergrande High -tech dive after opening the market in the morning, and touch the limit.

Jin Zhi Technology set up the concept of "virtual power plant+energy storage", setting off a round of surge. The company's shares have risen many times since July 4, 2022, and have won 9 daily limit boards in the nearly 12 trading days.

Zhejiang Shibao's main hype is the concept of new energy vehicles+driverless+BYD. The stock is the leading stock of the new energy sector car recently. Recently, the high -level stocks of new energy sector stocks have declined, and Zhejiang Shibao's stock price has also fallen.

Evergrande High -tech takes the concept of "supercritical power generation". Seven trading days and seven daily limit boards, the stock price rose from 5.13 yuan/share to 9.08 yuan/share, a cumulative increase of 77 %.

Some investors say: Many concepts such as virtual power plants, drones, etc. have not yet landed, and the market has begun to be restless. This is actually a blow to many stocks with poor fundamentals, because short -term speculation does not have to enterprises for enterprises in the short -term speculation. Any help such as financing and image improvement, on the contrary, will only eventually return to the end of "no one ask".

02

After the endorsement of Yue Yunpeng,

Zhongzhu High -tech continuous daily limit ...

After the official announcement of the well -known cross talk actor Yue Yunpeng became its spokesperson, the "second share of soy sauce" Zhongju High -tech stock price rose again and again. On the morning of July 20, the stock closed the second daily limit to 38.07 yuan/share.

However, what attracts investors to pay more attention is that the latest announcement shows that the company's shares held by the controlling shareholder Nakaya Runtian reached 1.6%. The shareholding ratio dropped from 19.44%to 17.84%. The controlling shareholder behind Zhongshan Runtian can penetrate to Baoneng Group, and finally the actual control is Yao Zhenhua.

It is reported that three years ago, Baoneng's heavy money entered the middle torch High -tech, and the original controlling shareholder Torch Group Qu settled in the second shareholder. Nowadays, Baoneng is retired due to the passive funds. Torch Group and the unanimous active actor Tao Huiye Yingying will increase its holdings of 1.09%of the company on July 18.

At present, the shareholding ratio of the two parties is only 5.53%. Behind the end, the equity balance of Zhongju High -tech is tilting.

According to the media, Dinghui Investment has worked closely with the central enterprise China Resources Group, including the field of consumer goods. This guess that it may be possible to join forces with China Resources and Zhongshan state -owned assets, and Zhongzhu High -tech will be possible. However, the news was not officially confirmed.

After the stock price of Zhongzhu High -tech in September 2020, it has fallen for nearly two consecutive years. The stock price has recently rebounded in the short term. At present, the low position has risen by nearly 40%. The stock price is gradually going out of the state of downturn.

In addition to the Zhongju High -tech, the food processing and manufacturing sector is stronger, the daily limit of Bao Li Food, Huifa Foods, Qianwei Central Kitchen, Ligan Food, Sky Food, Qianhe Weiye, Haixin Food and so on.

The investment of the golf friends@believes that the online China Resources may enter the torch high -tech. If it is true, it will definitely promote the re -reshuffle of the condiment track. What I want to analyze here is how China Resources enrolls has on the condiment track.

First of all, in the short term, the flavored track is still in the stage of common prosperity. This year, we still have confidence in whether the sales revenue or net profit continue to maintain double -digit growth this year, even if it has received the impact of the epidemic. Among them, the semi -annual performance forecast of Qianhewei has stated that the sales scale has expanded, with net profit growth of 60 % to 80 %.

Secondly, in the long run, China Resources enrolled in the middle torch High -tech, and I definitely want to make the company bigger and stronger, so it will focus more on the cake with a larger catering end. This is not a good thing for Haitian, so you can see that today Haitian's stock price trend has not followed the daily limit of Zhongzhu High -tech, and it has been hovering under the water under the market.

Third, China Resources's entry will definitely promote the consumption upgrade of the condiment track, that is, how to make everyone eat healthier, zero -added soy sauce will inevitably become the mainstream. Once the condiment consumption is upgraded to become the main theme, then you can imagine like new energy now energy. Like traditional car companies, car companies will re -reshuffle in the competition pattern and situation.

my country ’s zero -added soy sauce pioneer and leader Qianhe Weiye will inevitably benefit from it. This is the logic of Qianhe Weiye today.

Let's wait and see that the three companies work together to make the cake bigger, whether any company's cake will be eaten.

03

Military workers are now rising tide

Jianglong boat 20cm daily limit

The military industry sector has taken advantage of today. The "20cm" daily limit of Jianglong boat "20cm", Xinyu State rose more than 10%. Nearly 10 stocks. It is worth noting that aerospace power has daily limit for two consecutive trading days. As of July 19, among the ETFs of the National Defense Forces ETF, 20 have released the 2022 interim results preview, of which 14 have achieved positive growth, 8 pre -increased upper limit exceeds 100%, and the strong verification sector is high.

According to the official website of the Ministry of Communications, the recent international mobile satellite organization (IMSO) experts came to Beijing to carry out the Beidou message service system to join the global maritime danger and safety system (GMDSS) on -site evaluation.

Some institutions said that from the beginning of this year to the end of April, due to various aspects such as market style, the overall decline in the military index fell, and the valuation of the core standard of the sector fell below the reasonable range of the reasonable range. There are no major changes in sector companies in both growth logic and performance. After the disclosure of the first quarter, the industry's prosperity and performance certainty were further recognized, and a large wave of repairs also appeared at the valuation level. But overall, the valuation level of the military sector, especially some core targets, is still at a reasonable and low level, and the estimated valuation is expected to be gradually repaired to a reasonable center. Benefiting from the high prosperity, long logic, high certainty, and production capacity of the military industry, it is expected to start valuation switching in July-August.

In addition, the A -share doctors' US track stocks have risen collectively, and the Huaxi bilateral disk with a market value of more than 100 billion yuan in the past has soared by nearly 13%. Langzi Co., Ltd., Aoyuan Miyu's daily limit, Amei customers rose more than 4%, Multi -Sheep shares, famous ministers and other many shares rose.

On the whole, in addition to the rebellion of the strong automotive industry chain in the early stage, multiple branches of the growth style are active. Semiconductor, wind power, CRO innovative drugs, and cultivation of diamonds have been manifested in turns, and the market sector hotspot presents rotation characteristics.

Looking forward to the market outlook, after entering the dense disclosure period of the financial report, fundamental factors will become an important reference for market capital preferences in the future. CITIC Securities analysis believes that the performance of the semi -annual report of 2022 is significant, and the industries that continue to have high prosperity and inflection point are still the most important configuration clues.

04

Zhang Kun's management scale is approaching 100 billion again,

Star Fund Manager's latest positioning dense exposure!

In the second quarter, A shares were suppressed first and then pushed out of the strong V -shaped reversal. The market was active, and the active rights fund ushered in the "big return". According to data statistics, the average income of the entire market's active management of equity funds was 7.49%in the second quarter. The proportion of positive returns exceeds 90%. More than 30%of the active equity funds were more than 10%in the second quarter.

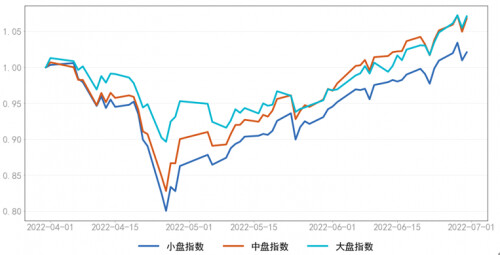

From the perspective of market style, the large market index accounted for in the second quarter, and the retracement performance and overall increase of the small disk index were backward.

Pictures from the Internet

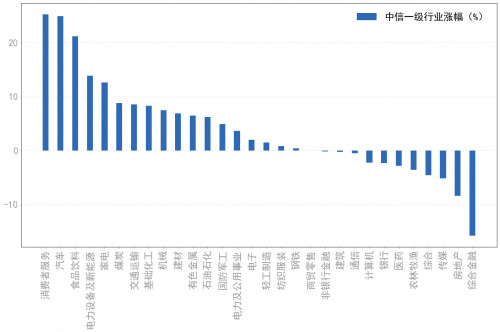

From the perspective of the industry, the three CITIC -level industries with the largest increase in the second quarter are consumers, cars and food and beverages, respectively. In the first quarter, the real estate and financial rankings with stable performance.

Pictures from the Internet

As the second quarter report came out, the positions of more star fund managers also surfaced.

Zhang Kun: Increase the allocation of the pharmaceutical industry, increase the Hong Kong stocks, and the new pharmaceutical creatures

As the first active rights fund manager in the public fund industry in the scale of more than 100 billion yuan, Zhang Kun once fell to less than 90 billion yuan in the first quarter of this year. As of the end of the second quarter, the total scale exceeded 97 billion yuan, and the management scale approached 100 billion again.

Among them, the Yifangda Blue Chip selection fund increased the allocation of pharmaceutical industries and reduced the allocation of technology and finance industries.

The four funds of Yifangda blue chip selection, Yifangda high -quality selection, Yifangda high -quality enterprise held in three years, and Yifangda Asia selected these four funds all added positions to Hong Kong stocks. Taking the Blue Chip selection of Yifangda as an example, the fund at the end of the fund at the end of the second quarter was 62.779 billion yuan, an increase of 7.507 billion yuan compared to 55.272 billion yuan at the end of the first quarter.

From the perspective of operation, the Blue Chip of Yifangda has increased its holdings of Tencent Holdings, and the new Bioming creatures are the tenth largest heavy stocks of the fund, holding 27 million shares. At the same time, China Merchants Bank, Yili and Meituan's stocks remain unchanged.

Xiao Nan: Increased the configuration of sub -high -end liquor

Xiao Nan said in the second quarterly report of the Ichida Consumer Industry Fund that the market liquidity in the second quarter continued to relax, and the pessimistic expectations of the macroeconomic economy had been amended to a certain extent. Based on the judgment of the rapid clearing speed of the liquor industry, the consumer industry has increased the configuration of some sub -high -end liquor. At the same time, in the early second quarter, the new energy leader was configured in the second quarter, and the overall valuation and expectations of the industry were at a high level at the end of the quarter.

Chen Hao: Related targets related to the upstream resources of the new energy industry chain

Chen Hao said in the Fund II report that there are many considering non -controllable factors. In the process of market fluctuations, he maintained a neutral position and a relatively balanced industry configuration, and added the upstream resources related to the new energy industry chain at the bottom of the market. The target brings more obvious excess returns to the combination.

Wang Zonghe: Meituan and Yaoming Bi Hong Kong stocks in the top ten heavy warehouses

Wang Zonghe's 10 products in charge did not return to the first half of the year. Among them, Penghua Pension Industry, Penghua Industry Selection, Penghua High -quality Bayment Two Years, Penghua Growth Value, Penghua Selection Return for three years, Penghua Consumption Optical Optional, Penghua Innovation Future In the first half of the year, it still lost more than 10%.

In this regard, Wang Zonghe also reflected in the quarterly report that he missed the time window of the time window for high -quality stocks that had been optimistic about the long -term optimistic stocks in the market panic.

Specific to holding the position, Wang Zonghe's ingenious product Penghua's ingenuity was selected at 67.63%at the end of the second quarter, which was improved from 60.03%at the end of the first quarter.As of the end of the first half of the year, the top ten heavy stocks of the fund were Guizhou Moutai, Bank of Ningbo, Wanhua Chemistry, Shanxi Fenjiu, China Resources Beer, Rongsheng Petrochemical, Xiaomi Group, Gujing Gongjiu, Meituan, Yaoming creatures.

From snowball

(Risk reminder: The views mentioned in this article only represent the personal opinions, and the subjects involved are not recommended. Based on this, the risk is on the risk.)

- END -

Deng Li, Deputy Minister of Foreign Affairs, meet with Kuwait's departure ambassador to China

On June 27, 2022, Deng Li, deputy minister of the Ministry of Foreign Affairs, met...

"Hangzhou Girls Fall" The nanny involved holds a senior infant teacher certificate.

Jimu Journalist Zhan YanOn June 14th, Hangzhou's babysitter forgotten the 2 -year ...